You may have already heard the story of how Bain & Company turbocharged growth at Dell by improving its customer lifetime value.

In the early days of the Net Promoter Score (NPS), Fred Reichheld and his team at Bain were working with the computing giant, Dell, to find ways to improve growth.

After a classic NPS analysis, identifying promoters and detractors and understanding how much they were worth, Bain found that Dell’s customer lifetime value (CLTV) was about $210.

That was the amount of cash that Dell was receiving from its average customer over its average lifetime. And it was clear why that wasn’t higher: every detractor (i.e. someone unhappy with their customer experience) was actually costing Dell $58.

Although, their promoters were earning them a whole lot more — $118 more than the average customer.

What did Bain suggest to improve Dell’s growth? Doing everything to maximize customer lifetime value. How? By working to improve Dell’s customer experience (CX), or, more specifically, by converting those costly detractors into promoters.

The result? Through the simple act of making customers happier, Dell could improve its CLTV and its bottom line by as much as $167 million.

This story shared in Fred Reichheld’s book The Ultimate Question 2.0,was groundbreaking in a number of ways. Most importantly, by linking CX to CLTV and revenue growth, Bain proved that improving experience increases lifetime value. And that’s a lesson that every business should learn.

In this article, we’ll show you how to maximize your customers’ lifetime value by focusing on their experience.

What Is Customer Lifetime Value?

Customer lifetime value is the total dollar value that you gain from a customer over the entirety of their engagement with your business. It’s not the value of a single transaction, but the sum of all the transactions they complete with your brand.

Businesses that are serious about growth want this metric to be high. But at the bare minimum, it must be higher than the cost of customer acquisition (CAC), which is the sum you’ve spent (on marketing and sales, for example) bringing a customer in.

If the ratio of CLTV to CAC is below one (if CLTV is lower than CAC), that’s bad news.

It means your relationship with your customers is actually costing you money. Imagine if all of Dell’s customers were detractors. You’re spending money to secure customers, but then they leave too soon to have made that initial investment worthwhile.

So, what can you do about it?

There are only two ways to fundamentally increase your customer lifetime value:

You can increase the amount that customers are spending in each transaction, through upselling (or, more crudely) putting up your prices. Or…

You can increase the length of the relationship, i.e. the length of the lifetime itself.

We’ll dig into both of these below. As we hinted at in the example of Bain at Dell, there’s one crucial element that often gets left out of conversations about CLTV, and that’s customer experience.

Ultimately, the most effective way to increase both the amount and the lifetime of spending is by improving the experience of your customers.

In short, you should make them want to stay and build a deeper relationship with you.

This is what happened with Dell: rather than detractors, they wanted promoters, who were loyal, would upsell, and refer them to other possible customers, too.

I think there’s a mistake in just looking at customer lifetime value as a single metric or equation. At CustomerGauge we always tie loyalty to customer lifetime value, because at the end of the day we’re trying to create loyalty to generate revenue and income. We think that’s the right thing to do. But it means that even if you have all the variables of CLTV in place, there’s always an emotional element in there, too.

How to Increase Customer Lifetime Value With Voice of Customer

Increasing customer lifetime value starts with measuring and improving the customer experience. To do that, you need voice of the customer (VoC).

Voice of the customer (VoC) is the name for the tools, processes, and techniques you use to measure and optimize your relationship with your customers. It’s the way you can listen to your customers across all channels and ensure their feedback reaches the right people in your business.

However, there’s one problem when it comes to the battle to increase CLTV: most VoC providers and CX “experts” don’t link VoC data to revenue. Instead, they’re happy to spray out CX surveys and sit on the results, without actually putting that information to good use.

At CustomerGauge we say this: to have an impact, CX data needs to be tied to revenue growth, i.e. to action that promotes growth. That’s the only way you’ll increase your CLTV.

And that’s why we put revenue at the heart of Account Experience (AX), our VoC program and methodology you can learn through customer experience courses & training.

Cary T. Self says, “Tie every aspect of your program to revenue. Not only is this the most important metric that your leadership and investors are constantly looking at, but it will also help you prioritize what’s most important. With limited time and money, you have to make decisions on what will have the biggest impact on your business growth.”

1. Improve retention by turning detractors into promoters.

2. Upsell when the time is right to provide customers with extra value.

3. Secure referrals from your most loyal customers.

These are the three actions you can take to increase your customer lifetime value through VoC.

In short, it’s about putting the customer experience first.

1. Improve Customer Retention

Increasing your CLTV starts with increasing your customer retention. The logic of this is simple: by preventing customer churn, you’ll extend the lifetime of your customer relationship and ensure continued spend.

