Customer lifetime value (CLTV) is the measure of the dollar sum that customers bring to your business over the entirety of their relationship with you.

If you want to track the financial value of customer loyalty, CLTV is the metric to use, as our VP for Education and Services, Cary T. Self, recently explained:

“At CustomerGauge we always tie loyalty to customer lifetime value, because at the end of the day we’re trying to create loyalty to generate revenue and income. We think that’s the right thing to do.”

It’s the right thing to do because improving your customer lifetime value means driving revenue growth in a sustainable and consistent way.

Why? Because CLTV is fundamentally based on your customer experience (CX). Give your customers an experience that satisfies them and you’ll improve customer retention and grow your CLTV. Simple.

However, if you’re searching for benchmarks for the average customer lifetime value by industry, you likely know the importance of that metric already — all you need now is the data.

That’s what we’re here for. We’ve collected metrics from some key B2B industries to help you monitor and compare your own performance. And along the way, we’ll help you improve your CLTV so you can get the most out of your loyal customers.

How Does Customer Lifetime Value Differ by Industry?

Customer lifetime value changes dramatically depending on the industry you’re in. To put it bluntly, it’s often pretty meaningless to compare different industries by CLTV because the averages are so different.

Take B2C apps and B2B SaaS as an example. A company such as Spotify will typically have a very low CLTV, because the amount that each individual customer spends is minimal.

Instead, where Spotify makes its profit is by having huge numbers of paying users (nearly 200 million at the last count).

On the other hand, B2B brands (like us) will have to leverage customer loyalty to make their CLTV a lot higher. That’s typically because:

B2B brands typically have fewer customers and so need to extract more value from each. As a result, B2B customers tend to spend more.

We have longer buying cycles, and therefore higher customer acquisition costs. That means we need more value from our customers to recover the costs of bringing them in. We call this balance between customer acquisition costs (CAC) and CLTV the CAC:CLTV ratio, which we discuss in detail below.

B2B brands typically have longer customer lifetimes. While there’s evidence that B2B relationships are generally getting shorter, they’re still much longer than in B2C. The longer a customer is retained, the higher the CLTV.

These factors aren’t only relevant when comparing B2B and B2C. Bear these differences in mind when you’re looking to compare any industry by customer lifetime value because, as you’ll see, it’s not the only metric that matters.

What Is the Average Customer Lifetime Value by Industry?

While there’s a lot of conflicting data out there, our research suggests that average customer lifetime value by industry looks a little like this:

Architecture firm CLTV: $1.13 million

Business consultancy CLTV: $385,000

Digital design brand CLTV: $90,000

B2B financial advice firm CLTV: $164,000

Healthcare consultancy CLTV: $330,000

Insurance company CLTV: $321,000

Software company CLTV: $240,000

As you’ll notice, the figures differ quite dramatically.

Of course, that’s not to say that some B2B industries are inherently more profitable than others. Rather, business models and customer relationships vary. Where a digital design brand might typically work with one-off projects, financial advice firms more likely work on a retainer basis.

What’s more, when you’re benchmarking, bear in mind that these figures are an average.

Within a single business, you’re going to get customers that aren’t retained for as long due to disappointing customer experience or simply, a poor fit with the product. One customer’s lifetime value won’t be the same as another’s.

However, there are things that are far more important than just identifying a specific number for your industry’s CLTV:

Benchmarking your own CLTV. Forget what others are doing in your industry for a moment. How are you performing right now? For future growth, this is a much more important CLTV benchmark for you than industry averages.

Measuring your CAC:CLTV ratio. We mentioned it earlier. CAC:CLTV refers to the balance between what you spend on acquiring customers and how much they give back to your company in revenue. How are you performing?

Improving your CLTV. With your own benchmarks established, it’s time you consider how to improve your performance, through strategies such as referrals and upsells.

Let’s explore these in detail.

Using Customer Lifetime Value Benchmarks to Drive Growth

Improve your customer lifetime value and you’ll drive growth. That begins by measuring where you’re at right now.

1. Calculate Your CLTV

How are you performing against your industry competitors? Find out by calculating your own customer lifetime value.

This can often be off-putting, thanks to intimidating equations and formulas. While you can calculate CLTV to varying levels of sophistication (even using complex predictive analytics), it’s not necessary if you just want to use it as a benchmark.

Calculate your CLTV really simply by multiplying your average customer lifetime in years by your average annual revenue from each customer:

CLTV = customer lifetime (years) x annual customer revenue

As you can see from this simple equation, there are only two elements that contribute to your CLTV: length of relationship and amount spent. As you work on increasing your CLTV, it’s these two key factors that you’ll be focusing on.

