Every business should be on the hunt for new revenue opportunities. But from what we’ve learned, there’s one crucial opportunity that businesses are overlooking.

That’s customer experience (CX).

Typically, when businesses think about growth, they’re focused on the new — new customers to be acquired and new sales to be made.

What they’re not paying enough attention to are their existing customers. And so, while they’re working hard (and spending hard) on customer acquisition, they don’t notice that existing customers are walking out the door.

At CustomerGauge, our research has shown that most businesses are missing a trick: they don’t see that current customers are their best new revenue opportunity.

That’s because 70% of firms don’t see that customer experience should be linked to revenue.

In this article, we want to show you why they’re getting it so wrong, and how you can take advantage of your most important opportunity for growth.

Why Customer Experience Is Your Best New Opportunity for Growth

In our experience, too many businesses don’t see customer experience as a central driver of revenue.

Even when we’re told that half of business leaders think of CX as a priority, or that CX is a key differentiator between brands, there seems to be something missing.

In fact, our data shows 63% of businesses can’t tell you the ROI of their CX efforts. And only 20% of businesses feel that customer experience actually supports their company strategy.

This way, businesses are missing out. That’s why at CustomerGauge we designed Account Experience (AX), our B2B CX software and methodology, to help businesses grasp the financial impact of their CX, and fully understand it as a revenue opportunity.

Customer churn, of which poor CX is a leading cause, costs businesses $2 trillion every year. And loyal customers are known to spend more, buy new products, and refer their friends.

Really, investing in CX should be a no-brainer. Let’s explore why in more detail.

Poor CX is one of the main drivers of churn. Substandard customer service, poor communications, not receiving enough value — all of these common causes of churn can be boiled down to one thing: inadequate customer experience.

But somehow there’s a vital fact that gets missed: churn costs you money. Fix the leaky bucket and you’ll see growth. The trouble is that 44% of companies don’t even know their churn rate to begin with.

Happy customers spend more, give feedback you can trust, and hang around for longer. A customer who enjoys their experience with your brand will provide you with more value. That’s the bonus of customer retention. And it’s not that satisfied customers just renew their contracts, they’ll typically expand revenue, too, by buying additional products and services.

