Net Promoter System (NPS) is the number one tool to assess and improve the relationship a company has with its customers. But tools are tools—and they only work best when you know exactly how to use them.

That’s why you need to adopt these NPS survey best practices. Without them, you won’t tap the full potential of this powerful methodology.

If it sounds as though things are about to get complicated, it’s quite the opposite. Best practices in NPS program design really help you to deliver simplicity.

When it comes to Net Promoter surveys, you want two things:

Better response rates. That’s the number of people who answer your survey versus the number of people who had the option to.

Actionable feedback that you can leverage to improve your bottom line.

NPS best practices generate results that actually mean something for your company’s growth. In the words of our VP of Education and Services, Cary Self, “NPS is not a research tool, it’s an action tool.”

But so many companies get this wrong. They over-rely on the Net Promoter score itself and not on how to put survey responses to good use.

With this guide to NPS survey best practices, we’ll show you how to get the most out of this tool, in a way that’s simple, fast, and meaningful for your bottom line.

Let us start with a very quick whip around how NPS surveys work.

What Is an NPS Survey?

Net Promoter Score (NPS) is a market research metric used to measure the likelihood of retaining customers.

Your NPS score is calculated on a single question survey and will yield a number between -100 to +100. The larger your number, the better the score.

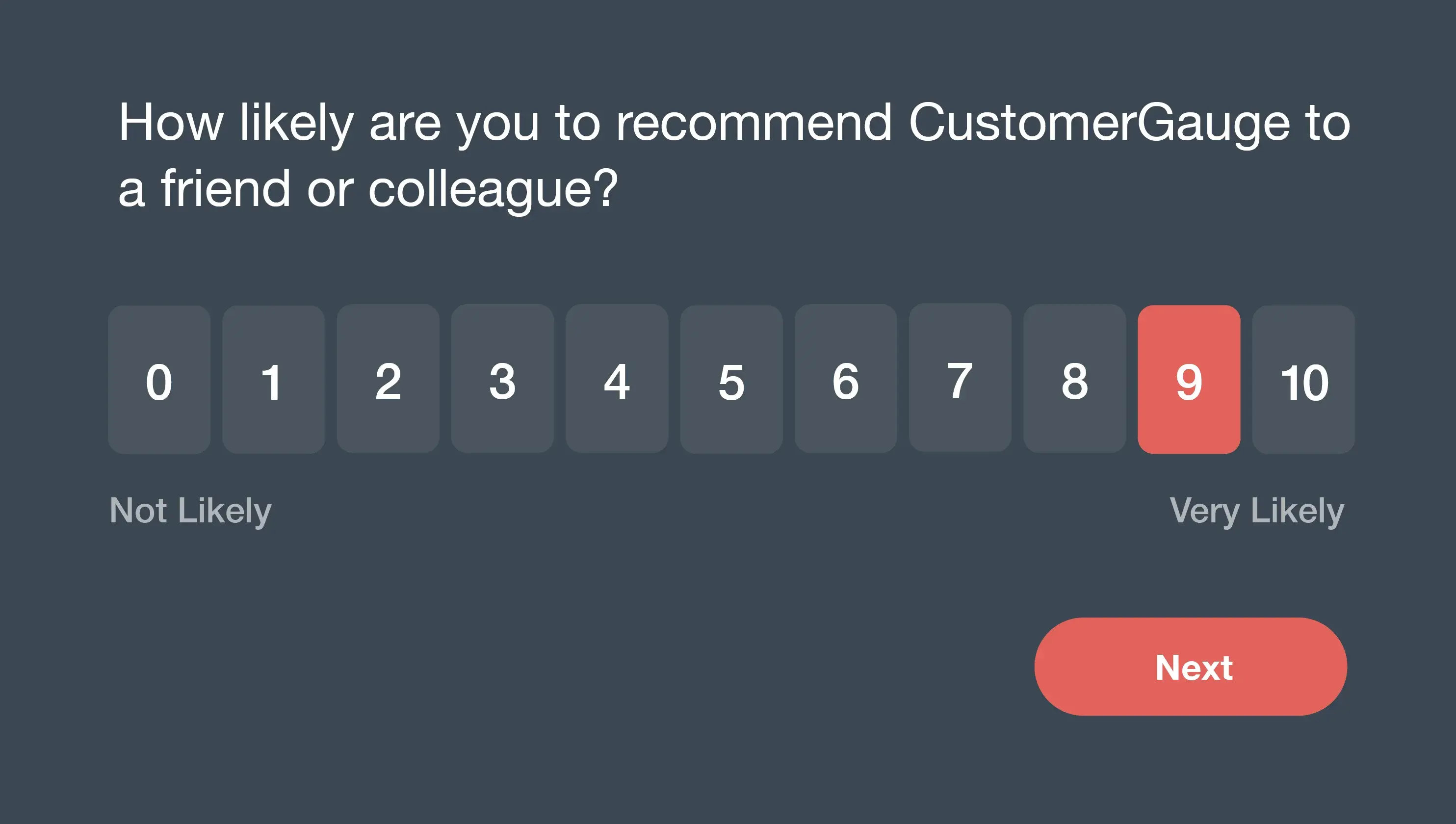

A Net Promoter Score survey asks respondents to give a rating between zero and 10 about how likely they are to recommend your company. Zero is not likely at all, and 10 is highly likely.

Those respondents are then divided into three camps:

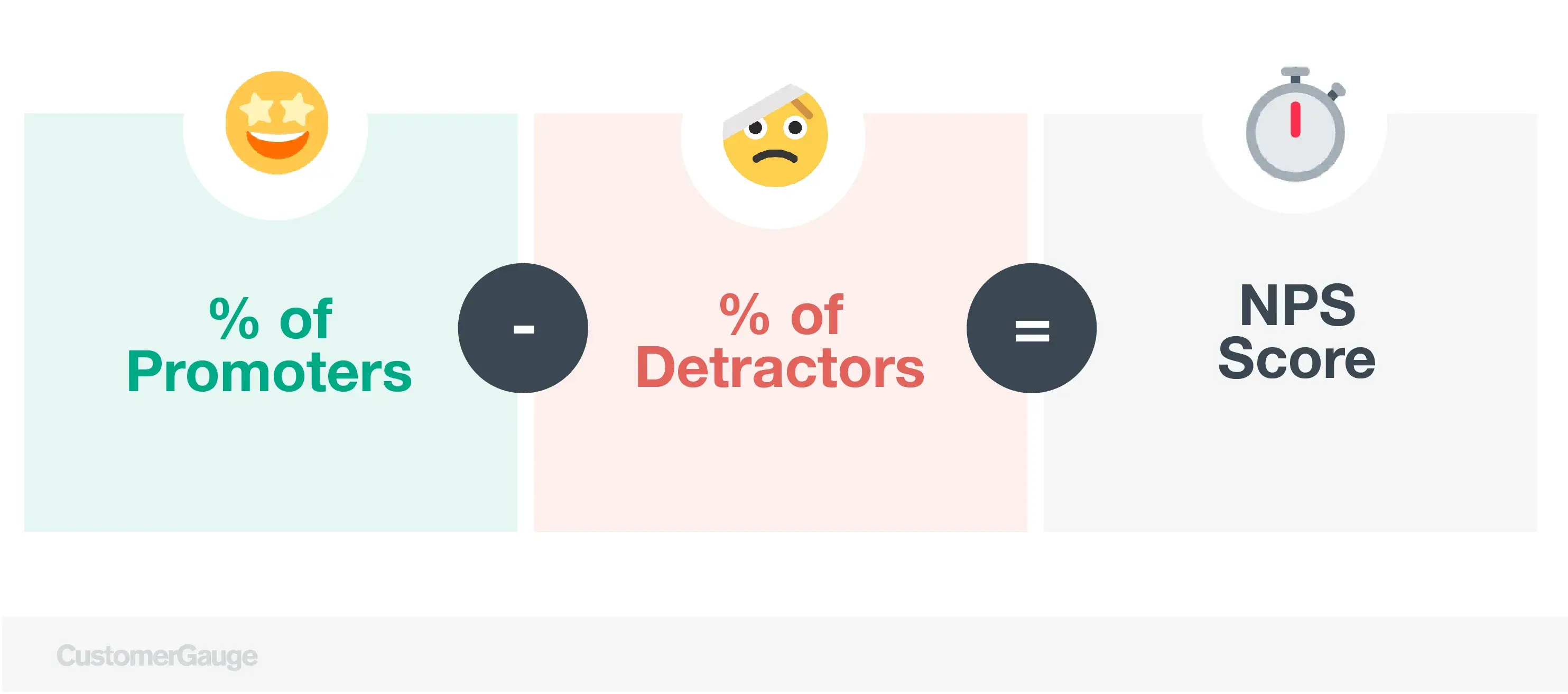

😊 Promoters (your most satisfied customers) give you a 9 or 10.

