Customer loyalty is what all brands should be striving for — not just in B2C, but in B2B contexts, too. Improve your customer loyalty and you’ll be well-placed to drive revenue, cut churn, and improve customer satisfaction overall.

Yet, while loyalty is a well-established goal among B2C brands, B2B businesses aren’t making the most of it. In fact, in our 2021 report The State of B2B Account Experience, we found that only 13% of B2B brands are analyzing financial data to understand the loyalty of their customers.

That means the overwhelming majority of B2B brands aren’t using loyalty to their full potential and we want to change that by starting with this guide.

Here, we make the case for the value of tracking customer loyalty in B2B. We’ll show you how to monitor it and ensure it’s working for your bottom line, too.

Let’s get started by diving into the strategies and tricks you need to boost retention, drive growth, and prove the worth of your customer loyalty program overall.

What Is Customer Loyalty?

Customer loyalty is the name given to a continued engagement between a customer and a business over time. It’s often referred to as a “commitment”, “faithfulness”, or “devotion”.

In this way, customers are loyal to a brand in the way that they could be loyal to their family or friends. They’re supportive and constant.

However, customer loyalty is not just an emotional connection. In reality, it’s both an attitude and an action. True loyalty reveals itself through continued purchases and other interactions, including recommendations and referrals, positive word of mouth, and sustained engagement with a brand’s surveys and campaigns.

There’s not just one type of customer loyalty, however.

Unlike customer retention, which is quite simple to understand and measure (i.e. customers are either retained or not), loyalty exists on a sliding scale.

That’s why we talk of five main types of customer loyalty, from customers who are simply taking advantage of a discount on a subsequent purchase to those who are serious brand advocates:

The Types of Customer Loyalty

Transactional. Typically built around offers, discounts, and other incentives, transactional loyalty describes the way that customers come back for a future purchase. Just like customer retention, it can bring powerful results, but it might not build the deepest relationship.

Engagement. Engagement loyalty refers to all the actions that customers might take to stay in touch with you. For example, they may subscribe to newsletters, download whitepapers or reports, or follow you on social media. This keeps customers up-to-date with your brand, builds engagement, and increases conversions later on.

Emotional. An emotional connection is an important part of customer loyalty. You can cultivate this by engaging with customers directly and individually to build mutual respect.

Behavioral. Once you know your customers well, you can begin to track (and modify) their behavior. For example, you can incentivize particular purchases with loyalty points or nudge customers to try new features.

Advocacy. The ultimate form of loyalty is when your customers display all of the above, while actively advocating for and recommending your brand. They’ll be your NPS promoters (we’ll introduce them more thoroughly later on)

What's the Benefit of Customer Loyalty?

Customer loyalty, in all its different types, is known as a powerful business tool for good reason. That’s because loyal customers bring revenue gains, easier business processes, and the opportunity for a powerful referral program.

Let’s take a look at what you can expect:

Secure continued business and growth. It’s said that businesses with solid loyalty programs increase revenues 2.5 times faster than competitors. Part of that growth comes through repeat business. Studies by Bain & Co. suggest that repeat buyers spend 67% more than new customers and are more likely to buy new products.

Reduce acquisition costs. It’s not that businesses with loyal customers don’t need new custom (they really do). However, loyalty can reduce the cost of acquisition by reducing churn, improving customer lifetime value, and making referral channels more lucrative. This is something typically overlooked by brands.

In a recent interview, CustomerGauge’s VP for Education and Program, Cary T. Self, explained:

“It’s much better to look at new business and growth as an organization. Everyone loves new! But we challenge you to have that same excitement for your current business. Every account manager you have dealing with a company relationship is going up against your competition’s best team of sales professionals. You have to bring the same level of excitement to retention that you bring to new sales!”

Improve your customer experience and satisfaction. Loyal customers are satisfied customers. And their satisfaction can tell you something about your customer experience (CX) in general. With every step you take to improve customer loyalty, you’ll be optimizing other customers’ experience, too.

Know your customers better. Enduring relationships with your customers allow you to better understand your customers, give them what they want, and collect data to inform future business decisions. This benefit goes both ways. Loyal customers are more likely to give you honest feedback in your customer surveys as well.

Optimize your referrals program. Crucially, loyal customers are more likely to refer your business to colleagues and friends in the future. This provides a revenue stream you’d be foolish to neglect. Here’s Cary again:

“With loyalty, while you’re gaining great insight on how healthy your relationship is and building trust, you’re also in the process of gathering an entire network of people that want to bring you more business. As a customer, I actually want to be called on to do more for the companies that I love—to speak at events, give references to prospects, assist in developing new products, or anything that can lead to success! Because I do not want them to not be successful!”