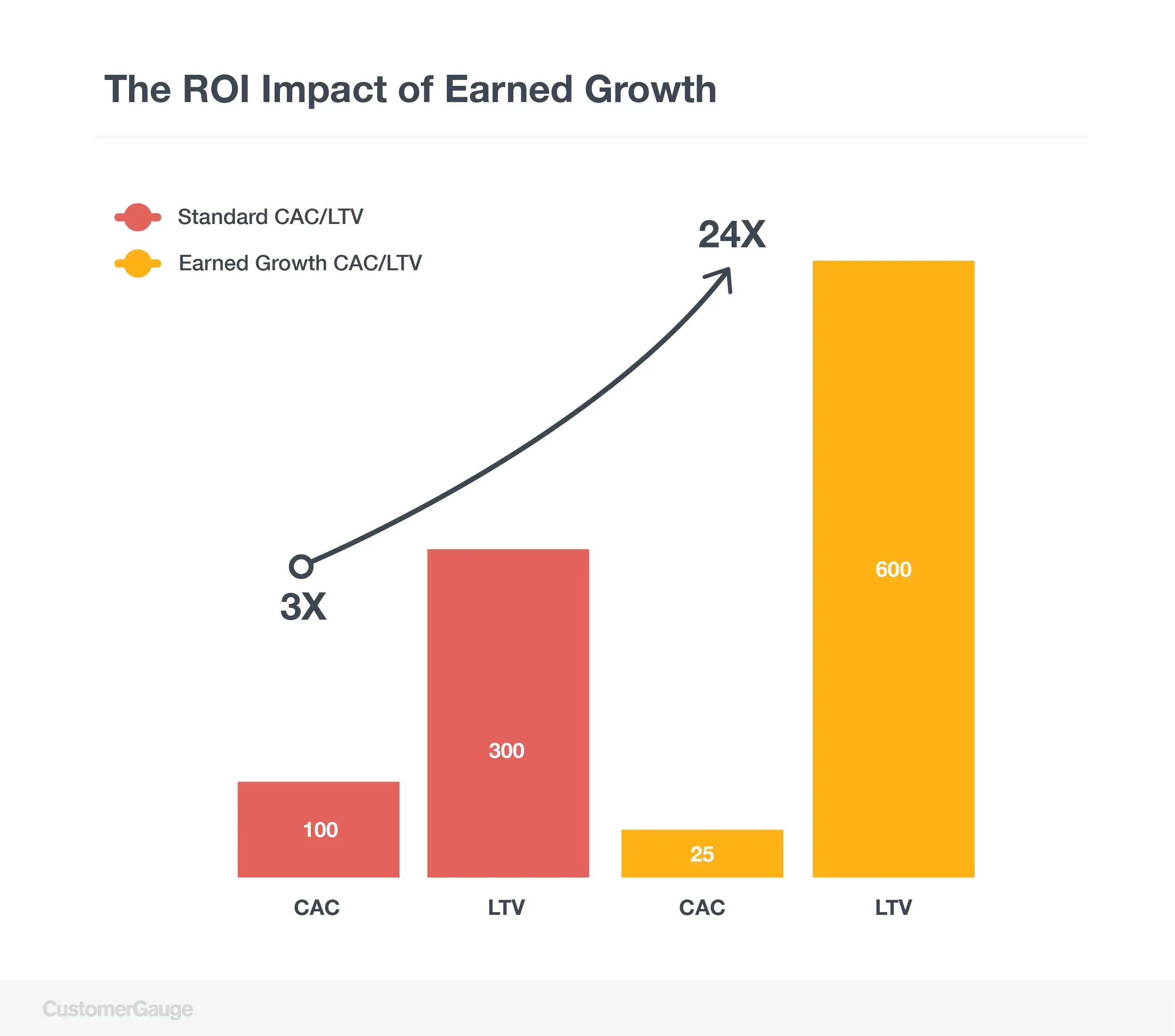

Good customer experience = loyalty & referrals. Customer experience matters not only because satisfied customers will stay, but because they’ll refer your business to others. The benefit? Referrals will increase your customer lifetime value while keeping acquisition costs to a minimum.

It’s time businesses did things differently.

Take advantage of customer experience as your number one revenue opportunity. Account Experience provides the playbook to make that easy.

Take On New Revenue Opportunities With AX

Account Experience is our framework to help B2B brands seize revenue opportunities. Rather than simply acquiring new customers to power revenue growth, AX helps you leverage your customer experience to earn your growth.

Earned growth is a concept that Fred Reichheld, Founder of Net Promoter Score, recently discussed at our Monetize! conference in Amsterdam.

It’s a metric that tracks the revenue generated by returning customers and their referrals.

That growth is earned. It’s sustainable, healthy, and based on a strong customer experience. Your customers are renewing returning and offering you just as new opportunities for revenue because they’re satisfied with the value you’re giving them.

As a result, their lifetime value increases, and your spending on acquisition drops.

We designed Account Experience to help you drive earned growth, by supporting your efforts to increase retention, secure upsells, and drive referrals.

Here’s how you can use it to access new revenue opportunities yourself:

Revenue Opportunity #1: Improve Retention

Earned growth begins with improving retention. The logic is irrefutable: each time a customer churns, you’re losing revenue. To maximize growth, you need to plug the hole in that leaky bucket and get customers to stay.

Take the example of Sweet Fish Media. The B2B podcasting company was suffering from a churn rate of 15% every month. By making some changes to its account management processes, it brought churn down to less than 3% within a year.

