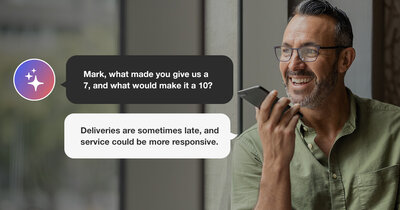

Your Top Accounts Are Slipping While You're Helping Everyone Else

You're improving the experience for everyone. Meanwhile, your top 10 accounts—40% of your revenue—are slipping. CustomerGaige connects account NPS to revenue so you see which relationships matter most, which are at risk, and what's at stake. Prioritize by dollars, not scores. Act on accounts that move your business forward first—This isn’t customer research. It’s customer action — built for leaders who can’t afford to guess.