When, back in 2003, researchers were exploring ways to measure customer experience (CX), they made a game-changing discovery.

Out of 17 possible questions they could ask customers to understand loyalty, the responses to one question, in particular, appeared extremely powerful in predicting a company’s revenue growth.

This question they called the Ultimate Question and it laid the groundwork for the Net Promoter Score system.

To this day, the Net Promoter Score question remains the most powerful tool organizations use to track customer sentiment. Ask this question and analyze the responses, and you’ll be able to see where your company’s growth is headed — and why.

Yet in the NPS system, how you ask the Ultimate Question matters, and the follow-up questions you ask will affect your results too. In fact, according to CustomerGauge research, to receive the best responses in your NPS survey, the sweet spot for the number of questions to ask is 2 to 6.

In this article, we’re exploring why the Net Promoter Score question retains so much power and we’ll share some Net Promoter Score templates to guide your own CX efforts, too.

What is the Net Promoter Score Question Wording?

The Net Promoter Score Question is the single question at the heart of the Net Promoter System. The question will unlock insight into your customer loyalty and the customer experience in general. After all, it is called the Ultimate Question for a reason.

The NPS question is this:

On a scale from 0 to 10, how likely are you to recommend our product/service/company to a friend, colleague, or family member?

That’s it, in a nutshell. But from that question, you get a whole world of crucial insight.

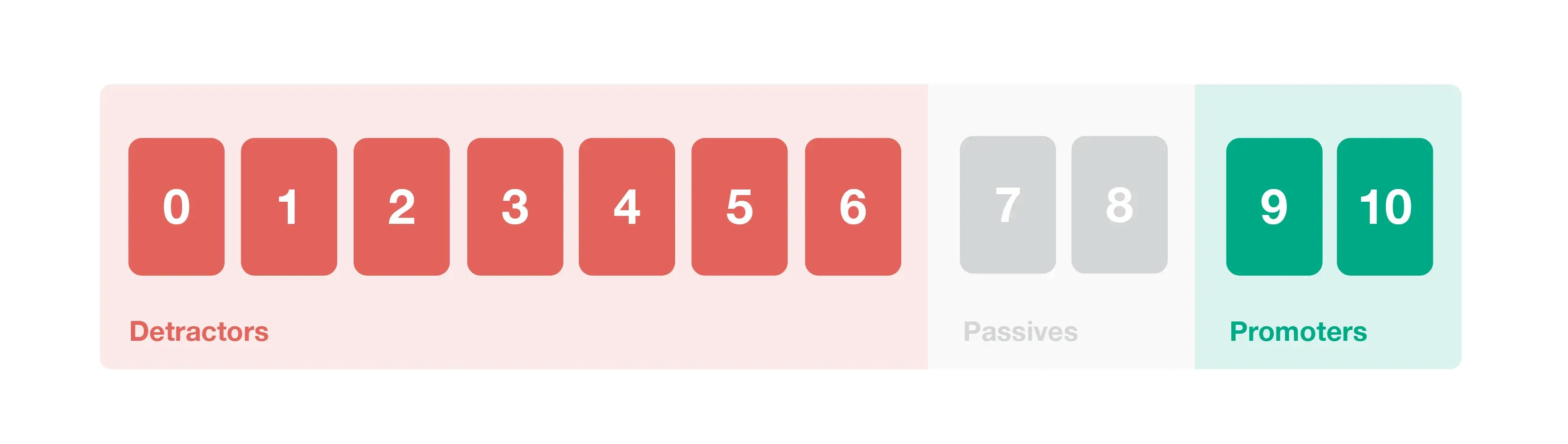

To start with, the Ultimate Question will help you to identify your different types of customer:

Detractors. These score 0-6 on your scale—and they represent your least enthusiastic customers. They’re most likely to churn and are likely to spread negative word of mouth. It goes without saying that high numbers of these are bad for your brand. But it’s crucial to know they exist—and how much they’re worth to you.

Find out more: NPS Detractors: Who are They and What Can You Do About Them?

