NPS Financial Services / 27 Banking NPS Scores 2025

by Ian Luck

In banking and financial services, Net Promoter Score (NPS) has never been more important. With customers becoming increasingly tech-savvy and expecting more personalized banking experiences, you can no longer afford to be lazy with loyalty.

The good news for consumers is that in 2021, 75% of banks are now investing in a business model that places the customer at the center. And a survey of the financial sector found that 47% of companies have set tangible CX targets (something that's core to actually improving interest rates according to research).

However, the reality of execution lags behind. In 2020, NPS for banking fell 7 points from the previous year—as you'll see below.

Want to know average NPS scores for all major industries? Get the most comprehensive B2B NPS benchmarks guide on the planet here.

Table of contents

- What's the average NPS score for banking and financial services?

- What's a good score for banking and financial services?

- NPS benchmarks: 27 NPS scores for leading financial institutions

- The CX and NPS profile of 9 banks

- Key industry trends

Let's started with some important context:

What's the average NPS score for financial services?

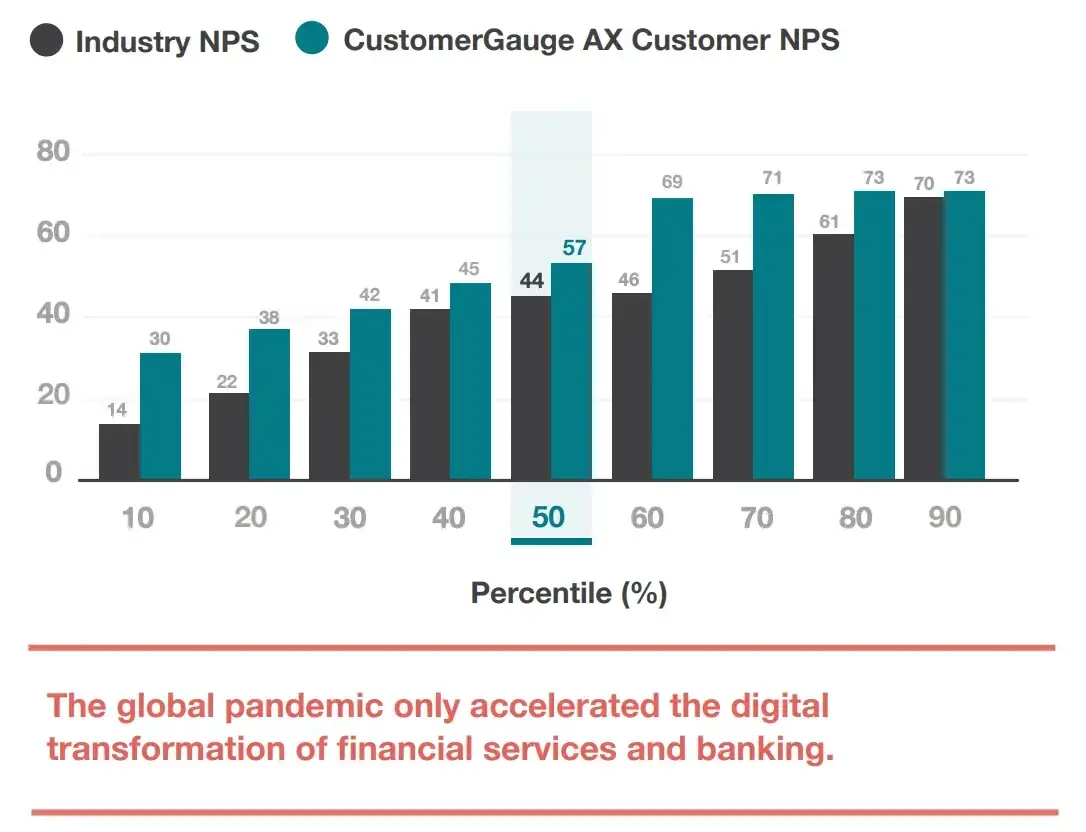

The average NPS score for financial services is 44 (previously 46). Whereas the average NPS score for banking fell at 30 (previously 37). Both have room for improvement compared to other industries like consumer brands and technology—financial services and banking need to up their game through more personalized experiences.