But how do you actually improve customer retention? While you can find a whole host of pointers in our guide to strategies to reduce customer churn, there are four fundamentals that you need to get right.

a. Measure customer sentiment with NPS

Your CLTV-boosting strategy should start in the same way as it did at Dell: by collecting customer sentiment with Net Promoter.

NPS is a form of customer survey that measures the level of customer loyalty. It’s a quick survey that we recommend you conduct every quarter to get a continual stream of customer feedback.

From the responses, you can see which accounts are happy and safe (your promoters) and those which are unhappy and at risk of churn (your NPS detractors). Crucially, the surveys can tell you why your customers feel this way so that you can act to change it.

For the purpose of cutting customer churn, any account that doesn’t respond to the survey should be considered at risk too.

Read more: NPS Analysis: 4 Ways to Analyze NPS Survey Results

b. Improve your NPS response rate

Your NPS response rate is one of, if not the most important metric in your customer experience management program.

It’s all well and good if customers explicitly tell you why they’re unhappy, but if customers don’t respond at all, you need to work harder to ensure you take the right action.

At CustomerGauge, we help all our clients aim for 100% response rate to ensure they’re reducing churn the most effectively.

However, for B2B brands, it’s not just collecting single pieces of feedback from each account that matters. Rather, it’s crucial that you have wide coverage across every level in each account, from CEOs to frontline staff.