😐 Passives give you a 7 or 8.

😒 Detractors give you somewhere between 0 and 6.

To calculate your NPS score, subtract the percentage of detractors from the percentage of promoters.

Let’s say 60% of your respondents were promoters, 25% were passives, and 15% were detractors.

To get your NPS score, you would subtract 15 from 60, giving you a score of 45.

The goal then is to improve this score, decreasing the number of detractors and increasing the number of promoters. Simple as that.

Deep dive this topic: How to Analyze NPS Results

What Are the Benefits of NPS?

There are multiple reasons why NPS continues to be the go-to method for managing and improving your customer experience.

Here are a few (of many!) NPS benefits:

- Offers a return on investment. According to Gartner, 80% of future revenue comes from 20% of existing customers. It's been proven time and time again that a lack of fantastic customer experiences results in customer churn (aka money in your pocket lost). Utilizing NPS lets you understand customer sentiment to create stand-out experiences — a huge brand differentiator.

- Simple to execute. NPS surveys should be short and to the point to ensure high response rates, leading to strong, accurate feedback. Not only can they be sent at any customer journey touchpoint, but sent through any survey distribution method using CustomerGauge.

- Actionable. Receiving customer feedback in real-time allows you to act immediately to reduce churn and increase customer loyalty.

💡A customer of CustomerGauge, Coca-Cola HBC, uses NPS to track both customer and employee insights. Hear from Natasa Prodanovic, Head of Lean and Agile Center of Excellence at Coca-Cola HBC backstage at Monetize! our voice of customer (VoC) conference in Amsterdam.

What Is a Good NPS Survey Response Rate?

