To identify the weak points in your customer experience you need to conduct Net Promoter Score (NPS) surveys.

NPS surveys are the quickest way to gain valuable insight into your customer base and are proven, in unison with closed-loop best practices, to raise retention, tackle B2B customer churn, and improve engagement.

There are two types of surveys that can be used to gather feedback effectively: relationship and transactional surveys. Both are employed for different purposes. Churn surveys can also be useful once a relationship has ended to learn what led a customer to churn.

In addition to understanding the type of survey that should be sent, knowing how you’re sending the NPS survey, when you’re sending the NPS survey, how many people should be surveyed, etc., is just as important.

Before you start any NPS survey campaign, you must set designated goals. Ensure your goals align across the company to ensure relevant insights.

Relationship vs. Transactional Surveys

Relationship NPS Survey Design

Relationship NPS surveys investigate a customer’s loyalty to a company/brand/product by asking customers to consider the overall experience and satisfaction they have.

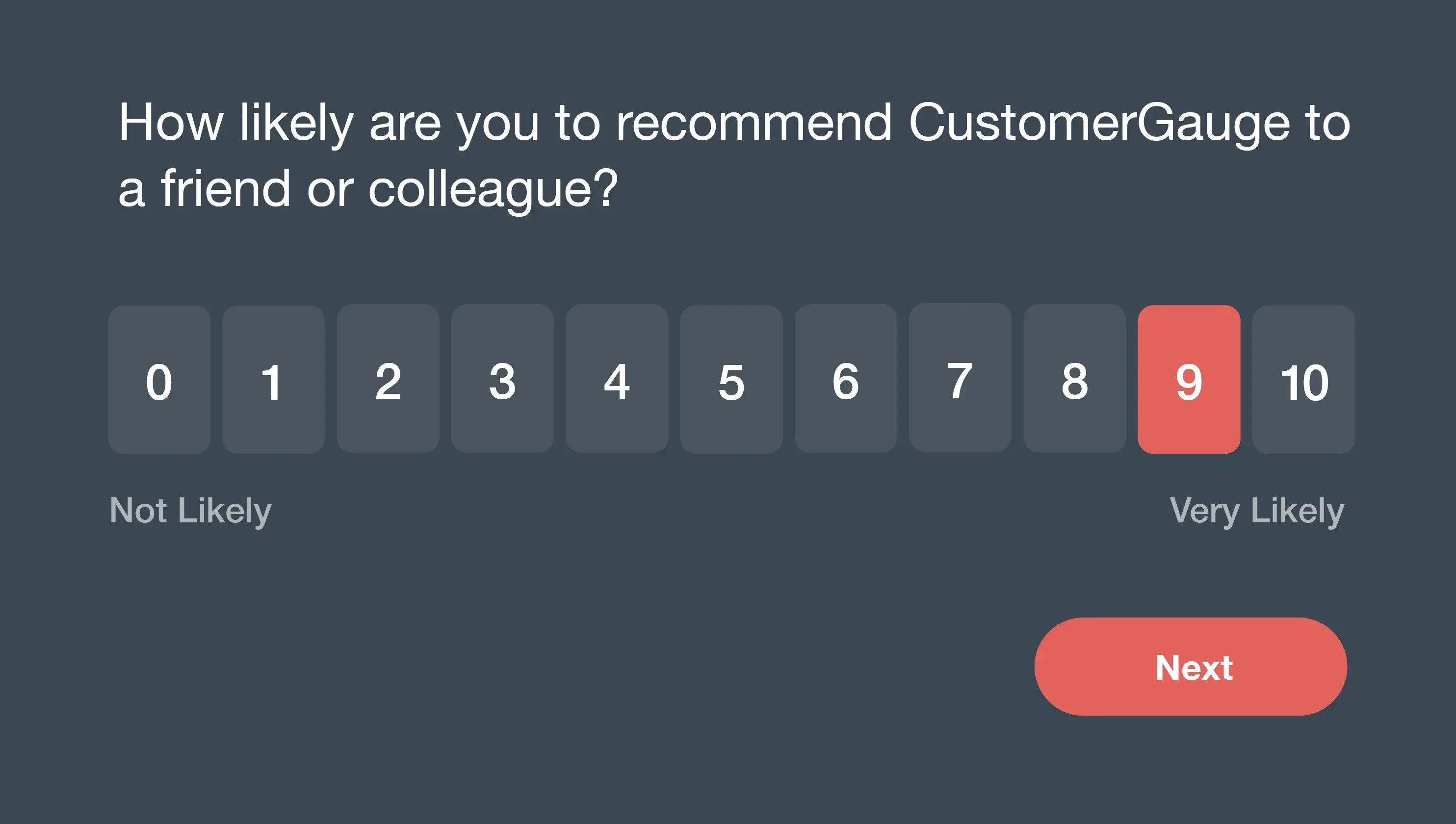

Relationship surveys ask the overall Net Promoter Score question about the company itself; which in our case would be, “On a scale from 0-10 how likely are you to recommend CustomerGauge to your friends or colleagues?” However, these types of NPS surveys can also ask additional questions that include drivers that directly correlate to touchpoints in the customer journey.

To ensure your relationship NPS surveys get you the biggest bang for your buck, keep these rules in mind:

✓ Keep relationship NPS surveys short, with 2 questions minimum and 6 questions maximum. Including primary and secondary drivers and comment boxes in your surveys can help keep questions brief.

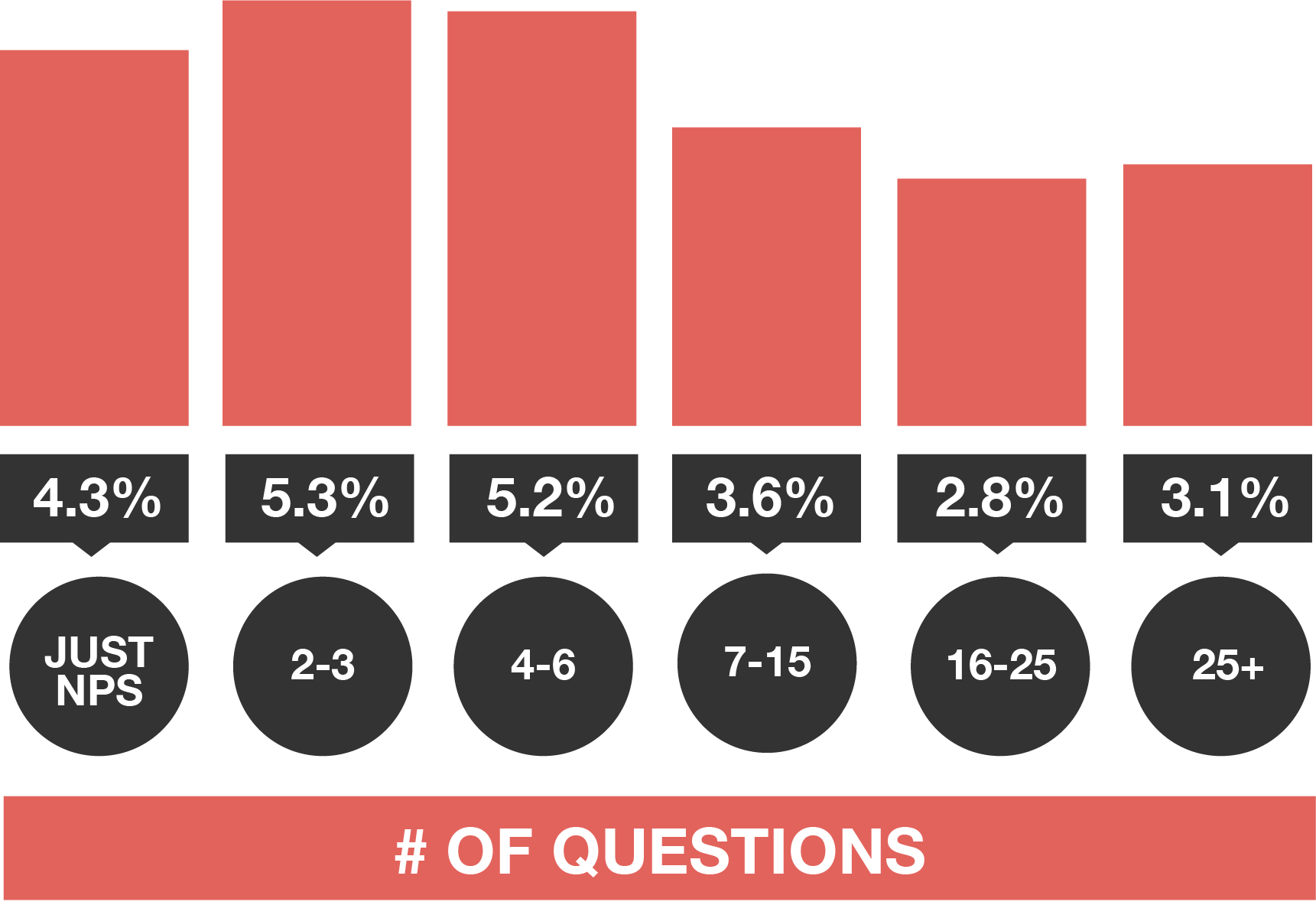

✓ The shorter your NPS surveys are, the more frequently you can send them. Send relationship NPS surveys quarterly (4x a year) or even monthly (12x a year). In our white paper, we found that companies that send NPS surveys at least every quarter receive a minimum 5.2% retention increase.

