Net Promoter® News: Ford, KPN & Australian Banks

by Ian Luck

Ford Targets Stand-Out Customer Experience

Ford is the second-largest US-based automaker and fifth-largest in the world. Since the inception of the company, Henry Ford has laid the groundwork for putting the customer first and emphasizing the need for an exceptional customer service.

“Employers only handle the money – it is the customer who pays the wages.” - Henry Ford

Let’s explore Ford’s current state with customer satisfaction. The U.S. Customer Service Index (CSI) Study (2016) by J.D. Power recently presented ratings of the automotive industry, featuring brands like Ford, Chevrolet, Volkswagen and more. The study shows that Ford’s overall service satisfaction is rated with 3 out of 5, thus showing there is an improvement opportunity. Ford’s Net Promoter Score is 28 (a “good” score is usually 30), further highlighting the possibility to do better when it comes to customer satisfaction.

The good news is that Automotive News has published a recent interview, which shared Ford management’s customer service strategy for 2017. The automaker has put a target to deliver a stand-out customer experience by making it easy for customers to do business with the brand. Cutting down the time it takes to resolve claims and making payments seamless and fast for Ford’s dealers are only some of the initiatives taken to enable an effortless customer experience. With a strategy that focuses on the customer, ease of doing business and satisfaction, Ford is surely on the right track to improve their NPS.

KPN Improves NPS with Closed Loop Feedback

KPN is one of the leading telecom and ICT service providers in the Netherlands. What was particularly interesting to learn is KPN’s commitment to customer feedback and the Net Promoter Score. KPN makes sure it sets its NPS improvement targets at the beginning of each year and tracks whether the programs and initiatives it launches result in a higher NPS. Every month, the company conducts a survey among customers in their Consumer Residential, Consumer Mobile and Business Market segments and tracks the NPS performance over time. When calculating the NPS for KPN, the company ensures that each of the three segments counts for one third. Then, the telecom and ICT provider investigates whether they have managed to achieve their NPS targets, and if not, what were the main reasons behind it.

Let’s dig a little deeper into KPN’s NPS performance over the years.

As can be seen from the graph above, KPN’s Business NPS has significantly improved from 2013—taking their score from -18 to -10 in 2015, and to – 3 in 2016.

In their Annual Report, KPN highlighted how they apply best practices when it comes to NPS by closing the loop after they receive customer feedback. As a result, the company has seen improvements in their NPS score in all three segments:

“We apply ‘closed loop feedback’ (CLF), which means we survey customers immediately after each interaction (in call centers, retail shops or with engineers in the field) to get their feedback and, if necessary, act to improve their satisfaction. NPS scores increased, especially at our Business Market contact centers for middle-size, large and corporate business customers. Also customer satisfaction for Consumer Mobile contact centers rose.”

It is great to see that a company like KPN is applying NPS best practices, like setting targets, investigating performance, working on improving their own Net Promoter Score and closed loop feedback. Clearly such steps are helping the company achieve sustainable NPS growth. The company' latest NPS can be found here.

Australia's Four Biggest Banks Improve Customer Advocacy (NPS)

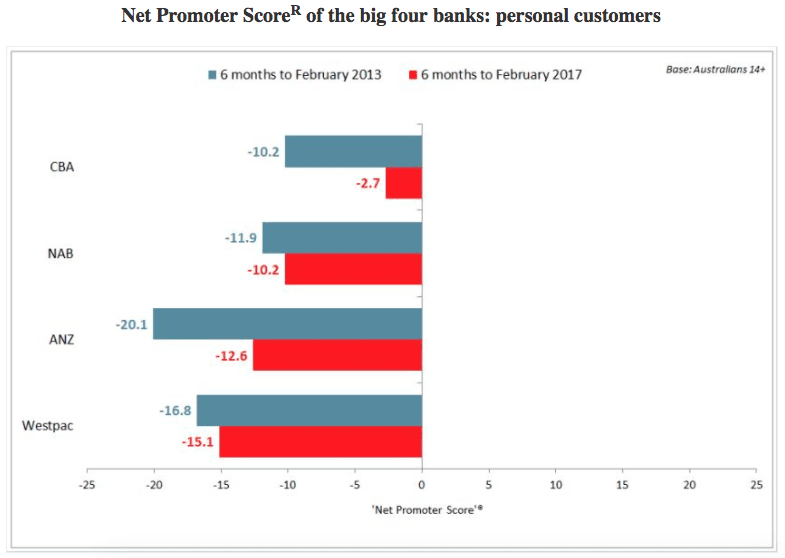

Some interesting news come from the banking sector in Australia as well. Roy Morgan Research' latest data shows that in the six months to February 2017, satisfaction with banks overall was 81.9%. This result is only 1.0% point lower than than the 20-year high of 82.9% recorded in 2015.

As seen from the graph below, over the last four years, all four of the major Australian banks have been working on improving their NPS scores. Even though the banks' NPS scores are still negative, an improving trend has emerged between 2013 and 2017.

Out of the four Australian banks, Commonwealth Bank of Australia (CBA) has achieved the biggest NPS increase over the last four years, taking their score from -10 to -3 (2.7 = 3). CBA's NPS performance is well ahead of NAB NPS = -10, ANZ NPS = -13 and Westpac NPS = -15. According to Roy Morgan Research, ANZ and CBA have showed the biggest improvement in terms of customer advocacy.

We went a little bit further to find out what has CBA worked on in the last couple of years to drive their NPS up. Improved customer service across multiple channels and leveraging data to better the customer experience are among the few initiatives taken by CBA.

We hope you have enjoyed today’s Net Promoter News and the tactics highlighted to improve NPS. Here’s something we thought you would find worth reading. CustomerGauge has released a groundbreaking whitepaper, linking NPS and revenue growth. Definitely a must-download if you want to take your NPS program to the next level!

Blog Home