Imagine two companies working hard to drive growth.

However, as they’re following different strategies they begin to see very different results.

Company A is focusing on acquisition, putting everything into winning new customers through discounts, deals, and marketing campaigns. There’s growth, sure, but the company is spending huge amounts to buy that growth (and hasn’t noticed that many of these new customers have walked out of the door).

Now, picture Company B. It has a different approach to driving revenue. Rather than upping their marketing budget to buy new customers, they want to earn their customers and growth through customer referrals and upsells.

What’s powering that growth is not paid-for customer acquisition, but an incredible customer experience.

This way, Company B is seizing the missed revenue opportunities that Company A isn’t even aware of, and the results are substantial. In fact, our research shows that companies that invest in customer experience (CX) see revenue opportunities that are 8x higher than other companies.

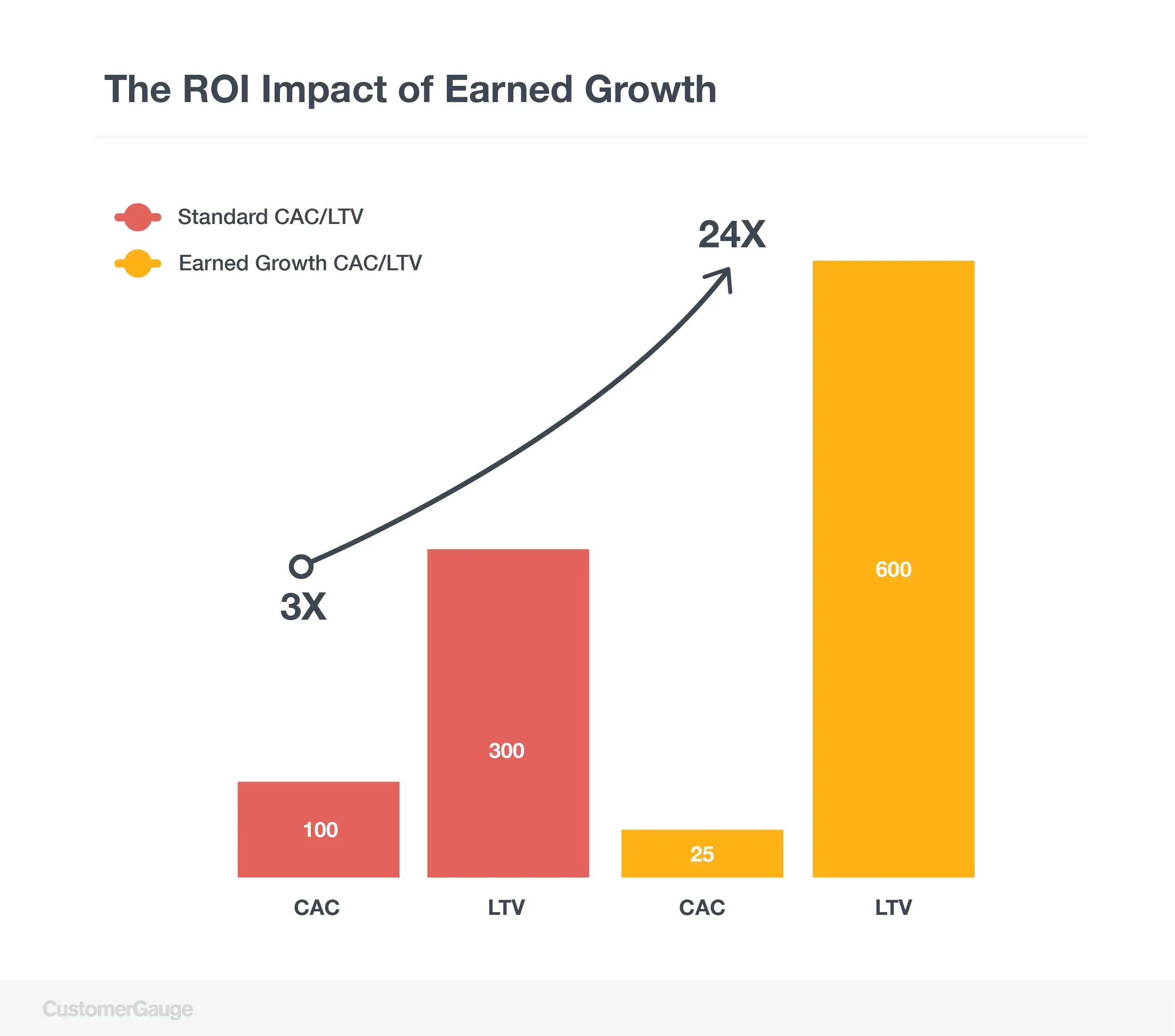

Thanks to their efforts to improve customer experience, their customer acquisition costs (CAC) are lower while the lifetime value (LTV) from each customer is higher, as the graph shows:

The sad reality is that most companies are Company A, i.e. they aren’t focusing on customer experience. And as a result, they’re missing incredible opportunities for revenue.

