HPE Software : Moving NPS® Beyond "Just a Metric" [Interview]

by Ian Luck

We are extremely happy to welcome Dr. James Borderick from Hewlett Packard Enterprise Software join us for NPS best practice series interviews. James currently leads the Net Promoter® Competitive Loyalty program at Hewlett Packard Enterprise Software. His official position is Master Strategist, leading multiple analytical projects, driving strategy and innovation, and providing intelligent business insight.

We sat down with James to learn how Hewlett Packard Enterprise Software turns NPS theory into practice to achieve great business results.

1. Can you explain why you started using NPS?

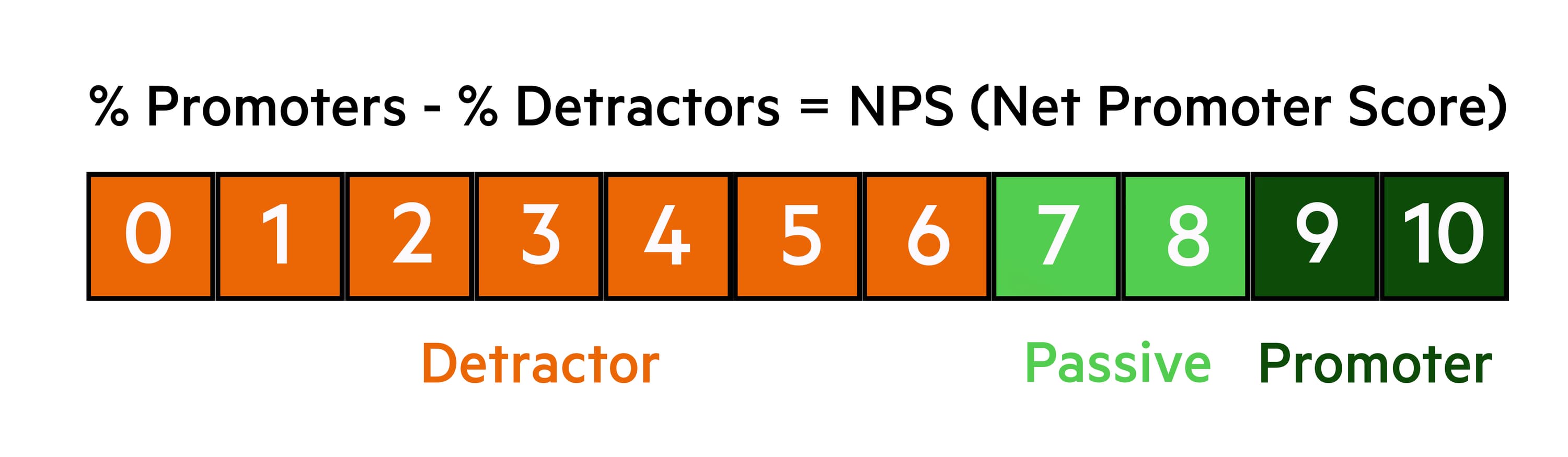

The Net Promoter Score (NPS) is the primary way we measure customer loyalty within Hewlett Packard Enterprise (HPE) Software. We use NPS as a methodology because it measures loyalty but also predicts revenue. Net Promoter was actually at HPE before I was on-boarded through an acquisition. Meg Whitman, CEO of HPE, brought Net Promoter with her from her time as President and CEO of eBay. Therefore, NPS was already a ubiquitous metric throughout Hewlett- Packard Company, which for me later became Hewlett Packard Enterprise. For HPE Software, in particular, measuring our NPS is a key way in which we can track how we are progressing against one of the key elements of our overall mission, namely, putting customers at the centre of our innovation and building high-quality products that our teams can be proud of. This is rather fortuitous, since I can happily report that out of all business metrics that I have researched, NPS is the most scientific, and given my background, this pleases me greatly.

Software Customer Experience, the group to which I belong, interviews our customers to answer the main NPS question: “How likely would you be to recommend HPE Software to your colleagues?"

