Introduction

Since 2003, when Frederick Reichheld first introduced the Net Promoter Score® in his article “The One Number You Need to Grow” in Harvard Business Review, thousands of companies have taken the steps toward turning customer loyalty into a competitive advantage. However, as companies’ needs have grown and technology and enterprise have changed, so too has the Net Promoter Score.

Over the years, numerous initiatives have been taken to expand on Reichheld’s original NPS® narrative. In 2008, the Net Promoter Operating Model ® (also referred to as “heritage NPS®”) was introduced in “Answering the Ultimate Question”. Heritage NPS helped mold the concept of “measuring” customer feedback and “acting” to close the loop with detractors.

Now, we’re entering the modern age of NPS—with monetization—which takes heritage NPS further and makes it more than just a loyalty metric, but also a compass for growth.

Introduced in our most recent white paper, Next-Generation Net Promoter, we've improved the "traditional" Net Promoter model by introducing processes around retention, revenue, referrals, and up-and-cross-sells.

In this eBook, we’ll discuss the four steps within this new model and summarize findings from our white paper that will help you capitalize on customer feedback and grow your bottom line.

Get to Know Monetized

Net Promoter®

The Net Promoter Score with monetization model takes what was once known as heritage NPS and ties it more closely with revenue. It goes beyond simply loyalty and into growing revenue and your company with an existing customer base.

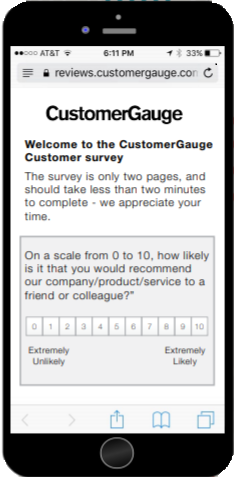

At its heart, the original NPS scale is still present within the monetizing Net Promoter model. Customers are given the ultimate question:

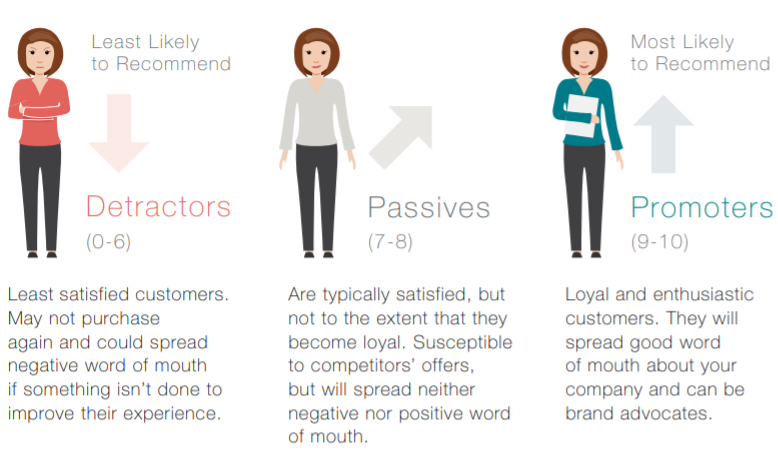

They are then placed within the brackets of promoters, passives and detractors.

Get to Know Net Promoter Score® with Monetization

Companies act on customer issues to quickly close the loop with passives and detractors to improve retention.

It is at this point that heritage NPS and Net Promoter with monetization begin to branch off. The following provides a clear comparison between the two.

Heritage NPS

Heritage NPS focuses primarily on measuring and acting on customer feedback. This includes:

- Listening and analyzing customer feedback

- Acting on feedback to close the loop with customers and optimizing business processes based on feedback

Monetizing Net Promoter

Within the monetization Net Promoter model, you add revenue figures within the first two steps and then commit to growth. This method includes:

- Listening and analyzing customer feedback

- Acting on feedback to close the loop with customers and optimization

- Monetizing NPS to correlate with revenue and measure retention and referrals

- Growing your existing customer base through referral marketing, up-sells, cross-sells and best practices

In the next few chapters, we’ll walk through each step of the Net Promoter® monetization model and offer best practices for succeeding at each stage.

Step 1: Measure

The first activity in any NPS program should be to measure your Net Promoter Score. To calculate this, companies ask their customers the NPS question, as mentioned in the previous chapter. When measuring NPS, companies must both listen and analyze their customer feedback to understand and address brand sentiment.

Before conducting surveys—or listening to customers—there are a number of variables you need to determine, such as:

- Who to ask

- When to ask

- Survey frequency

- Survey design

- Response requirements

NPS programs use both relationship and transactional surveys to listen to customers. Relationship surveys are short and frequent, and typically conducted on a quarterly basis. Transactional surveys are triggered after transactional events such as buying a dress online or after an item is delivered.

