25 Insurance NPS Scores for 2025 + NPS in Insurance Guide

by Ian Luck

To measure loyalty, insurers need to use tried and tested experience metrics like the Net Promoter Score (NPS). NPS in the insurance industry is a simple, but powerful measurement system that helps businesses understand the health of their customer base.

At its core is one simple question: How likely are you to recommend [product x] to a friend, family member, or coworker?

NPS dives deeper than a basic test of referral marketing. It also helps insurers gauge how likely their existing customers are to stay with them long-term and how likely they are to “shop around” for alternatives. It digs deep at dissatisfaction and looks for enthusiasm, not just satisfaction. And it can provide insight into how to improve their services, customer support, and more.

Insurance NPS can help insurers set themselves apart from competitors. In an industry where there are very few touchpoints with customers, it can be challenging to build rapport with customers. Net promoter score creates an additional point of contact and also provides valuable insight into how to create a better customer experience.

In this article, we’ll take a look at net promoter score for the insurance industry–why it’s important, how to measure it, the average net promoter score for the insurance industry, and where you stack up.

Table of contents

Part 1: Background on NPS in insurance

- What is Net Promoter Score in insurance?

- Why is Net Promoter important to insurance companies?

- What are the core drivers of NPS in the health insurance category?

- How to calculate your NPS score (with example)

Part 2: NPS benchmarks for insurance

- What's the average NPS score in the insurance industry?

- What's considered a good NPS score in this industry?

- How to read NPS benchmarks

- 25 leading insurance company NPS scores

- Analysis of 4 leading companies: how did they achieve a high NPS score?

Let's start with the foundations of Net Promoter:

What is Net Promoter Score in Insurance?

Net Promoter Score is a measure of customer loyalty, not satisfaction. A traditional customer satisfaction survey asks the question, How satisfied are you with this service or product? The answer provides very little insight. A satisfied customer may still be likely to churn when something better comes along. But a loyal customer is likely to persist even through hiccups in customer service.

In insurance, net promoter score is a measure of how likely a customer is to refer an insurer to an acquaintance. Because insurers don’t have ongoing communication with their customers, scores will often be based heavily on customer support. For example, net promoter score for health insurance will be connected to how agents help customers submit and pay bills and locate the right providers. Net promoter score for auto insurance will be connected to how agents help customers navigate accidents.

Other interactions that might impact net promoter score for insurance include:

How insurance agents provide support to insured homeowners in the event of a flood, fire, or other natural disasters;

How insurance agents support insured relatives and loved ones of the recently deceased;

How agents provide support to insured travelers during the event of a medical evacuation or lost/damaged luggage.

Of course, pricing also factors into a customer’s loyalty to an insurance company. But remember that customers will pay for value; even if a service is more expensive, they may happily stay with the insurer if they receive exceptional support.

Why is Net Promoter Score Important? Why is Measuring Loyalty Important in Insurance, and How Can NPS Help?

Net promoter score is important because it helps companies gauge customer loyalty before it’s too late. In other words, NPS helps companies take a proactive, rather than reactive, approach to customer retention.

A net promoter score survey can help a health insurance company, for example, identify problematic areas that can cause churn if left unaddressed. Net promoter score gives customers the opportunity to express their dissatisfaction with call center services, for example. When the insurance company learns of this through a low NPS score and negative feedback, they’re able to quickly troubleshoot the problem and directly follow up with the customer.

The end result? A happy customer that’s not only less likely to churn, but more likely to recommend the service to others.

Net promoter score also helps insurance companies to identify where they stack up against their competitors. Insurance has one of the highest average Net Promoter Scores, next to education and training (Financial services and SaaS are two of the lowest-scoring industries, for reference). If your own NPS falls below the average, you may need to reassess how you approach customer relationships.

An effective net promoter score survey collects a score and follows up with an open-ended feedback question–Why did you give this score? This is the customer’s opportunity to explain their rating and provide constructive feedback, if necessary. A customer who gives a 9 or 10 might give you enthusiastic feedback on why they’re likely to recommend you (“Your customer support is fast and friendly”).

