Editor’s Note: This post was originally published by Genroe – a CustomerGauge partner in Australia.

It comes in many flavours but easily the most common question on Net Promoter that I get asked is: how does my score compare to my peers?

Unfortunately it is also the question with the answer that people want to hear the least: there are very few ways to really know.

While there are some reasonably comprehensive multi-industry NPS research reports unless your company is actually included in the study they are generally worthless to give you a benchmark against which to measure your internally derived score.

The reason is quite simple. NPS can vary dramatically depending on a variety of factors and unless your survey process is the same as the benchmark process you will have issues.

Don’t worry I’ll give you two good resolutions to this problem but first why are those published data of so little assistance?

Factors That Change NPS

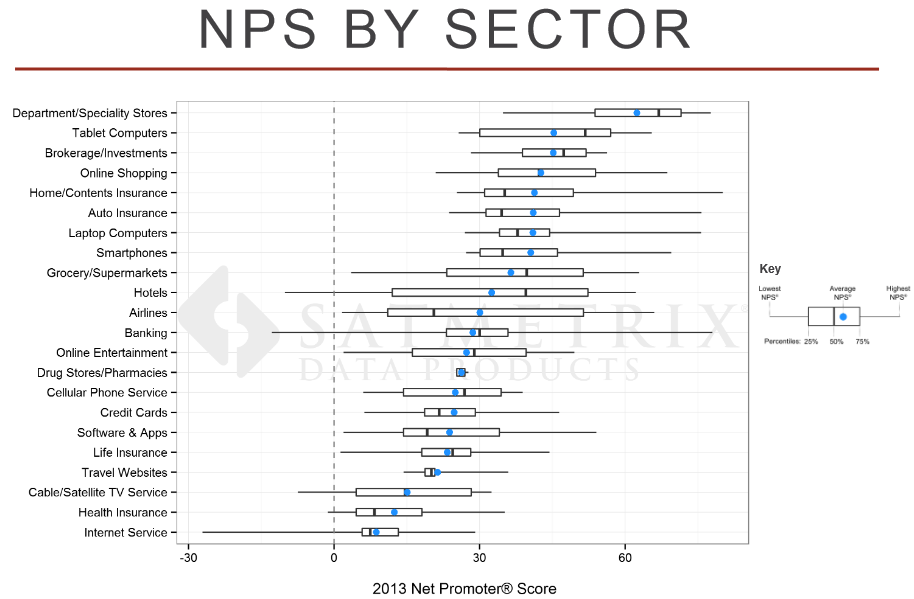

Industry Sector

As can be clearly seen by the chart below the NPS can vary dramatically between industries. With average scores for whole industries ranging between 10 and 60, if your industry is not specifically on the chart your chance of getting a viable benchmark are low.

Source: http://cdn2.hubspot.net/hub/26...

Source: http://cdn2.hubspot.net/hub/26...

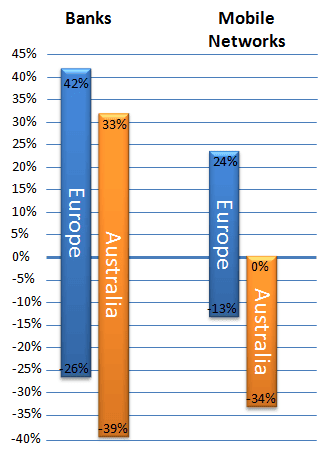

Country

If you are in an industry that is on the chart you might be thinking great there’s a benchmark that I can use. You’d be wrong.

NPS also varies by country and culture so even if your industry is in the benchmark set, if you are not in the same country as in the report then the benchmark is not of any use to us.

Don’t believe it, check out the image below for benchmarks for the same industry in different countries that we put together a couple of years ago.

Survey Administration

Terrific you are on the industry list and it shows numbers for your country – finally you’ve got your benchmark!

Probably not. Now the issue is that the survey administration process (telephone, internet, face to face) has a big impact on the score.

Just recently new research has been released on the issue of comparing scores that have different methodologies.

In their study Sam Klaidman and Frederick C. Van Bennekom identified that simply running the survey by phone gave one company a 40 point (58 to 18) change in the outcome for the same customer set.

The implications of this are enormous. If you don’t run your survey the same way as the benchmark then the comparison is almost meaningless.

NPS Varies Depending on How You Construct Your Questionnaire

Even if you use the same format (email, telephone, etc) the order of the questions can impact on your score. If you ask the “would recommend” question early in your survey the score will be higher than if you ask it later in the survey.

There Are More

Actually there are even more elements that can impact on the score but I think you get the picture here.

Solutions to the Net Promoter Benchmark Problem

So where to from here?

There are some real reasons why it would be good to know how your score stacks up relative to your competitors. The most important is that it has been found that your score relative to your peers is indicative of your relative revenue growth performance.

The further ahead of them you are the better your growth. So getting some type of benchmark is useful. The problem is knowing that, except in very special circumstances, published benchmarks are not very useful how can you proceed?

You have only two real choices.

1. Ignore External Benchmarks and Benchmark Internally to Your Own NPS

I tell customers that the most important Net Promoter benchmark that they have is their own score last month, last quarter and last year.

The whole purpose of this approach is culture change and continuous improvement.

So with that in mind, do you really care what other companies are doing?

If you’re ahead of them are you going to stop driving change? No.

If you’re behind them are you going to stop driving change? No.

So what does it really matter where your competitors are sitting?

Relax about external benchmarks and focus on improving your own change management processes. That is where most of the value lies anyway.

2. Construct Your Own Independent Survey

If you don’t buy the point above then you can always conduct your own independent Net Promoter benchmark survey. The steps are quite straight forward:

- Identify a set of your customers and your competitor’s customers. You will need 100 or more responses to aim for 500+ invites per company in the benchmark. If you are a large B2C brand this will be the easier as you can use survey panel companies to contact a large number of suitable respondents. On the other hand if you are a B2B player or a more niche provider that can be more difficult. How are you going to get hold of the 500 names and email addresses of your competitors customers? There are ways but you’ll need to bring in an external company to enable that to happen.

- Design a simple survey that includes the “would recommend” question

- Send that survey to the recipients and wait for their responses.

- Total up the answers.

[Blatant plug] Of course Genroe can do an independent Net Promoter benchmark study on your behalf that will accurately tell you where you rank against your competitors.

Knowing that, this may seem like odd advice but before you run that type of study I recommend you focus on your relative scores.

Get them working and you’ll already be way ahead of most companies.