“Ask Me Anything” With Jørgen Bo Christensen, author of Next Generation Net Promoter®

by Cvetilena Gocheva

Last week NPSBenchmarks.com invited a real NPS® guru, Jørgen Bo Christensen, author of Next Generation Net Promoter® to answer some of the community's most pressing questions.

We received numerous requests about additional information on how to succeed with the Net Promoter Score system, how to ensure high response rates with customer surveys or whether to use incentives for referral programs.

We decided to share some of Jørgen Bo Christensen's answers to these questions so that more community members obtain thought leadership advice on NPS.

Here are some of the most asked questions we received:

1) What are the most successful campaigns on increasing the response rate of an email NPS survey? Is there a themed subject line that creates the most responsiveness (opens/clicks/responses)?

Jørgen Bo Christensen:

I will try to answer both questions with one answer. I apologize for the length of my answer but there are no quick answers to either of these questions.

Does some campaigns work better than other? Definitely, but many of them are designed for one company’s specific audience. The wording in emails and surveys typically changes with the characteristics of your audience:

- Various demographics such as country, language and age matter. For instance, some cultures are more formal than others.

- The survey channel matters—more than 50% of surveys are now done on mobile devices, so your survey must be mobile-friendly. Also, millennials use emails less than other so text messaging the survey link may work better for this group.

- The survey design as well as email design, website design, etc. also matters. There are a lot of boring surveys out there and spending some time on the layout usually helps.

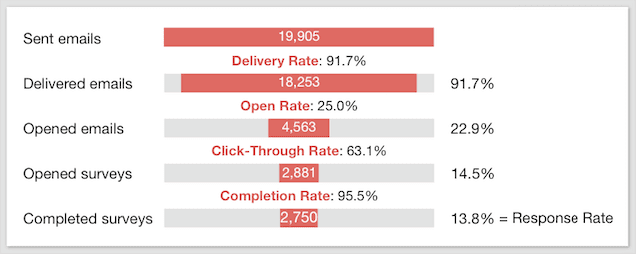

The keyword in the first question is ‘campaigns’. Survey campaigns are very similar to marketing campaigns and my colleagues and I teach our customers to treat them as such. The following “funnel" from our Net Promoter application shows an example of a survey campaign based on emails and the various conversion rates, e.g. open rate, click-through rate, completion rate:

The response rate is the multiple of these different rates, so if you want to increase the response rate, you need to consider where your customers drop out. Some companies have bad data, some can’t get the customers to open their emails and other make tedious surveys that customers don’t finish. In the example here, the open rate is the key issue.

Based on our client base we have calculated some benchmarks for the various rates:

Delivery Rate

If you survey delivery rate is below 95%, you have poor data and need to fix that.

Open Rate

In marketing campaigns an open rate of 20% - 30% is usually considered very good. For survey campaigns the benchmark is higher and well-performing companies have rates above 50%.

Your customers’ perceptions of the sender and subject title will decide if they open the email. There are lots of advice on how to create a good title (some tips are listed below) but I find the best advice is to think and express that you have a relationship with the customer. If you manage to state this —that you already know each other—they are more likely to open the email. I’ve seen examples such as “I just want to follow up on our talk the other day…” that performed quite well for a call center.

Other tips for increasing the open rate are:

- Personalize the email title, for instance adding the name of the customer increases open rates by 30% (note that first names only work in some countries)

- Emphasize the benefits: What’s in it for the customer? Don’t ask them to help YOU improve your business! Tell them that you want to give them even better experiences next time they come back.

- Be aware that short titles work best on mobile devices since long titles are cut off.

- A/B testing: There is no single solution that works for every company. Do some A/B testing on your survey emails, find out which title works best for different segments and refine your survey campaigns over time.

Click-Through Rate

Any click-through rate below 50% is bad. Some of the best performing campaigns I see have rates above 80% or even 90%.

How do you get customers to click on the survey link in the email? Here are a few tips:

- Make sure the survey button stands out!

- Make the email short. More than 3-4 sentences is too much to read.

- Use a language that’s easy to understand. I see many emails with long words and a too high Automated Readability Index (ARI).

- Highlight the benefits! For instance, explain briefly how previous respondents have benefitted from answering.

- Minimize the perceived customer effort by saying it only takes 2 minutes to answer the survey (or less for that matter).

- Think about the layout! Make the email look fantastic and create curiosity. Travel agencies sometimes use pictures of the next possible destination or ads as background image.

Completion Rate

To set the bar high I usually say a completion rate below 98% is bad. You may be satisfied with less but if you finally managed to get the customer to open the survey then make sure they stay and finish the survey.

Again, think about the layout but first of all make sure the survey is short. While you can ask up to 6 questions before the completion rates really starts to drop, I recommend to ask only 2-3 questions in a Net Promoter survey. With the right survey methodology you can ask both the NPS question, capture the drivers of the score and perhaps get a comment as well.

Learn more about the art of the NPS survey with our guide below.

2) How frequently should we survey our customers?

Jørgen Bo Christensen:

First my short answer:

We recommend to survey customers four times a year or more. There are two reasons for this answers:

- The Net Promoter Score is not static. Customers may have multiple interactions with you during a year, which gives you many opportunities to delight or dissatisfy them. Surveying NPS once a year is a bit like taking the temperature of a child once a year and think it will stay the same for a year.