A customer who gives you a 4 or 5 might give you critical feedback on why they’re unlikely to recommend you to others (“Agent was rude and unhelpful.”) A customer who gives you a 7 or 8 proves to be the least helpful. A basic level of satisfaction doesn’t give you insight into your strengths or weaknesses (and even a customer who gives you a net promoter score of 8 can easily churn when they find a better option).

While it always feels good to get a stellar score and gushy feedback, low scores often prove to be the most helpful for reducing churn and upping loyalty, as we’ll discover in the next section.

What Drives NPS—Example of Health Insurance NPS Drivers

To improve the customer's experience, it's important to listen to their feedback closely.

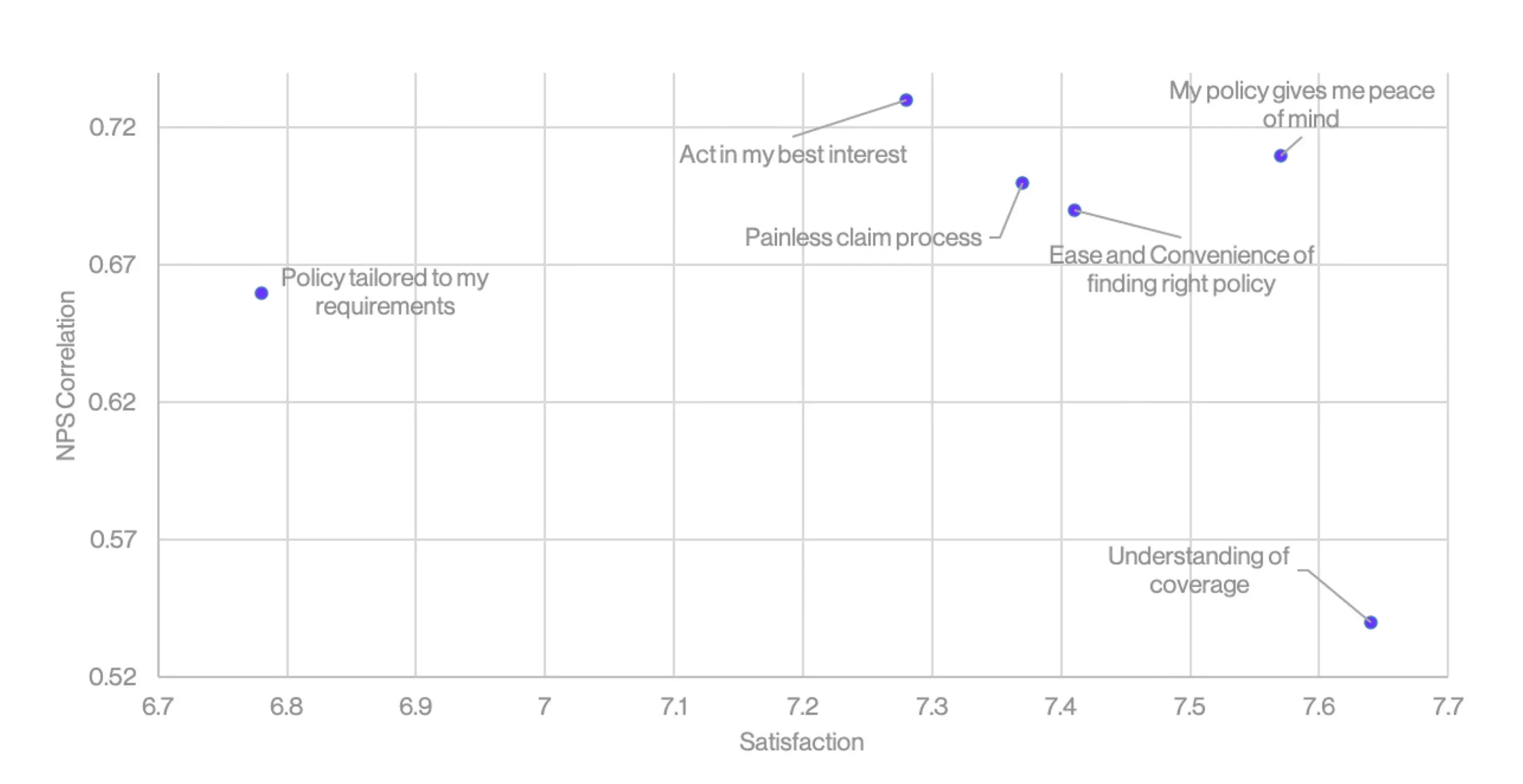

In a study by OCX Cognition, customers report that NPS was largely driven by 9 factors.