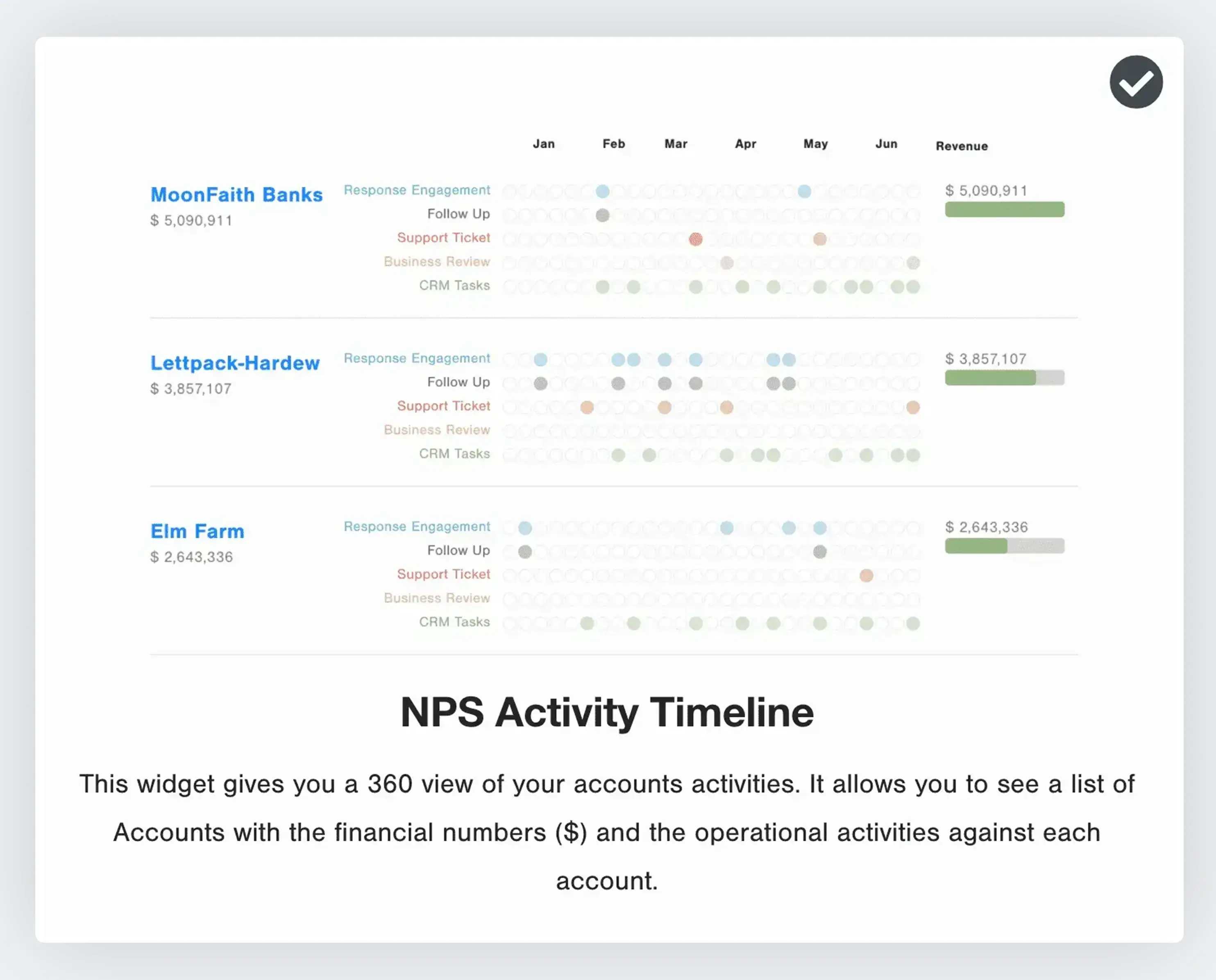

If they don’t respond, you have other ways to identify those at risk of churn. For example, Account Experience helps our clients measure engagement through product usage, business meetings, and support tickets.

Again, it’s a way for you to engage with customers that aren’t responding, which is crucial, as these are the most likely to churn.

c. Close the loop with every customer

So, you’ve received customer feedback. Now you need to act on what your customers have told you.

We call this closing the loop, and it’s perhaps the single most effective way to reduce customer churn. The simple action of letting your customers know you have listened by making changes to your service and telling them that you’ve done so, can help you improve retention by as much as 12%.

In fact, in recent research, we found that businesses who quickly close the loop with customers have 3x more promoters next time they run the survey. As Bain saw at Dell, increasing the number of promoters is a surefire way to increase your CLTV.

d. Tie account feedback to revenue size

Finally, for the sake of your CLTV, it’s natural that you’d put greater effort into your high-value accounts than those of a lower value. Despite this, 70% of businesses aren’t connecting their CX programs to financial metrics at all (according to CustomerGauge research).

To get the most out of your NPS, you need to understand exactly how much value is at risk from churn, as well as the areas in the customer journey that are impacting the most on retention.

Account Experience can tell you exactly that. Our tools split all customers by NPS and revenue, so you know exactly where to drive crucial churn-preventing resources.

2. Seize Upsell Opportunities

At the same time as fighting churn, an essential way to increase customer lifetime value is to encourage upsells among your customers. This way, you’ll build a deeper relationship with your customers and create more value both for them and for you.

But securing upsells shouldn’t be done indiscriminately. It’s not always the right time to upsell to customers. Simply, they’re not always ready, and the wrong pitch at the wrong time can drive them away.

That’s why at CustomerGauge we talk about upsell opportunities. Using the data you’ve collected through Account Experience, you can accurately identify the moments when customers are open to upgrading their service or product, which in turn, increases their CLTV.

Here are two ways to do that:

a. Sell to promoters who want more value

Happy, loyal customers:your promoters, are your best contenders for upsells.

Typically, they’re satisfied with their experience, engaged with you, and already told you in their NPS survey that they would be willing to refer you to others.

For example, one of our partners recently shared a story of how they simply upsold one customer. Their top promoter, while obviously very happy, was not spending as much with them as other companies of their size.

So, our partner just asked them, “You’re our best promoter, why don’t you buy more from us?”

It turned out that the company was divided into three units, each with their own buying committee. And while one unit was a strong promoter, the others didn’t even know our partner existed.

Next question: "Well, you're our promoters. Can you recommend us to the other teams?".

The result? A $30 million revenue deal from just a single conversation.

Lesson learnt: if you believe you could get more from your relationship with a promoter, they’re probably ripe for upsell.

When you’re thinking about upsells to customers, consider the following:

Are they a large company, but with only a small contract? This likely shows that a customer account could expand its users.

Is there only one geography in their business that’s using your product? They could be upsold so that your product is being used in every market they operate in.

Are they spending less with you than other brands of a similar size? This is how our partner identified their upsell opportunity.

All of these signs, alongside high NPS scores, indicate that your customer could be very receptive to upsells.

b. Offer detractors the chance to switch products or services

While it might come as a surprise, you can upsell to detractors, too.

Customers are unlikely to be satisfied if they’re on the wrong product. For example, they might not have access to the features that they require, or may not be able to support all the users they need.

It’s possible to get more value from that relationship while offering them a product they might prefer (and so turning them from detractors to promoters), but it needs to be done skillfully.

You’ll need to:

Know how your customers are feeling and why. It’s not enough to know they are detractors — you need to understand how your product is letting them down.

Know your product range inside out. If a detractor has a specific pain point, you’ll need detailed knowledge so you know exactly how to solve it for them.

This form of upselling is like closing the loop, and can be an extremely effective way to increase your CLTV.