✓ And, of course, always include the NPS question in your surveys, with the standard 0-10 Net Promoter scale for the most accurate results.

Discover: What are the costs of an NPS program?

Transactional NPS Survey Design

Transactional NPS surveys investigate the experience a customer has in a specific transaction/interaction, which we call a touchpoint. Transactional NPS surveys can give deeper insight into individual touchpoints and tailor the specific questions to a moment within the customer journey.

This type of NPS survey is designed not to measure overall customer loyalty, but to measure satisfaction with a specific company touchpoint to improve it.

The purpose of transactional NPS surveys is to understand how each (key) interaction creates detractors, passives, and promoters. Just as with relationship NPS surveys, transactional NPS surveys should be short to improve response rates, and additionally should have the following:

✓ The transactional NPS question should be tailored to a touch point completed by a customer

✓ Drivers included in the survey should be in response to the specific touchpoint mentioned in the NPS question

✓ Additionally, sample sizes between a relationship NPS survey and a transactional NPS survey will differ

Survey Sample Size and Length

How Long to Make an NPS Survey

NPS surveys are typically short, typically no more than 2-6 questions. In our research, we’ve found that 2-6 questions produce the most accurate feedback and higher response rates in the context of NPS surveys.

This will help avoid survey fatigue resulting in inaccurate answers and ensure that your data is still immediately actionable.

After all, while short NPS surveys may lead to higher response rates, if the questions aren’t optimized to give you helpful insight, then it’s all for not. Not only that but retention is also affected by how many questions you ask in your NPS surveys. By keeping your NPS surveys to 2-6 questions, you’re looking at a minimum 5.2% increase in retention.

Determining Your NPS Survey Sample Size

The sample size is important to make sure you have statistically significant results in your NPS survey. But what is a good sample size to avoid a margin of error in your data?

To ensure your sample is representative of your customer base, companies aim for statistical significance, which can loosely be translated into: There’s a 95% likelihood that your results lie within a limited error margin. For relationship NPS surveys statistical significance is vital.

Establishing statistical significance in your NPS survey is a matter of having a sufficient sample size. Start by looking at the size of your customer base, and then determine what would be significant number of customers you would need to send to.

To maximize the sample size in your NPS survey, release the surveys over weeks and months so that over time, you create the sample size you need. You can learn more about sample size and root cause analysis in our NPS Handbook.