Company reputation had the strongest correlation with net promoter score, meaning that brand awareness and public relations are critical to driving positive feelings and likelihood of referral.

Product features and ease of doing business also correlated strongly with NPS (view the graph here), indicating that the product must meet customer expectations to drive loyalty.

In the health insurance industry specifically, NPS correlated most strongly with 'policy peace of mind', 'painless claims process' and the company 'acts in my best interest'.

Listen up insurers, your customers are speaking.

How to Calculate Your Net Promoter Score

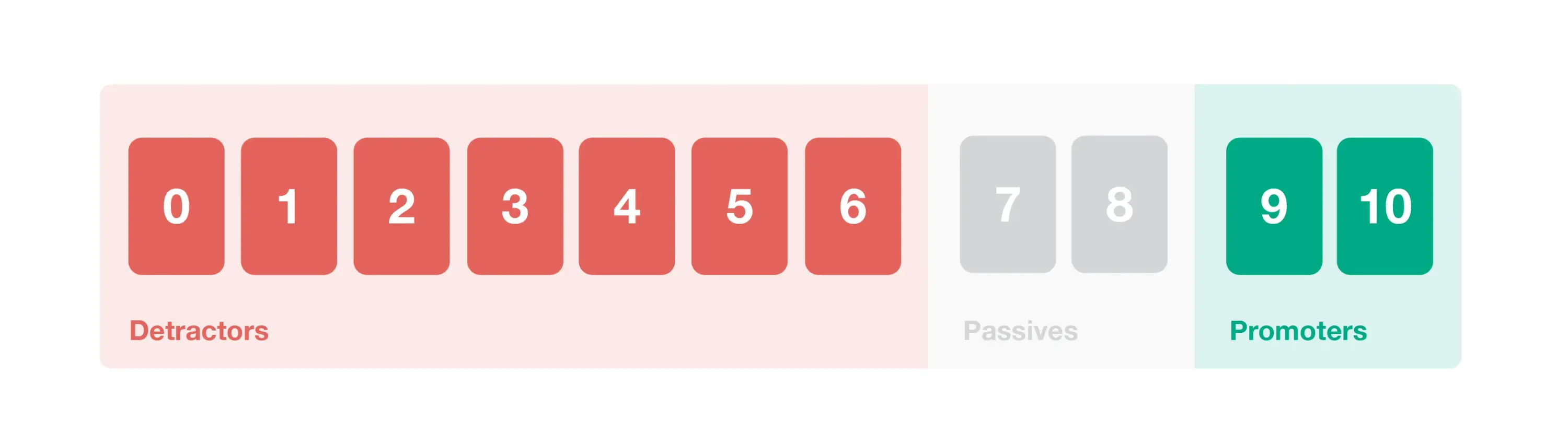

To calculate your Net Promoter Score, you first need to categorize your respondents into three different groups: promoters, detractors, and passives.

Promoters

Promoters are survey takers who have given you a 9 or 10 when asked, How likely are you to recommend [product x] to a friend, family member, or colleague?

At CustomerGauge, we affectionately call our promoters “brand evangelists.” These are the customers who will gladly recommend you to their friends–generating a powerful loop of referral marketing for your insurance company.

The ultimate goal is to convert more of your customers into brand evangelists. A net promoter score can help you to do so by giving you insight into both your strengths and weaknesses.

Detractors

Detractors are survey takers who have given you a 6 or below when asked how likely they are to recommend you to others. They are less-than-enthusiastic about your service, and there’s most likely a concrete reason behind their low score.

If you get low scores on your net promoter score survey, celebrate! You’ve now got opportunities to turn customers who have been turned off into brand evangelists. By closing the loop and following up with unhappy customers, you create a positive new touchpoint with a previously unhappy customer.