You might ask, why should financial service companies focus their energy and resources on measuring and growing their NPS? Research shows that the lifetime value of a promoter is 2.5 times higher than that of a detractor, while detractors are 2.3 times more likely to switch to another financial organization compared to a promoter. Even more interesting is that financial institutions that have an NPS score higher than 60 will see a 26% greater level of growth in their operating income compared to organizations with a score below 60. The higher the score, the better the sales and the higher level of profitability.

What is a good NPS score for financial services?

Bain & Company (the creators of NPS) note that a good NPS score is 0 and above. Above 50 is excellent and above 80 is world class.

A score that's zero and above suggests that you have more Promoters than Detractors, which is a good sign. However, it's important to compare yourself to others in your industry.

In the finance industry, where the average score is 44, a score greater than 44 would be considered good, but our customers achieved +57 on average and it should be your ultimate goal to match the likes of USAA with a score of 75.

Banks NPS top scores: 27 banking NPS scores for leading financial institutions

Below are several of the latest publicly available NPS scores for leading banks and financial institutions:

Leading Banking NPS scores

| Company | NPS Score |

|---|---|

| First Republic Bank NPS | 72 |

| First Direct NPS | 66 |

| ING Luxembourg NPS | 63 |

| American Express Bank NPS | 52 |

| Royal Bank of Scotland NPS | 51 |

| JP Morgan Bank NPS | 31 |

| Santander UK Banking NPS | 27 |

| Tesco Bank NPS | 23 |

| Bank of America NPS | 18 |

| CitiGroup NPS | 18 |

| Morgan Stanley NPS | 16 |

| ANZ NPS | 15.4 |

| National Australia Bank (NAB) NPS | 15.4 |

| PNC Bank NPS | 15 |

| TSB Bank | 12 |

| CBA NPS | 10.4 |

| HSBC Bank NPS | 7 |

| Goldman Sachs NPS | 5 |

| Westpac NPS | -6.9 |

Leading Financial Institution NPS scores

| Company | NPS Score |

|---|---|

| USAA NPS | 75 |

| Charles Schwab NPS | 52 |

| ABN AMRO NPS | 30 |

Leading Fintech NPS scores

We recently wrote a Fintech Customer Experience case study on these 5 companies:

| Company | NPS Score |

|---|---|

| SoFi NPS score | 90 |

| OnDeck NPS score | 84 |

| Affirm NPS Score | 83 |

| LendingClub NPS score | 79 |

| Funding Circle NPS score | 77 |

Want to know NPS scores for all major players in the financial sector? Get the most comprehensive B2B NPS benchmarks guide on the planet here.

NPS Finance: How did these 9 banks and financial service institutions achieve high NPS scores?

We have learned that NPS scores of financial service companies are among the most researched on customergauge.com/benchmarks. So we've decided to take a closer look at five of those NPS benchmarks and the CX initiatives taken to achieve them at USAA, ABN AMRO, H&R Block, RBS and American Express.

1. USAA NPS Score (75)

The American bank USAA is enjoying an NPS score of 75, one of the highest in the industry. The ease of doing business with the company, combined with the feeling that customers are treated fairly has helped USAA achieve the impressive NPS score of 75.

Currently one of the leaders in customer delight in the banking sector, USAA has carefully invested in initiatives that reduce customer effort and lead to active promoters. For example, a study by Stephanie Woerner and Peter Weill from MIT Sloan revealed how the bank has transformed itself, and specifically, how the IT unit has addressed the changing demands from customers in order to deliver superior customer service.

USAA has become the first financial services company to allow customers to check their bank balances via text message. The brand also now offers technology for customers who have been involved in car accidents, allowing them to instantly attach photographs and voice recordings to their insurance claims, which can be initiated remotely. Such innovations can serve as an example of customer experience best practices. USAA has become an epitome for a brand that is not obsessed with technology, but customers, and has their needs and expectations at the center of its operations.

Discover the top 25 NPS scores in the insurance industry in our guide here.

2. ABN AMRO Group NPS Score (30-71)

The Net Promoter Score is also a main focus and objective for ABN AMRO Group, one of Dutch leading banks.

Customer feedback helps ABN AMRO track and act upon client’s opinion of the product and service. The bank rolled-out closed-loop feedback throughout the organization in 2016 as a way to continuously learn from their client. The company has made tremendous progress in the past three years (coming from NPS -23 for their retail banking division) and in 2020 reported an NPS score of 30 in their Asset Based Finance division and a score of 71 in their Commercial Finance division.