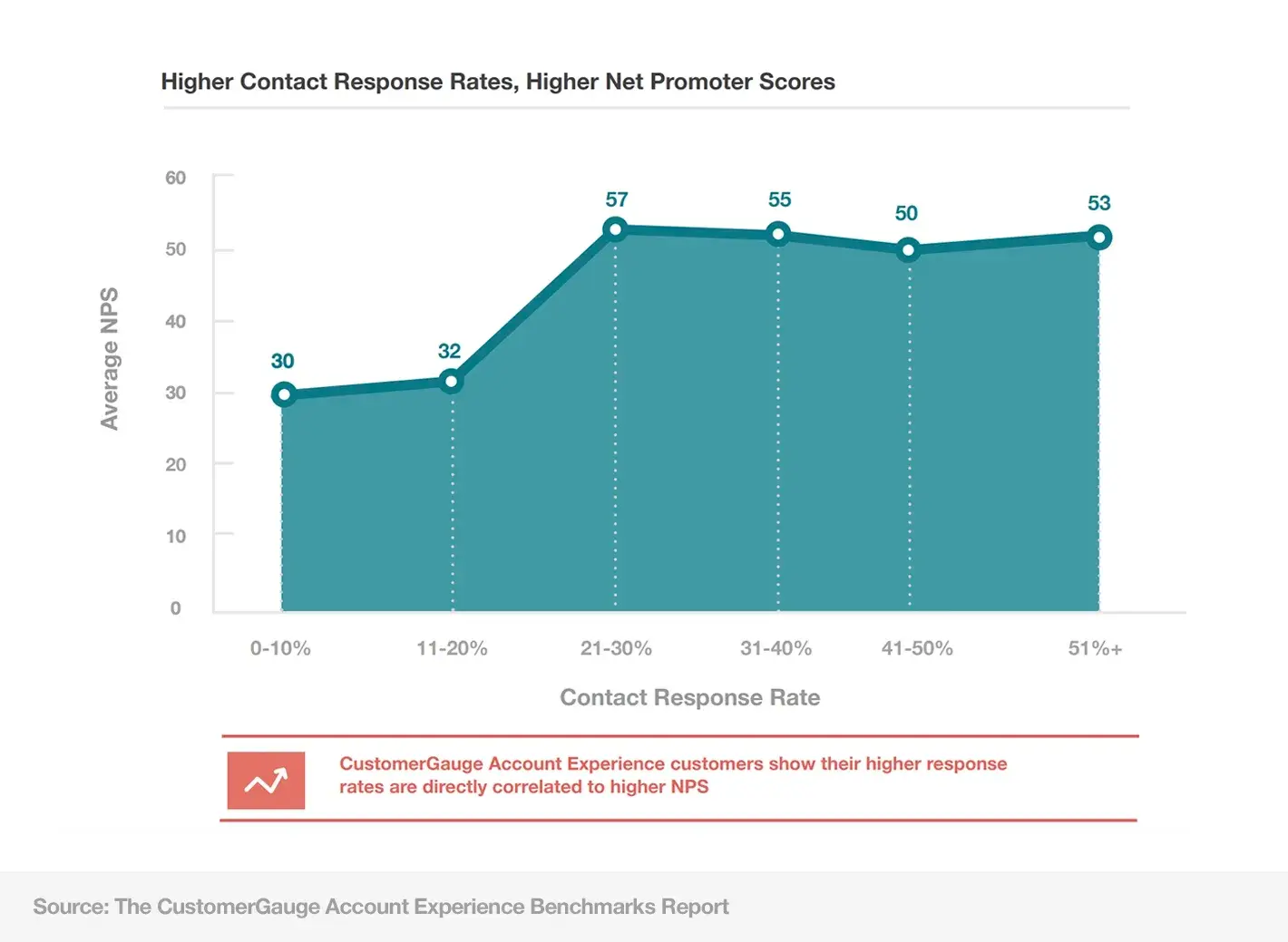

I wanted to highlight NPS survey response rates in particular because they are critical to success.

Your understanding of your customers is only as good as their response rate. Say if you're in the B2B space, if you are unable to get a response from each customer account, how do you know if they're happy?

We go a step further at CustomerGauge. We coach our clients that not only is account coverage critical (i.e. your goal is a response from 100% of the customers making up your revenue base), but you must also survey multiple stakeholders in each department of each customer.

Frontline, middle management and senior management all influence the buying process. You need to know if any are unhappy or disengaged.

Survey response rate can be useful even if they don't respond. Below average response rates indicate an unengaged, unhealthy customer base—absence of signal is a clear signal indeed.

NPS survey response rate is calculated with this formula:

Total Completed Surveys / Total # Surveys Sent * 100

The average response rate for B2B brands survey emails is 12.4% (although in our research they ranged between 4.5% and 39.3%.).

But it doesn’t have to be that way. At CustomerGauge, our clients are experiencing 60%+ response rates. One client, ICON Communication, is seeing a response rate of 100%.

Read more: 10 Ways to Improve Your NPS Survey Response Rates

Improving your NPS response rate all starts with survey design. Here are our customer survey best practices using NPS.

16 NPS Survey Best Practices

We’ve split this guide into two main parts:

Section A: How do you create and design an effective NPS survey?

Section B: How do you conduct an NPS survey?

A. Best Practice for NPS Survey Design (Creating an Effective NPS Survey)

At the core of NPS survey design are two basic components:

What to ask, and

When to ask it

Simple enough? We’ll take you through what that looks like in practice:

1. Don't Let Perfection (or Budget) Stop You From Starting

Read through these best practices and get set up properly, but don't let perfection get in the way of getting started.

Often running your first survey, even if on one market or one customer segment, will provide results that surprise and amaze the wider business. Those results and reactions arm you with what you need to get internal buy-in (enthusiasm, budget, and resources) for a larger-scale program.

So:

Roll out NPS in stages. Choose a small segment of your customers first. As a general rule, if you don’t have enough resources to close the loop with every respondent, then reduce the survey cohort size.

Start with the core of NPS: the relationship survey. (We’ll get onto this in a moment.)

As you master your first round of surveying, you’ll learn how to expand the program by adding new surveys, surveying larger numbers, or trying different customer segments.

The bottom line? Get started with a small cohort of customers and learn what processes you need as you go.

2. Should I Opt for a Relationship or Transactional Survey?

Whether you use only a relationship survey or you add transactional surveys, will depend on your business and your needs. But it’s important to be aware of what both mean and how and when to use them.

Relationship surveys investigate a customer’s relationship with a company/brand. They ask customers to consider the overall experience and satisfaction they have with a company.

Transactional surveys investigate a customer's experience at a specific touchpoint in the customer journey. While relationship surveys are designed to measure customer loyalty as a whole, transactional surveys are for the purpose of understanding satisfaction with a specific company segment in order to improve it.

We recommend that you begin your NPS program with a relationship survey to investigate customer loyalty and brand perception. Through this, you’ll uncover which touchpoints are affecting your customer experience. Transactional surveys should then investigate the touchpoints that relationship surveys indicate are the most important to the customer experience.

Learn more: Guide to relationship and transactional NPS Surveys

One of Alaska’s biggest internet providers and a CustomerGauge client, Alaska Communications, uses both survey types.

