Surveys are the bread and butter of your Net Promoter Program.

They're your conduit to understanding your customer's experience. They're the foundation upon which meaningful outcomes are built.

A core part of your NPS survey design is the type of survey used. Do you run relationship (aka relational) surveys? Or transactional surveys? Or a combination of both?

If you’re not sure, you’re in the right place.

The right NPS survey type depends what you want to achieve. Each type should be used within specific boundaries and best practices. For example, for B2B organizations, we suggest running quarterly NPS surveys at strategic times through the year.

In this article, we cover:

- The difference between relational and transactional surveys

- How to use relational surveys (what to ask and when to use)

- How to use transactional surveys (examples and when to use)

- How using different survey types impacts your NPS score

- When to use both relational and transactional surveys

- Case study: How Bisnode implemented both relational and transactional surveys

Let's get stuck in!

Side note: We've got an eBook on surveying you might find helpful, download The Fine Art of Surveying here.

What’s the difference between relationship and transactional surveys?

Before we delve into best practices and use cases, it’s helpful to understand the difference between the two types of surveys:

Relationship NPS surveys are used to determine a customer’s loyalty to a company/brand. These types of surveys ask customers to consider the overall experience and satisfaction they have with an organization and are typically carried out at regular intervals (e.g., quarterly, half-yearly, or yearly).

Transactional NPS surveys, on the other hand, investigate the experience a customer has had within a specific interaction or transaction (what is commonly called a “touchpoint”). This survey is designed to measure customer satisfaction with a company segment (or a particular part of the customer journey) in order to improve it.

How do I use relationship surveys?

In most cases, you should start your NPS program with relationship surveys. This is the main way to measure your relational NPS (i.e., your customer’s overall feelings towards your organization) and figure out which segments within your customer experience need to be improved.

When it comes to using relationship surveys, you’ll need to decide which customers to measure and when to send the surveys—and that can differ between B2C and B2B businesses.

In B2C, relationship surveys can be conducted across the entire customer base. However, why you use NPS will determine which customers should be surveyed. For example, an airline might choose only to survey its economy-class customers, as it knows that both first-class and business-class customers experience high loyalty levels.

Of course, in a sector like an airline industry, it’s possible to separate the customer experience and measure just the segments you wish to improve. Generally, though, in most B2C industries, the customer bases are pretty uniform, and therefore all customers should be sent relationship surveys.

In B2B, meanwhile, it’s important to understand that what you call a “customer” is actually an “account.” So sending a relationship survey means sending surveys to many employees within a single account.

Generally, all accounts in B2B should be surveyed, but it’s essential to determine which employees in each account are the most important and so should be surveyed as a priority. To better understand this, read our article: Why “Voice of the User” is not “Voice of the Customer” in B2B.

If you’re not sure who to survey in a B2B account, a simple rule of thumb is to survey people that affect loyalty, such as those with the ear of the decision-makers (and the decision-makers themselves).

What should I ask in a relational NPS survey?

