When it comes to measuring customer experience (CX), the three most popular tools are CSAT, NPS, and CES.

Each of these metrics provides insight into how your customers view your company—but each has its own strengths and its own niche application.

How you integrate these metrics into your customer satisfaction surveys will depend on the kind of business you’re in, the way in which you’re looking to grow, and the points and CX processes you’re aiming to improve upon.

Our research shows that amongst B2B companies, NPS is the most popular experience metric. Closely followed by CSAT and then CES.

In this article, we look at the details of these three useful tools. We’ll show you how, and when, they can be beneficial to you, as well as how to put them into practice.

NPS, CSAT, and CES: Definitions

Let’s start with a whip around the terminology:

Net Promoter Score (NPS) measures the overall relationship you have with your customers.

Customer Satisfaction Score (CSAT) helps you gauge how happy a customer is with either a specific interaction or their general experience of your company.

Customer Effort Score (CES) measures how effortless (or effort-full) it is to interact with your company.

Good customer experience can drive revenue by as much as 84%. And approximately 59% of customers in the U.S. will walk away from a company they love after several bad experiences with them (17% will leave after just one.)

As a result, your CX will have a serious impact on your revenue, whichever metric you use. But by using the right metrics at the right time, you’ll have a more accurate understanding of your customer sentiments — and a better chance of driving your bottom line.

Why Use NPS, CSAT, and CES?

All three customer experience metrics help you gather data on how happy your customers are to interact with your brand. This customer feedback can be related to how customers experience specific touchpoints along the customer journey, or how they view your brand as a whole.

But gaining insight from the data these metrics provide is not enough. The goal is then to action your findings to promote sustainable growth and improve your customer experiences.

There are two types of research where this customer experience data comes into play:

Relationship studies. This is how your customer views your brand as a whole. It’s a long-term measurement that tracks the ebb and flow of your CX. The point of this kind of study is to determine customer loyalty and minimize churn — and ultimately to increase your revenue.

Transactional studies. This kind of analysis is all about touchpoints. What is your customer’s experience of your customer service department, for example? Or how do they rate the ease with which they are able to purchase from your site? Understanding this can help you make valuable changes to everything from your products to business processes.

NPS, CES, and CSAT are all purpose-built to provide the relevant data you need. So is one better than another?

Let’s dive in.

CSAT, CES, and NPS Compared

Knowing which metric to put to use in your CX program, and when, is what will give you the competitive advantage.

The problem is that there’s some debate over which metric is best.

In CustomerGauge’s NPS® & CX Benchmarks Report, opinions on which metric to use varied wildly.

Some companies reported that they used CSAT, CES, and NPS together. Others used two in tandem, and many focused on a single metric.

Significantly, 49% of NPS users also measured an additional metric: Over 33% of companies used CSAT in addition to NPS, and 1 in 6 used CES as well.

Our research showed that rather than prioritizing a specific metric, companies rely more on customer experience metrics as a whole.

Linking metrics together gives a more holistic view of their businesses.

So rather than look at NPS vs CES vs CAT, perhaps a more helpful perspective is to look at them as individual tools that can be called upon to perform different tasks. Some companies will only need one tool to adapt for all their purposes, while others will need a few.

With that in mind, we’ll take you through each metric individually. We’ll explore their benefits and shortcomings and show you how and when to leverage each for your own needs.

Net Promoter Score® (NPS)

The NPS score is a metric that asks a single question:

On a scale of 0 to 10, how likely are you to recommend this company/good/service to a friend?

This question is asked in a short NPS survey and can be modified depending on whether your business is conducting a relationship or transactional survey.