After starting out using only relationship surveys, they realized they weren’t getting the whole picture. They needed to dig deeper into the touchpoints that were strongly impacting the customer experience, such as their contact center, field operations, and service delivery.

Transactional surveys helped them understand the performance of singular company segments.

What’s more, the two different survey types complemented each other. Relationship surveys captured the voice of the low-contact customer and uncovered issues that transaction surveys were not capturing, such as internet speed issues.

Transactional surveys helped them learn about frequently occurring troubles, such as the quality of an installation or the level of knowledge of a technician.

Read the full story here.

3. How Many Questions Should an NPS Survey Have?

Not more than six, but more optimally three. That’s all. Here’s why:

An NPS survey is about uncovering customer loyalty and what most affects it — not about investigating customer satisfaction with every segment of your company. Customer feedback surveys identify what you need to focus on to improve your CX. So knowing how customers rate every single driver has little, if any, value.

So, one of the most important customer survey best practices is: keep it short.

Long surveys mean low response rates, survey fatigue (resulting in inaccurate answers), and data that isn’t immediately actionable.

Our research shows that two to six questions are the sweet spot. And our best results have always occurred with just three questions.

With three questions, you can gather all the data you need to create actionable insights and still receive high response rates (40%—60%).

And that brings us to our next NPS best practice:

4. What Questions Should I Ask in My NPS Survey?

On a scale of 0-10, how likely is it that you would recommend our brand/service to your friends, family or business associates?

This is the standard Net Promoter Score question developed in 2003 by Fred Reichheld, who spoke intensely on customer love at our VoC conference Monetize! last year.

It’s the basis for the relationship survey. His team tested a range of loyalty questions and found that the “Would you recommend?” question correlated most specifically with a customer’s likelihood of repurchasing or renewing with the same company.

There is a long debate about the best way to formulate this question to measure loyalty. Some even promote asking directly, “How loyal are you to this company?” But if you want to experiment, save it for later when you’re more experienced with NPS and have figured out what works for your company.

One thing that should definitely not be toyed with is the scale.

When asking the NPS question, keep the scale from 0 to 10. Changing the response option to a 1 to 5 scale or a 1 to 7 scale doesn’t do much. In fact, it makes understanding detractors, passives, and promoters more difficult, and you can no longer benchmark against other companies.

And what about a transactional survey question? Does it work in the same way?

As someone’s likelihood to recommend a company is not directly related to a customer’s satisfaction with a touch point, a transactional survey should be formulated slightly differently.

If you measure a high-volume transactional touchpoint, asking people about their likelihood to recommend may defeat the value of the question. Consider alternative question formats such as “how satisfied” or “please rate.”

An even better option may be to use another metric, the “Customer Effort Score” (CES). This measurement shot to fame when this article in HBR begged the simple question: why are we trying so hard to delight customers? That’s not what keeps them coming back. Rather, what brings them back is how easy it is to get done what they need to get done.

The CES question is typically formulated as follows:

To what extent do you agree or disagree with the following statement: The company made it easy for me to handle my issue with customer service.

Learn when to use NPS vs CSAT vs CES.

5. How Do You Find Out The 'Why'?

Reichheld’s original “Would you recommend?” question is great, but it alone will only tell you how you are performing, not why. Now, it’s generally agreed that asking customers what drove their score is absolutely necessary.

The easiest way is to:

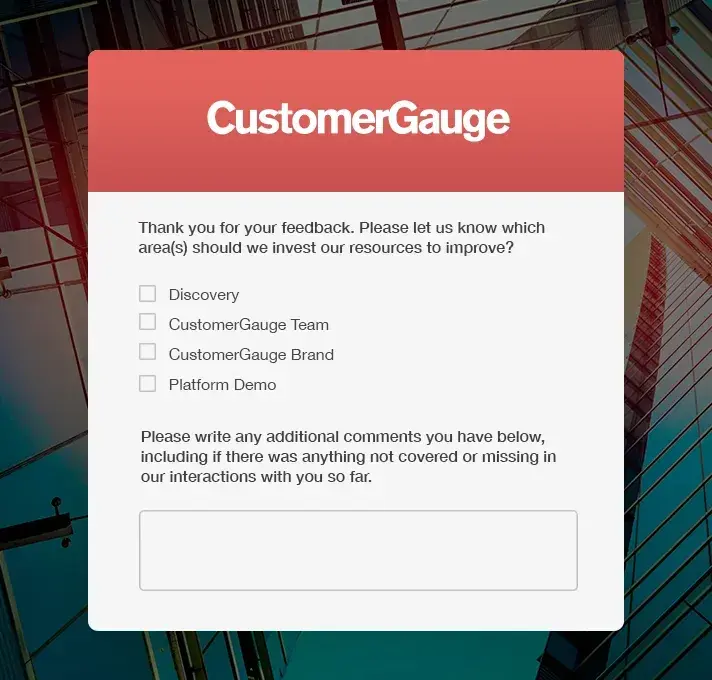

Ask customers to identify only the most important reasons (drivers) for their score

Present customers with a predefined selection of reasons, rather than have them submit their own reasons

How you ask customers what affects their score should be different for promoters than detractors and passives.

