Ask any B2B business if account retention is important to them and you’ll likely receive a confident “yes” in response. Ask them what processes they have in place to identify churn risks, troubleshoot detractors, and take action to drive loyalty, and you’ll probably get a much different answer.

But why?

The truth is that while organizations know the importance of account retention, they don’t always have the right systems in place to achieve that.

For example, CustomerGauge research revealed that only 26% of B2B businesses close the loop on all their accounts. That means that a massive 74% are neglecting feedback from at least some of their customers.

Worse still, some businesses don’t even have processes in place to understand who might be at risk of churn. The trouble here is that they could wake up one day to find that a valuable account has churned with no warning.

This happens far too often and hurts even more when you know that it could’ve been avoided.

The bottom line? If you’re serious about increasing account retention, put the steps in place to detect customer churn and then prevent it. Here we show you what works based on what other companies are already doing to increase account retention.

Why Do Customers Churn?

Every customer has their own reason for churn, however, some key reasons emerge a lot more frequently than others:

1. Poor customer experience. While subpar customer service is repeatedly cited as a cause for churn, research has repeatedly shown that the issue runs deeper: poor customer experience (CX) is the real culprit for attrition.

In fact, according to PwC, 73% of customers say customer experience affects their loyalty to brands, while over one in four say they would pay more for a better experience. Two-thirds say they would churn because of a bad experience.

2. Losing relationship contracts. Relationships are a great way to bring in new business, but limiting your relationship with an account to a single person increases your churn risk. If the person you’ve developed a relationship with leaves, the account becomes at a greater risk of attrition.

There are some things there that you can’t prevent such as a change in leadership. But the bottom line remains: the more contacts you have in your client account, the less vulnerable you’ll be to personnel changes.

3. Price increases. The received wisdom goes that when you’re working with a large B2B company, increasing your prices can put them in a difficult position. Either they reduce their profit margins or they have to sacrifice other tools or expenditures.

However, in reality, price is a less significant cause of churn than you might expect. Some industries are more price sensitive than others, so attrition rates vary across sectors.

Keep your customer experience as good as it can be and an increase in price will rarely make a significant difference.

4. Market changes. New entrants in the market are an obvious potential cause of churn. They might offer your existing customers lower prices or frankly irresistible offers. There isn’t much you can do directly to combat market changes, but customer loyalty (thanks to customer experience) acts as insurance against it.

5. Product bugs or failures. If you’re a company that delivers products, bugs, failures, and even slow updates can increase your churn risk. This is not just because it is frustrating for your customers. Rather, product failures can hurt their profits and damage their customer relationships, too.

Why Revenue Retention Should Be Your Primary Goal in B2B

In B2C, the arithmetic of churn is pretty straightforward. Typically, you’ll lose revenue proportionate to the number of customers that churn.

However, that’s not the case in B2B.

In B2B contexts, the value of your client accounts can differ dramatically, with some being as much as 10 times the size of others. When it comes to account retention, that means that some customers will need to be a bigger priority than others.

That’s why we say in B2B revenue retention is more important than account retention.

To put it simply, your largest accounts are going to need more attention and resources than the smallest.

Let’s break down why. Say your revenue at the start of Q1 was $5 million, from 9 accounts:

Three accounts are worth $1 million each

Two are worth $500,000 each

Two are worth $300,000 each

Two are worth $200,000 each

Now, let’s say that by the end of the quarter you’ve lost two accounts. From one perspective, your basic account churn rate would look like this:

(2 churned customers/9 total customers) x 100 = 22.2%

Depending on your industry, that number’s really not bad at all. But then consider that the two accounts that churned are both worth $1 million. In this case, your churn rate is a lot higher:

(2 x 1000)/(5000) x 100 = 40%

Here, you’ve got a problem on your hands. While you may have retained almost 80% of your accounts, you’ve lost 40% of your revenue.

That’s why at CustomerGauge we teach all our clients the importance of monetizing your retention rates. Without a clear image of how much you are losing in financial terms, you won’t have a clear sense of your business health.

5 Strategies Top B2B Companies Leverage to Increase Account Retention

So, how to increase account retention? Steal these five strategies that top B2B companies are leveraging.

