Most Recommended Music Streaming Service, Based on Net Promoter ScoreⓇ

by Cvetilena Gocheva

With the ever-rising tide of digital media, it seems even mp3 is becoming a file type of the past. But in this increasingly competitive arena, what draws customers to a music streaming service, and, even more importantly, what keeps them there? Understanding the Net Promoter ScoreⓇ and customer experience strategies of these companies and their services can help us understand what is or is not working for them.

According to Kirk Parsons, Senior Director of Technology, Media and Telecom at J.D. Power & Associates, customer experience and features that play into the sharing economy are key factors in competing within the industry:

“The streaming music customer experience appears to be affected by a number of dimensions, including paid vs. free streaming, device choice and content selection. The key to success, however, is increasingly becoming how well streaming music brands create a viable music ecosystem that can not only support multiple types of devices, but also facilitate listeners’ social sharing and following of playlists with others.”

In this article, we’ll explore the top five streaming music services based on self-reported Net Promoter Scores sourced from NPSBenchmarks.com.

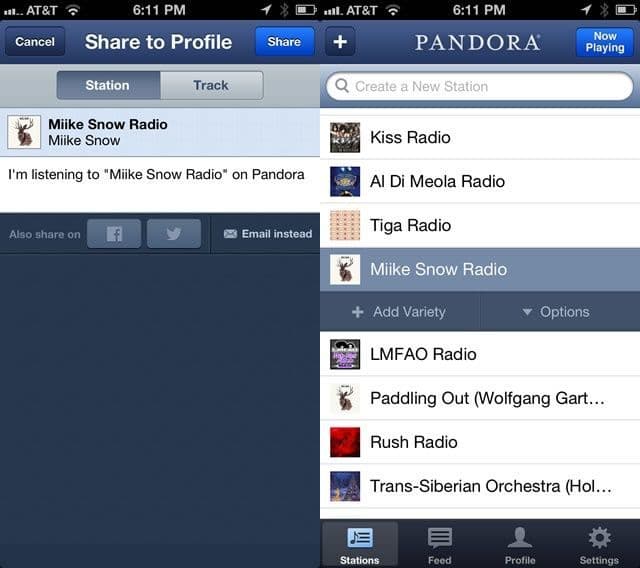

1. Pandora — NPS score = 59

Pandora holds one of the highest scores on this list—an impressive achievement, given that Pandora is also one of the first examples of streaming music on the internet. How has Pandora managed to stay on top of the game? Part of it is their tech is designed specifically with customers in mind.

The Music Genome Project® is a program that analyzes songs put in Pandora along 450 musical attributes, and uses these attributes to find tracks that are similar to one another to play near each other on Pandora stations. The more a customer listens and engages with Pandora, searching for particular tracks or genres and skipping or repeating songs, the more the Music Genome Project can best guess what other music that customer will like, introducing them to new artists and tracks catered to their particular tastes. As one of the first internet music streaming services, and the first to utilize such an algorithm, Pandora is benefitting from longtime name recognition, and a solid history of positive customer experiences.

Pandora is designed to find out what customers enjoy, and make sure that’s what they’re experiencing on an ever-developing basis. It makes sense then that Pandora scores well within the Net Promoter Score metric. In Pandora’s case, they can see if customers are skipping past songs the station is generating, or replaying them. But the measurement alone isn’t enough. Action must be taken to retain customers, and Pandora’s system evolving with its listeners—finding similar music based on replays, or avoiding other tracks because of skips--is a prime example of exactly that action.

As Pandora continues to evolve within this changing market, it’s working to keep up with the newcomers, developing an app alongside their original website platform. Additionally, as of 2017, it is offering premium services as well, putting it in the same market as Spotify and Apple Music. Pandora Plus and Pandora Premium offer ad-free listening, plus unlimited skips and replays, and Pandora Premium also adds an option of creating playlists, something not available in its original service, but very popular on services like Spotify. Catching up with these competitors won’t be easy, but with 5 million users already subscribing to their paid platforms (and 1 million of those on the more expensive Pandora Premium), and a killer strategy for continued customer experience success, Pandora is on the right track.