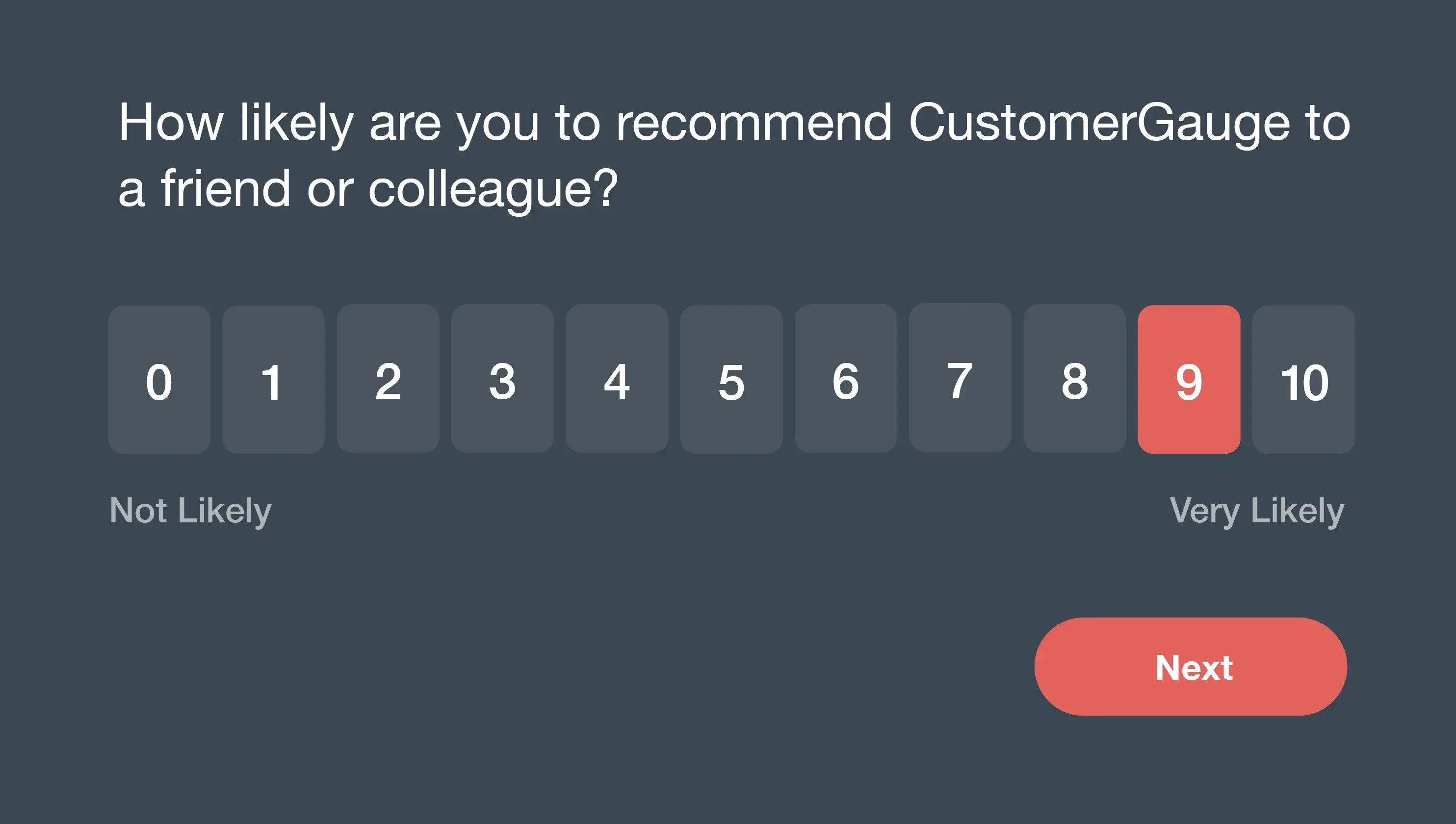

When you send out a relationship survey to your customer base, your aim is to gain a high-level view of customer satisfaction and loyalty. You can do this by asking the NPS question:

“How likely are you to recommend us to a friend or colleague?”, allowing your survey recipients to select a number on a scale from 0 (Not Likely) to 10 (Extremely Likely).

Because relational NPS is a single-question metric, you may want to add a comment box to your survey to determine what prompted a particular rating. Ask an open-ended question, like “what’s the main reason for your score?” to dig a bit deeper.

When should I send relationship surveys?

Choosing when to send relationship surveys is entirely up to you. They’re usually sent periodically (quarterly, half-yearly, or yearly), but can be sent after a specific event or interaction if that’s the only opportunity you have to survey.

For companies in single purchase models, such as in-store retail, there is little opportunity to conduct a relationship survey outside of the interaction itself.

But if you operate in a repeat purchase model, surveying on a regular basis can be a great way to gauge ongoing customer sentiment. Our research shows that sending quarterly relationship surveys can improve retention rate by 5.2%.

Read more: When to Send Your NPS Surveys (What The Data Says)

How do I use transactional surveys?

Typically, transactional surveys are only conducted after you have a functioning NPS relationship survey running. This is because the results of a relationship survey should help determine the touchpoints that need to be surveyed transactionally.

Ask yourself: "Which touchpoints do customers choose the most as the reason for their score in the relationship survey?" This question should guide your transactional survey process.

Transactional surveys allow companies to investigate how particular touchpoints affect a customer’s relationship with a company and make service improvements. With that in mind, it’s worth noting that these surveys are no more suited to B2C or B2B, as is sometimes claimed.

The customer support divisions of large B2B software companies, for example, are pretty much the same as those in the B2C industry. Understanding the experience within this touchpoint is valuable, as account loyalty is influenced by frontline staff being able to resolve issues and use the product successfully.

As mentioned above, your NPS relationship survey should guide your transactional survey process, but that doesn’t mean surveying all chosen touchpoints from the very start. This will only bring more headaches than answers.

Instead, transactional NPS surveys should be rolled out in stages. Start by surveying those touchpoints customers mention the most (maybe one or two to start) and slowly add more as you learn what is lacking in your knowledge.

