Customer retention and customer lifetime value (CLV) are both measurements of customer loyalty — a critical barometer of the health of your business.

Loyal customers stay longer, spend more, and are easier to serve. Plus, they’re more likely to promote your company to others, too.

Both metrics are essential customer experience (CX) indicators and have two important jobs.

While customer retention measures how many customers you can retain over a specific period, CLV identifies how much those customers are worth over their entire relationship with you. And that helps you understand which customers to prioritize in your later retention efforts.

At CustomerGauge, we have consistently been Gartner’s highest ranking B2B Experience Software.

Built into the foundations of our framework is this: linking data to revenue — including customer retention data, CLV insights, and data from the Net Promoter Score, widely considered the gold standard metric for assessing customer experience.

Along with referrals and up-/cross sales, retention forms a vital part of growing your B2B company through our Account Experience program. That’s given us keen, insider knowledge of how these two metrics, CR and CLV, operate independently and work together.

We’ll take you through the details.

Customer Retention and CLV: What’s the Difference?

Here, we’ll discuss each term in detail.

What is Customer Retention?

Customer retention is how many customers you retain over a specific period.

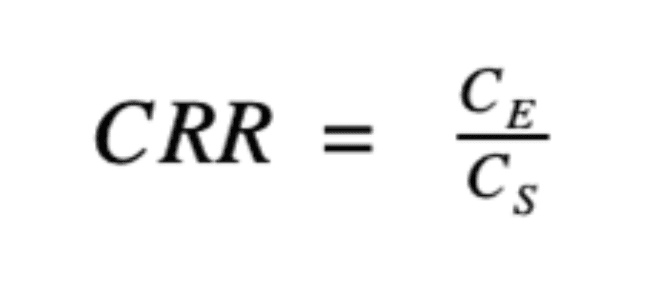

Customer retention rate is calculated with a simple formula:

(It’s essential to subtract your new customers from your current customer base to ensure your data isn't skewed. The aim is to determine how many are coming back without factoring in new acquisitions.)

Customer retention rate varies by industry, ranging from approximately 63% in retail to 84% in media. For our complete analysis of retention rate by industry, head here.

In our work, we’ve seen the impact when our clients focus on retention as a critical element of their strategy.

ZoomInfo, a traded SaaS company that sells access to its database, has a 98.5% retention rate. That’s huge. Their strategy centers around education and training at every touch point that their customers encounter. The result is that they add genuine value to their customers’ experience, keeping them coming back.

SugarCRM, a CRM system management company, places retention at the center of its strategy. Decisions are prefaced with the question: “Will this help create a customer for life?”

Their goal is to feed this information back into decision-making at all levels of their business.

What differentiates them is how they can then serve customers from all vantage points within their organization, eliminating a silo-based approach to organizational strategy. This is significant because as we’ve found 61% of B2B customer experience programs are isolated to one department or division.

A gauge of customer retention is also found in its opposite, customer churn, which measures who stops using your product over a period. While churn is a natural part of doing business, it’s also an indicator of your company's health.

If you don’t understand WHY customers are churning, you could be experiencing critical oversights in your business.

Reducing churn means reducing risk. By integrating that financial data into your strategy, you can identify high-priority areas within your business that need attention, as well as growth opportunities that would otherwise be overlooked.

But here’s the deal. Only 44% of B2B leaders aren’t even measuring their retention rate. Only by measuring retention can you start assessing what we call the cost of doing nothing — a dollar value on monthly churn.

Our ROI calculator is helpful in this regard, but the first thing you have to do is measure your retention rate.

Head here for more on retention management to combat churn.

What is CLV?

CLV (or Customer Lifecycle Value) is a metric that tracks the dollar value of a customer to your company, not just through one transaction but through their lifetime engagement with you.

It also goes by Customer Lifetime Value or Lifetime Value (LTV). When integrated effectively, CLV can drive decision-making about where to focus your resources.

McKinsey outlines three models for calculating CLV:

The descriptive model identifies behavioral patterns through manual analysis of historical consumer data

The predictive model predicts future behavior from historical data

The operative model uses machine learning to make predictions and recommendations that inform decision-making.

CustomerGauge’s Account Experience software fits into the third category.

Our AI tools provide unparalleled insight into customer behavior that’s consistently linked to revenue, allowing our clients to make data-driven decisions about their ongoing strategy.

