In a previous article, we explored the fundamentals of measuring and monitoring customer retention and revenue retention. In a similar vein, we will now dive into a metric familiar to almost any B2B or B2C business: Customer Lifetime Value (CLV).

What is Customer Lifetime Value?

Customer Lifetime Value (CLV), also referred to as Lifetime Value (LTV), is the net profit that can be attributed to a particular account over their relationship with a company.

Extending the lifetime of a customer (i.e., retention) is important for sustainable growth. After all, the value of a loyal customer can’t be understated. Loyal customers…

- Stay longer

- Buy more

- Refer your brand

- Are less price sensitive

- Are easier to serve

- Provide constructive feedback

In their report, Mastering Revenue Lifecycle Management, Forbes identified the role cloud software and SaaS have played in deepening the intimate relationships between vendors and B2B customers.

Companies can no longer rely on products and services to set their brand apart from the competition. A focus within B2B on amplifying experiences and more clearly translating business outcomes is being given greater prominence.

Part of improving CLV is understanding the various areas that can impact it. Having a deep understanding of the customer journey, the touch points within it, and the impact on lifetime value is necessary.

In the remainder of this article, we’ll look at steps for calculating CLV, and how companies can monetize CLV to generate growth within their accounts.

How to Measure Customer Lifetime Value

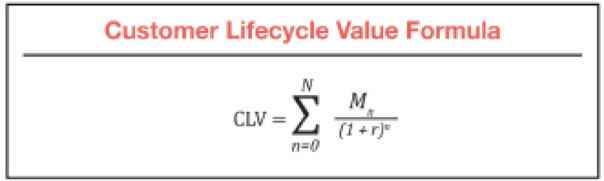

As mentioned, CLV is the net present value of the future stream of cash flow attributable to a customer.

The equation for calculating the CLV is as shown:

Without getting too overcomplicated, here’s how we define the known elements:

- N is the customer lifetime in years

- Mn is the margin in year n, i.e. the revenue minus operating costs

- 1 / (1 + r)n is the discount factor (and r the discount rate)

Currently, several factors are unknown. To calculate the CLV, companies can use varying levels of sophistication and accuracy, ranging from a crude heuristic technique to complex predictive analytics. To better explain the formula, let’s use an example.

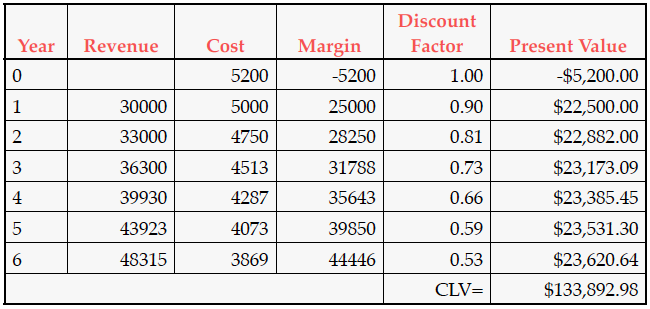

In the table above, we show how to calculate the CLV within a B2B non-SaaS tech example, where a customer has an average lifetime of 6 years.

For simplicity sake, we will assume that the discount rate is 10% per year. When we continue the calculation for every year and add all present values, we get a CLV of $133,892.98. As the example illustrates, CLV grows, unsurprisingly, with the customer lifetime. In addition, it grows exponentially with the retention rate. Let’s see how:

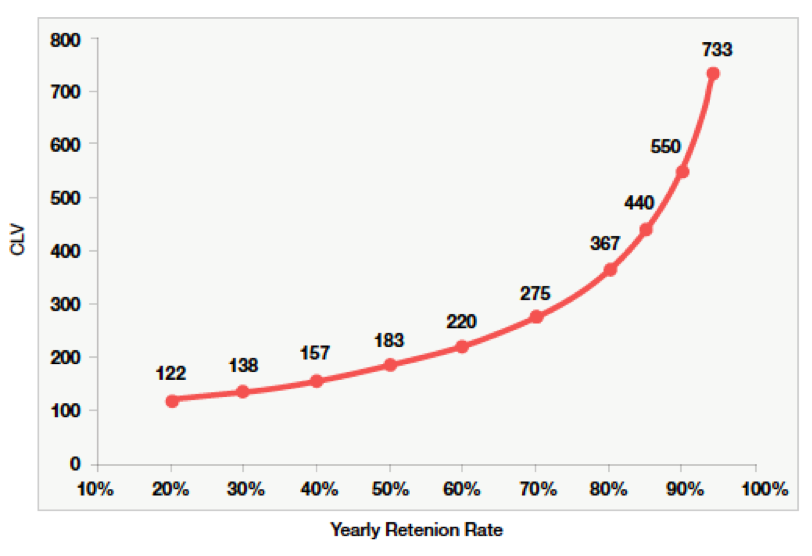

In the previous example, we used numbers that reflect a B2B non-SaaS company to better understand CLV. In the next chart, we simplified our numbers to show the impact of retention on CLV.

This example assumes that a customer has a profit margin of $100 every year and the discount rate is 10%. If the retention rate is 20%, the customer pays $100 the first year and an average of $20 the second year, which discounted gives a CLV of $18.18. In year 3, there are only 4% of customers left that contribute with a CLV of $3.31. Adding contributions from every year gives a CLV of 122.

A retention rate of 10% more has a different impact on CLV, depending on the initial retention rate. If you improve your retention rate from 20% to 30%, the CLV only grows by $16. However, if you grow the retention rate from 80% to 90%, the CLV grows by $183. So, the higher the retention rate, the higher the impact on the CLV.

How to Monetize Customer Lifetime Value

In a previous article, we discussed how roles like the Chief Revenue Officer are tasked with maximizing the customer revenue stream, in unison with sales and CSM.

Companies looking to monetize their CX program and grow CLV need to do more than just measure lifetime value. To begin building a monetization strategy around CLV and your CX program, your company must determine the following:

1. The value of an account (CLV)

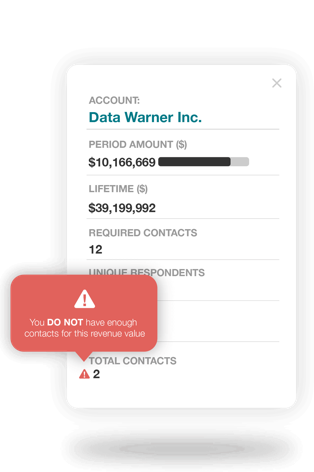

In the previous sections we defined CLV and provided steps for measuring it within your own business. At CustomerGauge, our clients use something called “Account Ranking” to prioritize follow-up with accounts by revenue. This feature also enables account managers to identify those accounts who may not have the necessary amount of contacts based on revenue.

2. The journey of an account (customer journey)

After measuring the value of an account, it’s important for your company to map the touch points along the customer journey. Below we see a fairly simple example of a SaaS-based customer journey.

Looking at the above journey, companies should try to answer the following:

- Do we know the pain points within this journey?

- Do we have a way to track the activities in this journey?

- Are we measuring the satisfaction in these touch points?

- Do we know what improvements will increase satisfaction?

- Do we understand the ROI of increasing satisfaction within certain accounts?

Answering many of these questions will lead your company into the next 3-5 steps. However, understanding the types of activities that occur in a customer journey is something to be answered now. Within a B2B SaaS journey, there are a multitude of activities that can take place: support tickets, email activities, product usage, etc. All of these “puzzle” pieces make up a company’s account experience.

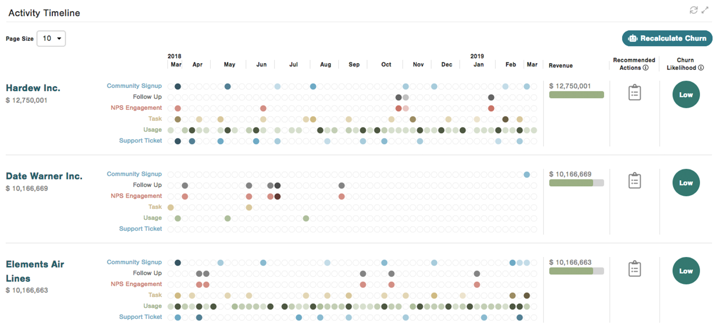

CustomerGauge clients use a feature called “Account Vitals” to monitor the frequency of these activities over a monthly timeline. This enables the system to calculate the likelihood of possible churn.