Passives

Survey takers who give you a 7 or 8 are passives. Passives may be mildly content with your insurance company. But they are unlikely to become valuable customers to you by recommending your service, offering constructive feedback, or staying with you long-term.

A neutral survey response (7 or 8) doesn’t present an opportunity to follow up. This makes it more difficult to convert a passive into a promoter than it is to convert a detractor into a promoter.

Want to know more about NPS scores for insurance companies? Get the most comprehensive B2B benchmarks guide on net promoter score.

Once you’ve categorized your respondents, you’re ready to calculate the percentages. To get the total percentage of detractors, divide the number of respondents who rated you a 6 or below by the total number of survey takers. To get the percentage of promoters, divide the number of respondents who rate you a 9 or 10 by the total number of survey takers.

Then, subtract the percentage of detractors from the percentage of promoters. That’s your net promoter score! That, of course, leaves a gap in your survey sample. Passives aren’t factored into your final score, as they don’t offer constructive insight into your performance.

Here’s an example of what a Net Promoter Score survey might look like for an insurance company:

Let’s say that you're a health insurance company that sends a Net Promoter Score survey to 70 people using a tool like Customer Gauge’s AccountExperience program. The results from this survey show that there are 14 detractors, 26 passives, and 30 promoters.

14/70 survey takers, or 20%, of your survey takers are detractors. 30/70, or 43%, of your survey takers are promoters. The NPS calculation = % Promoters - % Detractors, so in this case you have a score of 23.

Here’s a simple formula you can use to calculate your score (if you use AccountExperience, calculations will be done for you).

[# of promoters/total # of survey takers] - [# of detractors/# of survey takers] = Net Promoter Score

Keep in mind that a Net Promoter Score can range from -100 to +100. Rather than look at your NPS as an isolated score, it’s essential to compare it against NPS benchmarks for insurance. Then, you’ll want to measure changes in your score over time to see how your performance is improving or deteriorating.

In the following section, we’ll look at NPS score benchmarks for the insurance industry, giving you an idea of how leading insurance companies typically perform when gauging customer loyalty.

What's the average NPS score for the insurance industry?