According to Jane Huxely, Pandora Media’s managing director, it’s all about listening to the customer:

“You need to know every single thing about the customer, then demonstrate that you are listening by refining your offer every day.”

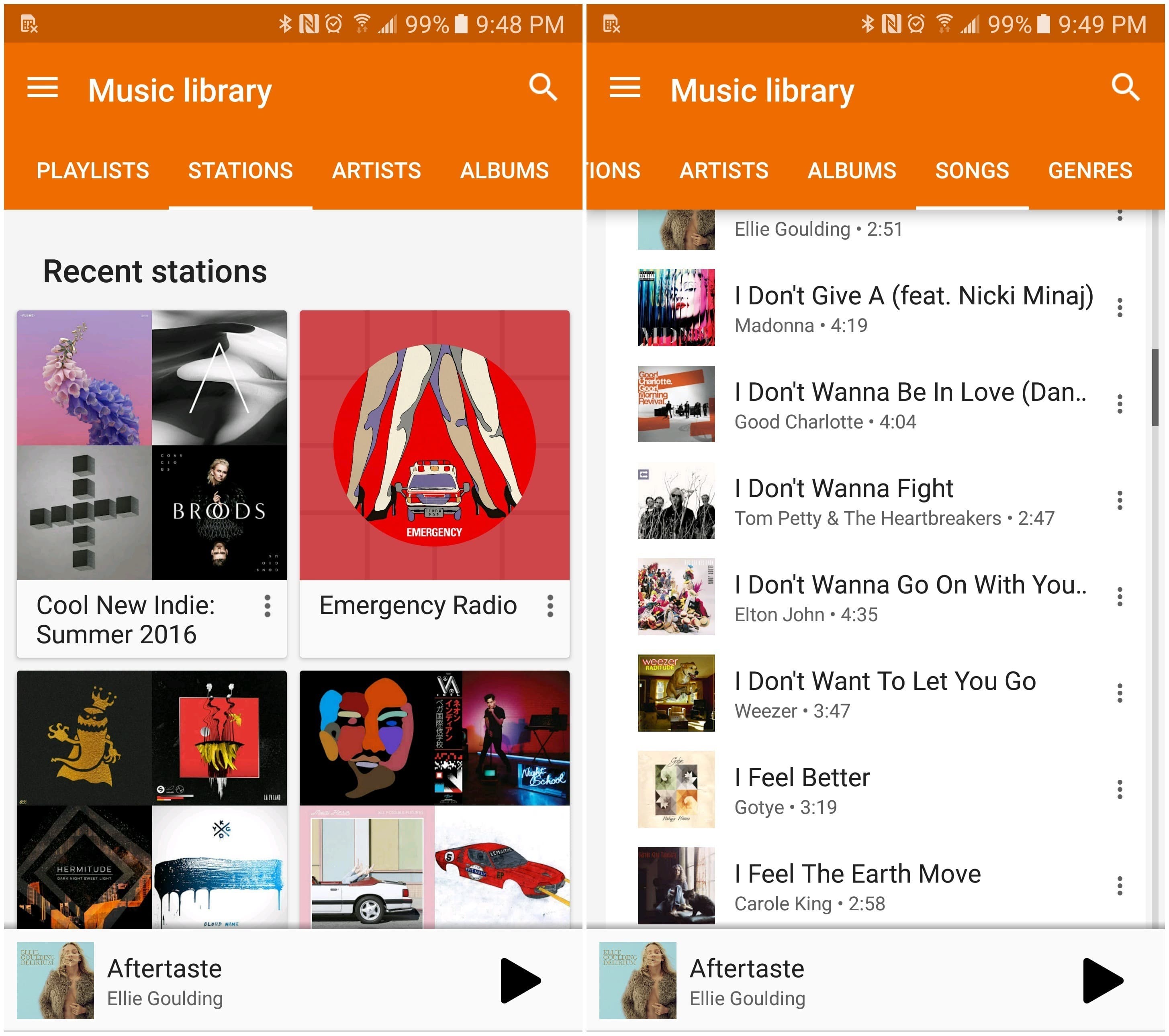

2. Google Play Music — NPS score = 35

In 2011, Google began an invited beta test of an online podcast and music streaming service that could store and play a user’s personal music library. After 6 months, the service went live as Google Play Music, a service that, currently, allows users to store 50,000 songs in its Cloud, allowing the song files to be accessed, played, and downloaded anywhere on mobile and desktop devices at no cost. In some regions, including the US and Canada, Google Play Music also offers free radio, which you can browse based on your “favorite genre, activity, mood, or decade.” Subscribers to the service can stream over 40 million songs via the site or app ad-free, with unlimited skips and offline music playback available. A free trial of this service exists for new users, but otherwise, to access Google Play Music’s vast library, you have to subscribe.

Google Play Music’s Net Promoter Score comes from Google Play’s overall score, which isn’t bad, but likely isn’t where Google would like the service to be. Google Play, offering different services such as eBooks, games, movies, and music, is a diverse storage and purchasing system for various forms of entertainment, but it may be spread a bit thin in optimizing the customer experience across all these offerings.

However, Google Play Music does still continue to develop new innovative ways to improve the experience. The free radio service is wonderful, offering a variety of search methods that could lead you to some great songs, but it’s a service limited to particular regions, where Pandora is not (and Pandora learns what you like as you listen). It’s possible to purchase mp3s to put in your Google Play Music library, which has extensive storage considering that it’s free (and it can hold non-mp3 music files as well, something iTunes has occasionally had issues with).

Considering the fact that Google owns both YouTube and Google Play Music that cross-benefits might come into play, as Google was in a position to offer anyone with a YouTube Music Key account (which evolved into YouTube Red) subscriber-level access to Google Play Music. However, the merge did little to drive users to Google Play, which continues to fall behind its competitors within NPS®, although Google has yet to announce subscriber numbers for the service.

This isn’t to say that Google Play Music isn’t innovating in their own right. Its family plan offers allows its services to be utilized by up to 6 people, possibly encouraging groups to join the service. And Google Play Music now supports podcasts (including some original ones) and is built in with Google Home, which is proving to be popular.