How? By listening to its customers, through customer experience surveys and quarterly reviews. In short, they used the Account Experience methodology which looks a little like this:

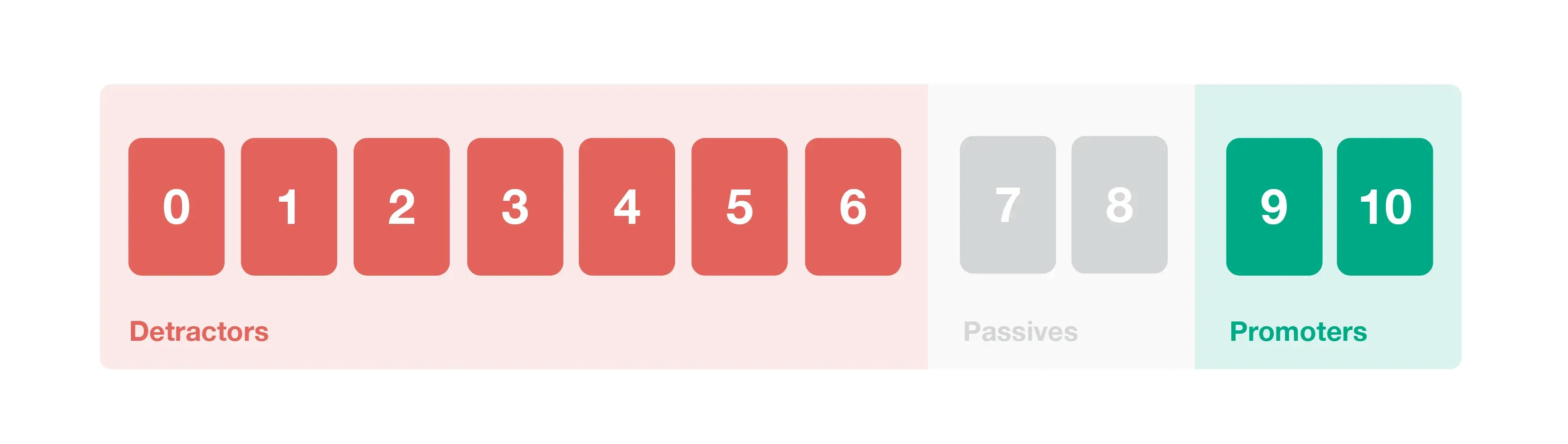

1. Collect customer sentiments through Net Promoter Score

Earning growth through customer retention relies on customer surveys. And the most effective (because it’s the simplest) surveying system out there is Net Promoter Score (NPS).

Based on a single question, “How likely are you to recommend our product/service to someone else?” the system is designed to gauge customer loyalty.

But it’s not enough to ask the question and shelve the answers. To ensure customers stay, you need to keep in touch with them. That’s why we say it’s best to run surveys every single quarter, to give you a continual stream of customer feedback. We recommend you run both:

Relationship surveys. Surveys are delivered every quarter to assess the overall state of the customer relationship.

Transactional surveys. Alternatively, these are surveys that are sent out after specific interactions, such as purchases, customer service engagements, or delivery.

From the survey, you can see which accounts are happy and safe (your promoters) and that are unhappy and at risk of churn (your NPS detractors).

Don’t forget, the surveys tell you why your customers feel this way, so that you can act to change.

2. Make survey response a priority

Sending customer surveys sounds smart, but what if no one responds to them? It’s for this reason that we say that your NPS response rate has to be the central metric of your CX survey program.

NPS is not a research tool, it’s an action tool. You’re not collecting customer sentiment just to know — you’re doing it to act on the data you collect.

So, aim for a 100% response rate (yes, that’s possible). But even if just one person replies at first, that’s an opportunity to build a better relationship with them.

In B2B contexts, where accounts are hierarchical and will have many different stakeholders, it’s not enough to just have one response from each account (because different stakeholders inevitably have different opinions). Instead, alongside response rates in general, aim to optimize account coverage, too, i.e. the number of people within an account who are responding to your surveys.

This will make a huge difference to identifying and preventing churn risks. If there’s just one person in your account that’s engaged with you, you should consider it vulnerable.