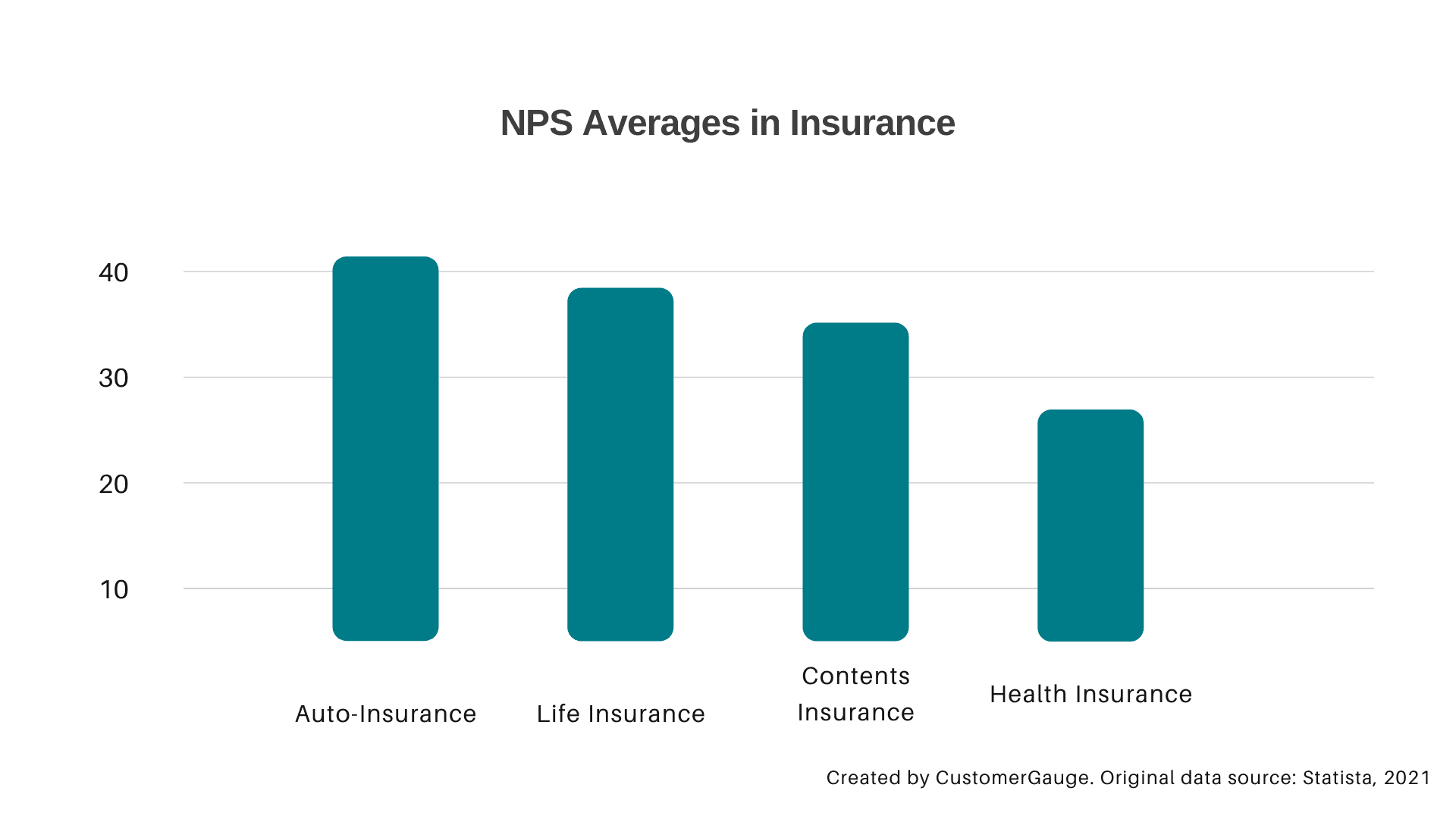

The average NPS score for the insurance industry is +35, which has room for improvement compared to other industries like consumer brands and technology—insurance companies need to up their game through more personalized experiences.

We calculated the average score by looking at the 2021 data from four core insurance categories:

- Auto-insurance, where the average NPS score = 41%

- Life insurance, where the average NPS score = 39%

- Contents insurance, where the average NPS score = 35%

- Health insurance, where the average NPS score = 27%

You might ask, why should insurance companies focus their energy and resources on measuring and growing their NPS? Let's take a look at the operational data from a similar industry: financial services. Research shows that the lifetime value of a promoter is 2.5x higher than that of a detractor, while detractors are 2.3x more likely to switch to another organization compared to a promoter.

Even more interesting is that financial institutions that have an NPS score higher than 60 will see a 26% greater level of growth in their operating income compared to organizations with a score below 60. The higher the score, the better the sales and the higher level of profitability—something is proven to translate across all industries.