In this article, we want to talk to you through what most companies are getting wrong. We’ll share the key revenue opportunities most companies are missing so you can start being more like Company B.

Two Mistakes That B2B Brands Are Making

Let’s start with where most businesses focus their attention.

Before we do though, a caveat.

These are not bad strategies in and of themselves. But you’re limiting yourself by only putting your efforts here, because by doing so, you’re missing the opportunities for earned growth.

So, which are the all-too-well-trodden paths B2B companies take?

1. Customer Acquisition at Any Cost

Just like Company A, most brands put too much of their energy into customer acquisition.

In some ways, this is great — new customers are always welcome. However, a single-minded approach is likely hampering your growth.

Because if you’re spending too much on acquisition, you’re likely not getting as much value from your customers as you should be getting.

Let’s be more precise. Every business should be tracking a key metric: the CAC:CLTV ratio, or the ratio of “customer acquisition costs” to “customer lifetime value”.

Here’s what those two terms mean in more detail:

Customer acquisition costs. Securing customers in a conventional way costs money through marketing, sales, and outreach processes. You can calculate the cost of customer acquisition by dividing the sum of all of these processes by the number of customers you have.

In B2B, these costs tend to be higher due to longer, more complex buying processes.

Customer lifetime value. This is the amount of value that customers bring into your business over the entirety of their relationship with you. If they stay for longer, this will be higher.

B2B brands typically have much higher CLTV than B2Cs and they should aim to get them as high as possible.

The dream is to have a very high CAC:CLTV ratio: which means having a high LTV and a very low CAC (it’s possible, just as Company B did, and we’ll show you how below).

But most brands aren’t doing that. Instead, they pump millions of dollars into their marketing budgets in an attempt to acquire customers at any cost.

Of course, that means that customers are often contributing very little value (in CLTV) compared to what you’re investing in them — and that means limited growth.

2. Getting Retention Wrong (By Neglecting Customer Experience)

Secondly, after customer acquisition, companies often focus on reducing customer churn.

And rightly so. Every customer you retain increases their lifetime value and improves your CAC:LTV ratio, accelerating growth. That’s exactly what you want and that’s why, at CustomerGauge, we’re committed to helping B2B brands maximize their customer retention!

Of course, it’s often the brief of account managers to improve customer retention no matter what.

Yet in many companies, the approach can be a little wrong-headed. For example, while they’re working hard to reduce revenue loss, what they’re not doing is attending to opportunities for growth.

That means customers are not nurtured to stay — they’re won over on an ad-hoc basis, often through panicked firefighting methods. Instead, their customer loyalty should be cultivated and they should be encouraged to get more value from you over time, share the word of your business with others, and help build your revenue.

Here we come round to the most important missed revenue opportunity there is: customer experience. It’s only this that will put you on the path to sustainable business growth.

Why Customer Experience Is Crucial to Earning Growth

Too many businesses are focusing on buying growth, not earning it. And simply, that’s because they’re neglecting customer experience.

Nearly half of business leaders say that CX is one of their biggest priorities for 2023 and beyond. Yet at CustomerGauge we found that 70% of businesses aren’t tying their CX to growth.

While businesses want to optimize CX, they’re missing out on its real potential.

Why? A customer experience management (CXM) program helps you seize revenue opportunities by giving you insight into what your customers actually think and feel about your business:

CX tells you if customers are likely to churn, and why. If customers aren’t satisfied, find out in advance and intervene before they become churn risks. Rather than simply reacting to customer complaints, as most businesses do, be proactive and build an experience throughout the customer journey that makes people want to stay.

CX shows you whether customers want more. Growth isn’t just about preventing churn — it’s about expanding revenue in your retained accounts. For instance, upsales are a frequently missed revenue opportunity, simply because businesses don’t know when and how it’s right to do it.

