When B2B brands have an average churn rate of 23%, knowing who is at risk of churn and when should be a priority.

There are several tried and tested strategies to predict and tackle customer churn. For example, when adapted to the needs of an account management team, the Net Promoter Score excels at identifying at-risk accounts (as well as upsell growth opportunities).

Yet, as few as 22% of companies consistently measure and act on their customer’s experience.

In this guide, we’ll walk through a number of signs to look out for to predict customer churn before it happens, including engagement, product usage, and key stakeholder attrition.

But first, let’s reiterate why you must not ignore customer churn.

Learn more: Account Experience—The Net Promoter System for B2B Teams

What is Customer Churn? A Costly Problem That’s Often Ignored

Customer churn is a hugely costly problem for businesses. In fact, according to estimates by CustomerGauge’s CEO, Adam Dorrell, it’s costing businesses as much as $2 trillion a year (that’s the size of the ninth biggest economy on the planet).

Customer churn refers simply to the number of paying customers that you lose in a given time period. In any given year, a quarter of customers may not renew their subscription or purchase another product. If your churn rate is the average, 23%, that means you’re losing as much as a quarter of your revenue every year (or even more, depending on the value of the customers that churn).

Yet far too many businesses don’t seem to pay the slightest bit of notice. As we said, 44% of companies can’t tell you their churn rate.

“In my role with company leaders, churn tends to be a metric that many know very little about. There’s a huge misconception around how much effort it takes to measure churn. It really isn’t difficult,” Cary Self, CustomerGauge’s VP of Education and Program, says.

“And the next biggest misconception is that there’s nothing their team can do to prevent churn. NOT TRUE! Once you know how to discover churn, you can identify the reasons behind it.”

Here’s why churn shouldn’t be overlooked:

Increasing retention by 5% can increase profits by as much as 95%, according to Fred Reichheld, the designer of Net Promoter. Cutting churn has a massive impact on revenue.

Finding new customers is more expensive than selling to the ones you have already. You’ll have seen the stat before: it’s 5 to 25 times more expensive to find new customers to sell to than to sell to the ones you have already.

Knowing churn data helps you improve customer experience overall. Understanding why your customers churn at such a rate can give you insight into how they feel about your brand in general. And that can inform efforts to improve the overall satisfaction of other customers too.

By predicting churn, you’ll be able to put steps in place to prevent costly customer attrition, while intervening with customers to improve their experience. And that will bring greater benefits in the long run.

So, how do you predict churn? Let’s take a look.

Customer Churn Prediction: How to See It Coming with Net Promoter

One of the most reliable strategies to predict customer churn is by using the Net Promoter Score (NPS). NPS is a voice of customer measurement tool that gives you insight into how your customers feel about your brand and why.

Typically, NPS is used as a marketing-department-owned sample-based research tool and nothing more—but this is not how it should be in B2B. When used by a savvy sales or commercial team leader, it is one of the most powerful tools to identify and tackle at-risk accounts.