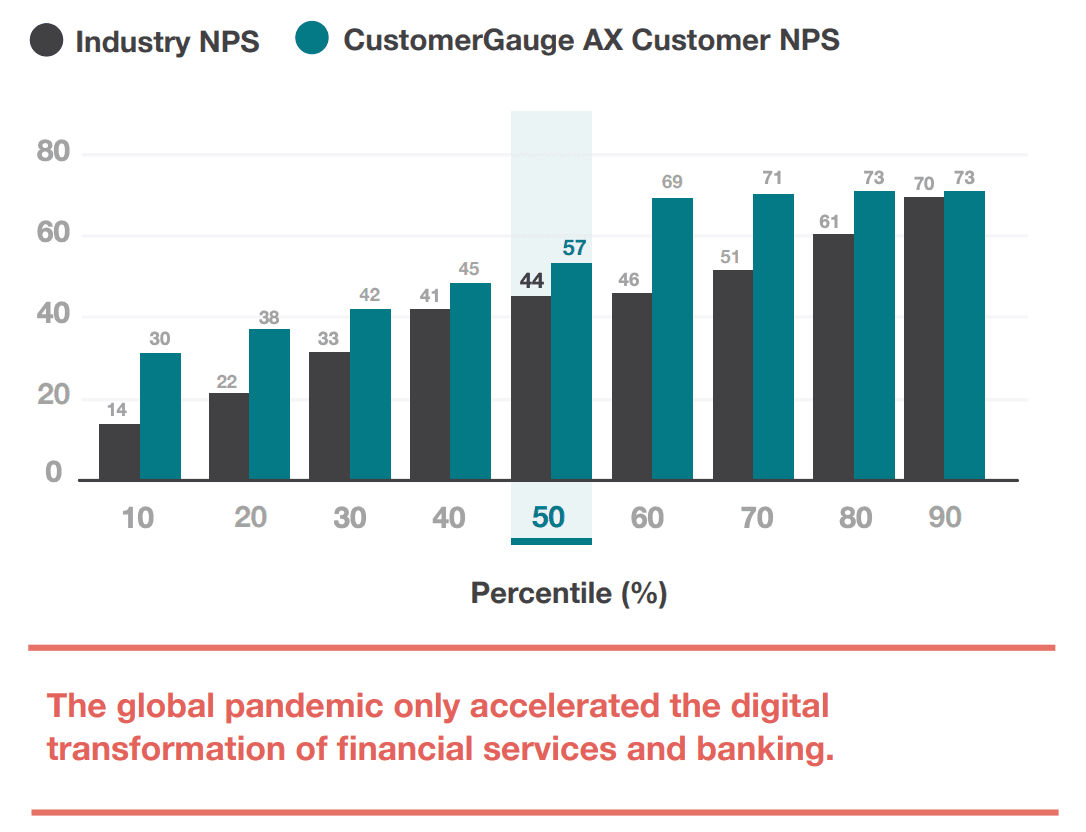

In our latest NPS benchmarks report, we grouped insurance companies together with others in the financial services industry. We discovered that the average NPS score for financial services as a whole is 44 (previously 46), whereas for customers using the CustomerGauge methodology the score sat higher at 57.

What is a good NPS score for insurance companies?

Bain & Company (the creators of NPS) note that a good NPS score is 0 and above. Above 50 is excellent and above 80 is world class.

A score that's zero and above suggests that you have more Promoters than Detractors, which is a good sign. However, it's important to compare yourself to others in your industry.

In the insurance industry, where the average score is +35, a score greater than 35 would be considered good, but our financial services customers achieved +57 on average and it should be your ultimate goal to match the likes of leading insurance players.

How to read NPS benchmarks for Insurance?

It's important to note that only some of the Net Promoter numbers are based on statistically significant data provided by surveyed customers—those are the ones where we collected the data ourselves and took Median scores in our benchmark report (find that here).

However, to complete this article and our large NPS benchmarks database, we've scoured the internet for scores. We've tried to source NPS scores from company financial reports (a trustable source) where we can, but please do take a look at the original sources for each score and take all scores with a pinch of salt (they're all self-reported after all).

Benchmarks can be useful to a point. As a simple comparison tool, and one to invigorate change across your organisation, they're excellent. However, many companies use different calculation methodologies, have varying maturity in their Net Promoter program, and may be artificially inflating their score. The best benchmark, therefore, is your own score from previous years.

Read our guide to Account Experience to learn how to setup your NPS program properly, or reach out to us today to talk it through with an expert.

Top insurance NPS scores: 25 NPS Benchmarks for Insurance Companies

Leading (large players) Insurance NPS scores

Want to know NPS scores for all major industries with tips to improve your score? Get the most comprehensive B2B NPS benchmarks guide on the planet here.

NPS Insurance Industry Leaders: How did these 4 insurance companies achieve a high NPS score?

1. Aegon NPS Score (41)

Aegon achieved their NPS score of 41 with three philosophies and tactics. You can download this full case study here, but here are some highlights:

Rollout your NPS program widely: The organisation has embedded their voice of customer platform across 47 departments, where it is enabling Aegon to automatically alert staff to customer issues, identify root causes, and track trends.