- In 2016 and 2017 we did some studies among nearly 1,000 NPS practitioners and found that companies that survey four times a year grow faster. They reduce churn faster and seem to have more up-sales to existing customers. Frequency did however not do it alone, companies also needed to close the loop, that is act on the input. Of course, if you survey more frequently, you can also act more frequently, which again leads to higher Net Promoter Scores and higher growth faster.

And then my longer answer:

You are probably aware that there are two different types of surveys: Relationship surveys and transactional surveys.

Relationship Surveys

These surveys asks the question: “How likely are you to recommend [brand name] to [some relevant person]?” and provide you with the Net Promoter Score than links to future growth. You may ask the question both after or independent of customer interactions but we suggest to use it four times a year per customer.

If your customers are used to only getting one survey a year, switching to four times a year should not be done in one go. Generally, customers are not fond of surveys so you need to prove that your surveys lead to actions and better customer experiences before you increase the frequency. If you have good follow-up workflows you can usually increase the frequency within 1-2 years.

Transactional Surveys

Individual customer interactions may destroy your standing with a customer but one interaction is unlikely to create promoters on its own. Transactional surveys are accordingly better off capturing the satisfaction with the transaction (CSAT) or the Customer Effort Score (CES), that is how easy it is for the customer to "get through" the interaction. You may ask the Net Promoter question in the survey but make sure the customer doesn’t think they have to recommend you based on only one transaction.

Bain & Co. suggests that you measure CSAT or CES but also add an additional question to your transactional survey: “To what extent has your latest experience made you more or less likely to recommend [brand name]?”. This question tells you if the transaction had a positive or negative impact on the overall brand perception.

In our opinion, you can use transactional surveys as often as you have interactions with your customers. Many companies choose to only survey customers (i.e. individual people) once a month but we have seen many examples in Business-to-Business where customers were surveyed much more frequently and still response rates were above 50%. The advantage of being in B2B is that you can sell the concept of surveying and following up to your customers and obtain high participation rates.

3) For our contact center we are incentivizing all the way to the agent/banker/individual level. Do you recommend this? Do you have any tips for success?

Jørgen Bo Christensen:

First, I’d like to say that I believe in the saying “What gets measured, gets done”. Also, our research with NPS practitioners shows that setting targets is key to future NPS increases and growth. Companies that didn’t set yearly targets, almost didn't reduce customer churn.

Does incentives work? It depends on your company culture. If employees don’t like them, they will not work. If it’s a natural part of your culture, they probably will work. My only recommendations are to ensure that your targets are realistic (for instance by using S.M.A.R.T. targets) and don’t lead to unwanted behaviors. If you are in doubt if targets are realistic, then try them out for a year without incentives and then introduce incentives later.

One company I worked with introduced targets and incentives for account managers in the second year of the program with great success. Account managers are competitive by nature and they were already incentivized on sales targets. The customer services dept. (our call center) did however choose to incentivize employees on team targets rather than individual targets. Since the company knew their customers very well, they chose team targets to avoid that employees would attempt to avoid difficult customers or difficult issues.

4) Call Center: What is your perspective on measuring NPS at the transactional level? We are currently measuring NPS on the transactional & relationship level. Do you advise to do both?

Jørgen Bo Christensen:

I don’t know exactly how you run your transactional surveys and relationship surveys. To ensure that we are on the same page I’ll briefly explain how I define these two types of surveys.

Relationship surveys:

These surveys asks the question: “How likely are you to recommend [brand name] to [some relevant person]?” and provide you with the Net Promoter Score that links to future growth. You may ask the question both after or independent of customer interactions.

Transactional Surveys:

Individual customer interactions may destroy your standing with a customer but one interaction is unlikely to create promoters on its own. Transactional surveys are accordingly better off capturing the satisfaction with the transaction (CSAT) or the Customer Effort Score (CES), that is how easy it is for the customer to "get through" the interaction. You may ask the Net Promoter question in the survey but make sure the customer doesn’t think they have to recommend you based on only one transaction. Loyal customers may still recommend you despite one poor transactional experience. Customers that are not loyal may on the other hand not be convinced by only one transactional experience.

Bain & Co. suggests that you measure CSAT or CES but also add an additional question to your transactional survey: “To what extent has your latest experience made you more or less likely to recommend [brand name]?”. This question tells you if the transaction had a positive or negative impact on the overall brand perception.

So, with our definition in mind, I recommend that you do both types of surveys. Our research shows that companies doing both grow NPS and retention rates faster. While the relationship survey gives you the real Net Promoter Score and explains how the different parts of your customer journey contribute to your score, transactional surveys give you a fast track to fixing detraction drivers. The relationship survey can also tell you, which transactions to survey.

We recommend that you do relationship surveys four times a year if you close the loop. The high frequency leads to faster customer experience improvements, thus higher NPS scores. If your customers are used to only getting one survey a year, switching to four times a year should not be done in one go. Generally, customers are not fond of surveys so you need to prove that your surveys lead to actions and better customer experiences before you increase the frequency. If you have good follow-up workflows you can usually increase the frequency within 1-3 years. Transactional surveys can be done after every transaction though some companies choose to survey customers at most once a month.

We hope you have found our AMA with Jørgen Bo Christensen helpful and useful!

Have more NPS & retention questions for Jørgen? Email us at support@customergauge.com (subject line: “Ask Jørgen ”).

Blog Home