Learn more: The Advantages of Customer Loyalty

B2B Customer Loyalty: Meaning, Challenges, and Opportunities

A frequently cited stat suggests that 90% of brands now have a customer loyalty program. Yet, this number falls dramatically in B2B contexts.

Why? Because while it has the same goals, B2B loyalty is much harder to track, cultivate, and formalize into a coherent system. And that’s because B2B companies are really quite different to B2C:

B2B loyalty needs to be tailored and individualized. B2C brands may have hundreds of thousands of very similar customers. But, in B2B, some customers can be worth 100 times more than others. To provide value for customers, B2B loyalty programs need to be flexible to customer experiences and expectations.

B2B purchasing cycles are more rational and structured. B2C purchases are often made on a whim, while in B2B, the complex sales process (involving many different stakeholders) makes purchases a rational, problem-based decision. Your loyalty program will need to be worthwhile.

There’s no individual B2B customer. B2B customers can be anything from SMEs to government agencies, and not all of them will be able to join your loyalty program. What’s more, individuals within your customer accounts will have different opinions, experiences, and demands of your product or service. You’ll need to speak to them all to maintain loyalty.

Customer Loyalty Definition

Customer loyalty is when your business enjoys an enduring relationship with a customer through an emotional connection, continued purchases, and advocacy. It’s not something that just happens; it’s something you need to cultivate. A customer loyalty program can help.

What Is a Customer Loyalty Program?

A customer loyalty program is a way for you to become intentional about your loyalty.

It’s the processes, methodologies, strategies, and structures you use to measure, optimize, and drive revenue through your customer relationships.

For B2C brands, such as those in retail, loyalty programs are typically quite simple: customers earn points based on their past purchase behavior which are then redeemable against future purchases. Often, B2C loyalty programs will link up this basic transactional structure with engagement through social media, newsletters, or other special touches.

Yet, we’ve already seen how customer loyalty can be a little different in B2B. While engagement through marketing material will be important, you need to find deeper ways to know your customers, find out what makes them tick, and keep them coming back.

Here’s what you need to know to get started.

The Essential Elements of a Successful B2B Customer Loyalty Program

What makes an effective customer loyalty program in B2B? Simply, it’s one that engages everyone in your customer accounts. It will tie your CX metrics to your revenue and crucially ensure your whole business takes part in closing the loop with customers.

However, in B2B customer loyalty, there’s one thing that needs to come first. That’s customer loyalty software.

That’s why it’s time we’re introducing you to Account Experience.

1. Choose Account Experience as Your Customer Loyalty Software

With different customers of different sizes, revenues, and touchpoints, B2B customer loyalty can be complex. That’s why we say that customer loyalty software should be a fundamental part of your strategy.

At CustomerGauge, we’re proud to have designed Account Experience (AX), a customer loyalty tool specifically for B2B brands. And we’re particularly proud that it’s been ranked by Gartner as the #1 customer retention and voice of customer (VoC) tool for B2B three years running.

Whichever customer loyalty software you choose, though, make sure it can handle the demands of B2B. Here’s what you can’t afford to do without:

Easy measurement of customer experience. The point of customer loyalty software is to dig into your customer sentiment, primarily through surveys such as Net Promoter Score (NPS), and understand how you can improve. As you’ll see below, this is a huge part of your customer loyalty strategy, and your software should support your efforts.

Flexibility. No two B2B brands are the same, let alone their customers. You need a customer loyalty platform that can reflect different customer journeys, account types, pricing plans, and more.

Integration with other customer loyalty tools. There are many tools out there that can give you different insights into your customer relationships. To get a comprehensive view of your customers, you’ll want a loyalty tool that can play well with others.

Engagement monitoring. Not all customers respond to surveys, but they do all engage with your products. Tracking the full range of activity on customer accounts will reveal the true health of your relationships.

Clarity on the financial metrics loyalty program. The biggest value of customer loyalty comes in the form of long-term improvements to your revenue. If your software tool doesn’t link your CX metrics to your bottom line, you’re not getting the full picture.

With CX data linked to revenue, you’ll also be able to prove to your C-Suite the value of your customer loyalty program. This will ensure you get the right resources you need in future.

Account Experience does all of these things and more. As Cary says,

“The reality is this: any relationship is difficult — because they depend on trust! But when you think of a B2B relationship, it’s already more difficult as you’re dealing with multiple relationships within that single relationship. You have to multiply all the points of contacts, conversations, and interactions in order to begin to see the health of that relationship.