Serve the real customer: The company previously worked closely with intermediaries to provide products to be sold to end customers. But in recent times, this has changed, and Aegon is increasingly dealing directly with customers - something that was a direct factor in choosing to partner with CustomerGauge. "The world is changing, technology is changing, customers are changing, and we're transforming form a product-driven company who served intermediaries to a customer driven organisation, which serves the real customer," noted Han de Ruijter, Chief Customer Officer.

Energize your frontline team: Aegon surveys customer transactions at a customer support level, and this is having a direct positive impact on support culture. As explained by Ruben de Haas, "If you get positive remarks back from customers, you start the day on a high, and if not, it gives you something to aim for by the end of the day."

2. Kaiser NPS score (48)

Kaiser reported an outstanding NPS score of 48 in 2021. According to NICE Satmetrix Benchmarking for the health insurance category, Kaiser has topped the leaderboard for 11 years in a row in the category of health plan providers.

But how? What's Kaiser's secret sauce? Kaiser's growth strategy is built around innovation service utility, service quality and service agility. They've developed a customer-centric culture led through employee engagement programs and world-class talent management—a key element of empowering frontline staff to own the customer experience and address customer issues quickly and with high satisfaction.

One core element to employee empowerment is Kaiser's technology and tools. Their self-serve platform makes it easy for customers to access healthcare services anywhere on-demand, connecting their customers with things like appointments, treatments and doctors they need in a way that's efficient and pleasing to members.

What are the key lessons from Kaiser? (1) Employees should not be limited by process and technology, (2) Make the value customers expect to get, easy to get. Easier said than done apparently, but not for Kaiser!

3. USAA NPS Score (75)

The American financial institution, USAA, is enjoying an NPS score of 75, one of the highest in the industry. The ease of doing business with the company, combined with the feeling that customers are treated fairly has helped USAA achieve the impressive NPS score of 75.

Currently one of the leaders in customer delight in the banking and insurance sector, USAA has carefully invested in initiatives that reduce customer effort and lead to active promoters. For example, a study by Stephanie Woerner and Peter Weill from MIT Sloan revealed how USAA has transformed itself, and specifically, how the IT unit has addressed the changing demands from customers in order to deliver superior customer service.

USAA has become the first financial services company to allow customers to check their bank balances via text message. The brand also now offers technology for customers who have been involved in car accidents, allowing them to instantly attach photographs and voice recordings to their insurance claims, which can be initiated remotely. Such innovations can serve as an example of customer experience best practices. USAA has become an epitome for a brand that is not obsessed with technology, but customers, and has their needs and expectations at the center of its operations.

What are the key lessons from USAA? (1) Leverage technology to develop ease and efficiency for customers, (2) Speedy, high quality customer service is critical to happy customers. When things go wrong—that gap in expectations and reality should be filled by your service team ASAP.

4. Allianz NPS Score (79)

Allianz has an overall NPS score of 79 in 2019, unheard of in the insurance industry.

Allianz claims to have developed a customer-centric culture that "consistently delivers on high expectations for exemplary customer service through rigorous quality assurance, flawless assistance and seamless execution. We focus on continuous process improvement and are dedicated to maintaining an agile environment."

Having implemented a 'robust' customer service technology in their contact center in-house, Allianz offers quick and helpful service to customers in need.

Allianz has also implemented customer experience management software like CustomerGauge to continuously measure customer feedback and act to tackle customer pain points. Their voice of customer tech measure more than 28,000 customer calls every year to understand success and discover areas of CX to improve.

That concludes our guide to the insurance industry. Want to discuss your net promotor program and how to leverage it grow referrals, identify upsell opportunities and tackle churn? Reach out to our team of experts today for a conversation.

Frequently Asked Questions About NPS in the Insurance Industry

1. What is the average NPS for insurance companies?

The average Net Promoter Score (NPS) for insurance companies typically ranges from 20 to 40, depending on sector and region.

2. What is a good NPS score in the insurance industry?

A good NPS in insurance is generally above 40. Scores above 50 are considered excellent and signal strong customer loyalty.

3. Which insurance company has the highest NPS?

Top performers like USAA and Lemonade often achieve NPS scores above 60, driven by digital ease and strong customer experience.

4. Why is NPS important in the insurance sector?

NPS is important because it helps insurers measure customer trust, identify service gaps, and improve policyholder retention.