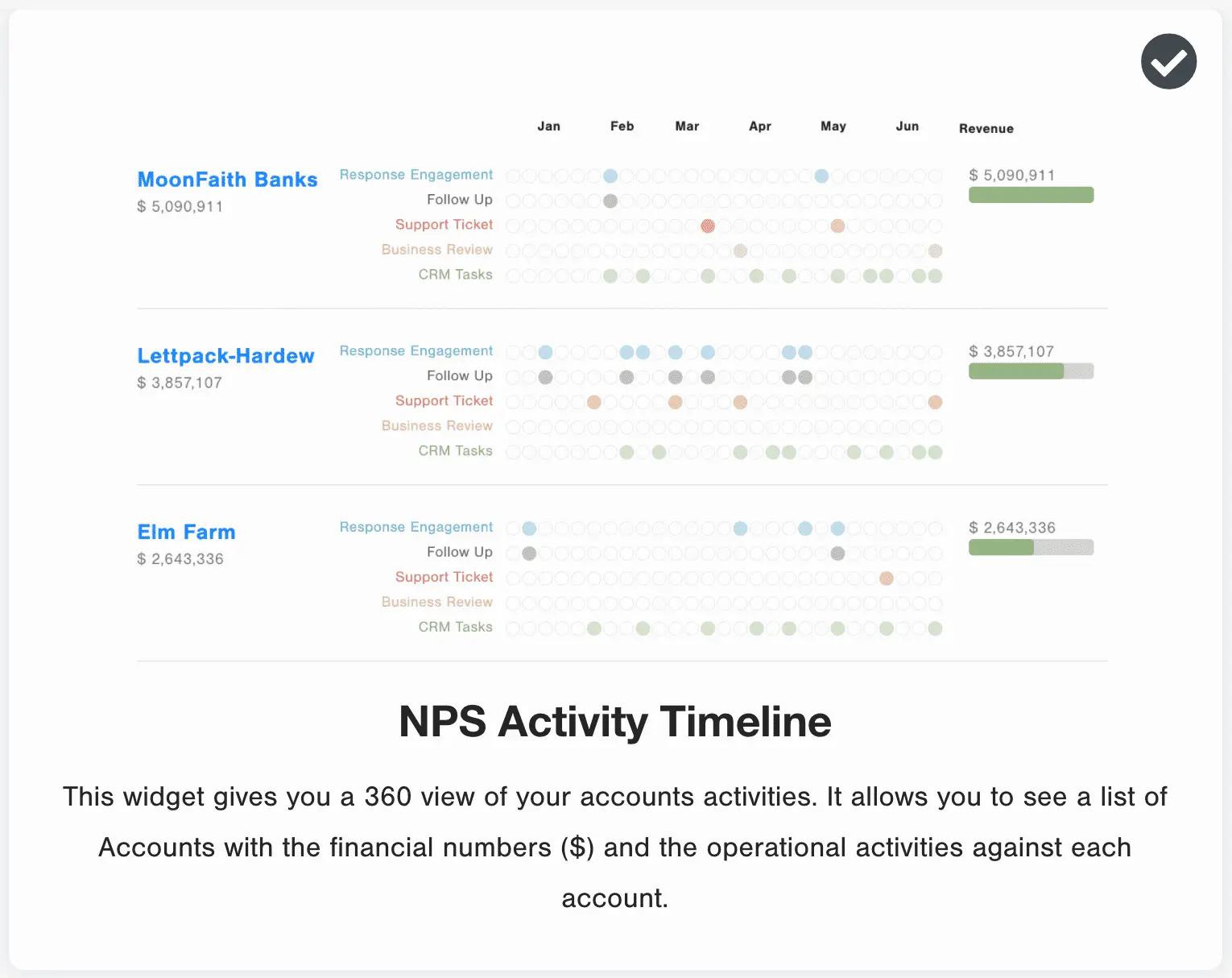

If they’re not responding? Firstly, they should be automatically flagged as customer churn risks, but you can take it further. At CustomerGauge, we’ve built a 360-degree customer tracking tool so you know how your customers are engaging with you, in terms of product usage, CRM engagement, and more.