Finally, CX reveals how likely customers are to recommend your brand to others. Referrals are the cornerstone of earned growth as they allow you to acquire customers without cost, immediately improving your CAC:LTV ratio.

But our research shows that 63% of businesses don’t track referrals as a result of their customer experience program, and so are not seeing how CX can drive growth.

Customer experience should be at the heart of your strategy for earned growth. But how can you make it a reality?

How to Seize Missed Revenue Opportunities With Customer Experience

Here, we’ll run you through each of the above in detail: battling churn properly, securing upsells, and seizing referral opportunities.

Securing Revenue Retention

As we mentioned, most businesses dedicate a lot of their account managers’ time to preventing churn. That’s great, but while it can keep LTV high, most businesses aren’t doing it in a sustainable, structured way (i.e. through customer experience management).

Rather, to do it smartly, you should be building a customer experience program that does three things:

1. Gain regular insight into which customers are happy, unhappy, and why (using NPS)

Rather than reacting to churning customers when it’s too late, tracking your customer experience throughout your relationship gives you insight into how customers are feeling before they churn. That’s what Net Promoter Score (NPS) is all about.

At CustomerGauge, we teach all our customers about the two types of NPS surveys:

Relationship surveys, which engage your customers every quarter, to track the overall health of your relationship

Transactional surveys, which survey your customers on the basis of specific transactions, such as purchases, deliveries, or customer service engagements.

By running both types of surveys, you’ll never be blindsided by churn and have to scramble to keep up.

Rather, NPS surveys will help you predict whether customers may churn and enable you to better direct your account management resources to those customers who are most at risk.

2. Close the loop on all feedback (negative and positive)

Surveying customers is one thing, responding to (and acting on) their feedback is another. That’s what we call closing the loop, i.e. returning to customers to show them that you’re listening.

It’s not an action that most businesses associate with growth. Less than half of B2B companies close the loop with every customer. However, we found that doing so makes customers three times more likely to become promoters next time you survey them — and it increases retention by as much as 8.5% overall.

Your customer experience program (your growth strategy) should have closed-loop feedback built into its very core. For example, at CustomerGauge, negative feedback is immediately distributed to account managers who are then given a strict time frame in which to act.

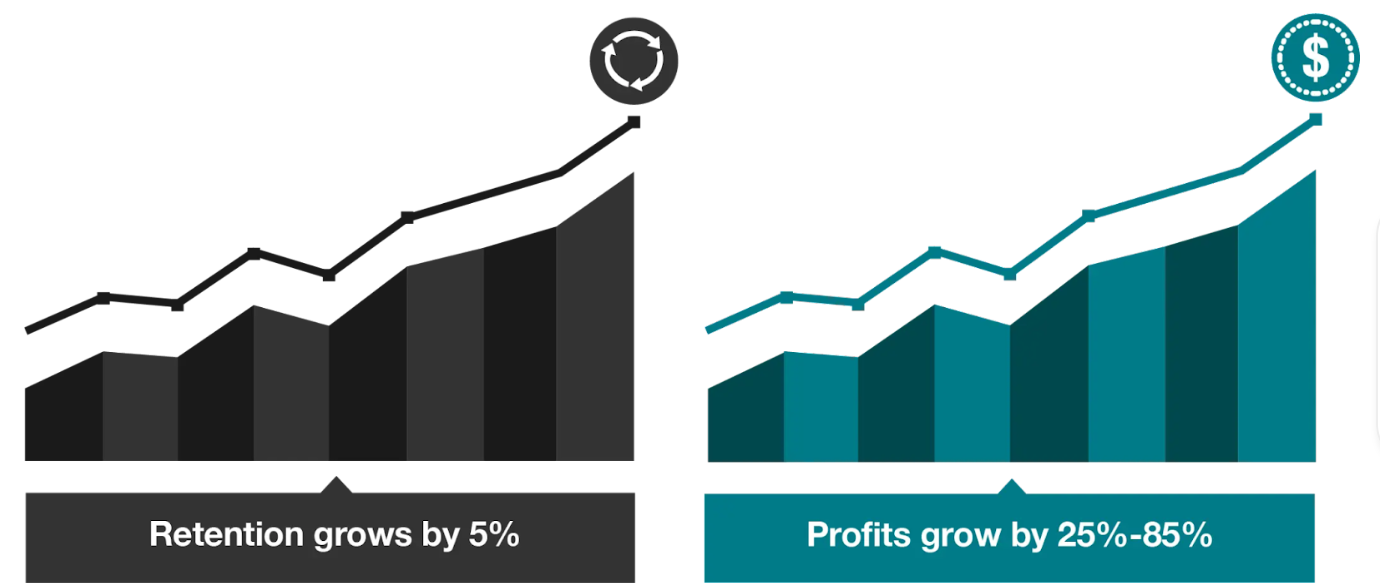

Closing the loop well is a revenue opportunity. Remember: a 5% increase in retention can improve your revenue by as much as 95%.