1. Detect churn indicators early by running NPS surveys

Imagine walking into the office one day, and your CEO says: “We just lost an account without any warning or signals. How did this happen?”

And you don’t have an answer, and nor does the account manager. Unfortunately, this nightmare is a reality for many – and it was once the case for Effortless Office, a hybrid managed services provider (MSP).

They lost an account abruptly and didn’t know why. The customer had no history of complaints, nor had they submitted any negative feedback. There weren’t any churn indicators.

Up until this point, Effortless Office relied on customer satisfaction (CSAT) scores and transactional surveys to collect feedback. They even had a very respectable CSAT score of 98.4. However, the problem was that the score only reflected each customer’s experience with a particular customer service interaction.

A customer would reach out for help with a problem, the agent would resolve it, and the customer would leave them a good score. But later, the problems would occur again, and the account eventually churned.

This lapse in visibility encouraged Effortless Office to take the leap and invest in CustomerGauge’s Account Experience platform.

Now, the Hybrid MSP uses Account Experience (AX) to detect churn indicators and take preemptive action to improve customer retention. The company now runs quarterly relationship surveys with Net Promoter Score, helping Effortless Office switch from collecting feedback for a single interaction to understanding their customer’s experience with them as a whole.

Effortless Office now uses Account Experience to identify negative feedback from customers in real-time and close the loop quickly to improve their retention.

2. Increase your survey response rates

Often when businesses run customer experience surveys such as Net Promoter Score (NPS), they distribute the surveys, calculate their NPS score, and give themselves a pat on the back. But the truth is that they’re probably not getting very honest results and are likely failing to make their CX as effective as it could be.

That’s why we always say that survey response rates should be one of the key elements of your CX program. CustomerGauge research revealed a direct correlation between response rates and higher NPS for Account Experience customers.

The more engaged an account is with your business, the less likely they are to churn.

There are several ways to increase your NPS survey response rates:

Keep your surveys short and sweet. Only ask questions about information you actually need to collect, i.e. insights that lead to action. Our research revealed that the number of questions you ask affects response rates, with 2-6 questions being the sweet spot.

Set clear expectations. Your customers won’t appreciate having their time wasted, so let them know exactly what to expect like how long the survey will take to complete and what action you plan on taking based on their responses. Let them know why you’re surveying them and how much you appreciate their participation.