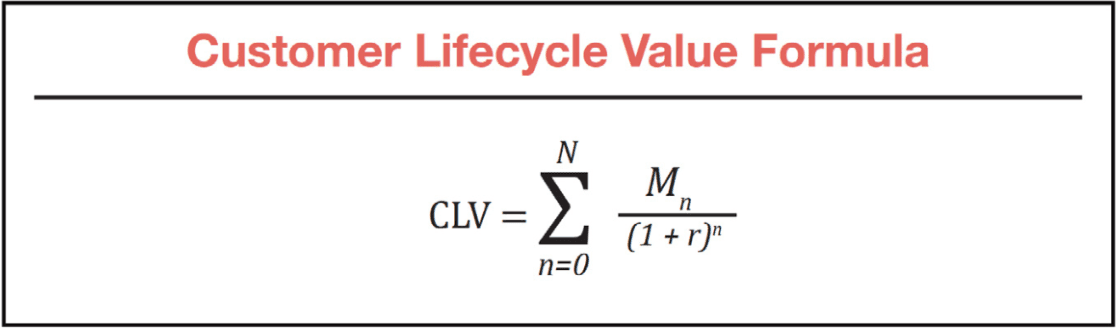

The formula we used for calculating CLV looks like this:

To break that down:

N is the NUMBER of years in the customer's lifecycle with your company

Mn is the MARGIN in a year (the revenue minus operating costs)

1 / (1 + r)n is the DISCOUNT FACTOR (a critical consideration to create an accurate picture of value — what is the price of the perks loyal customers receive?)

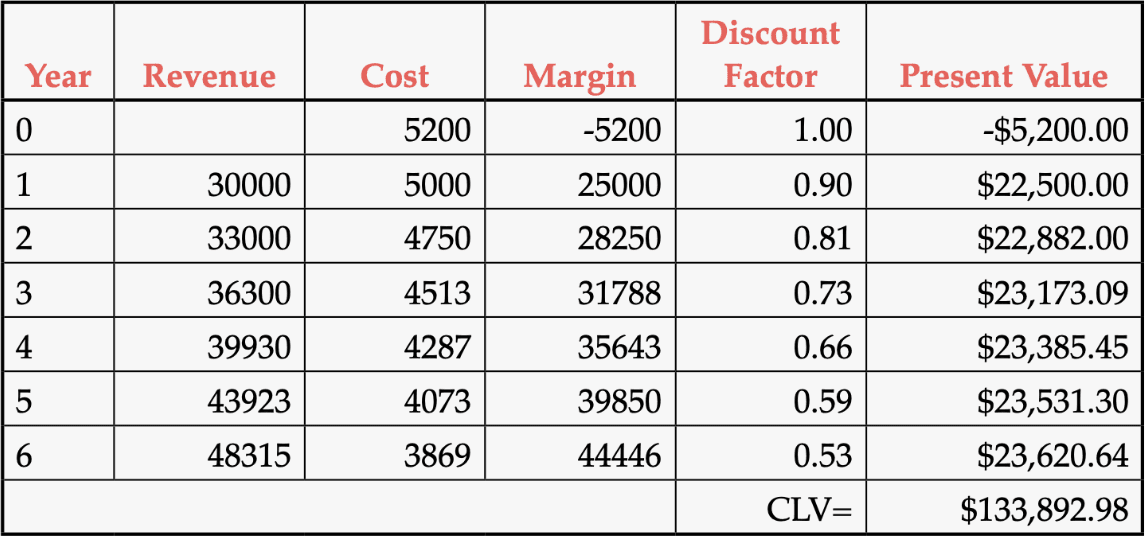

The following example is from a B2B non-SaaS tech company, where the average lifespan of a customer is six years.

As you can see, the longer a customer is retained:

the greater the CLV,

the higher the margins, and

the lower the cost to the company

(Get our full Account Experience ebook for more on this.)

Retention makes financial sense.

As the familiar stat says, it’s five times more expensive to acquire a new customer than to retain an existing one.

Wharton Marketing Professor Peter Fader offers in this piece for Forbes, CLV is a vital metric because it's based on future value and can help you make smarter decisions on allocating resources for maximum ROI.