Continue reading for closed loop feedback and best practices using CustomerGauge.

3. Tie CX data to revenue

Finally, there’s one thing that can get forgotten in account management: not all customers are worth the same in terms of revenue.

When it comes to growth, this is fundamental, because not every threat to your revenue is equal. By linking your CX data to financial metrics, you’ll better understand the precise value that is at risk of churn.

At CustomerGauge, we’ve long been at the forefront of the movement to monetize Net Promoter. Our Account Experience (AX) software and methodology helps you to visualize which customers are churn risks, and how much value is at risk, too.

The higher-value accounts that are telling you they’re unhappy should be your account managers’ priority for tackling churn, increasing retention, and driving growth.

Optimize Upsell Opportunities

With retention optimized, let’s turn to account growth.

There was an interesting insight from a study by Gartner of which every account manager should be aware: while excellent customer service will increase the chance of retaining customers, it really has no bearing on account growth at all.

The bottom line? Upsells have to be an intentional and active process.

You need to engage with customers to win more of their business, deliver more value to them, and build a closer relationship that’s mutually beneficial.

How do you do that? By being a good listener. And while simple conversations are great, we must go back to NPS to create upsell opportunities.

1. Firstly, cross-reference NPS with account size

We said above that the biggest threats to growth are high-value accounts at risk of churn. From a different perspective, though, the biggest opportunities for growth are the lower-value accounts that give you a great NPS score.

There are a couple of reasons why these smaller accounts may be good opportunities for revenue expansion:

Only one geography in the customer account is using your product, but the company is operating globally.

Your contract is smaller than other businesses of a similar size, suggesting that there are other users who could make use of your product.

You can easily identify the loyal customers who might be growth opportunities with a SWOT analysis, which groups your customers into Strengths, Weaknesses, Opportunities, and Threats. For account growth, your focus should be on “Opportunities."

2. Leverage internal champions

One great strategy for driving growth for “Opportunity” accounts is to encourage your promoters, or your product champions in your client accounts, to spread the word.

For example, is there another geography or unit that could get value from your product, too?

This sounds like such an easy way to seize new revenue opportunities, and that’s exactly the point.

One of our partners recently told us the story of how they did exactly this. They identified an account that was a promoter with plenty of room to grow and they went to that account and asked, “You’re our strongest promoter, why don’t you buy more from us?”

This simple question opened up a larger conversation and it turned out that the client account was divided into three units, each with their own buying committee. The trouble for our partner was that the other two units didn’t even know they existed.

So, what happened? Our partner simply asked for a recommendation. The result? A $30 million deal. Accessing growth opportunities can really be that simple.

Cary T. Self, our Global VP of Education and Services is always speaking to leveraging your program champions to hyper-charge net new revenue:

“When your accounts love you, they will recommend you to their friends and colleagues. It’s the original premise that NPS was founded on in the seminal article ‘The One Number You Need to Grow’ by Net Promoter Founder, by Fred Reichheld.

3. Know your products and customers inside and out

Of course, though, those revenue opportunities will still be missed if you don’t really know your customers.

The secret to this is simple: keep running those NPS surveys and ensure account managers are talking to customers whenever possible. We say that conversations help customer retention, but they really help upsells and account expansion, too.

Of course, there’s something to bear in mind: you need to know your products inside out. After all, you can only secure upsell opportunities by offering the most appropriate products to your clients.

Lean Into Referrals

The majority of your revenue should come from referrals. However, too many businesses leave this down to chance. Part of the trouble is that there’s confusion over whose responsibility, marketing or account management, this actually is. In reality, it doesn’t matter, as long as someone is doing it and it works for your business.

What’s crucial is that you need a process. This can be as simple as you like, as long as it’s tied to your NPS.

Here’s what we do at CustomerGauge:

Whenever a customer leaves a Promoter score on our quarterly NPS surveys, our teams receive a notification.

One of us is assigned the task to reach out to the promoter and ask for something: a referral, a case study, or a review. We set the clock: that team member has 5 days to act.