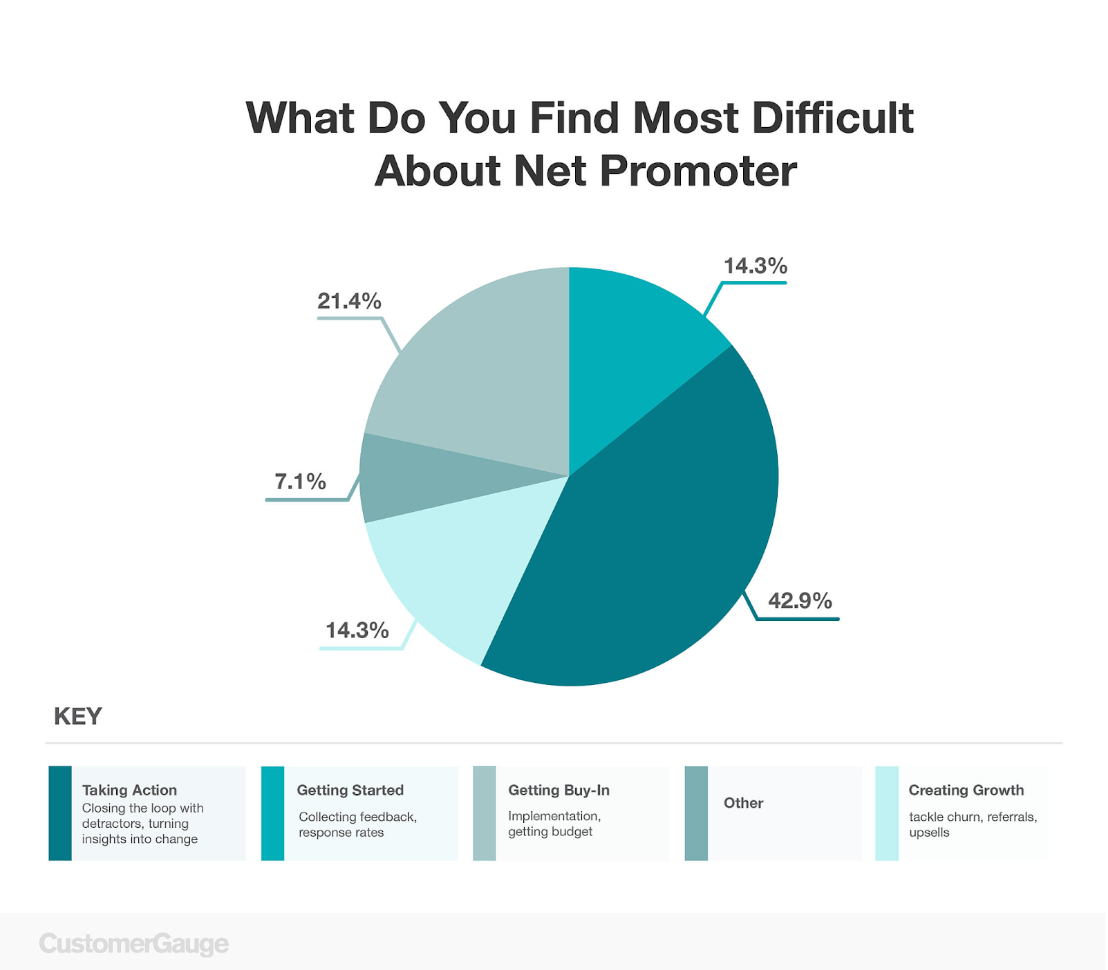

3. Close the loop on customer feedback

We recently ran a survey to ask CX teams what they thought was the hardest part of managing NPS. The winner? Acting on customer feedback and telling customers what’s been done.

That’s a process we call closing the loop, and while it may be hard, it’s one of the most important tasks in preventing churn and earning growth. Our research has found that closing the loop increases threefold the number of promoters and, when done right, can improve retention by as much as 12%.