2. Work Out Your CAC:CLTV Ratio (A More Important Benchmark)

Your CLTV is an important element of your business performance. However, it only really matters when it’s directly compared with your costs of customer acquisition, or your CAC.

So, how do you calculate your CAC? Divide the total you spend on acquiring customers (in marketing and sales) by the number of customers:

CAC = marketing and sales costs / number of customers

Then, compare your CAC value with your value for CLTV to see how your costs of acquisition compares to your lifetime value.

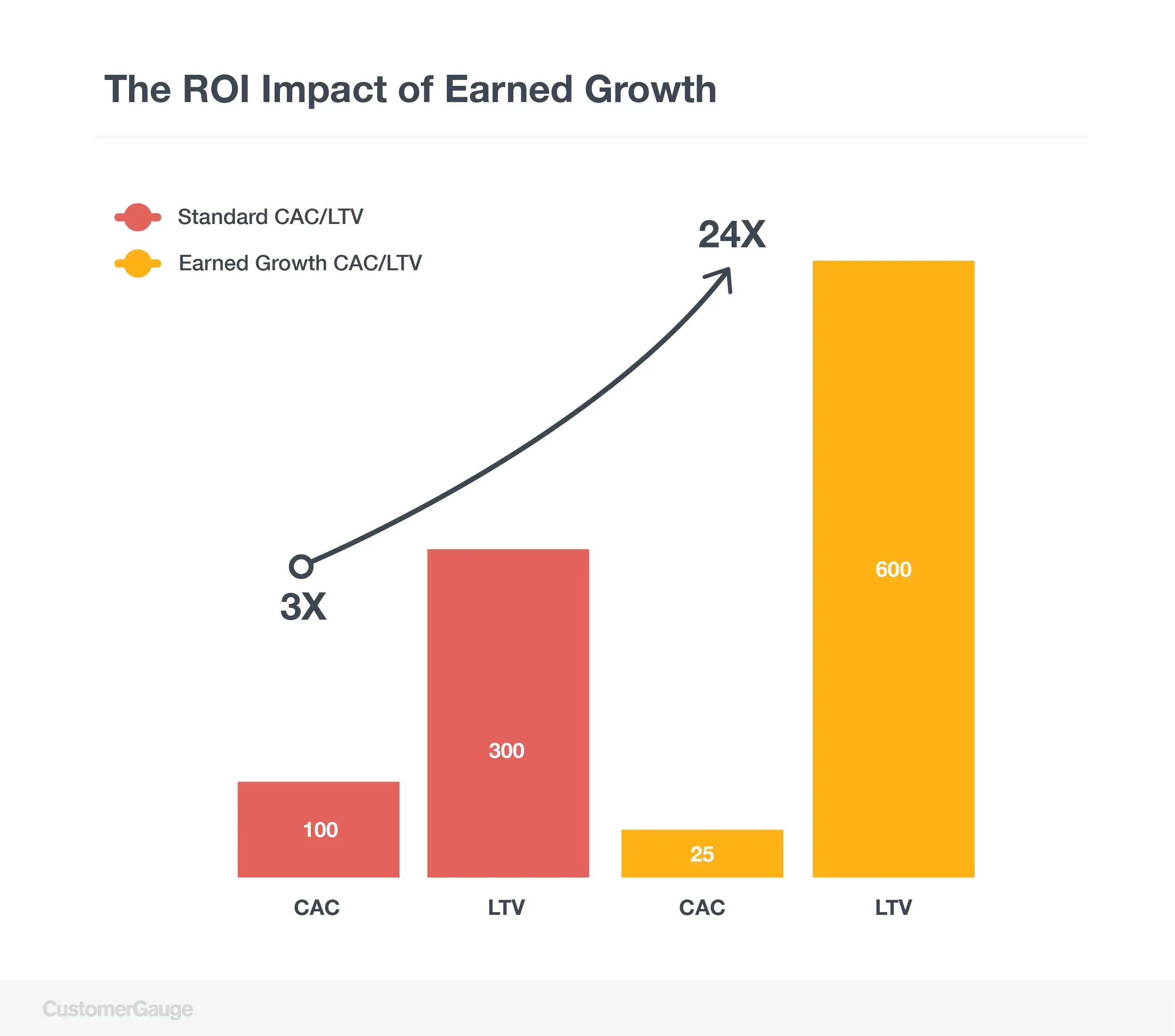

The standard benchmark in all industries for a good average CAC:CLTV ratio is 1:3, meaning that you should aim to earn 3x as much from each customer as you spend acquiring them.

