We support our customers to improve their customer retention rates every day.

Our team coaches them that their best shot at improving customer retention is to:

(1) Identify that churn is happening, quickly.

(2) Understand who's at risk of churn (utilizing Net Promoter technology).

(3) Build a closed-loop mechanism that ensures you ACT to tackle churn by listening to feedback.

Our customer experience management framework (measure, act, grow) is core to AccountExperience, which was designed specifically to help B2B companies improve retention and grow revenue faster using Net Promoter.

In this article, we're going to focus on step 1: Identifying that churn is happening (by calculating and measuring customer retention). We cover multiple retention formulas and their pros/ cons.

Free Guide: How to calculate customer retention rate in Excel (template)

How To Measure Customer Retention Rate

It shouldn’t be a surprise anymore that the subscription economy has disrupted the traditional business model. Businesses and even consumers are shifting away from the pay-per-product model to a subscription model. Why own when you get more flexibility subscribing?

You would think that keeping your customers and bringing them back to buy more has always been important for any business, but the subscription economy has made this even more critical. When you don’t get all revenue upfront, retaining customers has become a question of profitability.

Which metrics do you use to measure retention? Search the Internet and you’ll find a lot –including misleading – information.

Prepare yourselves, math is coming...

Basic Customer Retention Rate Formula

Retention is usually measured as the ratio of customers or revenue you have kept in a given period and lies between 0% and 100%. Having a retention rate of 100% is ideal but usually very hard if not impossible to achieve.

Churn Rate = 100 % - Retention Rate.

How do you calculate the Retention Rate?

Customer retention rate formula

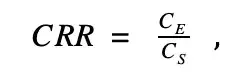

Let’s first look at the Customer Retention Rate (CRR) for a given period:

Where CS is the number of customers at the start of the measuring period and CE is the number of those customers that are left by the end of the measurement period (which = total customers-new customers). Note that we have excluded any new customers acquired in the period.

The Customer Retention Rate is sometimes referred to as the Logo Retention Rate.

Revenue retention rate formula (gross and net revenue retention)

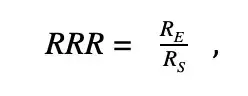

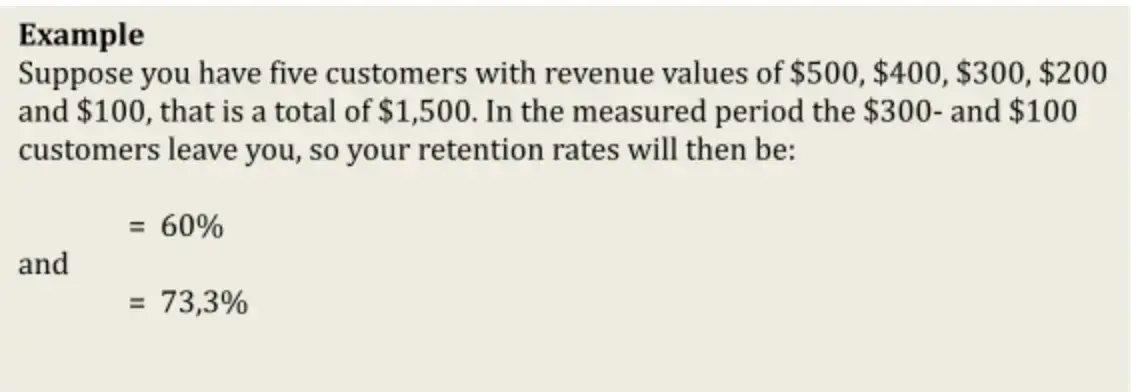

The Revenue Retention Rate (RRR) focuses on the retained revenue instead of customer volume. It’s basically the same calculation but customers are weighted according to their revenue:

Where RS is the sum of revenues at the start of the period and RE is the sum of that revenue still left at the end of the measurement period.

It's important to remove upsell and downsell from your end of period revenue measurement, as that would be Net Revenue Retention (which we'll explain next).

Which is best? CRR or RRR?

They both work and should both be monitored. In the example above CRR was smaller than RRR as we lost two less valuable customers. So, the Revenue Retention Rate captures the financial impact better but if you lose a lot of newly acquired and less valuable customers, the RRR will not capture this.

Net revenue retention (NRR) formula

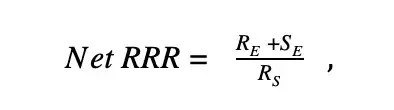

A very popular but also disputed KPI is the Net Revenue Retention Rate (Net RRR). This takes any up- and down-selling to existing customers into account:

Where SE is the amount of up-sales or down-sales in the period (down-sales is negative).

If you're experience a high rate of account expansion, NRR can be above 100% and is often referred to as Negative Churn. A rate above 110% is considered best-in-class.

This metric combines different metrics that in our opinion should be measured individually, e.g. down-sales.

What customer retention measure should you use?

As mentioned you need to measure Customer Retention and Revenue Retention. In addition, we suggest that you track the following metrics and the reasons for changes in values:

- Churn rates - despite that these rates are just the other side of the retention rate coin, showing churn rates per product, type of customer and other relevant segments, increase

- Base renewals – useful to see the customers who are steady-state. These customers may end up as future at-risk customers because they aren’t growing

- Up-sell – useful to see the performance of premium versions of your product offerings (if you have them). Your marketers spend a lot of time tuning your offer hierarchy and this is a great way to validate their efforts

- Cross-sell – useful to see the performance of complementary products in your portfolio (if you have them). Many vendors diversify their product portfolio, at great expense. The payback is often measured by how well your customer base consumes the new offerings

- Downsell – useful to see customers who lessen their commitment, which may present clues to overselling license capacity in a prior period

These should help you detect decreases in your customer retention rate quickly.