So, how do you do it right to access that revenue opportunity?

There are two parts. Close the loop as quickly as possible — the goal is under 48 hours.

Then get everyone in your business involved in the process. If a customer is very unhappy, make it the job of even the CEO to reach out and assure them you’re improving. It will show your customers you really care.

4. Tie CX data to revenue

Some accounts are more valuable than others. While the highest-value accounts won’t always be the best opportunities for new revenue growth, there’s no question that they’re the ones you should be making the most effort to retain.

But NPS in its conventional form won’t tell you anything about the financial value of your customer accounts. That’s exactly why we designed monetized NPS.

Monetized NPS ties your customer experience metrics directly to your revenue, to show you the size of accounts most at risk of churn (and those that are the best opportunities for upsells, but more on that later).

For example, if one of your highest-value accounts is a detractor, you need to know and act quickly to retain them.

Revenue Opportunity #2: Find Upsell Opportunities

Preventing customer churn stops revenue walking out of the door. Promoting upsells, on the other hand, earns new revenue from the satisfied customers you already have.

It’s a stat that’s bandied around a lot: retained customers spend as much as 140% more. But that doesn’t just happen by accident — you need to make it happen. And you do that by identifying and seizing upsell opportunities.

How? By understanding which customers are ready to grow and reaching out to them when the time is right.

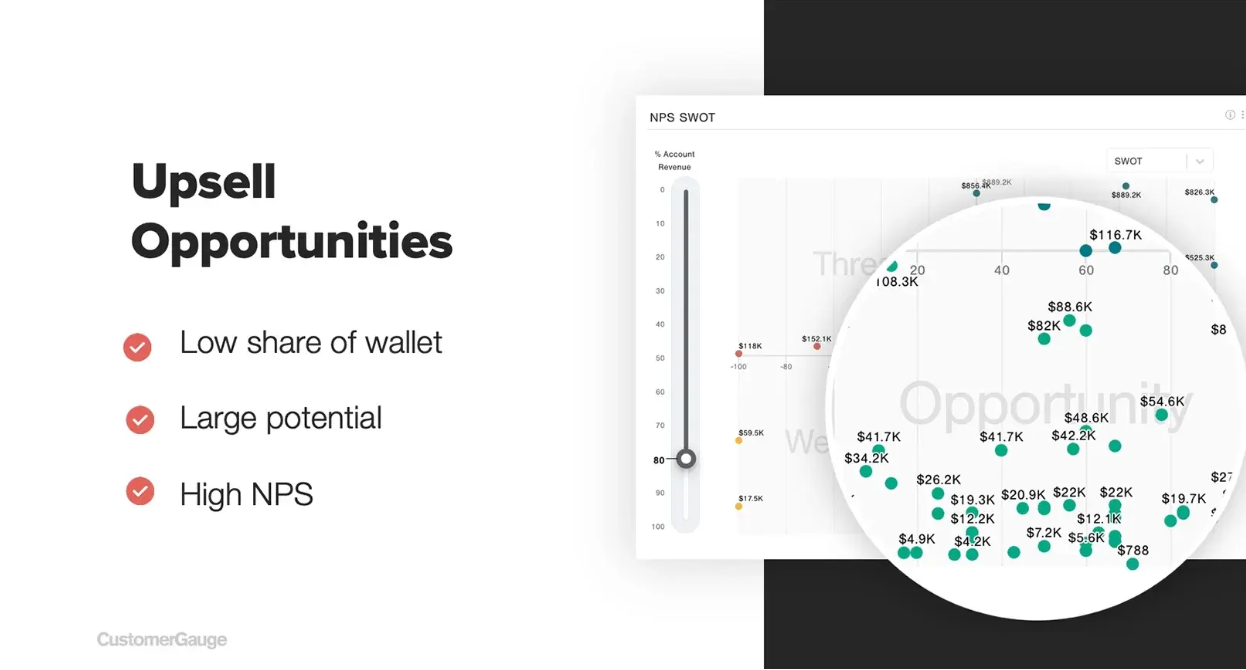

1. Identify opportunities by correlating NPS data with account value

If you’ve read from the top of this guide, you’ll know that tying NPS data to revenue is one of the central elements of managing customer retention. But, as we said, it’s an essential tool for securing upsells too.