This is a good benchmark because it doesn’t depend on your business model.

3. Increase Your Customer Lifetime Value (and CAC:CLTV Ratio) to Drive Growth

To drive business growth, increase your customer lifetime value. After all, your aim is not to increase your CAC, but to ensure you get more from your customers over their lifetime.

How do you do that?

Increase the length of your customer lifetime (i.e. increase retention)

Increase the amount of spend by each customer (i.e. drive upsells), and

Secure referrals

At the basis of all three is great customer experience. At CustomerGauge, we talk about earning growth through customer experience, rather than buying it. And the way to earn growth is by improving the experience of your customers.

You can find out more about earned growth here, but you need to know right now is that it can improve your CAC:CLTV ratio by as much as eight times:

And while that’s not always easy, there is a playbook: Account Experience (AX), our B2B methodology for using customer experience to drive growth.

How to Increase Your CLTV With Account Experience

So, how do you make it happen? Let’s take it step by step.

1. Improve Retention

Improving customer retention helps you increase your customer lifetime value by lengthening the lifetime of your customer relationship. What’s more, you’re able to increase the value of the relationship while spending nothing more on customer acquisition.

So, how do you improve retention? With Account Experience, it takes three key steps:

Gauge customer sentiment with NPS surveys

Net Promoter Score (NPS) is the best known and most widely used metric for B2B brands to understand their customers. To begin taking customer retention seriously, you need to join the two thirds of Fortune 1000 companies that are using the metric.