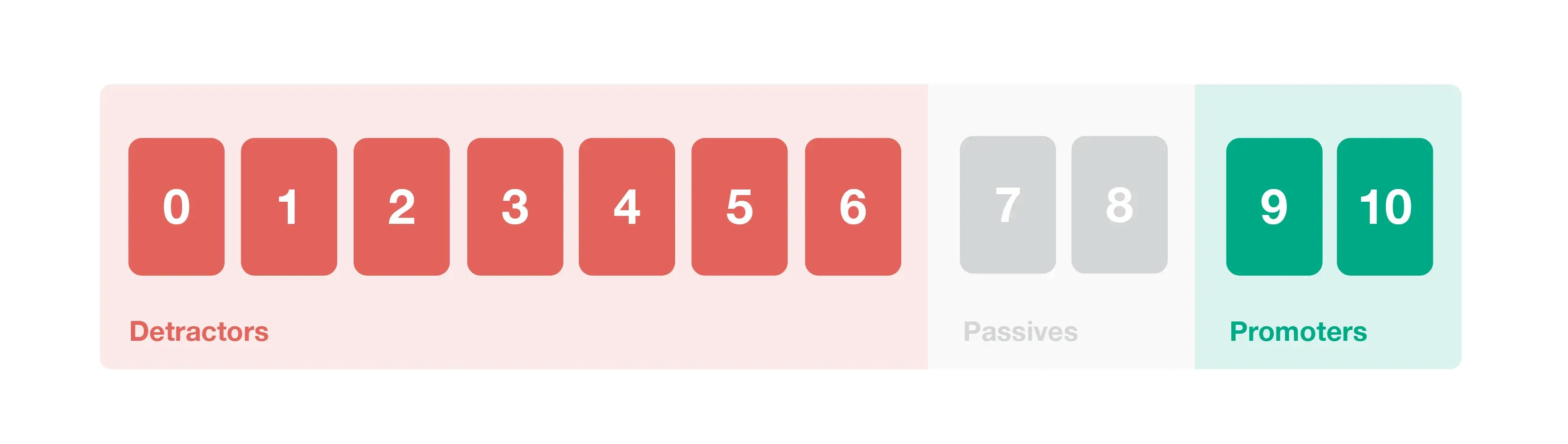

Based on responses to that question, customers are categorized as promoters, passives, or detractors:

Promoters are customers that give a score of 9 or 10. They’re customers that are very happy with their experience and are willing to tell others about it.

Passives give a score of 7 or 8. They aren’t unhappy with their customer experience, but they’re not overly thrilled either. Passive customers are more susceptible to competitor offers, and likely won’t talk about their experience with others, whether that experience has been positive or negative.

Detractors make up the rest of the customer base, giving a score somewhere in the range of 0 to 6. These are people who have had a bad experience with your company, and they’re likely to complain to others unless you quickly take action to address their concerns.