3. Spotify — NPS score = 31

With 140 million active users, and 70 million of them paying to use the streaming service as of January 2018, Spotify is clearly at the top of the music streaming market. So, what puts its Net Promoter Score behind Pandora and Google Play Music?

Some of it may come from the company’s history with customer service. In 2011, Spotify announced and implemented limits to how much music could be listened to on its desktop player—just 10 hours per month after a six-month grace period for free users. It was an incentive to go premium, but it wasn’t a big asset for the company, which removed the restriction in 2014, along with the repeat limit that in the UK restricted free users to 5 repeats of a song per month. Artists and music creators also have patchy history with the streaming service, mainly surrounding how little artists are compensated by having their music available through the streaming service, with big names like Taylor Swift and Thom Yorke pulling their songs from the app and site. Fans of both artists left the site for a time, and the give and take of other restrictions, including limited skipping options, have given Spotify some bad press from users.

Notably, Spotify always seems to learn its lesson. The company altered its listening limit policies when competition popped up from Google Play, which offered unlimited streaming of its radio stations for free users, and the limits show no signs of returning. And Spotify worked out the differences they had with Yorke and Swift, getting both artists back on the platform, and recently renegotiating its deals with several major record companies and labels to the apparent enjoyment of all. Spotify is significantly improving, listening to complaints from customers and music creators, and seeing what works for them as the company moves forward. As the company plans to go public in early 2018, we’ll see if the streaming giant won’t soon overtake its competition in terms of customer satisfaction as well. It’s very possible with continued success thanks to its playlist functionalities and easy shareability between accounts, the aftertaste of the rocky start to the service can finally be completely washed out of consumer’s mouths.

However, if their current customer service is any indication, things are looking up. One area where Spotify is crushing it is their social media customer experience. The company’s @SpotifyCares Twitter account works daily to resolve issues quickly with customers—sometimes even communicating with customers through playlists.

Now, that’s a personalized customer experience.