Passives. Passives score 7 to 8. They’re not as much of a risk for your brand as detractors, as they’re not actively unhappy enough to spread negative word of mouth. But they remain a threat because it won’t take much for them to churn to a competitor.

Promoters, scoring 9 and 10. These are your customers who are most loyal, enthusiastic, and passionate about what your business is doing. They will spread positive word of mouth, be the most lucrative source of referrals and resales, and help you achieve revenue growth.

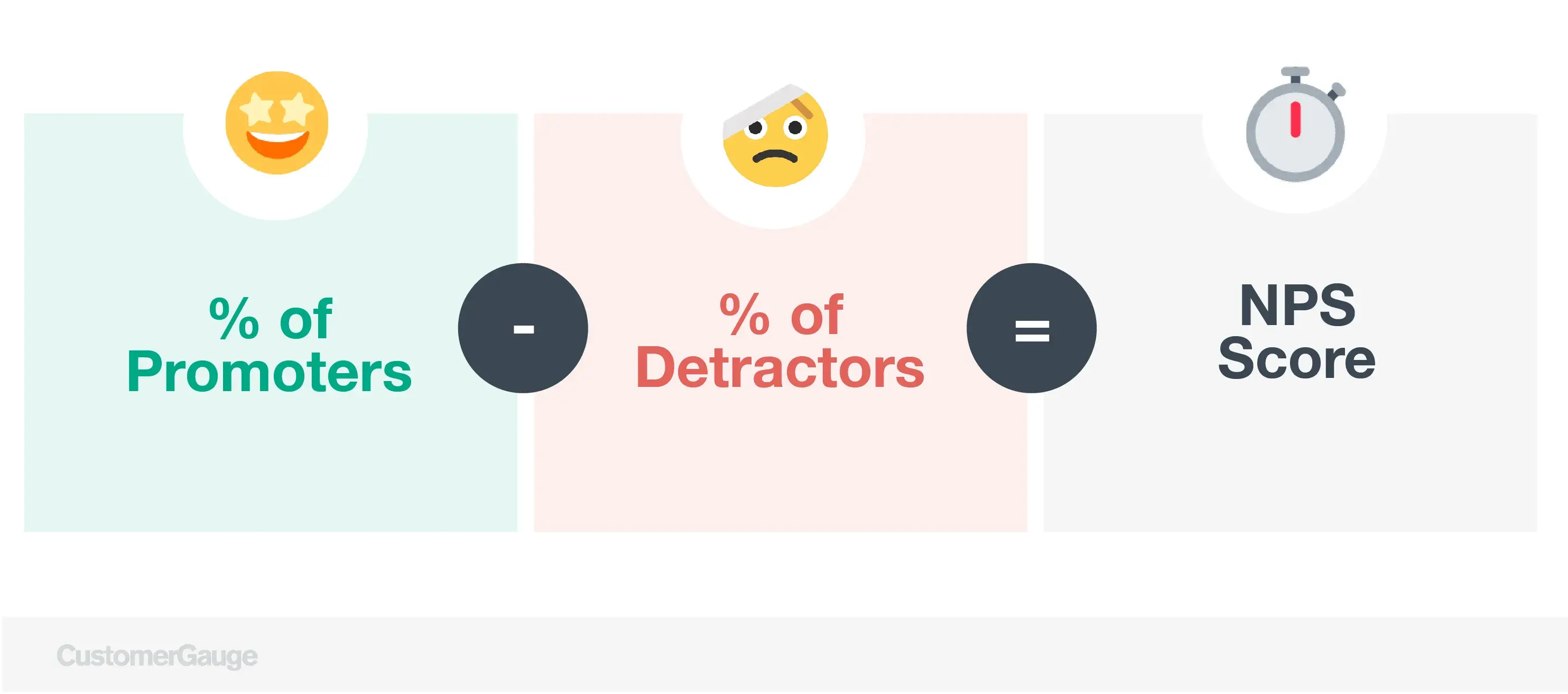

With these three groups, you can ultimately find your NPS score. Subtract the percentage of detractors from the percentage of promoters with the following formula:

So, if you have 50% promoters and 20% detractors, your Net Promoter Score would be 30. See how other brands are performing in our NPS and CX Benchmark Report.