Initiatives launched in 2016 to enhance the customer experience are the client loyalty program &Meer, the Tikkie payment app and the Grip app, which gives clients insight and overview regarding their spending.

CEO Frans Woelders, who we spoke to recently, has established a customer-centric transformation strategy based on the NPS and enhanced ABN AMRO’s CX by consistently improving customer journeys.

“The customer says whether we do well or not. It is up to us how we collect that information. " - Director for eCommerce Jan-Pieter Schrier, ABN AMRO

While working on enhancing customer experience and boost NPS results, ABN AMRO is still trying to create a seamless experience for customers across all channels and touch points.

3. H&R Block NPS Score

H&R Block leads the consumer tax preparation services industry as the only company to offer choices for consumers to get tax help on their terms, whether in person or online. Having 11,000 offices throughout North America and over 80,000 employees makes providing a cohesive customer experience a tall order. However, H&R Block is using its unparalleled customer experience and NPS as its key metric for growth.

The team at H&R Block uses CustomerGauge to assist in recognizing where they are succeeding and where there is room to provide a better experience. The product team uses the tool to identify upsell and cross-sell opportunities that make sense in various situations. This takes the pressure off front-line workers, as well as customers, so there is never a feeling of over-selling.

But where the program makes the biggest difference is in the H&R Block “Experience Council”. This is a team of front-line workers and corporate managers that work together to learn what’s happening in the stores so they can implement policies to create better experiences.

4. Royal Bank of Scotland NPS Score (51)

Another financial services company that has caught our attention with their CX initiatives is The Royal Bank of Scotland (RBS).

RBS currently has an NPS score of 51 after it increased investment in personalization. Research showed that RBS have even appointed specialized teams of “journey managers,” empowered to analyze entire customer journeys from start to finish, and order specific functional changes at any problematic touchpoint.

Find more discussion and sources for Royal Bank of Scotland's NPS Score in their SEC Filing.

5. American Express Bank NPS Score (32)

American Express is among the US banks that leads the NPS rankings in financial services, enjoying an NPS of 32. In combination with its emphasis on customer service and engagement, the American Express rewards are some of the most retention-focused (and therefore ultimately more valuable to the brand in the long term) in the market. Positive direct interactions and customer service and a generous financial rewards program has helped American Express make its cardholders feel that they are valued and that they are getting good value. In turn this has led to prevent switching of accounts to take advantage of introductory deals.

In an interview, Derek Martin, American Express’ director of global consumer card sales, retention capabilities and strategies shares that NPS is far from a vanity metric. It has instead become one that has correlated with significant improvements to the customer experience and the business’ bottom line.

"People who say you can’t correlate the data to actual revenue items—it’s not true, at least not in my case," says Martin. "I can show you data that says that as net promoter score rises, customers spend more money, they’re more loyal, they’re putting more dollars on an American Express card, and they’re leaving us less. - Source

Recent news about American Express show that although the bank continues to hold the leading NPS® score (52) in the Credit Card sector, customers were less satisfied with how widely the card is accepted.

6. First Republic Banks NPS (72)

First Republic Bank reached the #6 spot in Forbes most recent list of America’s Largest Banks, and in our list they’ve got one of the highest spots with a Net Promoter Score of 72.

Similar to USAA, First Republic Bank has learned that investing in customer service and customer experience is a competitive differentiator, especially at a time when most banks are minimizing costs in those areas.

In his article, “First Republic: A Customer Service Franchise Disguised as a Bank,” Sean Stannard-Stockton discusses how First Republic has benefited financially from this approach. In the article, Sean presents two forms of competitive advantages: price and differentiation. In the commodity business, you compete on price. However, when selling a differentiated product, consumers care less about the actual price and more about what differentiated aspect a company sells.

“At First Republic,” Sean states, “their customers aren’t buying and selling money like they do at the “big dumb bank across the street”, they are buying the peace of mind and time savings that come from having a customer service focused organization taking care of their banking needs.”

This customer-centric approach has paid off big time for First Republic, in a number of ways:

- Organic growth & enterprise value

Not only has First Republic become the first bank to surpass $50 billion assets through organic growth alone, but their value has grown at a compound rate of 23% a year.

- Net interest margin stability

While most interest rates are often chaotic for banks, First Republic’s has remained stable for the last 15+ years.