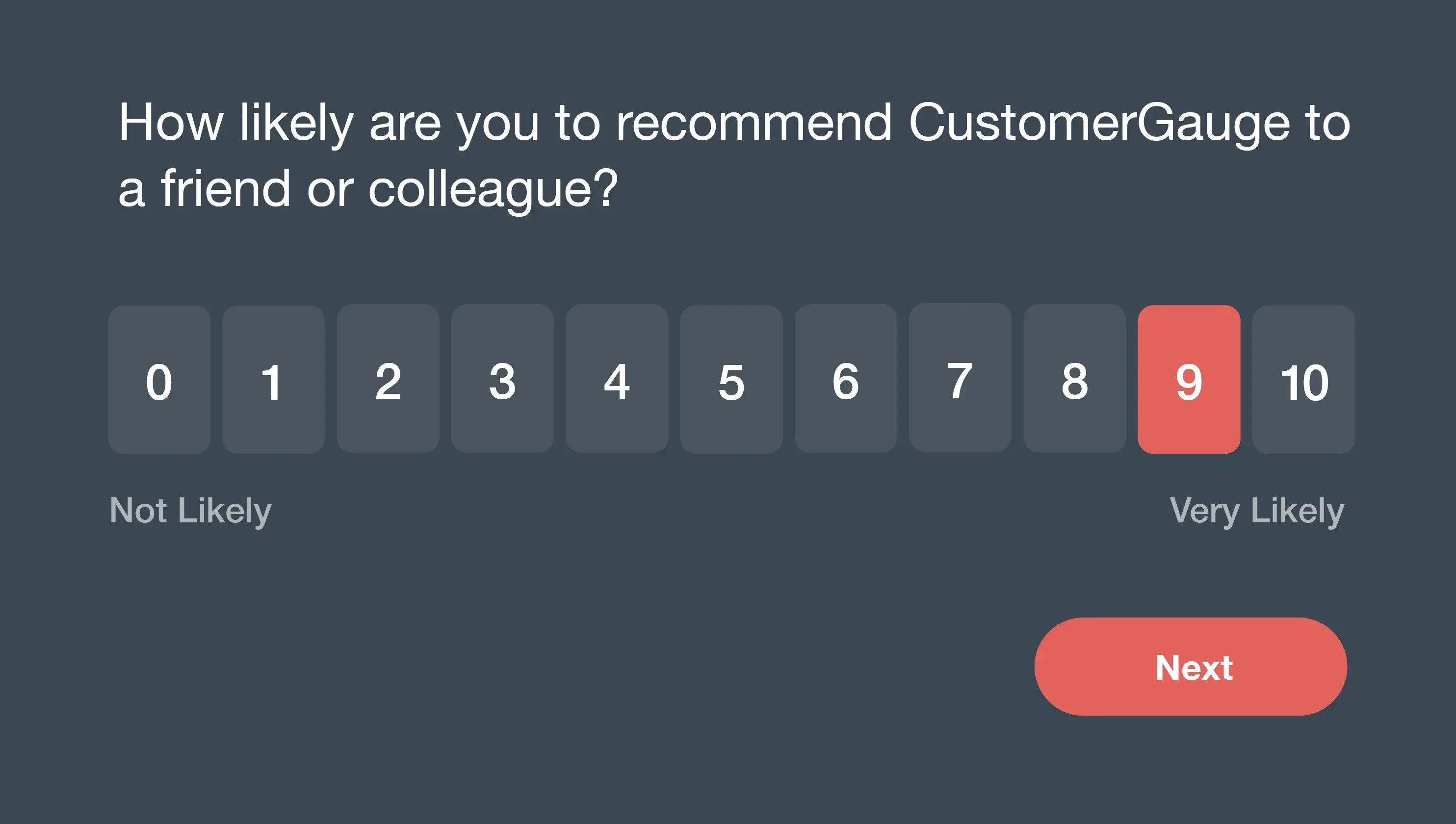

NPS gauges your customer loyalty by asking them a simple question:

Answered on a scale of 0-10, the responses tell you whether customers are promoters (i.e. enthusiastic customers) or detractors (customers who are dissatisfied).

To reduce churn (and improve CLTV), you need to be continually tracking customer sentiment through these surveys. We encourage all our customers to send out relationship surveys every quarter and to combine these with transactional surveys to understand the way specific touchpoints affect your customer experience.

There’s one thing that’s crucial. Too many businesses obsess over their Net Promoter Score, but we do something quite different. We believe that NPS is not a research tool, but an action tool. That means you have to actually do something with all the data that you collect — i.e. take tangible steps towards growth.

That means closing the loop.

Close the loop on all customer feedback

Closing the loop means listening to customer feedback, acting on it, and informing your customers what you have done to change.