5. How is NPS calculated for insurance companies?

NPS is calculated by asking customers: “How likely are you to recommend [company] to a friend or colleague?”, scoring from 0–10, and subtracting the percentage of detractors from promoters.

6. What factors affect NPS in insurance?

Key NPS drivers include claims experience, agent responsiveness, policy transparency, and ease of communication.

7. How does customer service impact NPS in insurance?

Customer service is a major NPS driver. Prompt support, empathetic claims handling, and clear communication boost scores significantly.

8. What is the NPS of life insurance companies?

Life insurance NPS averages between 25 and 40, but top brands exceed 50 through digital-first experiences and personalized service.

9. What is the NPS of health insurance providers?

Health insurers generally score lower, with average NPS ranging from 10 to 30, due to complex claims and perceived lack of transparency.

10. What is the NPS for auto insurance providers?

Auto insurance NPS tends to be higher, averaging 30 to 50, with top performers reaching 60+ based on digital claims ease and value.

11. What is the NPS of USAA?

USAA consistently leads the insurance industry with NPS scores above 75, reflecting its exceptional customer satisfaction and service.

12. What is the NPS of Geico?

Geico's NPS typically falls between 40 and 55, driven by competitive pricing and strong digital experience.

13. What is State Farm’s average NPS?

State Farm generally has an NPS of 35 to 50, varying by policy type and region.

14. What is Allstate’s Net Promoter Score?

Allstate’s NPS typically ranges from 30 to 45, influenced by customer service consistency and claims experience.

15. What is Progressive’s NPS score?

Progressive often reports NPS in the 40 to 50 range, especially strong in auto insurance due to its user-friendly tech and pricing.

16. How does NPS correlate with insurance customer retention?

Higher NPS directly correlates with better customer retention, as promoters are more likely to renew policies and refer others.

17. Can NPS predict churn in the insurance industry?

Yes. Detractors in NPS surveys are significantly more likely to cancel policies or switch providers within 6–12 months.

18. How can insurers improve their NPS scores?

Insurers can improve NPS by streamlining claims, enhancing digital experiences, training customer service teams, and following up on feedback.

19. What’s the difference between direct and broker-sold insurance NPS?

Direct insurance providers tend to have higher NPS due to better control over the customer experience, unlike broker-sold policies.

20. Do digital-first insurers have higher NPS?

Yes. Digital-native insurers like Lemonade and Next Insurance often outperform traditional firms due to simplicity and speed.

21. What NPS benchmarks are available for insurance segments?

Benchmarks vary:

-

Health Insurance: 10–30

-

Life Insurance: 25–40

-

Auto Insurance: 30–50

-

Homeowners Insurance: 25–45

22. Is NPS used for both personal and commercial insurance?

Yes. NPS applies to both B2C (personal) and B2B (commercial) lines, though benchmarks and expectations differ by segment.

23. What’s the impact of claims experience on insurance NPS?

Claims handling is the most critical touchpoint—delays or disputes significantly lower NPS, while smooth experiences boost loyalty.

24. Can insurance NPS be improved through automation?

Yes. Automation in quotes, renewals, and claims can enhance convenience and transparency, leading to higher NPS.

25. Should insurance companies use NPS for agents and brokers?

Yes. Tracking NPS by agent or broker allows companies to identify high performers and target training or process improvement.

26. What’s a low NPS in insurance mean?

A low NPS (below 20) typically indicates issues with claims delays, poor communication, or unmet customer expectations.

27. How should insurers follow up with detractors in NPS?

Insurers should follow up quickly, apologize where needed, resolve issues, and close the feedback loop to regain trust.

28. Can NPS be used in insurance marketing?

Yes. Promoter quotes can be used as testimonials, and NPS growth can be positioned as a brand trust metric.

29. Is NPS a reliable metric for customer loyalty in insurance?

Yes. NPS is one of the most reliable predictors of renewal behavior and word-of-mouth referrals in the insurance space.

30. How often should NPS surveys be sent in insurance?

Insurance companies often survey NPS after claims, at renewal, and semi-annually for relationship tracking.

Blog Home