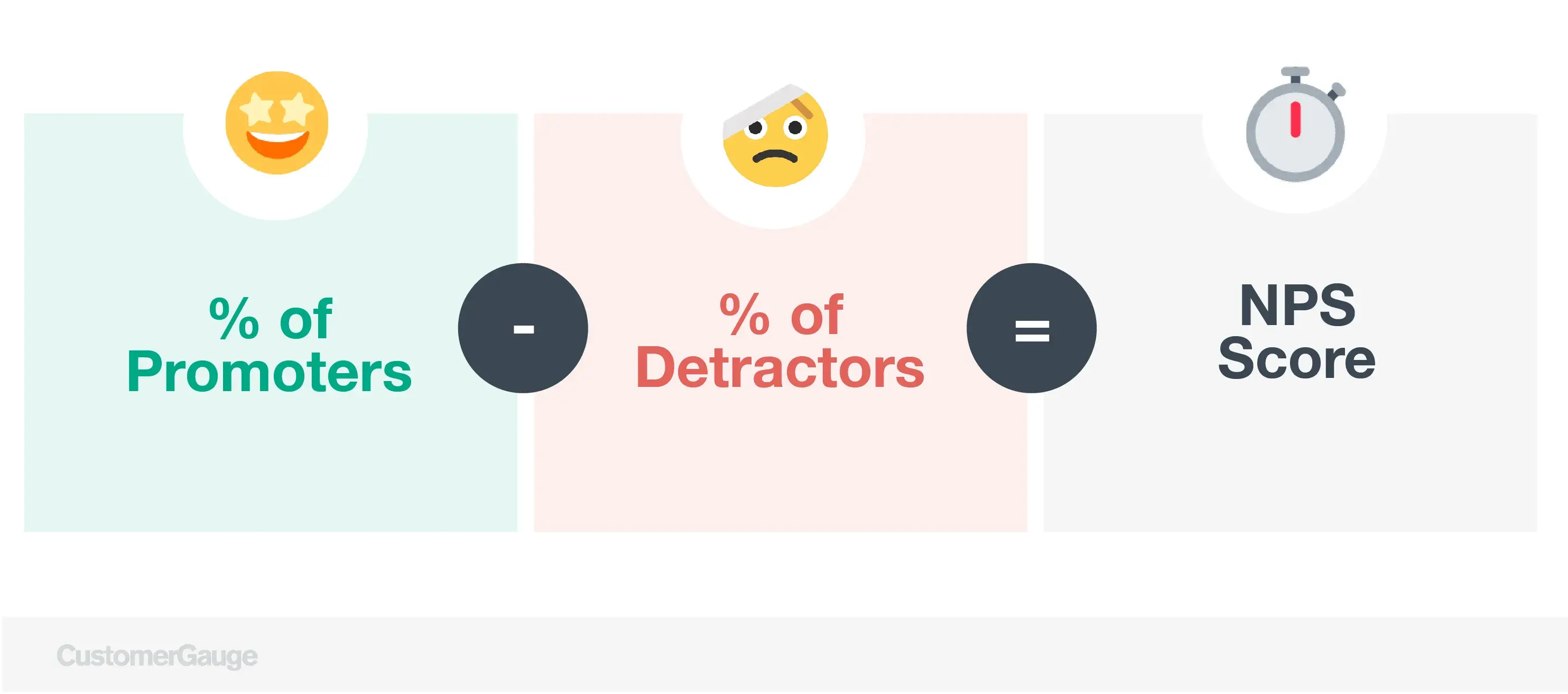

How is NPS calculated?

Your NPS score is expressed on a scale of -100 to +100 and is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

So if you have 60% promoters and 10% detractors, your NPS would be 50.

Get a free template for this in our guide: How to Calculate NPS.

What are the benefits of NPS?

NPS is first on this list for a number of reasons. It is:

Simple to use

Easily actionable

Focused towards growth

Able to provide both big-picture and granular analysis

With one metric, you can understand overall customer experience and loyalty, link that data up to your revenue, and take action on the CX problems that arise.

And not only does it give you a bird’s eye view, but it can also help you action on a specific issue.

When a customer is found to be a detractor, for example, you can reach out to them and seek to understand their complaints. With those complaints understood, action can be taken to correct the issue, ideally increasing customer retention.

What sets NPS apart from other customer experience metrics is that it transcends single experiences for customers and provides a wider view of a customer’s experience with every aspect of a business.

What are the limitations of NPS?

We’ll be the first to admit that NPS, by itself in a survey, isn’t always enough to determine the root cause.

So, yes, while NPS is considered the “Ultimate Question,” don’t be afraid to add additional drivers to this question to more easily determine the root cause of an issue.

Following up is key to taking action. Without it, NPS is just a research tool and doesn’t drive growth.

Learn how B2B companies can use NPS to drive real revenue growth with Account Experience.

Customer Satisfaction Score (CSAT)

Previously, an article came out in the Harvard Business Review with the title, Stop Trying to Delight Your Customers.

Its thesis was that it’s not wowing your customers that keep them coming back, but allowing them to conduct business easily and efficiently (i.e. meeting their expectations)

It's from this ground that CSAT was born.

CSAT asks the question:

“How satisfied are you with [blank]?”

That [blank] can refer to almost any part of the customer journey, depending on what you want information on. Perhaps you want to evaluate how well customer support staff are doing, and identify team members worthy of praise or employees that need more training. Perhaps you want to know how a software update is performing, or if a customer is enjoying their newest purchase.

Your customers will give you a response according to the scale you have set up.

It can exist on a scale of 1 to 10, 1 to 7, or 1 to 5, where the lowest end of the scale is “very unsatisfied,” and the higher end is “very satisfied.” But it may not use numbers at all and rather include a scale of smiley faces. It’s up to you how you want to design your survey.

How is CSAT calculated?

CSAT is calculated by first finding the percentage of customers that gave the two highest scores. On a scale of 1 to 10, that would be 9 and 10; on a scale of 1 to 5, that would be 4 and 5, or “satisfied” and “very satisfied.”

