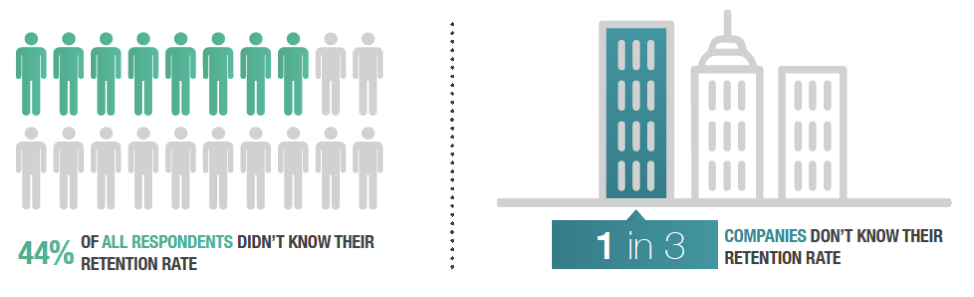

While there were many striking findings in CustomerGauge’s most recent NPS® benchmarks report, one of the most significant findings implied a strategic gap across industries: 44% of respondents didn’t know their customer retention rates (or 1 in 3 companies).

For those in senior management, that number was 32%, further suggesting that internal communication is not taking place around retention rates at these companies. All of these companies were looking at Net Promoter Score® in some way, but the retention metric was being neglected.

It is absolutely imperative that businesses be aware of their customer retention rates, for financial reasons and for planning the company’s future. This information is required for planning future growth, as without customer retention, there isn’t an stability, or sustainability, for the company.

So, why are so many companies missing the mark when it comes to churn and retention? We looked at the research and talked to a number of experts to find out, and found some key information gaps that seem to spell danger for some companies.

Understanding the Financial Impact of Churn

In his article, Welcome to Churn Nation, The 9th Biggest Country in the World You’ve Never Heard of—But Are Living In, Adam Dorrell discusses the magnitude of the economy’s churn problem:

“CustomerGauge made some estimates of just how large Churn Nation is. By taking the Fortune 500 companies (approx. revenue $12trn, with $1bn profit) and assuming a lowest possible scenario of 15% churn, we can size the problem: $1.8trn.” -Adam Dorrell, CEO & Co-Founder, CustomerGauge

Looking at the retention rate numbers across industries in the 2018 NPS & CX Benchmarks Report, 15% churn might even be kind. According to the report, the highest average retention rate across 15 different industries was 84%—denoting an average of 16% churn.

To talk about the financial realities of customer retention and customer churn, it’s helpful to define what a retained customer is, and what a churned customer is. This can be different depending on the business, as with non-contractual business settings, where clients come and go often, for example, but a simple definition is better than none at all. A good starting point we recommend is a churned customer is a customer with no purchases in the last 12 months. A retained customer is someone who has made a purchase in the last 12 months.

Note: This definition works in some situation—but not all. It’s important to build a definition that works within your industry and business model (B2C vs. B2B).

Now that a definition has been built—how can you understand the financial impact of churn and retention? For retention, there are a lot of quotes thrown around about the general concept of selling to your existing customer base. One that we’ve seen time and time again stick true (generally) is this: It’s 10% cheaper to sell to an existing customer. What does that actually mean?

In the survey for the benchmarks report, we call this “return on retention”—that is, the sum of the retention rate plus the up- and cross-sales rate. This provided insight into how much more on top of the base retention revenue companies were benefiting from existing customer relationships.

You might spend a lot on new customer acquisition when it would be better spent on retention methods. You might not be maximizing the potential of up-selling and referral marketing, because you don’t know who the customers to target are.

As for churn, there are two factors to consider: the amount of customers leaving you vs. the amount of revenue leaving you. We discuss Customer Retention Rate (CRR) and Revenue Retention Rate (RRR) in another post, but the sentiment can come down to this: How many customers vs. what customers are leaving you are both important questions, but with different financial impacts. In addition to the mentioned post, we also go in depth on these two metrics in another eBook, aptly named Retention Management to Combat Churn.

Building definitions are a cross-organization activity—but one that senior leaders need to spearhead. However, once a definition is established it is also management’s responsibility to be transparent about those numbers.

Communication Equals Growth—NPS Transparency

In Salesforce’s State of Service report, 78% of customer service teams said “they view every employee as an agent of customer service.” If everyone in the company feels personally responsible for the customer experience, that changes people’s perception and sense of responsibility.

CustomerGauge interviewed Salesforce, Microsoft, Affirm, Micro Focus and Colliers International in their latest report. Many told a similar tale of how Net Promoter® buy-in and success centered around internal transparency.

Max Levchin, CEO of Affirm and co-founder of PayPal, works closely with his teams to keep them informed on the high level executive overview of the customer experience.

If all employees aren’t clued into company expectations about Net Promoter, churn or customer retention, it’s harder for goals to get accomplished. More pressure is put on those aware of the situation, so the right work can’t be done by the frontline, or managers, to make things more effective. Frontline employees, after all, deal the most with customers, and managers are in the best position to take action on customer needs, and report those needs higher up in the company. Executives, therefore, have the responsibility of communicating their vision down the line to ensure good customer retention. They can also communicate to customers what actions have been taken.

Internal communication is important for all the reasons previously stated. And it all helps with retention; executives who communicated about handling strategic issues, and communicated actions, saw retention rates increase by 2.1% and 2.5% this year. Those that didn’t communicate only had a retention rate increase of 0.1%.

Tackling a Problem Like Churn with Retention Account Management

To steal a cheesy primetime slogan: “Knowing is half the battle.” When it comes to tackling churn, the same phrase holds true.

Many B2B businesses have some form of Customer Success Managers to maintain customer relationships. Part of a Customer Success Manager’s job is identifying the health of those customer relationships. This is done through a combination of tactics, including surveys, Quarterly Business Reviews, and check-ins. Think of these as the toolset of foresight—being able to predict a churn event before it happens.

These methods are also helpful for the other side of the coin: determining potential opportunities for retention growth—i.e., referrals, up-sales and cross-sales. One of the foresight tools we’ve built at CustomerGauge to help with these exercises is our 360 Customer Tracking feature. It looks at everything from support ticket systems to CRM activities and those QBRs we mentioned.

The Bottom Line

Companies need to be measuring their customer retention rate. Financially, it only benefits them to do so, as it is so key to profits and sustainability. Communicating with customers is a part of that, bringing in NPS, the ultimate communication-based metric, which helps determine actions that will keep customers engaged and happy. Internally communicating goals around retention is also beneficial, as employees can only strive for a goal if they’re aware for it.

Finally, having the tools in place to combat or nurture relationships is also important. We’ve developed an extensive toolset to help with this—but there are still some easy steps you can take to get started.

Want to learn more about customer retention, and how it applies to particular industries? Check out the 2018 NPS & CX Benchmarks Report, and see how you can improve retention in your business!