What Insights Can the NPS Question Unlock?

But dividing your customers into promoters and detractors is only the start of what the NPS question can offer. When used correctly, it can unlock some invaluable insights for your organization:

It provides a clear picture of customer satisfaction. Wherever your customer is at in the customer journey, the NPS score can reveal how they feel about the experience you’re providing.

NPS quantifies the likelihood of revenue growth from that customer. The central function of the NPS question is this: it enables you to predict whether a customer will churn, stick around, or refer other customers to you. This way, it’s not just about intangible feelings, but about the state of your bottom line.

A big picture or granular insights. By tracking customer sentiment regularly over time in relationship surveys, you can understand how your customers are feeling in general. Meanwhile, transaction surveys can give you a sense of your customers’ experience of a particular product, service, interaction, website, or staff member.

For B2B brands in particular, understanding the customer journey matters, because different people within your account may have different sentiments.

You can compare your CX with your industry. The beauty of NPS is that the results are easily compared against industry NPS benchmarks. When studies suggest that customer experience is the biggest brand differentiator—even over price and product—you need to know how your competitors are performing.

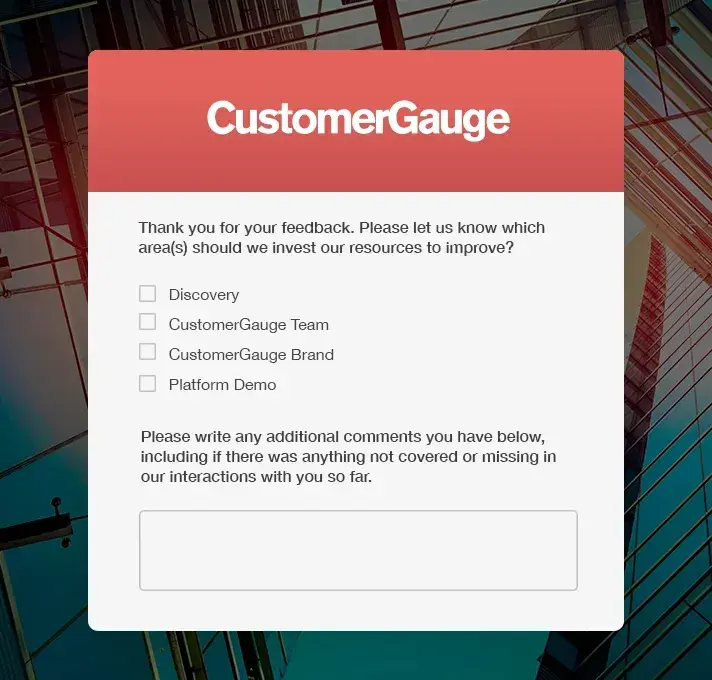

Driver analysis tells you exactly where you’re performing well—and falling short. The NPS question alone doesn’t usually cut it. You’ll need to follow up the Ultimate Question with what we call “driver questions”, questions that investigate why your customer gave the score they gave. An NPS analysis of your drivers can show you where you need to make extra effort in the customer journey.

Now, let’s dig deeper into the different types of NPS survey.

Related Read: 4 Ways to Answer 'What is a good NPS score?'

Relationship vs Transaction NPS: Does the NPS Question Change?