Consider a travel company. Take a look at the survey example below to see how they can discover what’s most affecting their CX in one question and a few drivers.

In this example, the customer is presented with 4 reasons for their score.

Constructing the survey this way keeps it short and simple for the respondent, as they only need to think about what’s most important to them, which leads to higher response rates. It’s also important not to restrict the customer to select only one reason. Customers should be able to choose as many reasons as they deem important.

When constructing the question this way, CustomerGauge research found that 82% of respondents answer this question.

And then:

Add a comment box in case they still have anything to add.

In our experience, 44% of survey respondents leave a comment if they have the opportunity. Frame the open-ended question as voluntary, to ensure the survey appears as short as possible. Also, convey that you do care about their feedback:

Comments provide valuable feedback from your customers. An NPS score of 5 can be debated. However, when a customer says, “Your product is great, but each time I need to ring customer support it takes forever,” it’s clear how the customer perceives the company.

Of course, analyzing free text is always a challenge, even with advanced text analytics. Your NPS survey tool should, in real time, identify keywords within the comments that are potential drivers behind customer scores.

And finally:

Give customers the option to be contacted. Add a simple tick-box asking customers “may we contact you to discuss your experience in more detail?” Doing this conveys to customers that you really are listening and willing to act on their feedback.

6. How Do I Make the NPS Survey Look Good?

Customers can just as easily be turned off by how a survey looks, as they can be by a poorly worded question. That’s why we need to talk about best practices in survey design.

Pay attention to colors, font, font size, images, and the layout of your survey. The type of market you serve will help guide this process.

Industries like finance might choose to strike a serious tone using company colors, a neat and well-placed company logo, and formal text. While for a travel company, it would be more effective to aim for a relaxed feel, by incorporating holiday-related images, multiple color schemes, and text that has a casual air.

We make our NPS surveys fully customizable for our customers at CustomerGauge so they can adapt them to their industry.

Once you’re established with how NPS works, test different surveys to see what works best.

B. How Do I Conduct a Best Practice NPS Survey?

The goal here is to ensure that you:

Send the right surveys to the right people at the right time

Create a survey process that is easy

Receive high response rates

Let’s explore some NPS best practices to achieve exactly that.

7. How Do I Upload My Data into My NPS System?

Whether you use a customer relationship management (CRM) tool or a simple spreadsheet, customer data needs to be uploaded into your NPS survey tool. The goal here is to avoid manually entering contact details when the time comes to send your surveys.

For those using a CRM, make sure you use survey technology that can not only integrate with your CRM, but also automate as much of the conducting and collecting process as possible.

Alternatively, try a customer experience management software such as CustomerGauge that makes it easy.

8. What Customer Data Should I Upload?

To get started with your NPS survey, upload the following to create a profile for each piece of feedback:

Customer contact details

Basic demographic information

Later, if you’re processing and analyzing customer feedback in your NPS tool, you’ll need to upload more extensive customer data, such as purchase history and support history, for example.

That way, you’ll be able to tie additional, contextual data to their NPS response to create a more actionable analysis.

9. How Should I Conduct My Relationship Surveys?

How many customers should I survey? Sample size and statistical significance are important in NPS, but not for your first surveys. While one part of NPS is about aggregating feedback to drive organizational change, its biggest strength is to determine how strong your relationships are.

Depending on the size of your user base, release your survey to your customers over a period of weeks or months. NPS surveying is a continual process and, over time, you will create the sample size you need.

Who should I survey? In B2C, all customers are eligible for an NPS relationship survey. In some cases, you may elect to narrow your sample. For example, an airline might choose to only survey its economy class customers because it knows that’s where improvement is needed. Generally, though, in B2C, customer bases are pretty uniform and companies will survey all their customers.

In B2B, sending a relationship survey means sending surveys to many contacts within an account. All customers in B2B should be surveyed, but it’s important to determine which contacts in each account need to be surveyed.