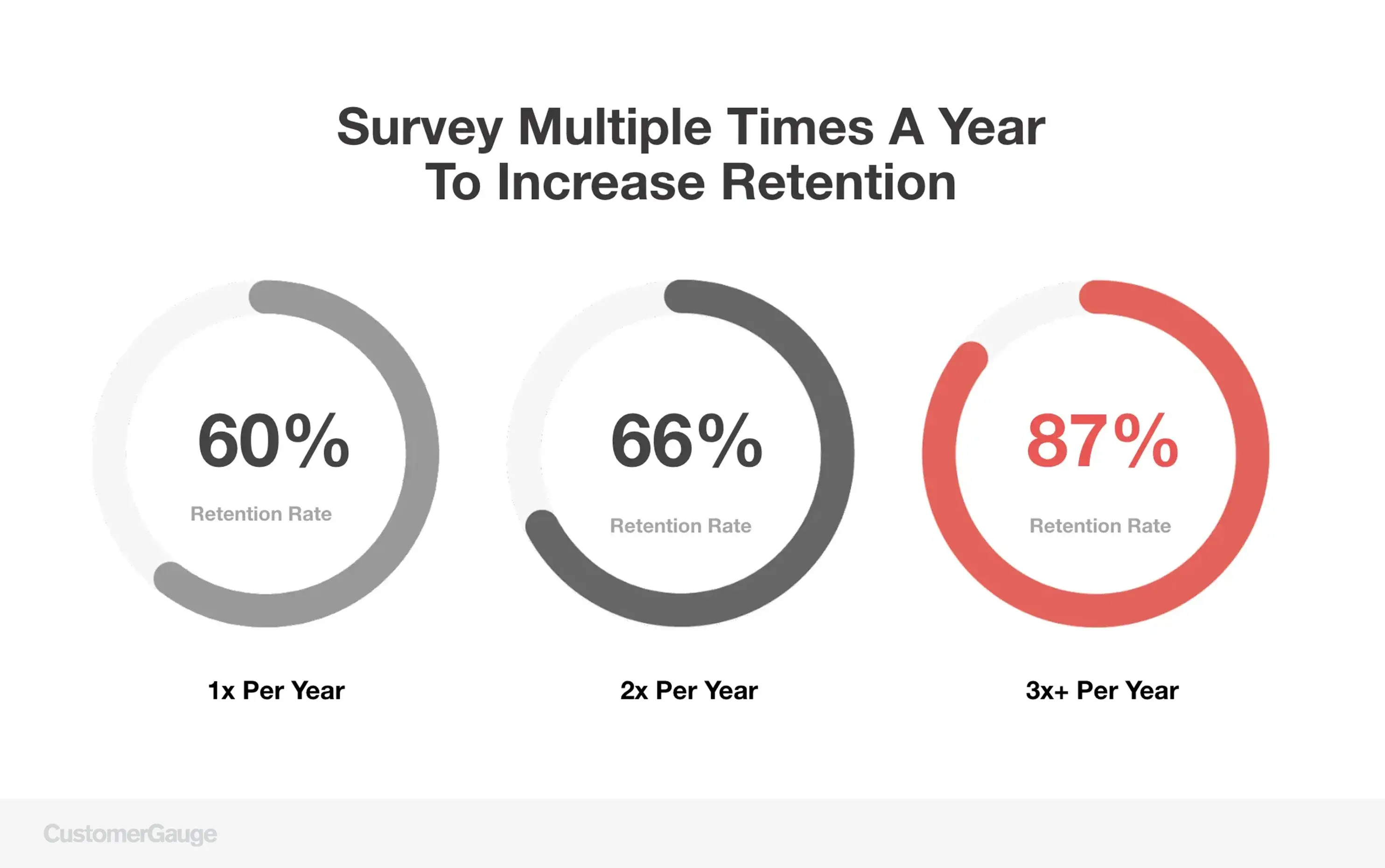

Get your surveying frequency right. This may come as a surprise, but CustomerGauge research showed that surveying customers every quarter increases account retention by 5.2%. It sounds like a lot, but it’s worth it.

ICON Communications, a B2B company that creates tailor-made outsourcing to deliver leading inside sales and account management solutions, achieved some incredible results through their customer experience program. They achieved a whopping 100% response rate, an impressive 98.8% retention rate, and an overall NPS of 70.

To achieve this mind-blowing response rate, ICON:

Shortened their surveys with the goal of them being completed in a minute or two, at most.

Combined their quick surveys with a solid closed-loop process. When ICON receives feedback that requires them to take action, they invite the customer to join a 90-day action plan to correct the problem. Keeping the customer engaged in the process cultivates a deeper sense of loyalty and increases their likelihood to recommend.

As you can see, ICON isn’t out here performing any miracles. They’ve achieved outstanding feats by employing simple, but effective, CX best practices. And you can implement them, too!

3. Close the loop, quickly

Closing the loop is when you respond to customer feedback, take action based on it, and let customers know of the changes you’ve made. It’s crucial to the success of any customer experience management strategy, especially if your goals are to improve customer retention and increase loyalty.

According to CustomerGauge research, closing the loop within 48 hours can increase retention, and companies that don’t close the loop increase their churn by at least 2.1% annually.

But the benefits are being missed: our The State of Account Experience benchmarks report revealed that only 26% of B2B companies close the loop on all their customers.

Beyond the story that these numbers tell, let’s draw a comparison to see why not closing the loop is a bad move.

Imagine your best customer walks up to you to share feedback on why they’re not happy with your product or service and they go the extra mile to tell you how you can improve their experience.

Now, imagine you walk away and don’t listen to their feedback. That would be crazy, right? You’d not only want to hear what they have to say, but you’d also want to follow up quickly with a resolution. That’s precisely why closing the loop, and closing it quickly, is so crucial.

Sure, a telecommunications company, challenged the industry’s stereotypically poor customer experience standards by implementing its own Account Experience (AX) program. Sure collects customer feedback, closes the loop, and quickly responds to challenges based on insights from real-time data.

