HPE Software On How To Respond to Customer Feedback [Interview]

by Ian Luck

NPSBenchmarks.com is very excited to welcome back Dr. James Borderick, Head of Customer Experience Analytics at HPE Software for the second part of our NPS® best practice series. Last time, James and NPSBenchmarks.com discussed some of the key NPS 101 tips for companies looking to implement the NPS program. HPE Software shared with us why they started with NPS, the challenges they faced, as well as the frequence of surveying and goals of their programme. What was particularly interesting however was the great discussion that followed, where Dr. James Borderick answered some of the most pressing NPS questions from our community members. This week, we take our NPS discussion with HPE Software a level higher. We discuss 2 major topics - responding to customer feedback and building a correlation between NPS and revenue growth. Keep reading to learn more! Use the discussion section below the article to ask any questions - Dr. James Borderick and our NPS experts are here to answer your most pressing questions.

1. How does HPE Software Respond to Customer Feedback? (closing the loop)

Why did we ask this question you may ask. Here’s the quickest explanation - responding to customer feedback is an essential component in creating a better customer experience so that customers remain loyal, spend more and tell others about you. That’s why it is important to share with you the best practices when it comes to responding to customer feedback. Here’s what HPE Software shared with NPSBenchmarks.com and CustomerGauge.

HPE Software uses three different methods to track and respond to customer feedback:

(a) Customer Interviews

HPE Software’s has an appointed Customer Experience Lead who conducts a series of in-person and/or phone interviews with their most valued customers. Based on the customer feedback collected, HPE Software executes an improvement plan, at the customer’s discretion, to improve the overall relationship between the brand and the customer.

The improvement plan methodology is shown below:

Then, HPE Software looks at customer feedback from two standpoints: ground and overview level.

Ground Level

What HPE Software learns during the interview process is submitted to the account leads to action.

Overview Level

HPE Software categorises the responses by sentiment and demographic/firmographic categories to look at overall trends.

(b) Competitive Loyalty study

HPE Software also applies double-blind benchmarking surveys when collecting customer feedback. Now, don’t get scared by how technical this sounds. At it’s core, double-blind benchmarking falls into the traditional market research. Researchers, typically from a third-party firm, ask respondents which companies they love. Bain & Company emphasize that double-blind benchmarking surveys are different than traditional competitive benchmarking as “ the respondents don’t know which company is asking the questions, and the customers remain anonymous to the company.” As such, the research is more independent and objective. However, because you do not know who the customers are, you cannot follow-up with them and close the loop. You can however have an understanding of your competitor’s strengths and weaknesses based on the survey results.

(c) 1:1 customer feedback and communication, both in person and remotely e.g. design partner programs, Customer Advisory Boards etc.

“We also have various customer success and advocacy groups throughout HPE Software, which provide customer follow up. The customers participate, in context, and discuss how elements of their feedback have been incorporated into our plans. As we develop our internal best practices, these are areas that we plan to increase our investment.”

You can read more about what has HPE Software achieved as a result of responding to customer feedback here.

Our Comment:

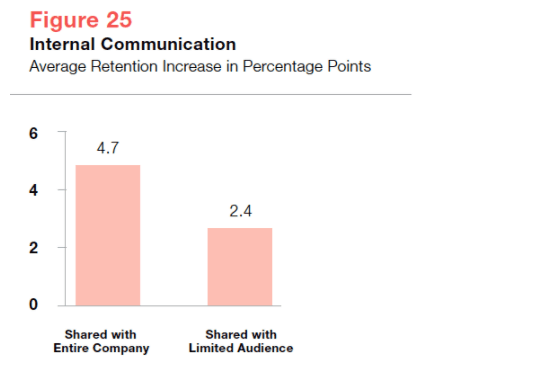

Dr. James Borderick outlined HPE Software’s diligent process of responding to customer feedback. Customer insights are carefully analysed on ground and overview level, shared internally and acted upon. Closing the loop process starts with an improvement plan, which includes 5 steps (see graph attached). What is important to highlight is HPE Software’s customer centric built-in DNA – customer feedback is shared internally, breaking organisational silos and engaging the C-suite. Now this is extremely important especially when it comes to customer retention. According to our whitepaper Next-Generation Net Promoter® – How to Monetize a Net Promoter System® and Create Profitable Growth. In fact, CustomerGauge found out that when there is internal communication on closing the loop, customer retention increases 4.7%.