Once this has been identified, the two highest scores are used in the following way:

(Total number Top 2 responses) / (Total responses) * 100 = % of satisfied customers

The idea behind using the highest scores is it gives the most accurate predictor for customer retention, as customers who are likely to stick around will give higher scores.

In the language of NPS, CSAT helps you find your percentage of promoters. The higher that percentage, the better your company is doing in the area you’re surveying.

What are the benefits of CSAT?

CSAT truly shines when it’s seeking to understand customer satisfaction in particular moments of the customer journey.

Another big benefit of CSAT is that it’s a great way to close the loop with customers.

Here’s how it might work in practice:

A customer makes a purchase.

They’re automatically sent a quick CSAT survey asking how they feel about the product and the ordering process.

They have the chance to make any complaints or praise they wish to make.

Your business has a chance to respond and take action to handle any complaints—as well as figure out what’s working.

What are the limitations of CSAT?

It’s designed to understand an individual interaction and is not as good at looking at the big picture of customer satisfaction. In that way, CSAT is not a great predictor for customer loyalty or repeat business.

That means that, unlike NPS, it’s not a hugely effective tool for understanding the way your CX links to your bottom line.

But the secret to using CSAT as a customer experience metric is to know what you want to evaluate—such as your frontline staff, or a new product—and survey customers for that specifically. It’s probably a good idea to leave overall satisfaction with your company to NPS.

NPS is the metric for a wider scope, as it focuses on customer intention. CSAT zooms in on a moment of customer satisfaction. This can change much more quickly and doesn’t account for a customer needing to purchase a product again, or only need a good or service once.

👉 What Effortless Office Learned When They Went From CSAT to Account Experience

Customer Effort Score (CES)

Customer Effort Score, or CES, measures how much effort a customer has to put in to complete a specific interaction with your company.

To measure this, customers are asked a question such as:

How easy was it for you to solve your problem today?

Or they can be asked to agree or disagree with a statement like:

It was easy for me to solve my problem today.

Then, there are various different scale types that you can use:

The Likert scale. Here, your customer can choose on a scale ranging from strongly disagree to strongly agree.

The numbered scale. Either on a scale of 1 to 5 or 1 to 10, the customer responds to the question of how much effort it took to do what they needed to get done. The upper end of the spectrum means they had a pleasant experience.

The smiley scale. This one looks a little something like this:

How easy was it to solve your problem with [business] today?

😡😐😊

How is CES calculated?

CES is about finding an average for the responses you have been given. So:

(Total sum of responses) / (Number of responses) = your CES score

What are the benefits of CES?

CES, unlike CSAT, is a great metric for understanding customer loyalty. Generally, if customers are putting in a lot of effort every time they interact with your company, in time they’ll go elsewhere for their goods and services. If it’s easy to work with your company, they’re very likely to repurchase with you.

The data you get out of CES allows you to follow up through customer support interactions.

What are the limitations of CES?

CES does have its drawbacks — mainly due to its limited scope of inquiry for your company. It tends to work best when asked about specific interactions, rather than how easy it is to interact with your company as a whole.

Additionally, while CES can identify issues with the customer support journey, it doesn’t identify what the nuances of those problems are.

To fully utilize the data gathered from CES, a company must ask follow-up questions. This necessitates extending surveys, getting enough responses to those surveys for statistically significant findings, and having structures in place to answer these concerns.

NPS vs CSAT vs CES: In Summary

NPS | CSAT | CES |

Assesses overall loyalty in a long-term, actionable, meaningful way. | Gives insights into levels of satisfaction and is good at honing in on customer touchpoints. | Provides actionable data about how much effort goes into a single transaction in your company. |

While NPS, CSAT, and CSE have specific jobs they excel at, only NPS is equipped to link your CX program to your bottom line. This can help you prove your ROI, secure investment for your CX management framework, and make smarter business decisions based on revenue.

70% of companies aren’t linking their CX to their revenue data. By monetizing NPS, you’ll get an advantage on all of them.

NPS vs CSAT vs CES — How (and If) to Use Them Together

When considering each of these customer experience metrics, it’s easy to see how they intersect. And the beauty is that they don’t have to be used in isolation.

Each metric seeks to:

Numerically explain some parts of customer satisfaction and/or customer loyalty, allowing you to create better customer experiences.