“CustomerGauge helps companies scale great relationships by measuring all these dynamic metrics. Companies can then prioritize where to spend their resources in order to build trust, improving the relationship. Our data shows over and over again, the better the relationship, the better the growth!”

2. Measure Customer Loyalty

To get a full idea of how loyal customers are and the value they’re bringing to your relationship, you need to put measurement at the heart of what you do.

For that, we need to talk about customer loyalty metrics. The most important? NPS, engagement metrics, and revenue.

Retention Rate

To measure your customer loyalty, you’ll want to start by getting a clear sense of how many customers are sticking around and how much they’re worth to your brand. This will give you an idea of your transactional loyalty.

To access that, we need to talk about customer retention rates and customer lifetime value.

Customer Retention Rate

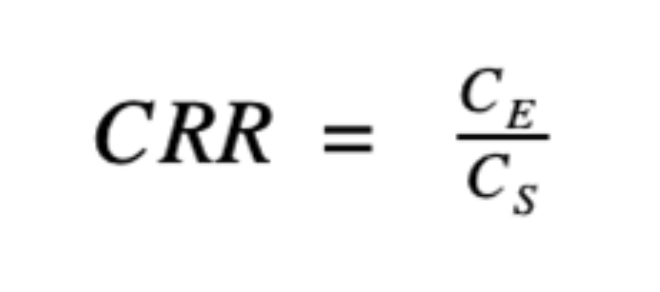

Customer retention rate (CCR) is the measure of the number of customers that you keep within a given period. It’s those who remain after others have churned and before any new acquisitions have arrived.

To this end, it’s the simplest quantitative metric of transactional loyalty you have. But, in our The State of B2B Account Experience report, we found that less than half of companies are actually measuring it — and their loyalty is suffering as a result.

To work out your CRR, you’ll need the following formula:

Here, CS is the number of customers at the start of any given period, while CE is the number of those customers remaining at the end. So, imagine you had 100 customers at the beginning of a year, but only had 80 of those customers left at the end. You’ll have an annual customer retention rate of 80%.

Revenue Retention Rate

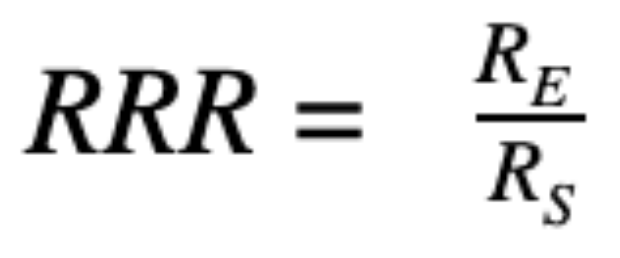

The number of customers you retain doesn’t show your whole customer retention story. We recommend you monetize your retention rate, by calculating how much revenue you’re retaining or losing to churn.

How? With revenue retention rate (RRR). You’ll need another similar formula:

Here, take the revenue you have at the start of a given period (RS) as well as the revenue you have at the end of that period (RE).

So, say your RS was $1,500, made up of five customers respectively worth $500, $400, $300, $200, and $100. During the period you lost the two customers worth $500 and $400.

In this case, your CRR would be 60%. However, your RRR would be 40%. It’s a big difference.

Customer Lifetime Value

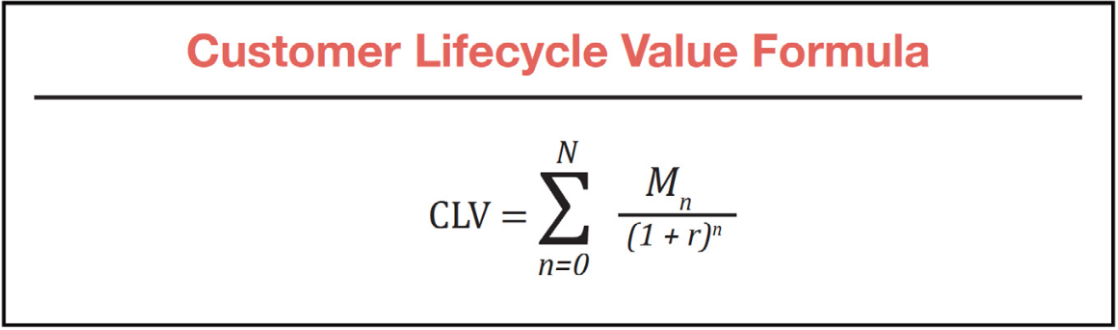

Alternatively, customer lifetime value (CLV) is the measure of the total revenue you can expect from a customer over their entire relationship with you. It’s an important metric for customer loyalty as it reveals the impact repeat purchases are having over the long term.