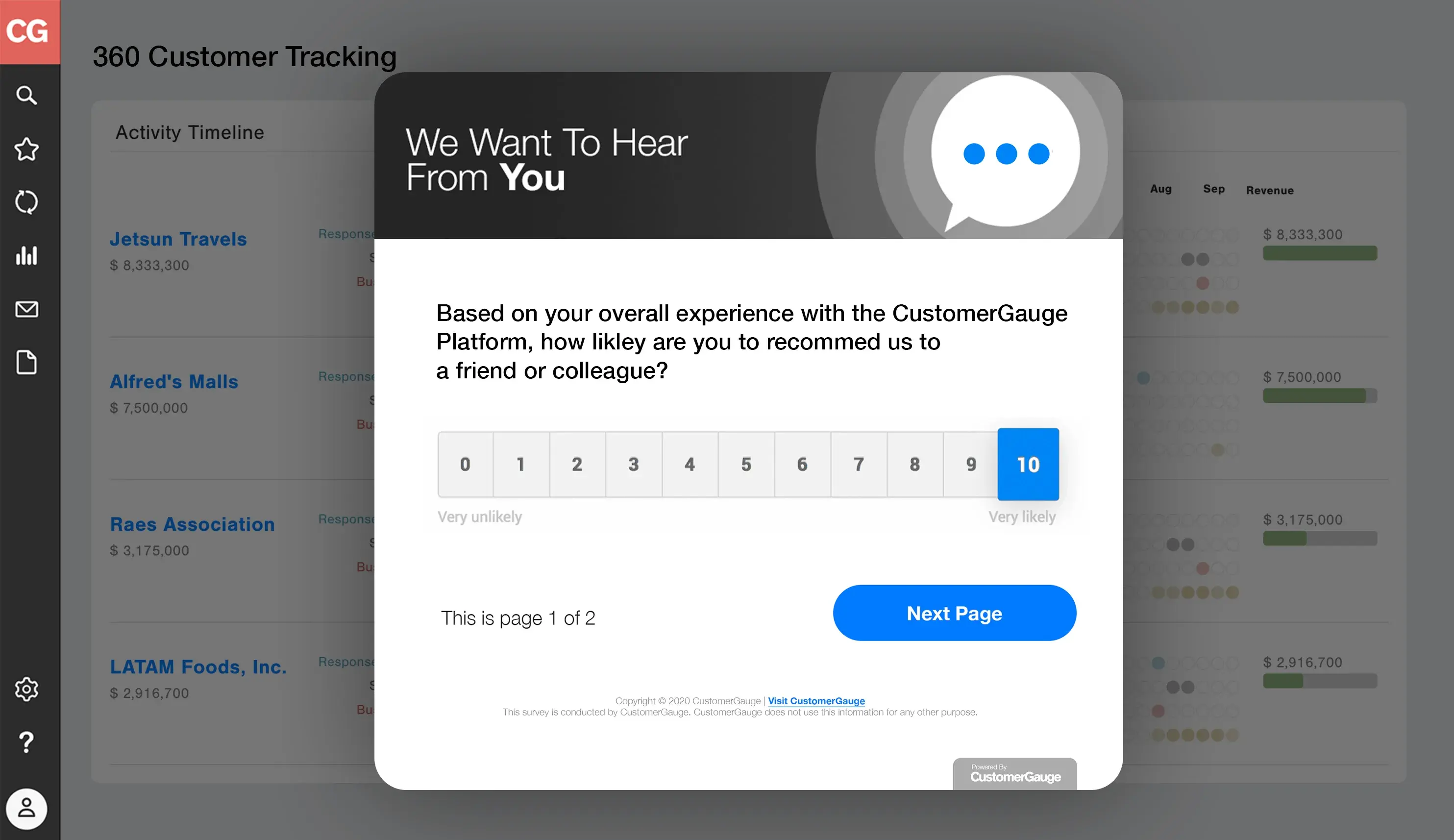

There are two main types of NPS survey and we recommend you perform both.

These are known as relationship surveys and transactional surveys. Yes, the NPS question will change slightly in the different surveys, as you want to get slightly different information from your customers.

Relationship surveys. These are surveys that track your customer relationship in general over time. They’re short customer surveys that are ideally conducted quarterly. CustomerGauge research shows that companies see a 5.2% increase in retention if customers are surveyed every quarter.