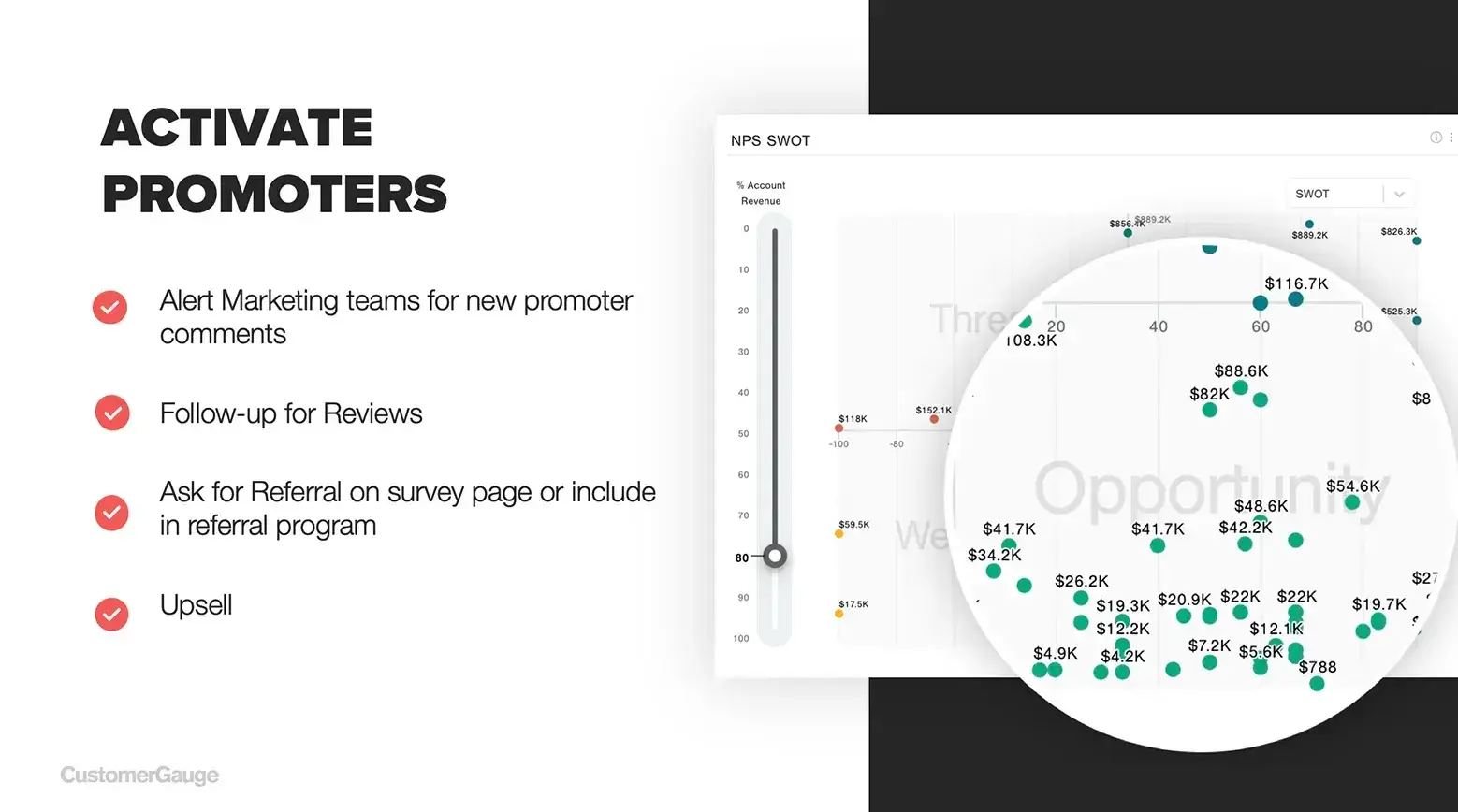

Top tip: Ultimately, upsells start by linking sentiment to revenue

To drive real increases in CLTV with upsells, we need to return to the point we raised earlier: to find opportunities for account growth, you need to link up your CX data with your revenue.

That’s what Account Experience’s SWOT analysis widget is for. We can help you identify Strengths, Weaknesses, Opportunities, and Threats among your accounts.

When you’re thinking of upselling, “Opportunities” is the segment you should focus on.

These are the customers with high NPS scores but with room for revenue expansion.

3. Secure Referrals from Loyal Customers

The third and final element of increasing customer lifetime value is the one that usually gets forgotten.