At CustomerGauge, we built hierarchy functionality into our NPS management software to ensure customers survey their full customer accounts and are able to report on NPS scores for each organizational layer.

Learn how to do this here: Why “Voice of the User” is not “Voice of the Customer” in B2B.

When should I send a relationship survey? When to send a relationship survey during the year is almost arbitrary — there’s no standard “best time.”

Experimenting with timing is only something you should attempt when you have an operationalized NPS, where you have the time and skills to test which days or hours work better. However, even this has only limited value, as we have found.

- Don’t send out a relationship survey to a customer if they have only been a customer for 24 hours. Wait until there’s a relationship to talk about, before you ask them to speak of it. How long this takes depends on how frequently customers use your products or services and interact with your company.

- Instead, send relationship surveys at strategic times of year. Just before a quarterly review can be a great time, as the survey response will give you action points to discuss in the meeting. Alternatively, send the survey before contract renewal, so that you can inform any effort to save churning customers.

- Create a global plan. If a transaction survey is due just days before a relationship survey, consider the effect of sending two surveys so close in time. Relationship surveys need to take priority over transactional surveys. They’re more valuable to your NPS program (particularly for B2B), and if they follow shortly after a transactional survey, the response rate and even the answers themselves may be affected.

- How often should you send a survey? Relationship surveys should be sent at least once a year, preferably twice. Depending on your industry, you may be able to get away with surveying every three or four months. Be careful, though, if you survey too often, you may annoy customers, which will decrease response rates.

10. How Should I Conduct My Transactional Surveys?

Who should I survey? As we advise NPS to be rolled out incrementally, start by doing transactional surveying for just one or two of your most important touchpoints. Important touchpoints are those that customers continually select in your relationship survey.

Later, when you’ve mastered a small number of transactional surveys, expand your transactional NPS to cover other touchpoints that your relationship survey uncovers.

When should I send a transactional survey? You should send a transactional survey immediately after a touchpoint. Waiting a day or two before sending a survey will mean the customer’s memory of the transaction will have changed, and the customer’s incentive to do the survey will have diminished.

Be mindful, though, of how you define the touchpoint. If you want to measure the whole experience from browsing/ordering to receiving the item, you should time your survey for when the item arrives, not immediately after the purchase.

How often should you send a transactional survey? Sending a transactional survey too frequently can be damaging to your data and response rate.

For example, a customer calls a support center to resolve an issue, but resolving the issue requires three or four interactions in the space of a day. If you survey after each interaction, this won’t raise new insights, and it will produce a low response rate.

Leave sufficient time between transactional surveys, so when completing a survey, the customer is not thinking about a previous transaction but about the one they just experienced.

This is particularly important for customers who experience two different touchpoints in a short period, as the experience with one company segment could affect the feedback about another company segment.

11. What Channels Should I Send My Surveys Through?

There are various different channels through which you can send NPS surveys to customers.

When deciding which ones, the two key points are:

Convenience for your customers

What will receive the best response rate

Two of the most common methods are to send survey links by email or SMS. This is particularly useful for relationship surveys, where the customer has not had any recent contact with a company.

We strongly recommend using email over all other channels. Email gives you the space to construct a proper invitation, and tends to produce the highest response rate.

When it comes to transactional surveys, a lot more options for sending open up, as surveys can be presented to customers immediately after a transaction. Think about the industry you are in, and how you can “grab” a customer straight after a transaction.

Some retail stores often put a survey link at the bottom of receipts, while others ask customers if they would like to complete the survey via dedicated in-store tablets. Online, many companies present an NPS survey link on the final screen of a transaction, while in the software industry, some present it during the use of an app or software tool.

12. What's the Best Way to Present NPS Survey Questions to Users on Phones?

Increasingly, people are living on their phones. No matter what channel you use to send your surveys, make sure it can open on mobile devices. Your survey invite might be something your customer has scheduled for the bus ride home.