Key Takeaway: Transactional surveys are not about surveying every single touchpoint, but those that impact the customer’s experience.

What are some examples of transactional NPS questions?

Transactional surveys should follow a similar format to the relationship survey, tweaked only to make the question more specific to a recent interaction. For example:

“Based on your recent experience, how likely are you to recommend us to a friend or colleague?” (with a 0-10 scale of Not Likely to Extremely Likely).

As we mentioned above, you should use additional, open-ended questions to gain more insights into your customer’s reasons for their score. Depending on the specific point of interaction, you might also consider asking questions like:

How can we improve your experience next time?

What was missing from your recent encounter with our support staff?

Which features do you value the most?

When should I send transactional surveys?

As soon as possible after an interaction—but be cautious about sending them too often. A customer that has to call a support center two or three times in a single week isn’t going to appreciate being surveyed after each interaction.

Furthermore, be mindful of how you define the boundaries of the touchpoint. If you want to measure the whole customer and product experience (from browsing/ordering to receiving/using the item), you should time your survey for when the item should arrive, not immediately after the purchase.

How do relationship and transactional surveys affect my Net Promoter Score?

In short, they don’t—provided you don’t combine different relationship and transactional scores into one Net Promoter Score.

While how to calculate your Net Promoter Score is often hotly debated, there’s really no need to complicate matters with additional parameters or variables.

Your company’s Net Promoter Score should be based solely on the results of your relationship survey. On the other hand, each transactional survey that measures a different touchpoint requires a separate transactional Net Promoter Score.

Combining the scores of different NPS surveys is never recommended because each survey measures a different aspect of your business. For example, a customer that scores you poorly in a transaction survey about their purchase experience might still score you highly during a relationship survey.

The same rule applies to combining the scores of different transactional surveys. Each transaction survey measures a separate and distinct experience, so each needs its own score.

Why should I use both relationship and transactional surveys?

There are a few clear benefits to running transactional NPS surveys alongside monthly, quarterly, or yearly relationship surveys:

You get a full view of the customer journey by touchpoint which allows for more granular and relevant process improvement

You can see in-the-moment feedback on specific interactions and the overall customer sentiment (and understand how one affects the other)

Reporting is standardized across the organization, and you have a single metric everyone can rally around

You can close the customer feedback loop faster by gathering actionable insights

Case Study: How Bisnode implemented both relationship and transactional surveysBisnode is one of Europe’s leading data and analytics firms. Prior to working with CustomerGauge, they were running a yearly relational survey, sent to thousands of contacts in a single blast. Without an effective distribution strategy, they struggled to improve the response rate, while their team was overwhelmed trying to analyze the data. This led to delayed action (if any, at all). In addition, they were sending a typical CSAT (customer satisfaction) survey made up of dozens of questions, resulting in high abandonment rates. After reaching out to CustomerGauge, Bisnode began sending out transactional NPS surveys at key points of the customer journey. This gave them a constant flow of actionable feedback for improvement. And once the transactional surveys were set up, they changed their yearly CSAT survey to quarterly relational NPS surveys. Instead of sending to the entire contact list, they strategically chose contacts at every level of each account and staggered the sends to give account managers adequate time to respond in a timely manner (48 hours or less). At this point, the data became very clear. Bisnode was able to look at both transactional and relational data together and tie it directly to revenue. They could see which account revenue was at risk of churn and which accounts were safe. This made it easier to advise the C-Suite as to where investment was required to retain their most valuable accounts. Listen: How to Operate a World-Class Experience Program Globally w/ Bisnode |

So, which survey is right for me? Relationship or transactional?

NPS is about more than simply measuring your company's health (although that’s a great place to start). Rather, it’s about knowing what affects your health and how that can impact your strategic decisions and business growth.

With that in mind, every NPS needs to start with a relationship survey, as you first need to understand customer loyalty and pinpoint what’s affecting it. Only then can you investigate those drivers of loyalty identified in a relationship survey by conducting specific transactional surveys.

NPS, though, should also be easy and fast to start. It’s about avoiding the long planning processes of other survey types, and just getting it out there (regardless of how many or few you survey) to collect your first round of feedback.

And while it’s important to know what both surveys mean, how to use them, and some of their pitfalls, you mustn’t worry too much about transactional NPS when you first start surveying your customers. Instead, kick things off with a relationship survey, and you’ll soon understand if you need to do transactional surveys once you better understand the landscape of your customer experience.

Mastered relationship and transactional surveys? Download The Fine Art of Surveying to learn about simplistic survey design, how to construct the perfect survey invite, and much more.