However, the act of responding to customer feedback is just one part of the equation. Companies that are successfully retaining customers are doing so partly because of their rapid response rates.

So how fast is your response rate?

CustomerGauge has found a direct correlation between the speed of responding to customer feedback and customer retention. Figure 22 below shows that if you respond to customer feedback in less than 48hrs, customer retention can increase up to 5.4%. Imagine that! For more information on closing the loop, be sure to download the Next Generation Net Promoter Score whitepaper.

2. What response have you seen from within the company in reaction to your NPS program?

NPS has always been top-of-mind at HPE Software. I previously mentioned Meg Whitman, CEO of HPE, being an advocate of NPS since her time at eBay. What I have not mentioned is that HPE will, this year, spin-merge with Micro Focus to create the sixth largest software company in the world.

Chris Hsu, Chief Operating Officer of HPE and Executive Vice President of HPE Software, will be appointed as the new CEO of the go-forward combined company once we merge with Micro Focus. Chris is directly engaged with our portfolio investment strategy, has a keen sense of the market and a strong commitment to a customer-centric culture. I know he’ll take this experience and his HPE values to serve as an excellent leader of the future software company. And, like Meg, Chris is an advocate of NPS. Chris receives my competitive analysis of NPS. Reporting to Chris are the business leaders, which I spoke of previously, to whom I present the quarterly Competitive Loyalty results to.

The response throughout the company has been highly successful to say the least. Especially, when you are armed with NPS and Revenue correlations and prove that NPS is a driver of revenue. As far as I’m concerned, the success is a positive feedback cycle. The more interest, the greater focus and actioning of the points found throughout the NPS process, which consequently drives further NPS growth against our competitors, and thus, increases revenue.

3. Do you have any advice for people looking to use NPS?

For brevity, I detail the most salient of these below:

(a) Make sure you Implement an Effective Sampling Strategy

Ensure you have a governance strategy that ensures your NPS can be measured by these various roles: decision maker, influencer, and end user.

(b) Do not ask the NPS question after a Purchase Experience and do not ask demographic and firmographic questions, which the customer knows you already know the answer to!

The customer has not experienced enough to provide an accurate assessment of loyalty with a purchase experience and the customer will just become annoyed if you ask them questions that they think they have already answered.

(c) Link Transactional Data, which is either Customer Effort Score (CES) or Customer Satisfaction (CSAT), to Net Promoter®

You may ask touchpoint CSAT or CES questions, and ultimately you need to unite these to your relationship NPS.

(d) Close the Loop

(i) Make a point of getting in touch with every dissatisfied customer and close the loop.

(ii) Apologise for the bad experience, and empathise. Apologising works, and you must do it on behalf of the company.

(iii) Tell the customer how you are addressing the issue.

(iv) Listen to the customers who have provided responses to the verbatim questions “Why?” and “What should be improved?” Those that take the time to respond, care (generally longer responses imply that they care more!). They have taken a lot of time providing thoughtful input. Anyone who provides many suggestions is a potential Promoter, regardless of their present status.

(e) Take Action!

(i) The whole point of gathering NPS feedback is to make changes, which improves Customer Experience and builds loyalty. You need to do this as quickly as possible. Six months is too long!

(ii) Loyalty leader companies channel customers’ concerns immediately to frontline employees and supervisors, who are empowered to do what they can to make things better.

(iii) This is a self-directing, self-correcting workforce.

(f) Talk to the Passives!

Passives are the category that are most likely to leave you in a B2B setting, and represent around 40% of your customers. The Detractors have lots of attention, and thus, become happier with time. The Promoters are the category we enjoy speaking with because they love us. Herein is the crucial point, the passives have been forgotten! They will leave you, silently. Naturally, you can leverage this knowledge to your advantage and speak with the passive populations of your competitors…

(g) If you do not plan to do anything positive with the input, you should not waste your customers’ time with surveys.

(h) Regular Communication

Regularly communicate to your customers and employees the key takeaways from your NPS data, and the improvement actions.

Final Words

NPSBenchmarks.com and CustomerGauge is saying a massive "Thank You" to Dr. James Borderick and encourages you to ask any questions you might have on the interview. Comment below and James will be more than happy to give you an answer!

Want to learn more about how to respond to customer feedback? Make sure you download CustomerGauge's Closing the Loop eBook below.

Blog Home