- Lending with foresight

First Republic has managed to weather the housing boom and bubble and protect their customers by not lending money to people who can’t pay it back. Net charge-offs over the last 16 years have been 0.03% (rising +0.11% in 2009 and 2010). During this same time, the top 50 US banks saw 1300% higher annual losses than First Republic’s.

7. Charles Schwab Banks NPS (52)

Back in 2003, Charles Schwab was in a bit of a conundrum both financially and with their customer service, with a Net Promoter Score of -35. After implementing the Net Promoter System in 2004, Charles Schwab began turning their financial and customer experience woes around by focusing on employee engagement and quick follow-up with customers. Today, Charles Schwab sits at a Net Promoter Score of 52.

This impressive jump over the years can be attributed, in part, to a change in focus at Charles Schwab, where running the business “through the client’s eyes” is an everyday mantra. In 2017, this strategy led to a number of improvements to the customer journey to better serve clients, including lowering commissions to the lowest in the country.

They also launched the Schwab Intelligent Advisory, an interactive online financial planning tool that provides 24/7 access to certified finance planners and additional support for common questions.

To show customers how serious they are about delivering on their customer service mantra, Charles Schwab is putting their money where their mouth is with the introduction of their “satisfaction guaranteed” promise, which states that if a customer isn’t completely satisfied, they will refund any fees and work to correct the issues immediately.

8. Citigroup Banks NPS (18)

Citigroup is the fourth largest bank in the United States, with a revenue of $69.87 billion, with over 200 million customers in 160 countries. Since the financial crisis of 2008, Citigroup has worked hard at improving their image among customers, and currently has a Net Promoter Score of 18.

A few key factors can be attributed to their continued rise in Net Promoter Score:

- Rewarding customers with perks

Understanding the value of giving back to customers, Citigroup is positioning itself to invest in both reward perks and building relationships with retailers such as Home Depot, American Airlines, Costco and Best Buy. In addition, their cash back program, branded cards and rewards card platform has taken off with customers. Combined, each of these customer enhancements have accelerated growth by +$136 billion between Q2 of 2015-2017.

- Digital transformation and innovation

Much like their FinTech counterparts, Citigroup is embracing the power of digital innovation in increasing engagement among current and new customers.

Back in 2016, current Citi Customer and Digital Experience Officer Alice Milligan pronounced that Citigroup would be expanding their mobile capabilities: “…we are launching a number of enhancements to our mobile app, with the goal of expanding the functionality and utility of the app by delivering new and innovative features. Citi offers a number of exclusive benefits to our card members, which is our way of thanking them for their loyalty to us, and we want to ensure these are available cross-channel.”

It seems Citigroup has benefited from this approach. Between May 2016 and 2017, engagement with innovations made to digital and mobile platforms has gone up 9% and 17%, respectively.

- Streamlining the omni-channel customer journey

In addition to ensuring the digital experience was enhanced for customers, Citigroup is also largely focused on ensuring that the customer journey has as few pain points as possible. According to Alice Milligan, this requires a holistic view of the customer experience, especially in the handoff between different channels. As part of her team’s analysis, they realized customers, after making a payment online, would often call within 24 hours to confirm whether payments went through:

“By having a cross-channel journey view, we develop omni-channel strategies that better serve customers, such as providing real-time payment confirmations online, text, and via email, as well as educating our customer service agents about how to handle incoming calls from customers who are active online.”

9. PNC Banks NPS (15)

PNC currently sports a Net Promoter Score of 15, and is another retail bank that is taking a hard look at where improvements can be made in the customer journey.

In a recent interview with Karen Larrimer, Head of Retail Banking & Chief Customer Office, she discussed the large role technology takes in a customer’s everyday banking with PNC:

“At PNC, we want to create a seamless experience for our customers so that each new product or service we create is faster and easier to use. Our success is dependent on our ability to serve our customers efficiently through their channel of choice and to provide customers with access to the financial expertise and unique tools they need to successfully manage their money.”

As part of this push for improved customer experience, in 2015 PNC implemented their PNC CARES initiative across their different lines of the business. According to PNC, this model encourages employees to connect with customers in a personal way, and share best practices among their colleagues.

Hungry for more? Here's a couple more financial service NPS case studies to browse.

Banking NPS Scores: The Best Follow These Trends

Now that we have gone over some of the NPS scores of financial services companies, let’s discover what key trends will shape the FS industry in the next couple of years.