What About Measuring New Customer Retention Rates? A Look At Time-Weighted Retention Rates

The formulas above do not take new customers and their retention into consideration. To do that you need to calculate time-weighted retention rates, a concept similar to how the Investment Management industry calculates investment performance.

Let’s start with the fact that retention rates are multiplicative, i.e. the retention rate over several periods is the product of the retention rates for every period.

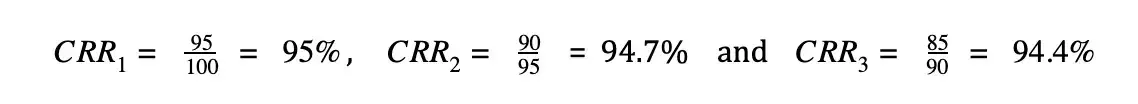

For instance, let’s assume that we start with 100 customers and lose 5 customers in each of the following three months. The retention rates for each of the three months are:

The total retention rate can be calculated as the product of these three rates:

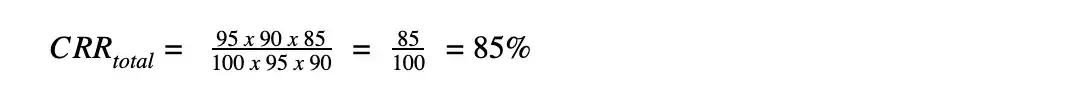

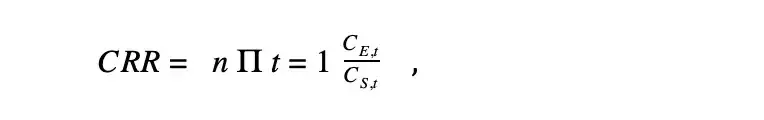

Now, let’s take an example where we get new customers in the period but also lose some of these new customers in the same period:

In the example, we used months as sub-periods but even this calculation is an approximation as the acquisition of new customers are likely distributed throughout the month.

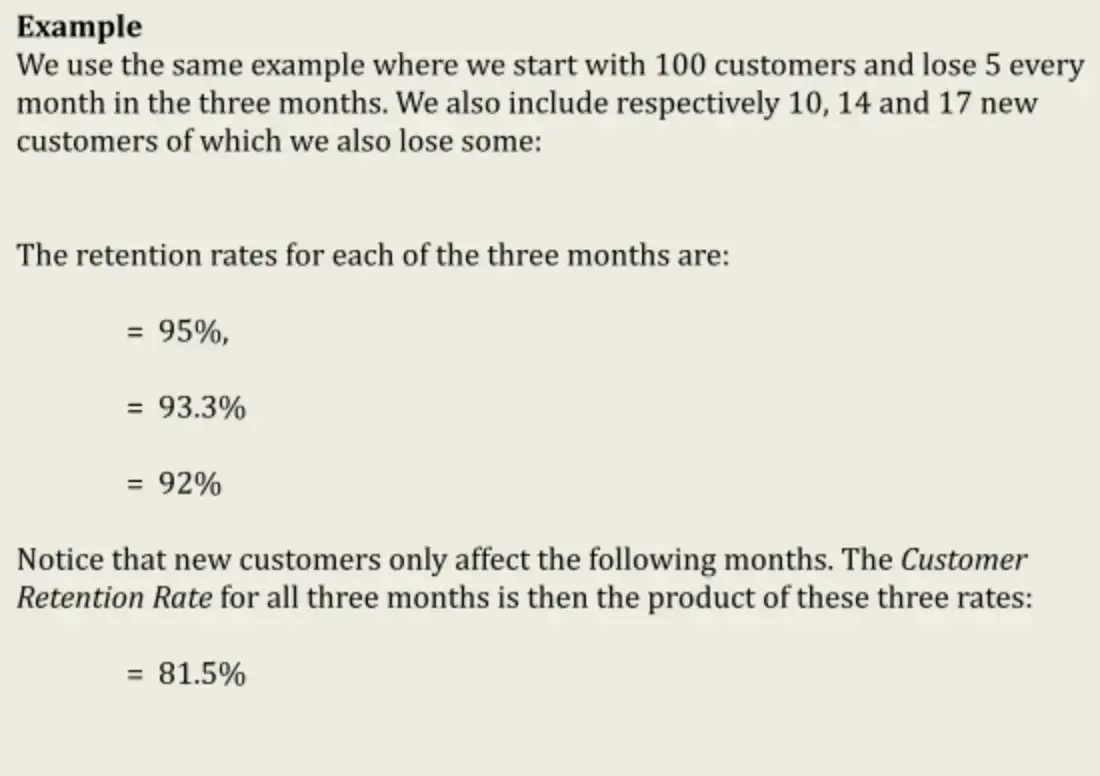

The accurate retention rate, also called the time-weighted retention rate is calculated as:

where n is the number of sub-periods (typically days), CS,t is the number of customers at the start of sub-period t and CE,t the number of those customers left at the end of sub-period t.

From a mathematical point of view, the formula is simple but when you calculate retention rates over longer periods of time and for multiple segments, you will need a proper retention tool.