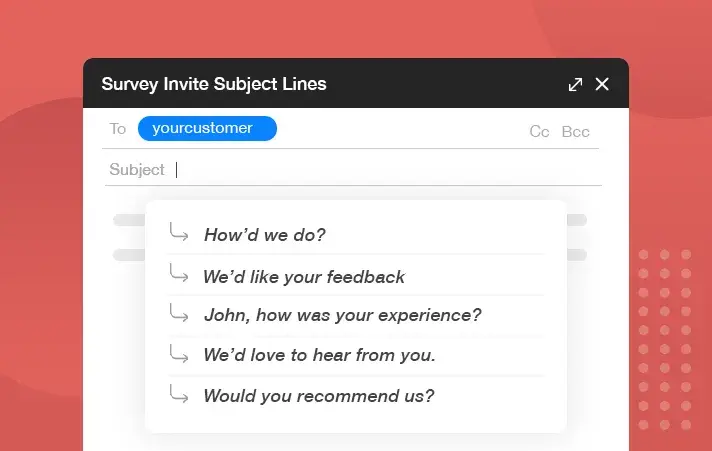

13. What Do I Say in a Survey Invite?

In your invite, pay careful attention to each word you write and eliminate everything that isn’t necessary. Are you repeating yourself or communicating things that aren’t relevant or interesting to the customer?

First stop: your email subject line. These are psychological triggers to get the attention of customers. Your subject line should be brief, straightforward, and friendly. Examples of good subject lines include:

For more on this, read our article: 20 Email Subject Lines Strategies to Increase Survey Response Rates

Then, it’s time to construct the body of the text. To create an invite that gets the highest possible click rates, follow these rules:

Personalize the text with their name and relevant transaction information, particularly if you are sending the invite via email.

Get straight to it and tell them what the email is about. Begin with something like:

We’re constantly trying to improve our service and would like to hear your feedback on how we performed.

You know that one of the strengths of NPS is how quick the surveys are. Make sure the customer knows too:

This survey is short and will only take 2 minutes to complete.

Customers often think, “Why respond? My issue will just end up as data on a spreadsheet rather than being fixed.” Convince them this is not the case, and let them know you analyze feedback at an individual level:

We promise to read every customer's comment.

A well-designed button for a survey link isn’t as good an idea as you may think. If recipients’ email servers block images for security reasons or customers choose not to download images, then your survey button will be lost. It is more important that the link is viewable by all. A hyperlinked phrase that is easy to find will do the trick.

The invitation should be aesthetically pleasing and designed as well as the survey itself. Plain HTML won’t do much to capture their interest. Choose an appealing font (Helvetica, Gothic, or Arial work well), think about alignment and layout, and consider adding a banner image.

14. Should I Send Follow-Up Invite Reminders for my Surveys?

Sending survey invite reminders is a good idea as it may improve your response rate. Many customers, particularly over email, may not see or be able to respond to your survey the first time around.

A standard waiting time for CustomerGauge clients between sending out the survey and following up is three to seven days. You don’t want to remind the customer too soon after the first request, but especially if it’s a transactional survey, you don’t want to wait too long either.

Note. Survey reminders become tricky when you send invites through the transaction channel itself, such as the final screen of an online purchase. A reminder then requires a different channel, such as email. However, in this case, it may be better not to send a reminder, as most customers probably saw the initial invite and chose not to do it. You don’t want to bug them.

15. How Do I Avoid Email Spam Filters?

Various things may trigger spam filters. Avoid these common red flags in your invitation email:

All-cap subject lines

Exclamation marks in the subject line

Trigger words such as “free,” “urgent matter,” “act now,” or “last chance”

An email with one big image and little to no text

Lots of different fonts, font sizes, and text colors.

16. How Do I Test My Survey?

Before you send anything out to customers, test your survey internally. Send it to other employees within the company, to test technical problems.

Make sure:

Your email engine is working.

The emails open in the format and layout intended.

Links to the survey work.

The survey itself runs smoothly.

The survey opens across different browsers.

Your email invitation works in all major email services (not everyone uses Gmail or Outlook).

Ask employees what they think of the survey and the surrounding process. Do they have any issues or ideas about the invitation or the survey itself?

Testing NPS surveys isn’t difficult, and it will help ensure you create the most reliable data possible.

Voice of Customer Survey Best Practices: The Bottom Line

You don’t want to use this tool just for the sake of it. You want to use it to get real results. And you want to get those results effortlessly. That’s all about asking the right questions, at the right moment.

The aim of this guide was to demonstrate how simple and quick it is to get started with NPS.

Unlike other survey types, designing and conducting an NPS survey does not require a long planning process. With these customer survey best practices, an NPS survey can be designed in one day and sent out the next. The longer you wait, the more insights you miss and the more customers you might lose.

Don’t worry about surveying all your customers or designing a survey for each division of your company. Start small, so that you get started fast.

Reach out to our team at CustomerGauge to get help setting up and running your NPS program.

Or learn more about Net Promoter best practices in our NPS & CX Benchmarks report—where we look at more than 25 company case studies of companies who’ve had success with NPS.