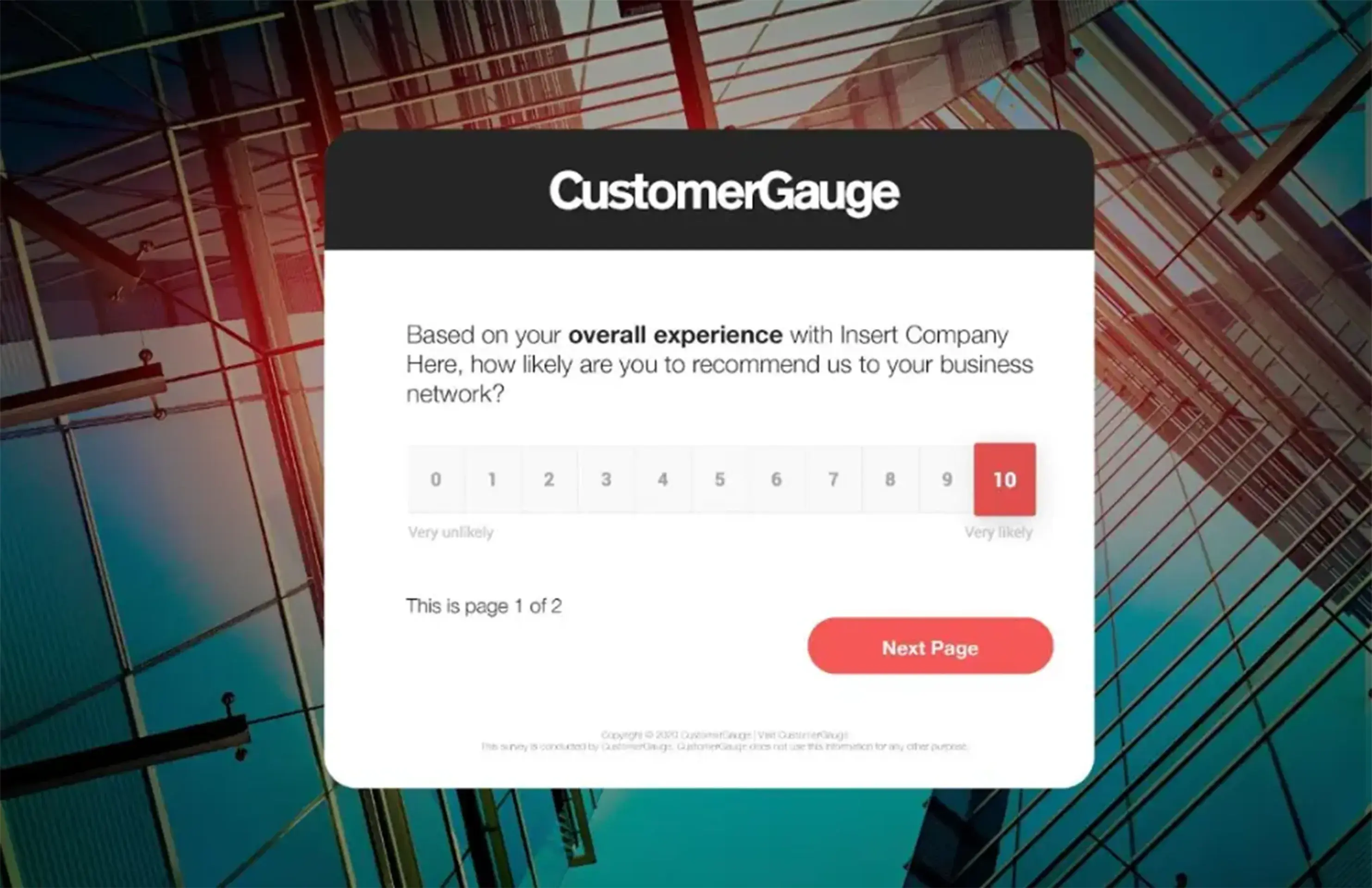

Typically, a relationship survey will look a little like this:

Transactional surveys. These are short surveys that are triggered after a transaction —such as a purchase, upgrade, or delivery. They will be tied to specific touchpoints in your customer journey. Here, you’re not measuring overall customer loyalty, but seeking to understand how each interaction creates detractors, passives, and promoters.