4. Apple iTunes — NPS score = 30

While having historically led the charge in mp3 purchases and downloads in the popularization of portable digital music, Apple Music actually came to streaming services somewhat late. Still, that hasn’t stopped the service from gaining over 30 million subscribers as of September 2017, putting it on par with Spotify’s pace of growth over the last two years. Still, Apple Music isn’t dominating in the realm of NPS or customer experience, which is surprising given Apple’s overall Net Promoter Score is quite high at 76. What isn’t working here?

Apple Music found its origins in Beats Music—having bought the service when it bought Beats Electronics in 2014. In 2015, Beats Music officially discontinued with the launch of Apple Music, with subscriptions to Beats carrying over to the new platform. Part of their lower streaming music might have to do with the merger itself, as Apple Music was built on top of Beats. Beats, when it was discontinued, also had a Net Promoter Score of 30, indicating perhaps that what wasn’t satisfying Beats Music customers is now not satisfying Apple Music users.

Another aspect might be Apple Music’s ever-shifting focus. It was launched as a music streaming service, with music video content like Drake’s “Hotline Bling” premiering there exclusively, but primarily, it was in direct competition with Spotify, hoping to be a subscription-only service with more profitability than its limited free service offering competitors (Spotify has had some issues with profits, and raised a $1 billion debt round in 2016, and seeks to go public to help deal with rising interest rates). In 2016, however, Apple executive Jimmy Iovine announced that Apple Music would also be moving into video, and whatever else would “hit popular culture smack on the nose.” A noble ambition, allowing the service to purchase the Carpool Karaoke series, and launch a documentary about Taylor Swift’s 1989 tour. But taking Apple Music away from purely streaming music means its competition isn’t Spotify and Pandora—now it’s services like YouTube, Google Play, and Amazon Prime, which have also been around longer, and also offer free or non-subscriber content to users, making them fairly popular amongst consumers.

However, despite not being #1 on our list, Apple Music still continues to deliver the same customer support and care across their products, according to JD Power & Associates, meaning Apple is still a fierce competitor within the music industry, and shouldn’t be overlooked.

5. Amazon Prime Music — NPS score = -11

Amazon’s streaming services have perhaps the most surprising score on this list, as Amazon has a Net Promoter Score of 61, and -11 is quite a leap in the other direction. However, this score is derived from Amazon Prime’s Net Promoter Score, which is -11, and as Prime Music and Amazon Music Unlimited are each tied to the service, it is perhaps appropriate they’re dragged down accordingly.

Prime Music is a service that comes as part of a Prime membership. Prime Music offers the ability to stream over 2 million songs, ad-free, and allows offline listening of downloaded tracks. Amazon Music Unlimited is a subscription service that allows access to more songs—tens of millions versus 2 million—and that’s about where the differences stop. Amazon Music Unlimited is cheaper if you have a Prime account ($7.99 a month instead of $9.99 a month), and both services can be used in conjunction with the Amazon Echo and Echo Dots.

Much like with Google Play Music, there is an advantage to having a streaming service connected with a highly popular piece of tech, but when both services require payment of some sort (Amazon Prime is, after all, not free), there’s already a disadvantage compared to Google, Spotify and Pandora, which have been highly successful cultivating subscribers via a freemium model. Highly devoted Amazon fans might find some advantage to subscribing to either service with their tech, but the Echo and Echo Dot can connect to Spotify as well (and Spotify has 28 million more songs to choose from). With fewer song options, and no free option, Amazon’s streaming services don’t feel designed for customers or customer engagement. They feel like a means for Amazon to expand into the streaming market, and very little else.

Streaming companies, particularly right now, do not exist in a vacuum. When other streaming services and companies have larger libraries, or more appealing offline listening and unlimited skipping options for paying or non-paying customers because of customization, or even just more attempts at finding a niche, users have no qualms about switching sides. To continue remaining competitive, at least within the streaming music market, Amazon needs to hunker down and work on building out the service to be more than just a perk of Prime membership, but into a standalone product that can stand up to the likes of top competitors.

Keep checking back for more of our recommended series—we already have articles on top most recommended laptop providers, and the top most recommended banks. More will come in the months ahead!

Don’t see your name here? Add your score here if you think you should be on our list!

Blog Home