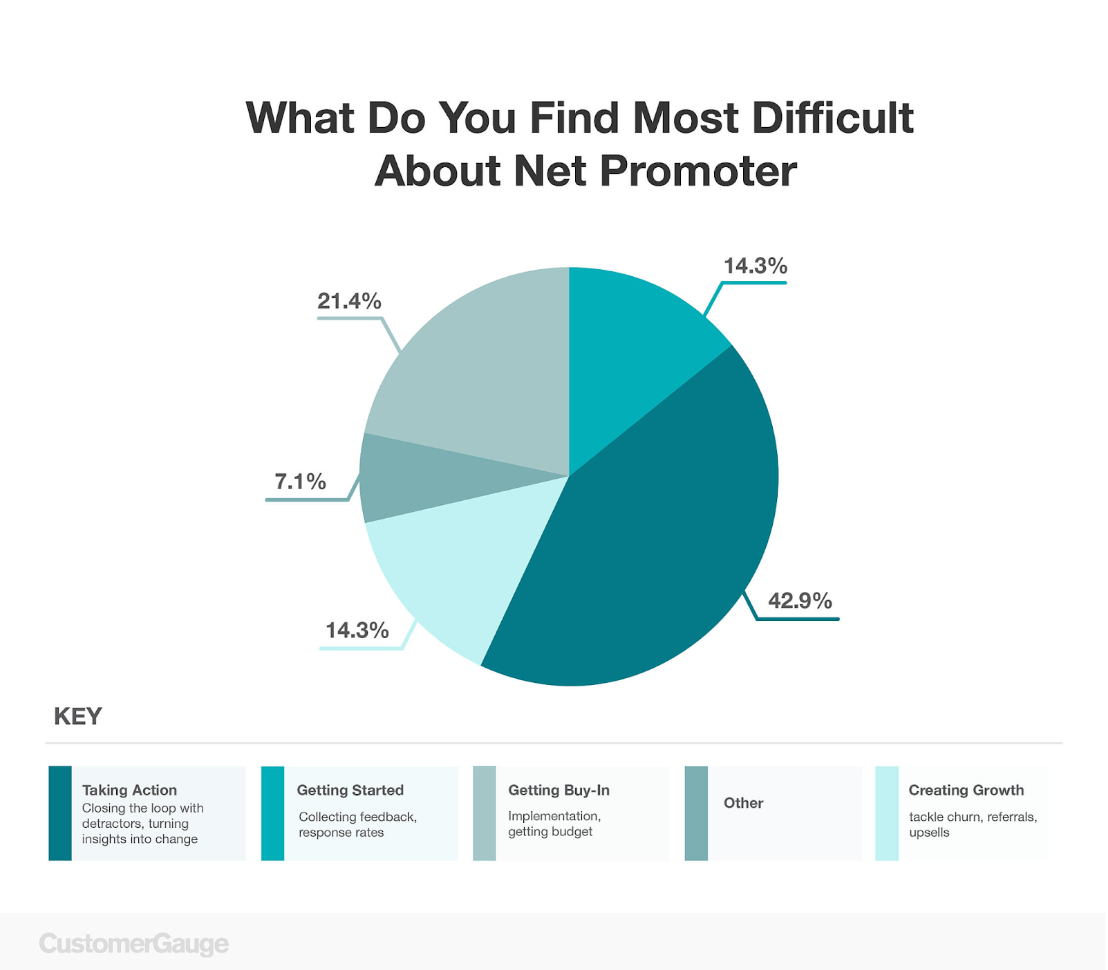

This might sound obvious, but it isn’t. According to Gartner, only 5% of businesses let their customers know how they have changed in response to feedback. Meanwhile, recent research conducted by CustomerGauge found that closing the loop is the thing that B2B brands find hardest about NPS.

Now, it may be hard, but the rewards are well worth it. We found that businesses that close the loop with all their customers increase the number of promoters by three times. What’s more, they can increase retention by as much as 12%.

Tie customer sentiment to financial metrics

Finally, it’s worth being honest about one crucial weakness in the NPS system. While it’s excellent at gauging customer loyalty, it doesn’t have anything to say about revenue.

At CustomerGauge, we designed an upgraded form of NPS to fix exactly this problem, and we put it at the heart of Account Experience. That’s Monetized NPS, which links your NPS performance directly to your bottom line.

Why does that matter? Because it tells you the value of your customers’ loyalty (and the potential of your CLTV) in real terms.

Cross-referencing your NPS scores with financial metrics provides crucial insights:

How much promoters are worth to your business (and by how much detractors are holding you back)

Which accounts are ripe for revenue expansion

How much revenue is at risk of churn

Which specific touchpoints are costing you the most.

Improving retention through customer experience is about driving growth. And only by linking CX metrics with revenue is this possible.

Wajax, a Canadian distributor in the selling, renting, and after-sale and service support of equipment, discovered Promoters are worth 2X more than Detractors by tying CX to revenue.

2. Drive Upsells from Existing Customers

We’ve covered one fundamental technique to improve customer lifetime value: increasing the lifetime through customer retention. Now it’s time to turn to the other side of the equation: increasing the amount that customers spend.

How to do that? Through upsells. Upsells allow companies to improve the annual customer revenue by offering them more value, and it happens in two basic ways:

Grow promoter accounts that have space for expansion. Your NPS promoters are the key to your upsell success. These are the happy customers that are really satisfied with their customer experience. If anyone is going to want to buy more from you, it’s them.

However, realistically, not all of them are in a position to spend more. You may already have a high share of their wallet. Or they could already have all the users in place that they need.

