Retention: The Key to Survival

In the early 2000’s, growing usage of the Internet made access to competing products and services easier than ever. Businesses could no longer rely on customers or accounts sticking around indefinitely when consumers or clients had easy, instant access to a database of potential competitors.. Instead, they learned to focus on customer retention–ensuring that their customer bases remained loyal in the midst of mounting competition.

Today, this reality remains more pertinent than ever. Especially for SaaS and B2B companies, retention is critically important. The number of software-as-a-service companies continues to grow rapidly, with almost two-thirds of existing SaaS companies formed in the last decade alone. And in an industry where over 35% retention is considered exceptional, companies that prioritize loyalty and retention over acquiring new customers win. Ultimately, long-term buyers spend more, cost less, and are more likely to refer others to a business. They come with a lower cost of acquisition (CAC), and help ensure steady, consistent growth.

Customer Retention Rate (CRR) vs. Revenue Retention Rate (RRR)

Your retention rate can be evaluated from two different perspectives: number of customers, and amount of revenue. Recognizing that these two metrics will produce different results confirms this statement: All customers are valuable, but not all hold the same value.

For example, you might measure both metrics for a given time period. Let’s say you have 10 customers that are worth a total of $5500 at the beginning of the period. At the end, you’ve lost 5 customers–but only $1100.

Now, you have a CRR of 50%–but an RRR of 72.7%. The five customers you’ve lost were not nearly as valuable as the five remaining.

The 80/20 Rule & Customer Retention for B2B Businesses

Now, imagine the reverse of the situation above: You’ve lost only 10% of your customers–but they happen to be your highest value customers. Perhaps they even outspend a significant majority of others. Losing these customers could be extremely damaging to your business.

The 80/20 rule, or Pareto Principle, asserts that in many cases, 80% of the effects are produced by 20% of the causes.

For B2B businesses running high-value accounts, this principle very frequently holds true. Unlike a high-churn e-commerce website running on a massive number of customers and small purchases, B2B companies often rely heavily on a few loyal accounts. In some cases, these are accounts that produce well upwards of $1M annually. In short—losing a single account like this could spell disaster.

Unfortunately, businesses too often overlook this important principle. Yes, they focus on retention–but do they focus on retaining the right customers or accounts?

That’s why it’s critical for businesses to examine both CRR and RRR. They need to know not only how well they are retaining customers and accounts, but how damaging the loss of certain accounts are.

Examining these metrics is critically important–but it still doesn’t answer the vital questions of how to improve overall retention, and most importantly, how to prevent your highest value customers from churning.

That’s where Account Experience and customer satisfaction come in.

Customer Satisfaction: Improving Customer Experience (CX)–Before It’s Too Late

In 1998, authors Joseph Pine and James Gilmore had written a breakthrough article in Harvard Business Review, titled “Welcome to the Experience Economy.”

In this article, Pine and Gilmore asserted that consumers are just as likely to invest in experiences as they are products and services. By the early 2000’s, their vision began to see fulfillment, as CX insights were delivered into the hands of key decision makers.

Customer experience–and ensuring great retention–was no longer considered a peripheral element to running a great business. Research confirmed it: Retention played just as vital a role in a company’s long term growth as acquisitions.

Modern CX metrics such as Customer Satisfaction Score (CSAT) and Customer Effort Score (CES) were conceived out of a need to track and evaluate customer satisfaction. In theory, these metrics act as strong indicators of how a customer base feels about their experience with a business, and whether or not they are likely to churn. But these metrics don’t always deliver the sort of comprehensive insight that business owners need to understand whether or not a customer or account is thrilled with their product or service, or passively satisfied and perhaps looking for a superior solution.

In 2003, Net Promoter Score (NPS) was created by business strategist Fred Reichheld. This metric was born out of the desire to measure loyalty over basic satisfaction, and to identify promoters of a product or service. Promoters are not only high purchasers and long-time customers–they are a powerful source of referral marketing.

Net Promoter Score: A Breakdown

Net Promoter Score (NPS) generates a customer satisfaction metric with the following question:

On a scale from 0 to 10: How likely are you to recommend (this company, this product, this experience, this representative) to your friends, family or business associates?

Based on their answer, respondents are grouped into three categories: detractors (0-6), passives (7-8), and promoters (9-10). Then you’ll calculate NPS using this equation:

[# of promoters / Total # of survey takers] - [# of detractors / Total # of survey takers] = NPS

Ideally, your NPS will be well above zero, indicating that you have far more promoters than detractors. Your rating is a valuable insight in and of itself. But just as important–if not more important–than learning your actual score is gaining knowledge about your detractors.