That means the question you ask will be a little different:

Alternatively, you can ask: “Based on your recent online experience with booking your holiday, how likely are you to recommend the experience to your friends, family, or business associates?”

Your customer experience management strategy must include both types of NPS surveys. And that means you’ll have to structure your surveys in slightly different ways.

How to Structure Your NPS Survey Questions

Your survey’s structure will inevitably affect your NPS response rate. That can be a problem, because the lower the response rate, the less reliable your data. So, how can you structure your NPS survey to get the best results?

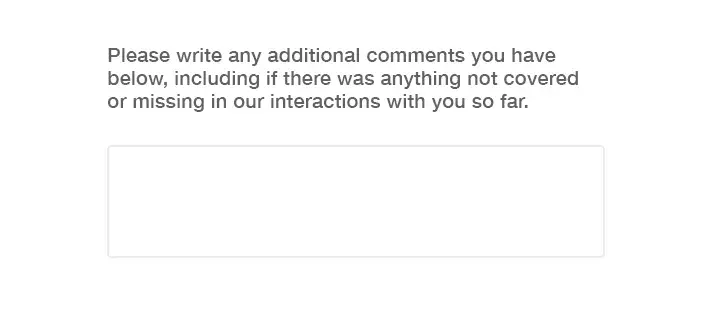

Well, to start with, typically, every NPS survey has two questions at its core. They follow a pretty standard format:

The Ultimate Question: How likely are you to recommend us on a scale of 0 to 10? It gives you the best insight into customer loyalty, but it’s also a great way to break the ice.

The Driver Question. This is open-ended and requires you to ask why the customer gave that score. “What do you love about our product?”, for example, could be a great driver question.

Whichever NPS format you choose (and you can find some options below), these two questions should be included. But they’re not the only questions you might want to ask.

Can I Add More Questions to the Net Promoter Question?

You can add more questions to your NPS survey, yes. But be aware. The beauty and effectiveness of NPS come from its simplicity. And the more questions you ask, the less likely customers are to respond.

In fact, our research found a sweet spot. Asking between two and six questions usually gets you the most responses—and the most detailed results.

Asking the Right Net Promoter Score Follow-Up Questions

Our research shows that you have a maximum of questions you can ask without dramatically affecting your response rate. So, you don’t have much space to get these questions wrong.

Consider the following:

What are your goals for your NPS program? Are you just getting a first sense of what your customers think? Or do you have specific business goals in mind, like turning passives into promoters? In the latter case, you’ll want to ask your customers exactly what you can improve.

Do you have a particular focus? Are you interested in a specific customer segment or touchpoint? Or are you tracking changes in customer loyalty over time? Here, demographic questions can help you understand which customers think what.

It’s also good practice to end the NPS survey by asking if you can follow up with your customers. This way, they won’t be put out if you keep in touch.

NPS Driver Questions: Wording Matters

Driver questions are the most common type of follow-up question—and they are a must for any NPS survey worth its salt.

Many standard NPS templates suggest asking “What is the reason behind your score?” as a driver question. But it’s a bit impersonal. To tease out real feedback, wording the Net Promoter Score question to respond to their initial response can be helpful:

For promoters: What did you love about our product/service?

This will encourage your customers to discuss the parts of their experience that they appreciated, so you can keep doing what you are doing.

For passives: How can we improve your experience?

From customers that aren’t promoters, you want to get information on how you can do better. Asking directly encourages customers to be forthcoming.

For detractors: What was missing or disappointing in your experience with us?

If customers are disappointed, you really want to know why, so you can close the loop.

Cascading NPS Questions

Alternatively, rather than relying on text, you can provide customers with cascading questions in your NPS survey design.