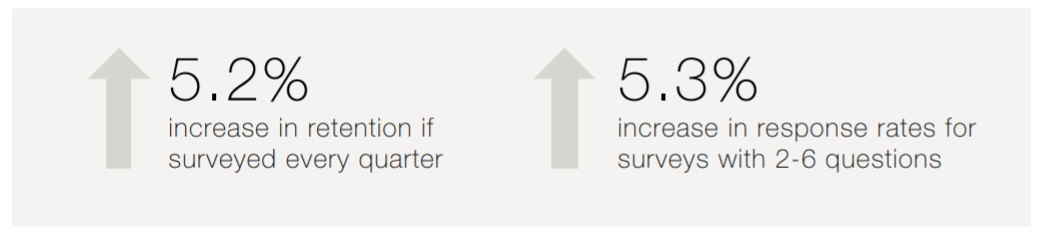

According to our research, short and frequent relationship surveys have a number of benefits, including:

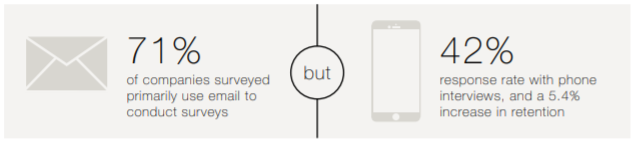

There are a number of methods for conducting these types of surveys. The most popular, and cheapest, is email invitations, which 71% of our surveyed companies chose based on our research. However, phone interviews seem to have some of the highest response rates, and interestingly enough, higher retention rates, with 42% responses (compared to 30% for email invites) and a 5.4% increase in retention.

Once you’ve conducted your surveys, you need to begin analyzing your responses. This is necessary to understand the root causes of your Net Promoter Score.

By simply asking two additional questions besides that ultimate question, it is possible to conduct driver analysis. Driver analysis allows companies to determine how much each driver contributes to the overall Net Promoter Score and what part of the customer experience needs to be improved. These types of cascading questions also eliminate longer survey lengths, thus boosting responses.

In our findings, companies that do driver analysis improve their retention more so than companies that don’t. Alternatively, companies can also use free-text comment boxes as a way to keep their surveys shorter. Text analytics is one way to make sense of many comments. But presenting unfiltered customer feedback to frontline employees is the recommended way of working with feedback.

Step 2: Act

Now that you’ve listened to and analyzed your feedback, it’s time to Act on it. There are two substeps within the Act stage: closing the loop and optimizing.

Closing the loop is essential for improving customer experience, your Net Promoter Score and increasing retention.

Closing the loop happens at three levels: frontline, management and executive.

- Frontline

Depending on whether you’re B2B vs. B2C, the frontline will close the loop with respondents or accounts. The purpose of closing the loop at the frontline includes:

- Determine root cause for score if it is unclear

- Fix open issues

- Turn a passive into a promoter

- Reasons for promotion and encourage referrals

2. Management

Closing the loop at the management level includes:

- Understanding NPS drivers and steps to improve

- Identify best performance and best practices

3. Executive

The executive level deals with structura issues that frontline employees or managemen cannot solve due to organizational limitations, investment needs or strategic implications.

Measure performance and set targets

The key to optimizing your NPS program is to measure performance and set targets.

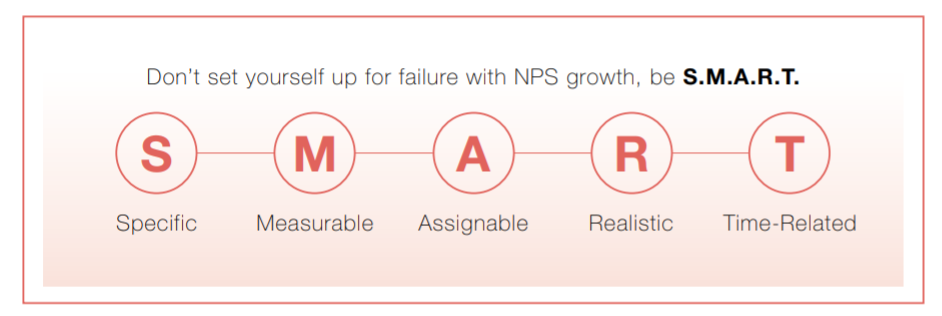

In our research, we found that 21% of surveyed companies didn’t set targets on how much their NPS should grow. This is a big miss on their part considering that companies that did set targets grew 2x more than those that didn’t!