The Best Way to Send Your NPS Survey

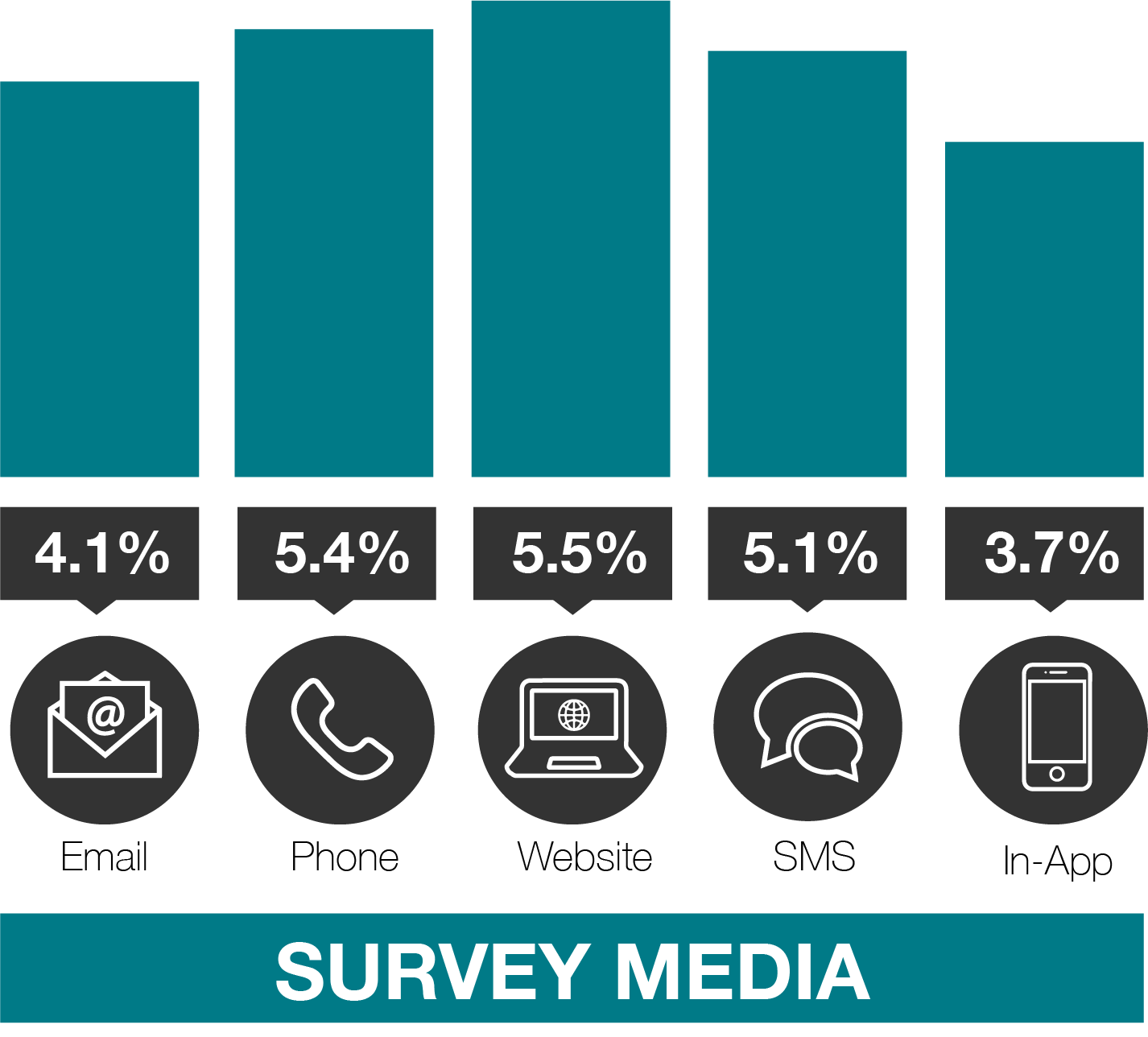

There are a lot of ways to send a NPS survey and deciding which channel to use can be daunting. The most common survey distribution methods to send surveys include email, SMS, phone, website and in-app. These methods are useful for getting relationship NPS surveys out there to new customers that have not had recent contact with the business.

Based on research from our white paper, channels that contributed to the highest retention rates include email, phone, website, SMS, and in-app.