This is followed up with two verbatim questions:

1. Why?

2. What would you Improve?

We keep surveys short and simple to improve verbatim feedback (so we can analyse with techniques such as those outlined here) and actually improve customer happiness (who really wishes to spend over 10 minutes on a survey?).

Our comment:

It is great to see that Hewlett Packard Enterprise Software masters all of the best NPS practices we preach about. Firstly, as James shared, having a C-suite NPS “buy-in” in the company ensures that there is adoption across all departments. NPS is applicable to each facet of the business, from frontline employees to CEOs, which is how NPS has become an ubiquitous metric across HPE Software. Secondly, the company masters another best practice - keeping surveys short and simple! This is one of the most important factors for getting a higher response rate on your surveys. We have found that every extra question drives down the response rate by 5-15%! Furthermore, results from our NPS Benchmarks Survey 2016 confirmed that 50% of NPS Leaders said that up to 3 questions is their favored option for surveys. 13% of NPS Laggards, on the other hand, ask up to ask upwards of 26 questions! Apart from the issue of using up customers time, these companies risk losing significant responses for each additional question.

You can find out more about Hewlett Packard Enterprise Software's NPS here. HPE Software is enjoying and NPS of 48.

2. Can you mention challenges you are facing leveraging NPS? Were you using transactional or relationship survey, or both?

As my recent article entitled, “Survey Failures in Action? Impact on Strategic decisions for Business” highlights, there are many problems with a poor implementation of Net Promoter, and these are not just internal strategic problems for the company involved, but have severe implications for worldwide competitive loyalty benchmarking.

The two main challenges I see time and time again are:

(a) When and where should one leverage Net Promoter, and

(b) What does the NPS number mean?

In answer to (a) one of the issues I’ve seen is the incorrect transactional application of NPS. One of my biggest successes was recently uniting Customer Effort Score (CES) and Net Promoter so that there can be a conversion between them. This research allows transactional studies to leverage the more correct CES metric since the studies can now correctly compare with historic NPS data. The conversion is non-trivial since it maintains the correct distribution of promoters, passives and detractors, and is thus non-linear. Prior to this invention there was a reluctance to move to this new metric since all historical trend data would be lost.

(b) is the most common question I think. Like all datasets, a numerical answer is rather meaningless without a baseline or comparison. For HPE Software, I’m in charge of our Competitive Loyalty program. I’ll detail this in one of the more dedicated questions below, but for now I’ll just say that the comparison between our competitors is highly useful when providing a score to the wider HPE community. I will also make the point that the scores are almost meaningless if actions are not taken to improve the scores themselves. I speak with the leaders of our business units, on a quarterly basis, highlighting areas that will increase our NPS, predicting how much the NPS would increase given implementing the changes, and consequently what effect this has on our revenue. The main aims are to help the various stakeholders across the organisation to understand NPS and provide application context.

If NPS is treated simply as an index instead of a system, real value will be lost. - Dr. James Borderick, Hewlett Packard Enterprise Software

Our Comment:

Dr. James Borderick has pointed out yet another key pitfall to be aware of with NPS - the difference between transactional vs. relationship surveys. CustomerGauge has always preached that when starting your Net Promoter program, you need to first decide on what type of survey to conduct: relationship, transactional or both. Here’s a quick overview: Relationship surveys investigate a customer’s loyalty to a company/brand. These types of surveys ask customers to consider the overall experience and satisfaction they have with a company and are typically carried out at regular intervals (e.g., quarterly, half-yearly or yearly).Transactional surveys investigate the experience a customer has had within a particular transaction/interaction (what is commonly called a touchpoint). This survey is designed, not to measure customer loyalty, but satisfaction with a specific company segment in order to improve it. You can read more about when to use relationship and transactional surveys here.

3. How often are you sending surveys?

Presently, quarterly and biannually for the competitive benchmark program and customer interviews, respectively. Best practice would consider three months a minimum touch rule. If customers' respond to a survey and one immediately sends another survey, this will reduce loyalty. I like to view this statement through the eyes of a quantum physicist, that the very act of measurement changes the result itself!