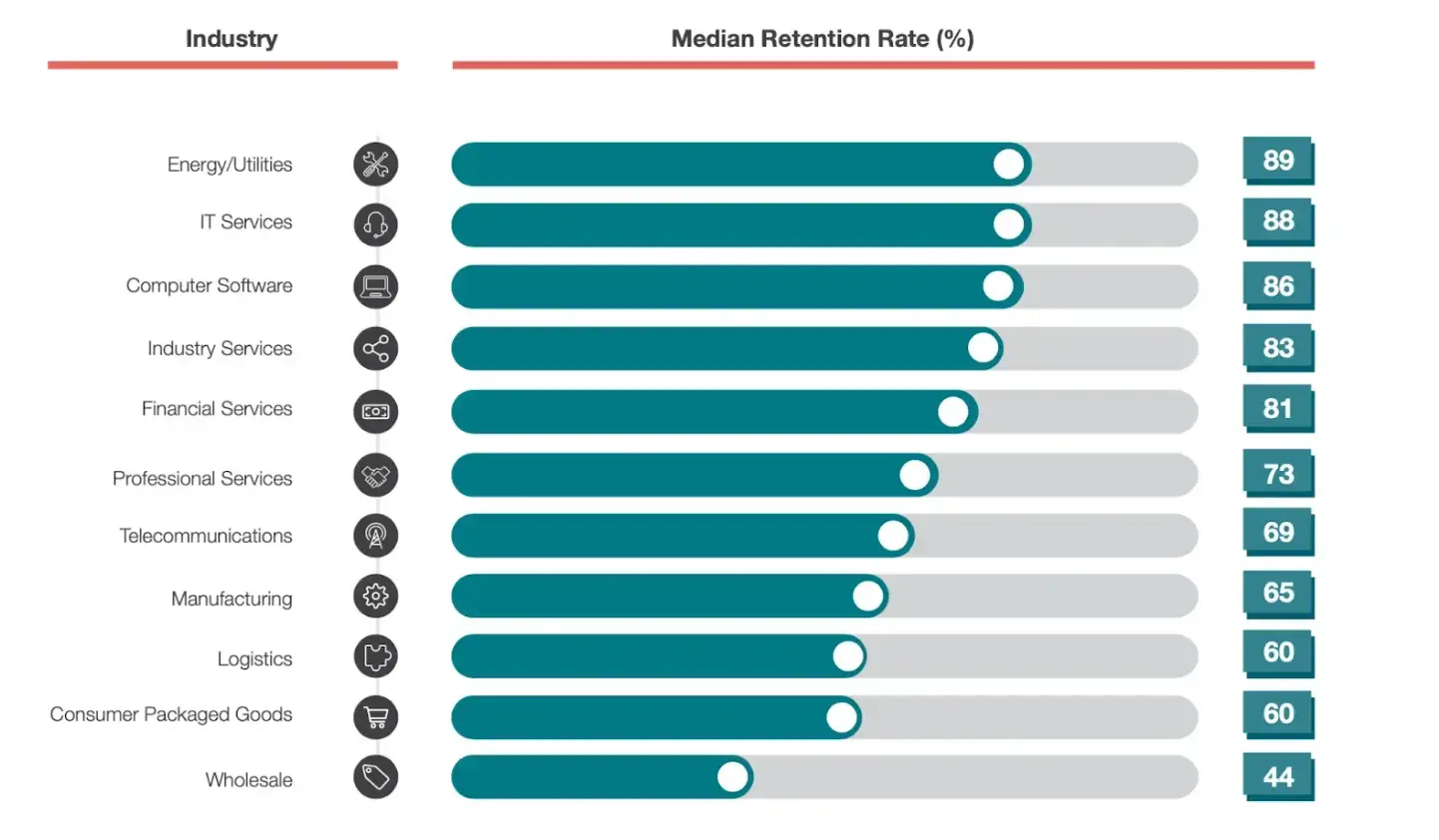

By listening (and acting on)customer feedback, Sure has now achieved a churn rate that’s substantially lower than the industry average.

You can improve your retention, too, by adopting these best practices for closing the loop:

1. Do it at every level. It might seem easier to leave the closed-loop process to customer service agents and frontline professionals, but doing so can increase your churn.

Some problems require managerial or even executive-level intervention, so it’s important to engage all the levels of your company in your closed-loop process.