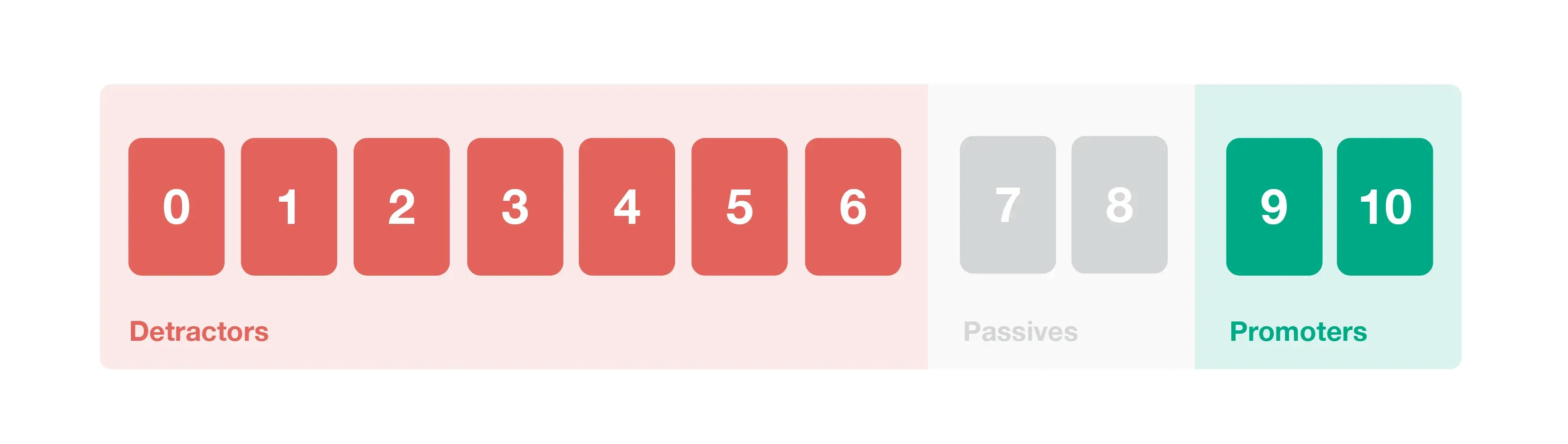

NPS surveys work by asking your customers a simple question: On a scale from 0 to 10, how likely are you to recommend our product/service/brand to a friend or colleague?

If customers answer 9 or 10, you can be pretty sure they’re reliable and loyal customers who’re probably not going elsewhere. These are your promoters. If customers answer 7 or 8, we call them passives—meaning they’re unlikely to churn, but may be tempted if they get a better offer.

Finally, customers who answer 0-6 are your detractors. In any customer churn analysis, it’s passives and detractors you have to look out for.

Now, nothing says that NPS detractors are definitely going to churn (particularly if you can close the loop fast and solve their problem). But they’re making the effort to make you aware of their problems. And you’d be a fool not to trust them if they say they’re not satisfied.

Ultimately, running customer surveys gives you the opportunity to listen to customers that want to tell you they might disappear.

It’s a simply unmissable opportunity for you to drive visibility into your account management process to warn your team about potential churn risks. We found that companies that implement a Net Promoter System reduce churn by at least 7%. Those that build Account Experience methodology into their system can expect an improvement that’s even better.

CustomerGauge’s VP of Education, Cary Self, gave some great advice on this:

“Do not delay! If you’re waiting for perfection in your NPS program or for all your data to be clean, you’ve missed the whole point. We all have flaws and opportunities to improve. The purpose of the program is not to wait until everything is fixed, but to identify what our customers are not happy with and improve.”

The first step is to get started. Every step after that works towards reducing customer churn.

Get in touch today to discuss how we can help you reduce customer churn.

Other Strategies to Predict Customer Churn

Net Promoter isn’t the only tool out there to predict churn, although it may be one of the most reliable.

In reality, you’re likely to need to supplement your surveying efforts with other analytics, to ensure that you’re getting as full a picture of your churn risks as possible.

Indeed, as Cary will tell you:

“Churn does not come from feedback and data, it comes from a lack of feedback and data. The majority of churn we’ve experienced over the years is preluded by an absence of signal”.

They’re wise words. Why? Because while NPS invites customers to tell you if they’re considering leaving, many unsatisfied customers are likely not to respond to your survey at all.

That means one of the most important methods to predict churn is tracking usage and engagement.

Here are three things to look out for:

1. Track Engagement

Engagement is one of the most important signals you can monitor to understand a customer’s churn risk. We call it absence of signal, when customers aren’t responding to surveys, aren’t filing support requests, or just aren’t saying anything at all.

In reality, of course, these customers may not be dissatisfied with your brand at all. You just can’t really know — and you can’t be sure how you’d make their experience better even if you did.

That’s why tracking engagement is so crucial. Keep an eye on survey responses, how many business reviews they attend or request, or how many times they touched base with your customer success managers. If they’re not doing any, you need to intervene to find out why.

2. Look Out for Loss of Account Contacts

Often in B2B client accounts, there’s one particular contact that’s making the case for your products within their organization. Generally, they’ll be working to maintain a smooth relationship with you too.

Yet imagine this one contact leaves your client business (or you may lose contact with them for another reason). It can be a big problem. Without the champion there to fight your corner, the whole account may lose interest in your product—and move elsewhere.

This means the loss of contacts in your account is a big part of your churn prediction analysis. But there are ways to mitigate the risk. During onboarding and throughout the account lifecycle, build relationships with as many stakeholders within your account as you can.

When your key contact is leaving, ask them to do a proper handover. Both will mean that you’re not relying on a single individual to keep the relationship intact.

3. Keep an Eye on Product Usage

Finally, the rate at which your customers use your product is another important signal that you can use to predict churn. If activity is slipping, or if the customer’s telling you that they no longer need a particular feature, it may signal a problem.

Product usage is a key feature of the health of your customer account. And as a result, you should put it at the heart of your customer experience monitoring.