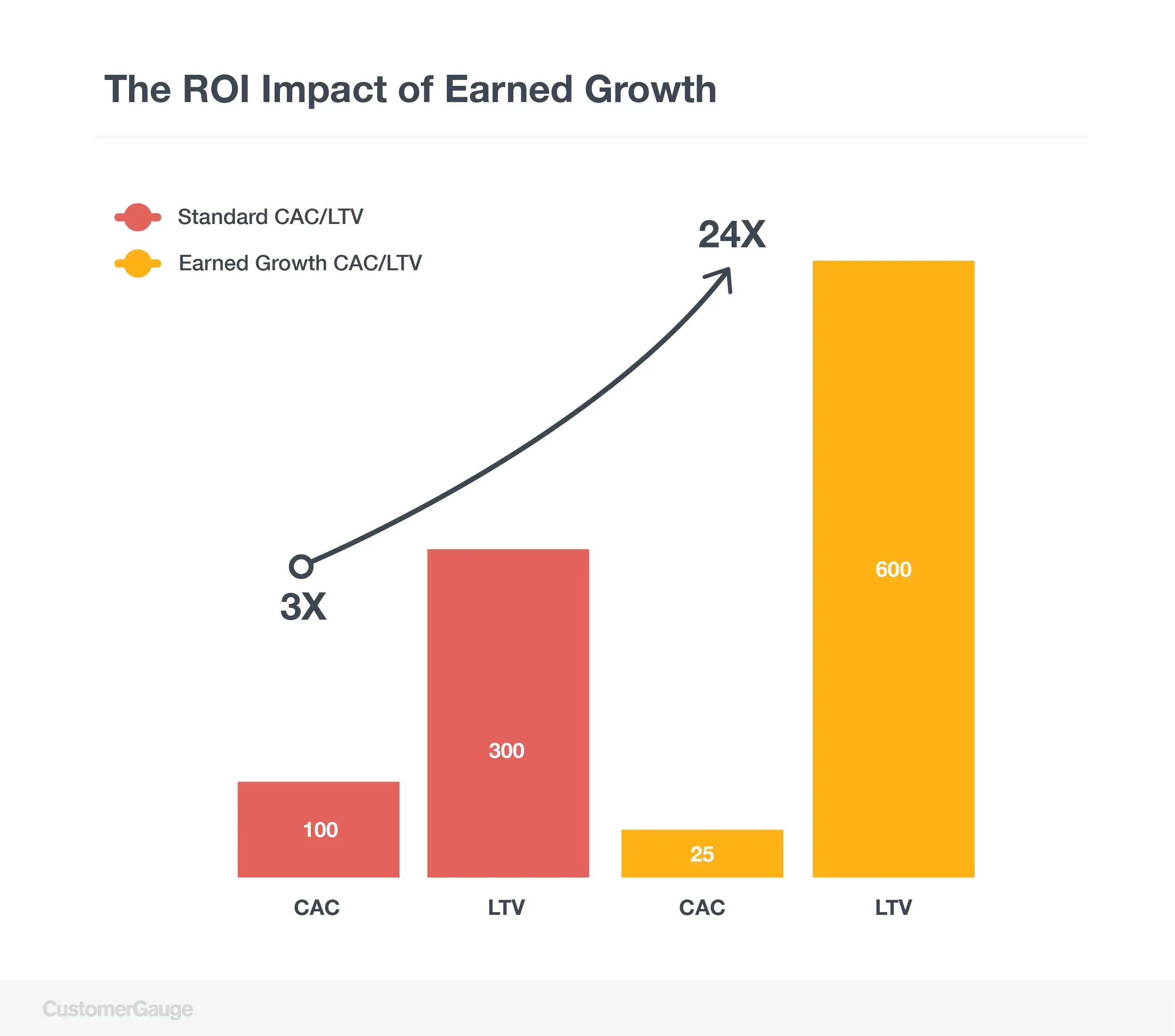

Reducing churn extends the customer lifetime, while upsells increases their value. But customer referrals drive CLTV without increasing customer acquisition costs at the same time.

This way, your can completely transform the relationship between CAC and CLTV, increasing the ratio by as much as 8X.

But how do you secure referrals? You need to leverage your promoters, i.e. those customers who said that they would refer you in your customer surveys.

We found that 63% of businesses aren’t tracking referrals as a result of their VoC program. But as the chart above shows, it’s one of the most effective ways to increase your customer lifetime value.

Maximize Customer Lifetime Value With CustomerGauge

At CustomerGauge, we can help you cut customer churn, take advantage of upsell opportunities, and drive growth through referrals. Informed by your customer experience data, these are the three essential ways to increase your customer lifetime value.

What’s more, with our Account Experience software you can automate all of these processes, from survey distribution and closing the loop to building a referral program that works.