1) Data analytics capabilities

Improving data analytics capabilities will be a crucial component for better customer experience in the financial services sector. According to Adobe, a full 99 percent of respondents consider “improving data analysis capabilities” to be a key element in better understanding customer experience requirements; and more than half of respondents (53 percent) plan to increase their marketing analytics budget over the next year. As mentioned earlier, FS companies like the Royal Bank of Scotland (RBS) have already started investing more into such capabilities by appointing customer journey managers. As a result, RBS is better equipped to analyse the entire customer journey from start to finish, understand the key problematic and successful touchpoints.

Banks who will combine big data with advanced analytics will be better positioned to engage with their customers at the right time, channel, and with the right interaction.

2) Omni-channel will remain critical for many financial institutions

During WSJ’s CFO Network conference, Bank of America chairman and CEO Brian Moynihan discussed some of the key attributes that financial services companies will need to develop in order to remain competitive in the market space.

“You have to be able to meet every customer, everywhere they want, and no one channel wins,” Moynihan said.

During the conference, BoA' CEO shared that the bank hosts 130 million consumer interactions every week, and while 123 million transactions don’t take place in a branch, 7 million still do. As such, Moynihan stressed that while some financial services companies will be available only via mobile or the internet, most will continue to have a presence across a variety of channels. Therefore, the importance of creating a seamless customer experience across channels cannot be understated.

3) Mobile payment technologies that offer more value

A recent report published by Ipsos MORI, a market research company, and VocaLink, a global payments partner to financial institutions and governments, indicates that European millennials are

struggling to adopt mobile payment technology. The study uncovered that while there is a great interest in mobile payments by customers, the lack of features and benefits that today’s technology offers is preventing them from changing their habits.

What is even more interesting is the fact that the study found that millennials in the U.K. and the Netherlands would be more inclined to use new mobile payment services if such services were offered by their banks, followed by PayPal. Earlier we discussed how the Dutch bank ABN AMRO is leveraging the power of mobile payments to enhance the customer experience it offers. ABN AMRO's Tikkie app allows any bank customers to send payment requests via WhatsApp, thus making the experience extremely effortless and time-efficient.

Ipsos MORI and VocaLink's research finishes off by saying that there is an appetite for more innovative mobile services by customers and that financial services companies should continue investing in the development of mobile payment solutions in order to meet customer expectations.

Want to get the latest Financial Services NPS Benchmarks? Click below to get the most comprehensive NPS Benchmarks report on the planet with over 24,000+ data points!

Quick FAQs for NPS in Finance

It's easy to forget that not everyone knows the fundamentals of NPS, so here's a short reminder of the basics.

What does NPS stand for in finance?

In finance, NPS stands for Net Promoter Score. It's a performance metric widely used (by thousands of companies, including two-thirds of the Fortune 1000) to measure how likely a customer is to recommend your company to a friend or colleague.

Fred Reicheld of Bain & Co discovered that one question (the Net Promoter Score question) was the ultimate test of customer loyalty. If a customer falls into the high, "promoter", range of the score then they're receiving real value from your company to the extent that they'll but their reputation on the line to recommend you.

Customers on the lower end of the scale, called "passives" or "detractors", are at-risk of leaving you, bad mouthing you, are more costly to serve and unlikely to be upsold other products of yours. Customers in this category should be listened to closely and their issues fixed with the goal of moving them to the "promoter" group.

What is a good NPS score for banks?

In the banking industry, where the average score is 34, a score greater than 34 would be considered good, but it should be your ultimate goal to match the likes of USAA with a score of 75.

What is the formula of NPS?

The Net Promoter Score is calculated by subtracting the percentage of detractors from the percentage of promoters, yielding a score between -100 to 100.

Read our in-depth guide on how to calculate NPS here.

What do you do with NPS results?

We strongly believe that the Net Promoter System is not about research—measurement and feedback collection—it's about action. What do we mean by that?

At CustomerGauge, we've designed a step-by-step pathway for acting on and monetizing your NPS scores: the Monetized Net Promoter model.

The model is all about action. There's no value in surveying your customers if you don't quickly put the results into action. The beauty of the NPS model is that it helps you identify opportunities to grow faster as a business.

Customers who score 9 and 10 (i.e. promoters) should be asked for that recommendation, driving more business. They're also your most happy customers and are likely open to hearing about your other products.

These two action points are just one of the ways you should be taking action on your NPS results. Read our full guide here to be learn more about tackling churning customers and closing the loop with detractors and passives.

Blog Home