CustomerGauge’s SWOT analysis tool, which identifies Strengths, Weaknesses, Opportunities, and Threats, is one of the key weapons in your arsenal for identifying revenue opportunities through upsells:

Each customer that the tool identifies as an “Opportunity” is a customer that has given you a high NPS score and has room to grow. Maybe its contract with you is not as valuable as other companies of a similar size, or perhaps it operates across various locations but only uses your product in one.

That’s your job to find out. But by linking your NPS results with your financial data, you’ll have a clear picture of where your best new revenue opportunities lie.

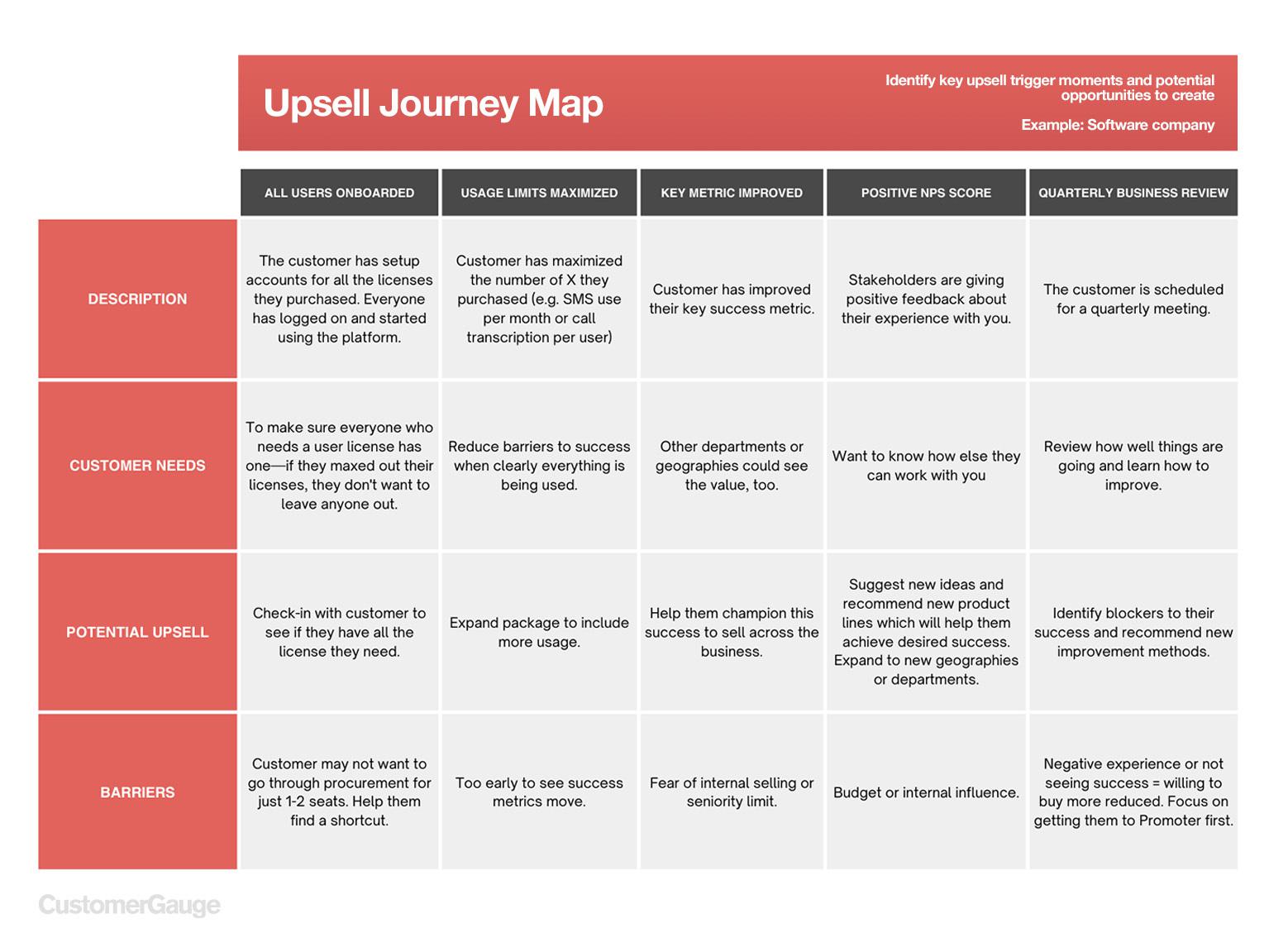

2. Reach out to promoter accounts with room to grow

Once you’ve identified the opportunities, you need to talk directly to those accounts that can give you more.

There are many moments at which you can do this and many ways to make it happen. Often, we find that all it takes is a conversation.

For example, one of our partners recently identified a client account with the SWOT method we mentioned above. They were enthusiastic promoters but they weren’t spending as much as they could have.

Our partner approached them to ask why.

It turned out that the client had three separate units each with their own buying committee, and while one unit was very happy with the product, the others didn’t know it even existed.

So our partner asked for a recommendation. And guess what? That simple conversation soon led to a $30 million deal.

Not everyone can be that lucky, but it’s always better to ask. We find that a customer journey map can help you identify the right moments to do exactly that.

3. Offer detractors the chance to switch proposition

You might not immediately think that an unhappy customer would be a great opportunity for upsells, but you’d be surprised.

Customers who are aren’t utilizing the product the best they can be for their business are likely to be unsatisfied with what you’re offering. They may not have enough users or thave the features they require.

In these cases, it’s possible to upsell them onto a product that better suits their needs.

Of course, while it makes for a great revenue opportunity, it’s a difficult one to get right. You need to know your customer’s feelings and struggles inside out and your product range well, too.