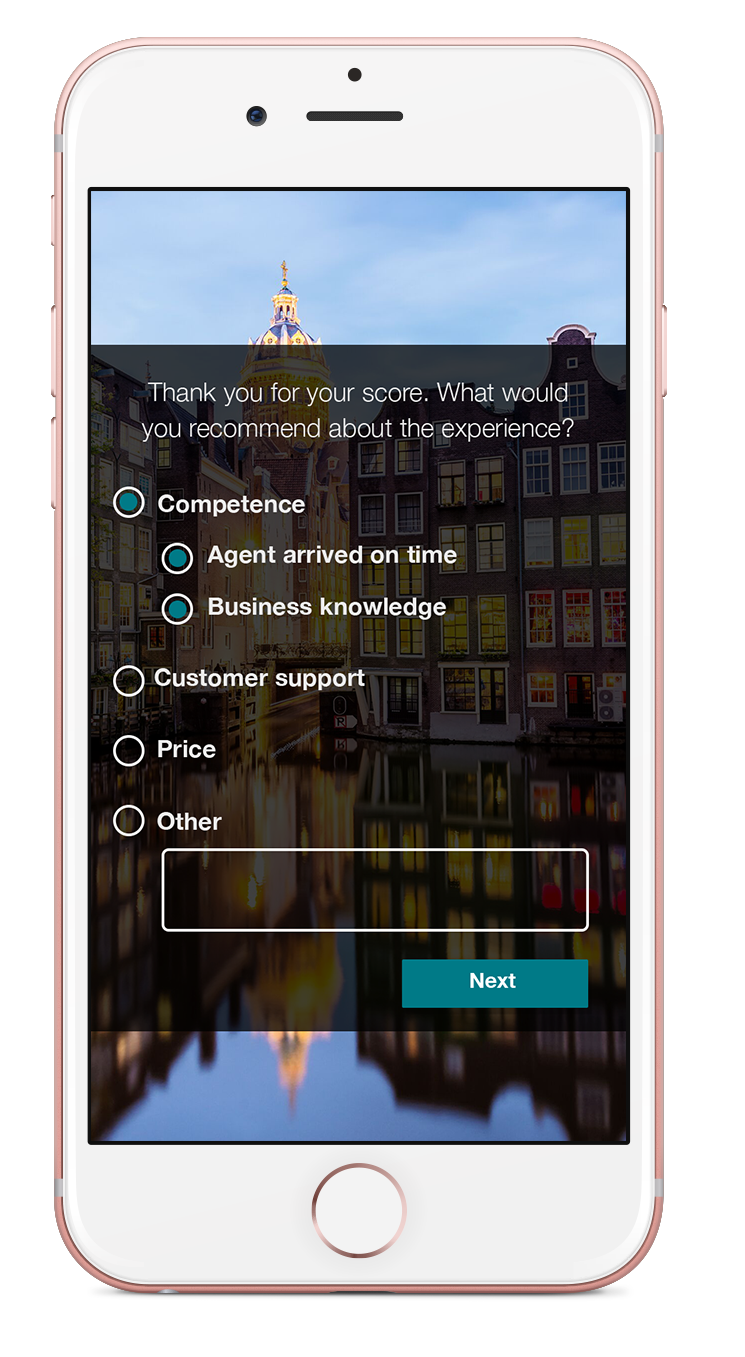

No matter what channel you send your NPS survey through, be sure that your customers can open the survey on their mobile devices. Convenience is key!

Using Drivers in NPS Surveys

NPS survey drivers are useful for not only keeping surveys short but providing data that is relevant, which includes:

- Which drivers (touch points) contribute to your Net Promoter Score

- What aspects of your business can be improved to reduce churn and increase retention

NPS surveys can include both primary drivers and secondary drivers. Secondary drivers add more depth to individual touchpoints to get closer to the root cause.

You can learn more about drivers and driver analysis, including how to calculate driver contribution to Net Promoter Scores in your NPS surveys in our root cause analysis eBook.

NPS Survey Design Best Practices Checklist

Before you embark on your next NPS survey campaign, make sure to follow this 5-step best practice checklist:

- [ ] Is it short?

The best NPS surveys are short, sweet and to the point. Keep both your relationship and transactional surveys short to ensure higher response rates. In fact, just a three-question NPS survey you can gain actionable insight with higher response rates between 40-60%. - [ ] Do you have drivers, are they up-to-date?

Having short NPS surveys doesn’t mean you have to scale back insights. Using primary and secondary drivers in your surveys can enhance your datasets further. Ensure the drivers in your NPS surveys are up-to-date and reflective of your customer journey and current business model. Tip: Drivers are great for getting consistent data, but sometimes comments offer a deeper dive into sentiment analysis. Always include room for comments in your surveys if you have the NPS tools to analyze them. - [ ] Are your NPS surveys consistent in this send?

Variety is the spice of life…except in NPS survey campaigns. If you want your data to mean something, you need consistency in your NPS surveys. Make sure questions appear in the same order, with the same drivers, etc. for a single Net Promoter campaign. - [ ] How and when are you sending your survey?

Will you send surveys on a Tuesday at 10am via email, or are you using in-app surveys post-transaction or timed navigation? How and when you send a survey are tightly correlated with one another as the medium will always dictate the time of send. Make sure you do your research for any medium you’re using to employ NPS surveys. - [ ] Is your sample size significant?

If you want statistically significant results, you need to consider the size of the send. Surveying only 100 of your 20,000+ customers doesn’t give an accurate picture of your customer loyalty.

There are a number of other factors that can be included in this list, so be sure to include them in your own personal checklist.

Final warning: No matter how the results look, never try and game the system by changing the scale. Countless research has gone into the 0-10 Net Promoter Score scale. Changing it from 10-0 may confuse or increase scores, but results are ultimately meaningless. The best way to ensure nobody is gaming the Net Promoter System® is to create complete transparency from top to bottom at your company.

You can learn more about "gaming" the Net Promoter System or how to conduct NPS surveys in the Measuring NPS eBook.

Article suggestion: 10 Best NPS Software's for B2B