They complete the task, or an alert warns them when the deadline is approaching.

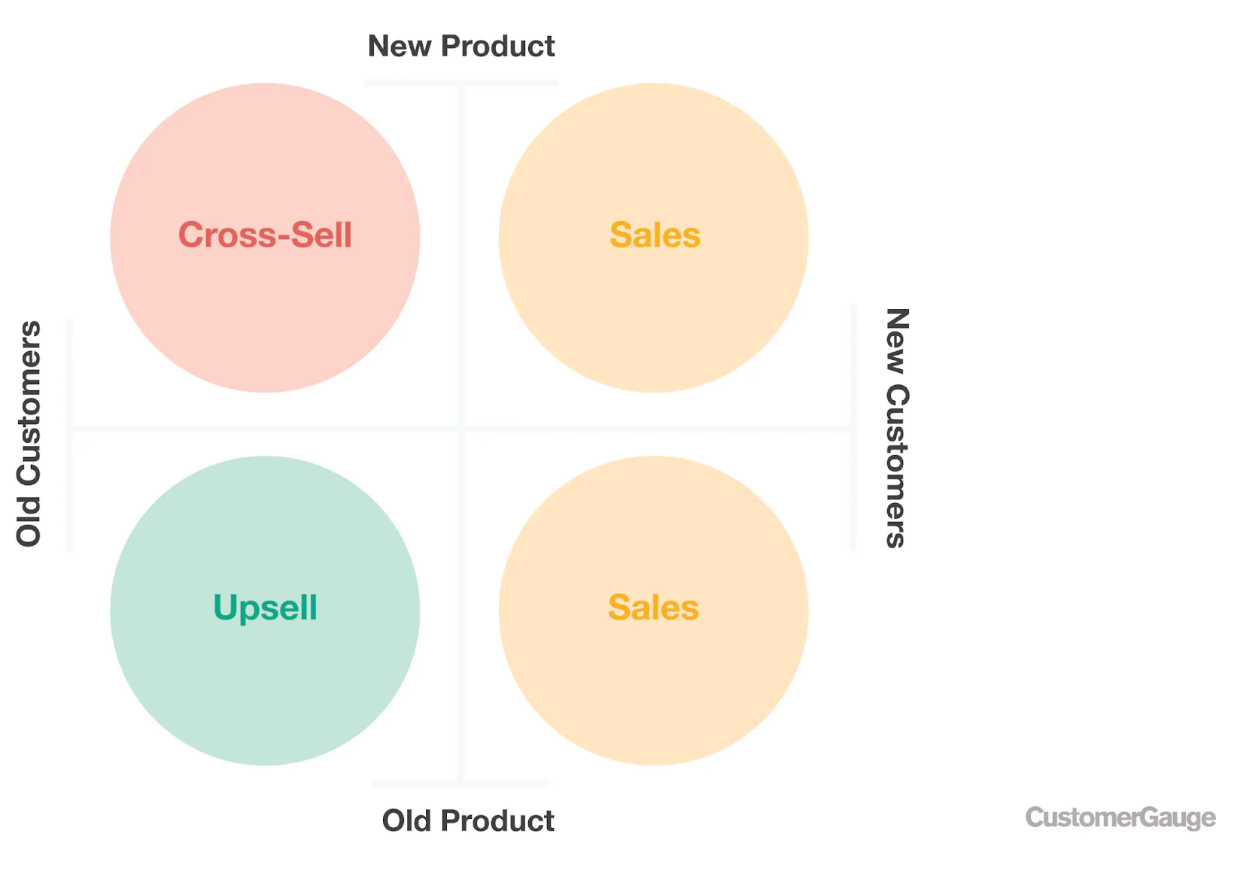

Before taking off with the insights you’ve learned here, you may fall into one of two buckets Cary mentions when tying upsells and cross-sells to your program:

Seize Your Revenue Growth Opportunities With CustomerGauge

At CustomerGauge, we help make missed revenue opportunities a thing of the past. Don’t pay for growth, or scrabble around trying to stop customers walking out the door when it’s already too late.

Instead, put customer experience at the heart of everything you do and earn your growth.

Our Account Experience platform can help you do exactly that, and along the way, we’ll teach you the very best practices for improving your NPS score and increasing your customer lifetime value.

Book a demo to find out how it works!

Interested in taking your education to the next level? Check out the CustomerGauge Academy.