Revenue Opportunity #3: Customer Referrals

Account management teams typically know the importance of retention and upsells (although they may not always link that to customer experience).

What gets overlooked far too often is how important referrals are as a revenue opportunity for B2B brands. The reality is that referred customers have a 16% higher customer lifetime value than other customers.

According to a study in the Harvard Business Review, 84% of B2B sales start with a referral.

Yet, too often, this whole revenue pipeline is left down to chance. Our research found that 54% don’t have a formal B2B referral program of any sort and only 9% link their referrals to their customer experience program.

So, how do you build a referral program that helps you identify and seize new revenue opportunities? Net Promoter Score is the starting point once more. Your promoters are those you need to leverage.

Here’s what we do at CustomerGauge (feel free to do the same!):

We start with quarterly NPS surveys to every customer and multiple individual stakeholders in each account. The aim is always to ensure high response rates.

Whenever a customer leaves a “Promoter” score, our teams receive a notification.

Then we set the clock. Someone is assigned the task to reach out to the promoter and ask for something: a referral, a case study, a review. They have 5 days to do it.

They complete the task, or an alert warns them when the deadline is approaching.

It’s really simple, you just need to make sure you do it. If you don’t ask, you don’t get, and when that’s potentially millions of dollars in new revenue, it’s a real missed opportunity.

Use Customer Experience for Growth With CustomerGauge

At CustomerGauge, we can help you make the most of new revenue opportunities. Our Account Experience program is designed to support earned growth, by automating and optimizing your processes for driving retention, securing upsells, and ensuring customer referrals.

But what’s at the heart of all this? Customer experience. Without monitoring how your customers really feel about you, you’ll inevitably leave revenue on the table.

Never miss a revenue opportunity again. Book a demo to find out how Account Experience works!

Learn more about Account Experience through our customer experience courses & training.