2. Do it quickly. In a closed-loop feedback process, acting quickly is crucial to keep customers satisfied. If you wait too long to respond, you risk increasing tensions and the likelihood of churn.

In fact, our research revealed that closing the loop within 48 hours can increase account retention by 12%.

3. Aim to close the loop with all your customers. It’s good to close the loop quickly with all your accounts, but make sure you prioritize your most important ones. And within your top accounts, make sure you’re surveying all the key stakeholders and closing the loop with them.

4. Tie CX to Financial Data

Earlier, we saw just how important it is to track revenue retention, and how not all accounts are equal in B2B. In other words, linking your CX program to financial data is crucial.

And we discovered that most businesses are lagging behind here. According to our data, 70% of B2B CX programs aren’t linked to financial data, and 63% of businesses can’t tell you the ROI of their CX programs.

Inevitably, these businesses aren’t prioritizing their most valuable accounts, so they could wake up one day having lost one of their most valuable accounts with no warning. They’re also neglecting one of the best revenue opportunities in B2B: customer experience.

Beyond helping you prioritize your retention strategy, linking CX to financial data also helps you grow revenue through upselling, cross-selling, and referral marketing. By getting clarity on who your most engaged and most valuable accounts are, you can identify and leverage revenue opportunities. What’s more, you might identify detractors that can be converted into promoters to increase your bottom line.

We call this Monetized NPS.

Amdocs, a multi-billion dollar company that specializes in software and services for media and communications, used Account Experience to prioritize their key accounts which make up most of the company’s revenue.

Because of the sheer size of their top accounts, Amdocs appointed a Customer Business Executive (CBE) for each, who’s responsible for the longevity and health of the accounts. The CBEs’ responsibilities not only included collecting Voice of Customer (VoC) feedback but also closing the loop and implementing improvement plans, specifically for that account.

By tying their CX program to revenue, Amdocs has continuous insights into the willingness of their top accounts to recommend them. They’re also able to predict customer growth, identify revenue opportunities, and measure the success of referral businesses.

5. Make CX the Responsibility of Your Entire Organization

A lot of organizations claim to be “customer-centric,” but are they really? And what does it mean to be truly customer-centric?

For PandaDoc, an electronic document creation and e-signature tool, customer-centricity means quite literally making customer experience everyone’s responsibility. The company realized early on that a siloed experience program was doomed to fail, and they set out to get the whole organization (of over 600 employees) immersed in customer feedback.

Their CX team integrated feedback directly into their company’s Slack channel, empowering everyone to see feedback, troubleshoot detractors, celebrate wins, and keep customers at the center of what they do.

PandaDoc even created a customer advisory board (CAB) to collect valuable insights for its strategic decision-making. Every six months, 10-20 customers from the CAB meet with PandaDoc’s team to discuss CX strategy, the product roadmap, and each customer’s experience with the product.

Putting customers at the heart of their business helps PandaDoc make decisions that truly benefit their customers, increasing their revenue and improving customer retention. They’ve created a system of collecting feedback, immersing the organization in it, and making strategic decisions.

So, like PandaDoc, are you ready to put customers front and center?

Start Increasing Your Account Retention With CustomerGauge

Ranked as the #1 platform for B2B experience by Gartner, CustomerGauge Account Experience software automatically collects feedback from your accounts and helps front-line managers take action in real-time to fight churn.

Account Experience increases account retention by:

Monitoring which customers are happy or unhappy (and why) with the Net Promoter system. With CustomerGauge, your account teams can survey accounts quarterly and categorize them as churn risks, safe, or unknown.

Account managers can use these indicators to prioritize building relationships with at-risk accounts.

Increasing your response rates. If an account doesn’t fill out your survey, then you should consider them a churn risk. CustomerGauge helps you collect feedback from all your accounts, and from different stakeholders within each account.

Enabling you to close the loop quickly. CustomerGauge identifies unhappy accounts for you, so account managers can ensure they close the loop quickly and effectively.

Prioritizing revenue retention. Since some accounts are worth significantly more than others, CustomerGauge helps you prioritize CX activities by tying customer feedback to account revenue size. If one of your large value accounts is at risk of churning, it’ll be flagged as a “Threat,” and your account manager will be alerted.

Schedule a demo with us to learn more about how CustomerGauge can increase your account retention.