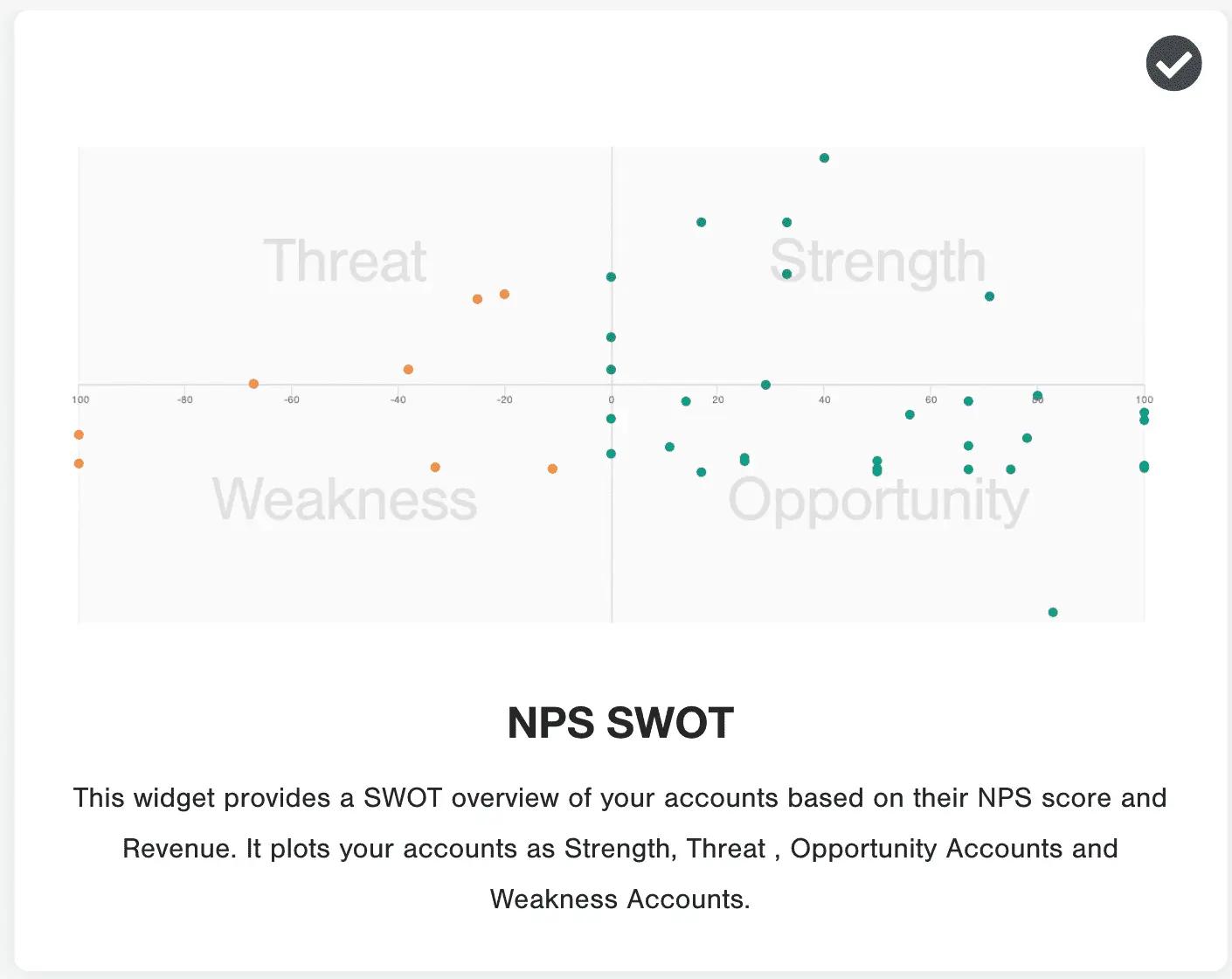

To identify upsell opportunities, you need to find those accounts with room to grow. With Account Experience, we use SWOT analysis to discover who these accounts might be.

The customers you are interested in are the opportunities:those with high NPS scores and low spend. This is where the majority of your upsell efforts should go.

Sell to detractors who could benefit from a different proposition. In some cases, your unhappy customers can be opportunities for upsells too (believe it or not).

Customers can be unhappy if they are using a product that doesn’t suit their needs. In these situations, your job is to understand why they are dissatisfied and find the alternative that’s the best fit.

In both cases, you’ll only understand how your customers are feeling by asking, with NPS. A journey map can help you identify the right moments in the customer journey to ask for an upsell.

If you don’t ask, you’re missing out. Simply by having the conversation, one of our partners secured a $30 million deal.

3. Secure Referrals

Finally, the thing that most businesses overlook, but that probably has the biggest impact on increasing CLTV.

That’s referrals.

It’s said that as much as 84% of B2B revenue comes from referrals. That’s awesome, but there’s a problem. We found that the majority of B2B brands don’t have a formal process for asking for, securing, and welcoming referrals. And what’s more, their referral processes typically have nothing to do with their CX program.

They are missing out. Building an effective referral program can help you secure a reliable path to earned growth.

Here are some ideas to get you started:

Activate your promoters. Your enthusiastic customers would be likely to recommend you to someone else—they’ve told you this already. The job of your referral program is to turn that into concrete action.

Pass on happy customers to your sales team. It’s the dream of any sales department to receive a list of satisfied clients to ask for a referral, case study, or review.

Act fast. At CustomerGauge, our teams receive a notification whenever a customer leaves a high score. Someone is assigned the task to reach out to the promoter and ask for something within 5 days. The faster you do it, the better.

Grow Your CLTV With Account Experience

It’s time to earn your growth with customer experience. And at CustomerGauge, we can help.

Account Experience takes NPS to a new level to help you use your CX to increase your CLTV and drive growth. Stop scrabbling to acquire new customers. Instead, build steady growth through retention, upsells, and referrals.

Book a demo with us to find out how Account Experience can help you!