Your Detractors: At Risk of Churn

Your detractors have been disappointed by your product or service, for one reason or another. If you run a B2B business, maybe they had one negative interaction with an account manager. Maybe you’ve missed critical opportunities to upsell and cross-sell to them, and your service has grown stagnant. Maybe you’ve failed to respond to the feedback they’ve already provided.

In any case, your detractors are at particularly high risk of churn.

Bain & Company & Fred Reichheld, have helped hone and develop NPS as a core strategy for business growth and development. As part of their research, Bain conducted a study with their client Dell, who performed an NPS survey with their customer base. They found that Dell lost $68 million worth of revenue due to their 15% rate of detractors. The same study found that by converting just 2-8% of those detractors, Dell could have recouped $167 million annually.

Our Story: Losing Accounts to Blind Spots

Net Promoter Score (NPS) can help companies gain powerful insight to help them prevent situations like the one described above, but in and of itself, it’s not perfect. What do we mean by that? Many companies use NPS–but fail to acknowledge its blind spots. [To download “Avoiding Net Promoter Pitfalls” click here].

We should know–we fell susceptible to the same error. Early on at CustomerGauge, we conducted an initial NPS surveys that pointed to great oveall customer satisfaction. We had a higher-than-average response rate, we were closing the loop on roughly 80% of the cases. And our Net Promoter Score was in the 60’s–a rating that indicates an exceptional level of success (Remember, anything above 0 indicates that you have more promoters than detractors).

Then, all of a sudden, accounts began dropping off…and we couldn’t quite figure out why. If our Net Promoter Score surveys showed success, then why were we failing at retention?

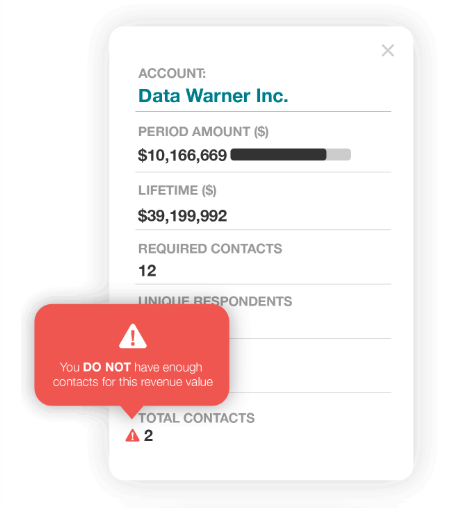

Here was our blind spot: Our shining NPS results were not produced by our highest-value accounts. In fact, when we stacked our top 20 accounts, we found they were generating an extremely low response rate to our NPS surveys.

The core of our business was exposed and we made a commitment then and there to go beyond the Net Promoter Score and focus on the Account Experience to drive retention as our core focus.

Many companies fail by simply focusing only on Net Promoter Score and other customer satisfaction metrics. They don’t link these statistics to actual revenue and other account signals, and thereby miss the whole point: retaining and growing highly profitable customer relationships.

Customer Satisfaction as a Means to Retention

To answer the question posed at the beginning of this article: Retention is ultimately more important than satisfaction. As you learned in our own story of excellent customer satisfaction coupled with failing retention, your stats mean nothing if you’re losing valuable customers–especially for B2B with typically large accounts. Customer satisfaction is not an end in and of itself. It’s a means to an end: greater retention of high-value customers and accounts.

That’s we’ve developed Account Experience to address this critical relationship, linking customer satisfaction to actual revenue.

Measuring Churn Likelihood

As you’ve discovered, losing high-value customers and accounts can come as a bitter surprise, especially when statistics might indicate otherwise. Churn Likelihood measures customer engagement on a variety of levels to predict whether an account is likely to drop off. If the account is at risk, it makes informed recommendations on how to close the loop and prevent churn.

Voice of the Account

Your highest value accounts need your greatest focus and attention. Voice of the Account gives you a holistic view of relationships that allows you to closely monitor engagement with your top accounts. Voice of the Account also allows you to strategically survey your accounts–and assess feedback across multiple contact stakeholders, for rich, actionable insight. Finally, you’ll discover specific drivers of customer satisfaction…and how to stay ahead of churn.

NPS Revenue Simulator

Most companies make the critical mistake of not linking NPS to revenue. The NPS Revenue Simulator links Net Promoter Score to hard data to help you predict how changes in your score can affect your bottom line. You’ll be able to see the average spend of promoters, passives, and detractors, and how much revenue is being produced by each category.

The Bottom Line: It’s About Your Bottom Line (and Account Retention)

You need to improve metrics insofar as they improve your bottom line. Don’t waste your time measuring and assessing customer satisfaction metrics such as NPS if they’re not directly linked to your primary sources of revenue. Focus on delivering an excellent customer experience with the goal of retaining your highest value customers (or accounts)–and seeing steady, consistent revenue that grows.