4. What was/is the goal/target?

Given what I have said above, the numerical NPS value does not really matter. What matters is the actionable insight that you have learned, and where you stand relative to your competitors. The goal is to always listen to our customers who have provided responses to the verbatim questions “Why?” and “What should be improved?” Those that take the time to respond, care (generally longer responses imply that they care more!). They have taken a lot of time providing thoughtful input. Anyone who provides many suggestions is a potential promoter, regardless of their present status. Ultimately, our goal at HPE Software is to increase NPS, and subsequently better deliver on our promise to place the customer at the centre of what we do. We always wish to ensure constant feedback loops between customers and those stakeholders involved in product development, marketing, product management, and sales.

Our Comment:

We cannot stress enough how much we agree with Hewlett Packard Enterprise Software’s view on NPS: the numerical value does not matter, what’s important is what you do with it! Do you work on increasing your score? Do you know what drives the increase? Have you set the right goals/targets with you NPS program? We see so many companies using NPS as a “vanity metric”, i.e. as just another cool metric to have, but not really doing anything with it. Dr. James Borderick outlines perfectly that it is important to have NPS goals set in place, such as working on increasing the score, sharing it internally and acting on it. Failing to set goals with your NPS program is one of the 5 reasons why NPS programs fail.

5. What kind of initiatives are you taking to address your findings through NPS?

I’m in charge of our double-blind Competitive Loyalty program for Software and I quarterly present the results and deep-dives of this study to our business leaders. The study seeks to understand both: (a) our overall loyalty position within the market; and (b) the position of each business unit within Software.

The survey is double-blind in that we do not know who the respondents are and the respondents do not know that HPE is supporting the study. The key point here is that if our competitors commissioned the same study, they would see the same result. This means we have a great benchmarking tool at our disposal, with low bias and high statistical confidence, to truly see where HPE Software sits within the market space. Software itself is an exciting area to be in since it changes so rapidly. New competitors can spring up within a matter of months and become market leaders within a year. The effective monitoring of our competitors is something that I take very seriously, and I endeavour to always keep our competitive lists up-to-date. I speak with the leaders of our business units on a quarterly basis to highlight the areas that will increase our score, showcase how much our NPS would increase if found changes are actioned, and what effect that has on our revenue.

I find that linking NPS and revenue makes people sit up straight, and moves the conversation from “just a metric,” to strategic responses and actions. - Dr. James Borderick, Hewlett Packard Enterprise Software

Examples of how we put NPS into action, so to speak, include influencing marketing plans and strategy, and even product roadmaps and direction.

Our Comment:

We have found that another key reason why NPS programs fail is because the C-suite is not convinced that NPS is connected to revenue. Hewlett Packard Enterprise Software are among the few companies we have seen that actually make a link between NPS and business revenue. According to our NPS Benchmarks studies (Report 1 and Report 2), only 33% of respondents linked NPS to revenue. However, we also believe that many companies don’t follow agreed upon best practices because they don’t know them, and instead focus on the wrong outcome (i.e. not growth). The purpose of any Net Promoter System should be to create long-term, sustainable growth. The good news is that we can now offer these best practices and help more companies make the link between NPS and revenue. CustomerGauge’s recent white paper — Next-Generation Net Promoter®: How to Monetize a Net Promoter System® and Create Profitable Growth— shows that NPS is more than just a loyalty metric, but ultimately a compass for growth.

Final words

Next week we will publish the second half of Dr. James Borderick’s interview. In it, James shares exclusive insights on how he prove that there is a correlation between NPS and revenue growth. Along with that James will share how does Hewlett Packard Enterprise Software close the loop with customer feedback and give advice for people looking to use NPS.

We are extremely thankful to Dr. James Borderick and Hewlett Packard Enterprise Software's team for making this interview happen! It is always inspiring to see that such big companies like Hewlett Packard Enterprise Software are so customer-obsessed and are using best practices on NPS and benchmarking. NPSBenchmarks.com and CustomerGauge is saying a massive "Thank You" to Dr. James Borderick and encourages you to ask any questions you might have on the interview. Comment below and James will be more than happy to give you an answer!

Click here for Part Two of HPE Software's Interview.

Blog Home