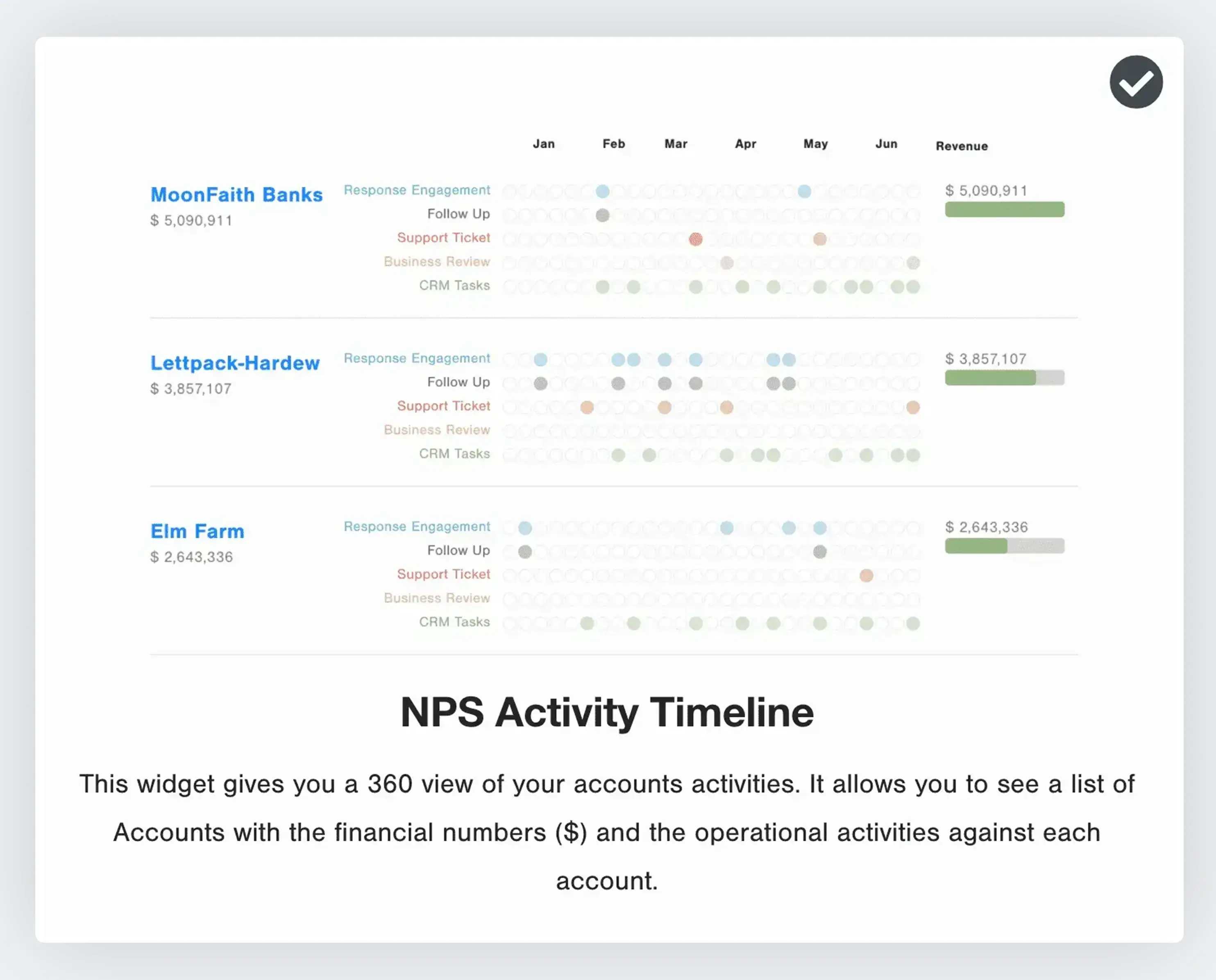

At CustomerGauge, we built activity tracking into our platform. Sales and commercial leaders can simply check in to see which of their accounts are lacking engagement signals (see 13 more of our visualizations here).

Make Customer Churn Prediction Easy with CustomerGauge

Of course, you don’t have to predict churn all by yourself. There are tools and software out there that can help you with your customer churn prediction efforts.

CustomerGauge’s Account Experience Management platform takes all of your customer experience, engagement, and revenue data and helps your frontline teams to understand which customers (and how much revenue) are at risk of attrition.

“So many companies are focused on feedback and data, and rightly so,” says Cary.

“But CustomerGauge’s platform will do that AND then help identify the gaps in engagement from pretty much every metric a company tracks. With this insight, our customers are able to see beyond just one survey response and get a full 360-degree view of all the true indicators of the customer experience.”