Moreover, when setting targets, it’s important to ensure they are achievable within your specific program. We can’t count the number of times that companies set unreasonable high NPS score expectations. To avoid this, companies should set S.M.A.R.T targets, i.e. Specific, Measurable, Assignable, Realistic and TimeRelated.

In addition to setting acceptable targets, companies can also create what-if scenarios to determine goals. For example, “people that marked this issue will give us one score higher if solved.” You can assign the likeliness of Net Promoter Score increases based on a series of drivers.

“Companies that set growth targets for NPS grow 2x more than those who don’t!”

Step 3: Monetize

The primary purpose of any NPS program should be to create long-term growth. Customer experience is an important goal, but your bottom line should always be at the top of the list.

Step 3: Monetize enhances the Measure and Act stages further using revenue figures. Doing this provides insight into a company’s strengths, weaknesses, opportunities and threats.

There are a few substeps to be performed within this step, including:

- Measuring your retention rate

- Measuring and analyzing referrals

- Correlating revenue with NPS

To reduce churn, companies need to continuously (on a monthly basis) measure their retention and churn rate. We discuss more about the basics of doing so in our NPS 101: Retention Management to Combat Churn eBook. Part of this measurement should include determining the following using revenue, segmentation, churn and NPS data:

- When customers churn

- Which customers churn

- Why customers churn

Once you identify your churn issues, companies should also start measuring referral value. Many companies assume that just because a customer is a promoter that they’ll automatically refer their brand. In reality, this rarely happens without initiative.

Referral Marketing

Including referral marketing within your NPS program will allow you to mobilize promoters. To determine the value of every last referral, companies can calculate their Customer Referral Value (CRV). To calculate CRV companies must know:

- Which customers join due to referrals

- How much referrals help to shorten the sales process

You can find the full formula and best practices for calculating CRV in the full white paper.

The final substep within the Monetize stage is to correlate your NPS with revenue. This is vital to proving the program’s success to the c-suite. Some revenue types may not always correlate well to NPS, such as subscription fees, however, upsells and cross-sells often do. The key to tying revenue gains and NPS is by accessing revenue data and using the proper NPS analytics tools.

For B2C companies, the sheer volume of customers can make this correlation difficult. To solve this, companies can aggregate the financial value for detractors, passives and promoters to know their average value (and hopefully show that promoters are more valuable than passives, etc.). This can show how an increase in NPS may correlate to an increase in revenue.

Step 4: Grow

Having now monetized NPS and retention, it’s time to focus on growing your bottom line.

The Grow stage, includes a number of substeps:

- Growing retention

- Growing referrals

- Growing repurchases, up-sells and cross-sells

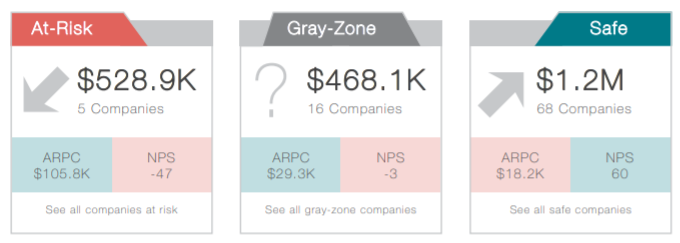

When growing retention, you first need to predict the likelihood of churn within your customer base and then determine the value of those customers and their probability of churn. You can do this by segmenting customers into three categories: at-risk, gray-zone and safe.

Grow Referrals with NPS

To grow referrals, it’s vital that companies take advantage of referral marketing in combination with their NPS program. NPS adds a great amount of value to referral marketing, and some Net Promoter Systems even come with their own referral marketing capabilities. Using a combination of both, companies can:

- Run marketing campaigns aimed at promoters

- Publish scores and customer comments on review websites

- Include referrals as part of closing the loop

- Ask customers for an online review as part of their NPS survey

When promoting up-sales and cross-sales, companies should first aim for their high-value promoters. These customers like and are invested in the brand, so creating campaigns targeted to these customers is a no-brainer.

However, many companies also miss the opportunity to sell to low-value, but high-volume customers, which by volume alone can make a sizable impact.

“When promoting up-sales and crosssales, companies should first aim for their high-value promoters.”

Conclusion

The Net Promoter with monetization model is the next step in the NPS narrative. While not all companies are practicing each step in the process, this model does provide a road map for where to take an NPS program moving forward.

By measuring and acting on customer feedback, companies can understand brand sentiment and act to change it. Adding revenue figures, companies can begin correlating revenue with an NPS program with monetized NPS. Once that value is recognized, businesses can foster promoter relationships through referral marketing and more to grow revenue.