3. The satisfaction of an account (NPS® or other relevant satisfaction metrics)

Tracking activities is great for understanding CX and its impact on CLV. However, directly asking your customers how satisfied they are on a quarterly- or touch point basis will always be a powerful tool to understand customer sentiment and satisfaction. Companies can do this using Net Promoter Score®(NPS) surveys or other surveys such as CSAT and CES.

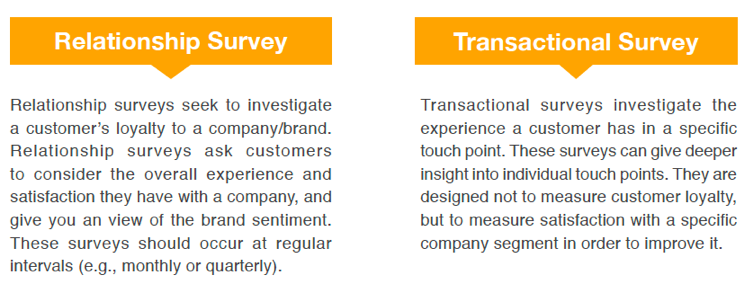

In a previous article, we discussed the importance of relationship and transactional surveys in capturing satisfaction data within the customer journey. In terms of NPS and it’s correlation to CLV, surveys enable you understand if your accounts “value” your brand.

You can learn more about customer journey mapping, and survey best practices, in our NPS® 101: Mastering Omni-Channel Customer Experience with NPS eBook.

4. The drivers of satisfaction (NPS drivers)

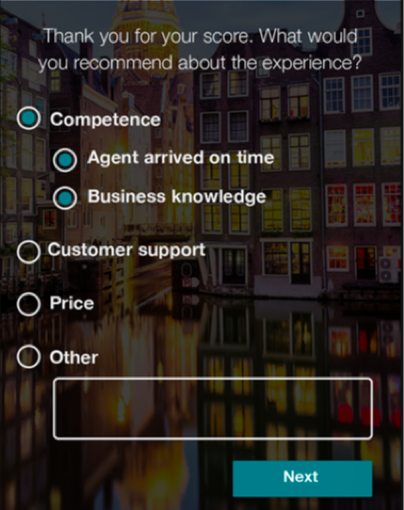

Within each survey, you should include drivers representative of your various touch points (relationships surveys) or aspects of a particular touch point (transactional surveys). Not only does this keep your surveys short (thus, increasing the likelihood of someone completing it), but it more accurately pinpoints root cause.

5. The opportunities that exist in an account (up-sales, cross-sales, referrals, reviews…)

With all the information you’ve gathered, it’s now time to maximize your CLV opportunities. There are a number of methods that companies can use to increase an account’s CLV:

- Referrals

Almost 84% of B2B sales come from a referral, according to Harvard Business Review. One way to increase the value of an account is to understand the referral opportunities it presents and establish a referral marketing program to manage these opportunities. - Up-sales/Cross-sales

As your accounts grow, additional opportunities may present themselves. Tracking opportunities around up-sales for new, relevant features to enhance CX, and cross-sales for presenting similar alternatives that may increase satisfaction, is necessary for monetizing CLV. - Reviews

More than 70% of consumers—and 85% of millennials—ask the opinion of others before making a purchase. Reviews, especially in the technology industry, are incredibly vital for generating new business. B2B buyers are also actively seeking reviews for vendors using tools such as G2Crowd. The winning combination for B2B businesses when it comes to reviews is coupling them with their CX survey program. CustomerGauge clients do this by embedded a final question at the end of surveys to request if their comments can be published on a CustomerGauge-hosted site for their brand. Learn more about using reviews as part of a CX program in our previous post.

Account executives and sales leaders use CustomerGauge's NPS SWOT tool to identify accounts that are good candidates for up-sell or referral opportunities.

Conclusion

Identifying opportunities to monetize CLV isn’t possible without the right tools—and the ability to track CX in real time. At CustomerGauge, our clients use the Account ExperienceTM platform to prioritize follow-up, identify possible churn and monetize accounts.

If you’re looking to monetize CLV and streamline your B2B customer experience program, schedule a demo today with one of our experts.