The formula we used for calculating CLV looks like this:

We know it looks a little complex, but to break that down:

N is the number of years in the customer's lifecycle

Mn is the margin in a year (the revenue minus operating costs)

1 / (1 + r)n is the discount factor (you need this for an accurate picture of value. i.e., what is the price of the perks loyal customers receive?)

What’s the difference between customer retention and CLV? Find out here.

Net Promoter Score

Once you’ve understood your customers’ transactional loyalty, it’s time to gauge how they actually feel about your brand and why. As such, the most important metric you’ll want to use in your customer loyalty program is Net Promoter Score, the most widely used and most effective measurement of customer sentiment out there.

NPS is designed to access emotional and advocacy loyalty through a simple question:

On a 0-10 scale, how likely are you to recommend our brand/product/service to a colleague or friend?

It’s a powerful metric in itself, as research has found that likelihood to recommend is one of the most accurate predictors of continued revenue. However, it’s what you do with the results that really counts.

Depending on their responses, you group customers into three different categories:

Promoters (scoring 9-10). These are your most loyal customers. They’ll likely be highly enthusiastic about your brand and willing to recommend you to a friend. They’re your advocates.

Passives (7-8). Although not as enthusiastic, passives are not churn risks either. Instead, they are engaged and recurring spenders. However, ideally, you’ll want to nurture them to become promoters.

Detractors (0-6). These are your least loyal customers and highest churn risks. Your loyalty program will suffer unless you engage with them and give them incentives to stay.

To get a view of your NPS performance across all your accounts, you’ll need to calculate your NPS score. To do this, simply subtract the proportion of detractors from the proportion of promoters.

While this will give you a sense of your business health, it won’t tell you how to improve to boost your loyalty. For that, you’ll need to understand your customer experience drivers.

NPS Drivers

This is the name we give to the different factors that drive customer experience. For example, it could be a particular transaction, customer service interaction, or product experience. By putting these at the heart of your customer surveys, you’ll discover the things holding back customer satisfaction or those driving loyalty.

Simply, that means asking why. Once you have asked your customers the NPS question, follow it up with a question a bit like this:

What is the reason behind the score you gave us today?

What could we do to improve your experience with us?

Engagement Signals

While a fundamental part of your loyalty efforts, the difficulty with customer experience surveys is that most customers don’t respond. In fact, on average, B2B brands typically achieve a survey response rate of only 12.4%. That means you’re not getting insight into the sentiment of the vast majority of your customers.

As such, alongside strategies to improve your NPS response rate, it’s important that you also track other customer activity on your account to get a full sense of your customer behavior.

For example, you should be tracking metrics including the following:

Support requests. If customers are asking you for help, it means that they’re using your product. But it can tell you a more nuanced story. Too few requests, and they may be disengaged. Too many, and they may be getting frustrated.

Product logins. If you’re a SaaS brand, it’s really easy to monitor product activity by simply tracking their logins. It can tell you whether customers are getting the most of your offering.

CRM activities. Track the level of your day-to-day customer engagements including meetings, calls, and any additional activities that your account manager might conduct with their customers. It will help you make sure you’re engaging with your customers enough, too.

Business review. Monitor your customer business review schedule separate from your other CRM activities. Have you conducted all the business reviews as planned? Importantly, which customers are missing their business review meetings and why?

Account Experience puts all of these customer loyalty metrics side-by-side to give you the big picture of your customer relationships.

3. Improve Customer Loyalty

Once you’ve measured customer loyalty, it’s naturally time to put steps in place to improve it. There are many strategies you can take to improve your customer loyalty program, but we recommend you absolutely get these best practices down.

1. Close the Loop on Feedback

Once you have received customer feedback, or identified an absence of signal in an account, reach out to your customers. Tell them what you’re doing to improve based on their feedback or ask them for further details on what you can do.

Too many businesses don’t actually act on the feedback that they receive. Yet, as loyalty is built on an emotional connection, building trust and impressing customers through engagement is a must.

In fact, we found that closing the loop with all your customers can improve retention by as much as 8.5%.

To create the best conditions for loyalty, we recommend that you:

Close the loop with everyone. Just 26% of brands close the loop with all their customers, according to our research. The more you close the loop the better. We suggest you set a target of closing the loop with 100% of your customers.

Do it fast — ideally under 48 hours. Our research shows that it can improve your NPS score by 6 points.

Set goals for closing the loop. Only 62% of B2B companies set goals for closing the loop. However, our data shows that companies that set goals grow twice as fast as those that don’t.