Cascading questions are a type of survey in which questions appear in response to a previous question. They’re useful for three main reasons:

They keep questions relevant to customers—and therefore keep responses high.

They allow you to more easily identify root causes of any problems customers may have.

They keep surveys shorter and reduce customer effort.

Find out more here: Why You Should Use Cascading Questions in Your Surveys

Other Things to Consider in NPS Question Survey Design

What else must you know to make your NPS survey design perfect? Here are some tips to bear in mind:

Keep it short. It’s worth repeating. NPS surveys are powerful because they’re short, simple, and demand very little from your customers. Asking too many questions undermines all of this.

Don’t mess too much with the Net Promoter Score question wording. Decades of research have gone into the NPS survey question. The standard model is the best option out there.

Send your survey through the right channels. We found that website and phone surveys get much higher response rates than email surveys. Phone interviews have a 42% response rate, compared to 30% over email.

NPS Questions Templates and Examples

Let’s end with some examples of Net Promoter Score templates you can use to kickstart your CXM program.

What Do I Say in a Survey Email Invitation?

Your first challenge as a business is to encourage your customers to start the survey. Some of the following NPS templates can get them clicking:

“You have the power to build a better experience.” By leveraging people’s desire to make a difference, you trigger an emotional response. You also make it clear that their perspective matters.

“The survey is short and only takes 2 minutes to complete.” Customers don’t want to waste their time—and knowing how much time they can expect can avoid frustration later.

“We promise to read every customer comment.” Again, it shows you care.

Remember, 47% of people open emails based entirely on the subject line. That means it really needs to make an impact.

How to Word the NPS Question Correctly

We said above that you shouldn’t play around with the NPS question too much. But depending on whether you’re doing a relational or transactional survey—and depending on your business model—questions can change.

Here are some templates you can use for the NPS question itself:

- Relational survey question (this won’t change very much from context to context):

“On a scale of 0 to 10, how likely are you to recommend our business to a friend or colleague?”

- Transactional survey question templates:

“How likely are you to recommend our product to a friend or colleague?”.

“Considering your recent purchase experience, how likely are you to recommend our company/product to your friend or colleague?”

“How likely are you to recommend our company/product to your friend or colleague based on your interaction with our support team?”

- Alternatively, you may want to dig into a particular customer segment:

“How likely are you to recommend our company/product to someone with similar business challenges?”

Ultimately, you’ll want to tweak your questions in your NPS program to find the wording that gets the best responses. And that will be unique to your business.

NPS Driver Question Templates

The same goes for driver questions. There’s no single way to ask a driver question that will work best for every brand. But here are some options you can try:

“Which features of the product do you value the most?”

“What do you like most/least about our company or product?”

“How do you benefit from using our product/service?

“Why did you opt for our product over our competition?”

“What change in the product would make you want to continue using us?”

Download our free NPS driver analysis template here to learn how to add drivers into your NPS calculation.

Follow-Up Messages

Finally, the NPS survey doesn’t stop there. Show your customer that you appreciate their effort by sending a thank you note that responds to their answers. It doesn’t have to be complex, but it should reflect their sentiment:

For promoters. “Thanks for your feedback. It’s great to hear that you appreciate our product. We’re really grateful that you’ve taken the time to tell us about your experience. Your feedback helps us to improve and to continue providing the best possible experience we can.”

Passives. “Thanks for your feedback. We want to make sure that everyone has the best possible product/service. Your suggestions enable us to do just that."

Detractors. “Thanks for your feedback. Your thoughts and suggestions matter a lot to us. We strive to ensure that every customer can enjoy the best possible experience with us. In the future, we might reach out to you to learn how we can further improve."

Get Started with CustomerGauge NPS System

At CustomerGauge, we help companies to tackle churn and drive revenue growth through referrals using Net Promoter. Our NPS software is a one-stop shop for B2B companies to setup and run an NPS program linked to revenue outcomes. Book a demo to get started.

To learn more, download our ebook, 14 Steps to Net Promoter Surveying, to optimize your surveys.