Because CLV is more about predicting future revenue than analyzing already-won data, it can be seen as too speculative and thereby less reliable. However, in the operative model where machine learning is used effectively, it has real-world clout as actionable intelligence.

Thanks to automation tools, we know so much more about our customers than ever before, allowing us to make more accurate predictions on future behavior.

Furthermore, personalization tools have allowed us to tip the balance of the acquisition versus retention scales.

That’s made CLV a crucial growth indicator, and an important driver for CX departments within major companies to legitimize their efforts.

How Customer Retention and CLV Work Together

What is the relationship between customer retention and CLV?

The two metrics are inextricably linked:

There are two key considerations here:

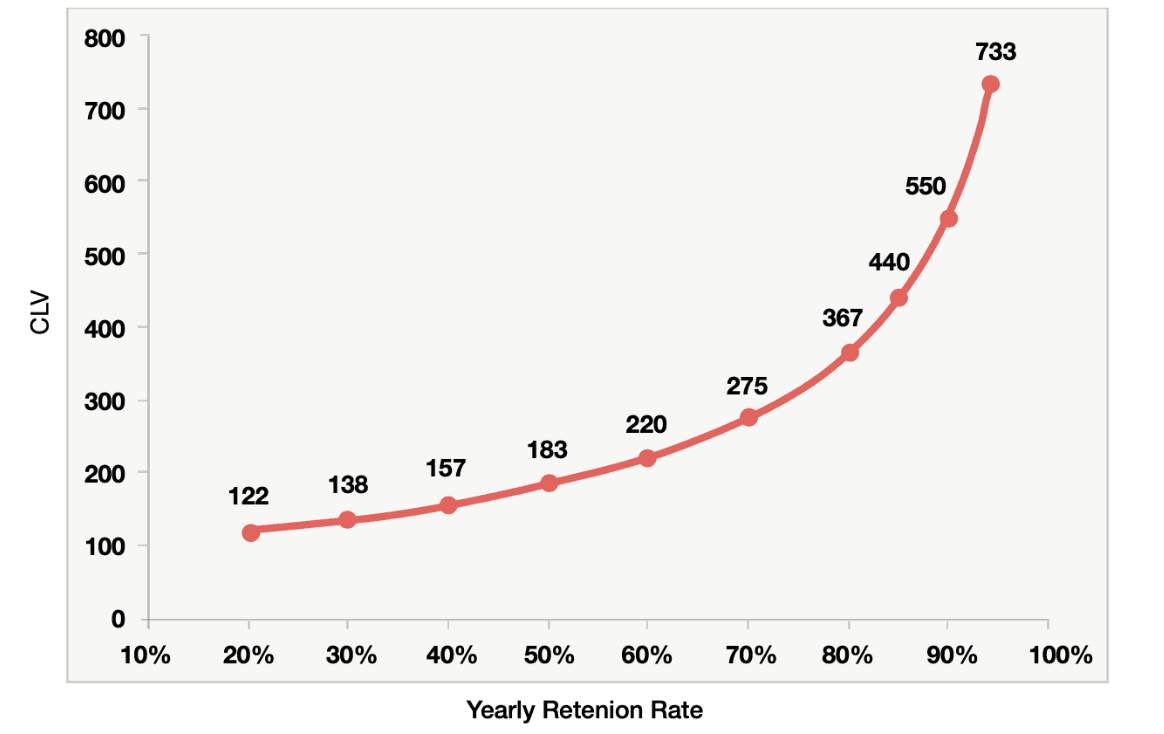

CLV and retention rate are positively correlated. As one goes up, so does the other

CLV increases exponentially as the retention rate increases. (CLV increases more rapidly when the retention rate is over 90% than on the lower end of the spectrum)

Customer Retention and CLV: The Bottom Line

Measuring retention alone will not give you actionable data that can help you strategize for long-term growth.

Understanding CLV is about leveraging the intricacies of customer relationships to improve ROI. And the bottom line is monetization.

Because here’s the thing — 70% of companies don’t have their customer experience data linked to revenue, and 62% of B2B companies do not calculate the ROI of their experience programs.

Without this crucial revenue-based understanding of your company’s customer experience, you can be data-heavy but devoid of the insight that data can bring.

If you’re in the B2B arena and want to know how we can help, get in touch with us today.