2. Drive Survey Engagement and Boost Signal

Customer surveys are the most important place businesses can start with their customer loyalty programs. Though too many businesses make the mistake of thinking that sending out a regular customer experience survey is enough. It isn’t.

To get the most reliable, actionable data, your job will need to involve boosting your survey response rate and ensuring you’re collecting the clearest signal from the biggest range of customers. As we said, a 12.4% response rate is not enough. Aim for 100% across your full range of accounts.

That means response rate should be a key metric in your customer loyalty program. Supplement visibility of your engagement rates with your products and customer service staff.

3. Engage Your Whole Team Through Customer Loyalty Goals

Any customer loyalty strategy will be severely limited if you leave it to one team (or just one individual) alone. Rather, improving your customer experience should be everyone’s responsibility, from your frontline staff right up to your C-Suite.

All departments need to be involved with the retention and growth strategy. And here, goals can help. We suggest setting SMART goals: specific, measurable, achievable, relevant, and time-bound to define and track your progress.

These can help you drive motivation and identify success.

4. Leverage Your Loyal Customers to Drive Revenue

Once your customer loyalty program is in place, your efforts shouldn’t end there. After all, your loyal customers are those that are most likely to bring more value to your business.

You now need to nudge them to make that likelihood a certainty.

Upsells and cross-sells are your most lucrative channel here. Loyal customers are believed to spend 140% more than other customers, and they’re more likely to try new products.

Putting attractive offers in front of them will help you drive revenue.

Referrals are another key part of this growth strategy, too. Of course, NPS surveys measure how likely customers are to recommend a product to a friend. But, it doesn’t mean they actually will. You need to make that happen through a dedicated referral program.

Here’s another important thought from Cary:

“Think of and treat your referral network as an extension of your sales team. You should track how much they bring to you, measure their true earned growth, and reward them just like they’re a member of your team that’s responsible for bringing in the big sales.”

Examples of Effective B2B Customer Loyalty Programs

We found that companies who have used Account Experience to boost their customer loyalty see a median improvement of 4 points on their NPS score. Many have a 9+ point advantage over their competitors.

We’ll end this guide by showing you three B2B brands that have worked with us to improve their loyalty.

Rehmann

Financial services provider Rehmann implemented Account Experience to automate, monitor, report on, and improve their customer experience.

The brand developed a customer loyalty program that used NPS to reduce churn and offer ongoing support and engagement to customers. As a result, Rehmann grew its NPS score to 79 — well above the financial services industry average of 37.

In the words of Mitch Reno, Rehmann’s Director of Customer Experience:

“CustomerGauge allows us to take client feedback and move swiftly to focus on targeted relationships. Once you get to a certain level of NPS achievement, it’s important to continue to use software tools like CustomerGauge to help and monitor the drivers of satisfaction so you can continue to improve.”

PandaDoc

The eDocument software brand, PandaDoc, has been using Account Experience alongside a couple of targeted strategies to improve customer loyalty.

One of the unique ways that PandaDoc creates customized customer experiences is through “success KPIs”. These are data points tracked on the customer level inside the application and include rejection rates and close rates. During business reviews, account managers can benchmark each customer against this data to determine where they need to improve.

Then, PandaDoc builds loyalty by putting customer feedback at the center of their strategic planning sessions. Every six months they meet with 10-20 of their customers for a ‘customer advisory board’, to discuss the product roadmap, CX strategy, and allow customers to share their experiences with the product.

“The Customer Advisory Board has been an integral part of our experience team. Having the customer at the center of strategic decision making has given us valuable insights that we wouldn’t have had otherwise,” says Nick Szenberg, Customer Marketing Manager at PandaDoc.

ICON

At the communication center company, ICON, over 80% of new business comes from referrals, cross-sells, or upsells. However, these numbers don’t just happen by accident. Rather, ICON has put customer feedback at the very heart of what they do.

The process starts with an impressive 100% response rate on customer surveys which can be completed in less than two minutes. Part of their success is the way they close the loop with all of their respondents.

While closing the loop, ICON invites the customer to join their 90-day action plan to correct the problem. This way, they don’t only close the loop, but they include the customer in the action plan to correct it.

The customer’s involvement drives deeper loyalty and higher willingness to recommend, hence ICON’s astonishingly high referral revenue. It’s also a major factor in why ICON boasts an incredible 98.8% customer retention rate.

Improve Your Customer Loyalty With CustomerGauge

At CustomerGauge, we can help you build a customer loyalty program that drives referrals, encourages upsells, and boosts your bottom line.