Give your company goals to achieve with those numbers.

Provide an overview of your company’s strengths and weaknesses.

They also all require some form of follow-up when it comes to the action of the data they provide.

Below, we look at how a company may—or may not—choose to use multiple metrics.

Benefits of Using Multiple Customer Satisfaction Metrics

There are a number of reasons why using multiple metrics might be useful:

They can be complementary: CSAT seeks to understand customer satisfaction as a metric, while NPS and CES both give you wider data on customer loyalty.

In this way, NPS and CES are perfectly complementary, while CSAT can offer further insights into specific customer interactions.

NPS, meanwhile, is a great big picture metric. But thanks to transactional surveys, it can provide a granular perspective too.

- They can work in layers:

NPS gives you an overview of how customers are feeling towards your company, and if there are larger issues.

CSAT then evaluates how satisfied customers are with specific interactions or processes,

CES sees how pain-free it is for customers to interact with you.

They can help you close the loop: NPS improves when companies close the loop, meaning they bring the opinion of the customer to bear within company strategy and processes.

But not only does NPS improve when those loops get closed. Instead, those loops are closed because of NPS.

NPS offers a clear picture not only of dissatisfied customers, but promoters and passives as well. This makes it particularly well-suited for follow-up processes across your customer base.

CES surveys provide another way to close the loop, particularly on customer support interactions. And CSAT surveys facilitate this process too. After a sale, CSAT surveys give customers a place to issue grievances, as well as a place to express satisfaction. The goal then is to ensure that those insights are effectively addressed.

Challenges of Using Multiple Customer Satisfaction Metrics

While using multiple metrics can be highly beneficial, this should always be done with the following in mind:

- Keep It Simple: The biggest issues with using multiple metrics are:

Not using them for a specific purpose

Not making that purpose transparent throughout your organization.

At CustomerGauge, we often recommend starting out by picking one customer loyalty metric and sticking to it. Simplicity typically wins out in the end. Otherwise, you can find that the noise of your data escalates quickly, and it’s tricky to action the insights you get.

Which brings us to our next point:

You may be able to do all you need with one metric: NPS, for example, can easily be used to measure interactions as well.

If you choose to only use NPS, a transactional survey using NPS can pick up the slack of helping to understand individual interactions.

Discover New Content: 10 Best NPS Software's for B2B

NPS vs CSAT - The Expert Opinion

On the Account Experience podcast, our resident experts debated this topic in depth.

Learning about what your customers feel and think about your business should lead to action–whether that means personally reaching out to a customer, making an improvement, or leveraging a strength.

A critical piece of action, of course, is timeliness. To be effective, insight needs to lead to a quick response. Otherwise, you might have already lost a customer….or at the very least, lost trust.

This is one of the core differentiators between CSAT and NPS.

While it can produce detailed insight, CSAT doesn’t necessarily create a system for quickly responding to customer feedback. Long, detailed surveys used to collect CSAT require time, labor, and organization. And while a high CSAT might make you feel good or give you bragging rights, it doesn’t necessarily create a direct course of action for improving customer experience.

Net Promoter System, on the other hand, leads to direct action through “closing the loop” with customers...and then circles back around to ensure that action has been taken.

“NPS is actionable,” says Cary, Global VP of Education and Program Development at CustomerGauge. “It basically asks, where should we invest our time? It allows the person completing the survey to select what they think your organization should be focused on–why they buy from you, why they renew, and why they stick with you.”

Listen to the rest of the episode to dig into the topic with Cary and Ian from CustomerGauge.

NPS vs CES vs CSAT - The Bottom Line for B2B Brands?

NPS, CES, and CSAT can be incredibly useful tools for monitoring your customer experience. Using these metrics together can be a great solution—but we recommend starting with one metric and evaluating if it provides the actionable data you need.

For B2B brands, there’s no better place to start than NPS. Providing easily measured and benchmarked data, and delivering both big-picture and granular insights, the Net Promoter System is the easiest way for B2B companies to track customer sentiments from every contact in their accounts.

But after all — it's not just the numbers that matter, it's what you do with them. Now you’re armed with your CX data, it’s time to use it to drive growth.

Interested in Account Experience? Contact our team to learn more!