Customer retention drives growth. When retention grows by just 5%, profits grow by up to 85%. Customer retention analysis is the first step to moving the dial in your company’s favor.

It may surprise you then that 44% of C-suite executives do not know their retention rate or why their customers may be churning.

If that’s where you’re at, don’t panic.

Experience software has changed the landscape of conducting retention analysis and meaningfully implementing strategy based on those results. That’s what our Account Experience platform has accomplished in the B2B arena (we’re the number #1 VoC platform for B2B brands in Gartner’s eyes, so believe us when we say this is our area of expertise).

So our first piece of advice would be to onboard an appropriate platform. But next on the agenda is to run through the following steps:

Customer Retention Analysis: The Kick-Off

The temptation is to dive head first into a customer retention program in a bold attempt to take action.

We would say: stop.

Before you implement a customer retention analysis strategy, consider this one all-important question: what does retention mean for your bottom line?

Our research shows that 62% of companies don’t tie their Voice of the Customer data to revenue. The danger is that you land up with a plethora of data that doesn’t have material ties to real-world implications.

As Cary Self, our VP of Education and Program Development says,

“Just running a retention program or analyzing churn because it’s the right thing to do is not enough. Your program should be able to quickly show what impact it has on the bottom line. You’ll not only gain support for your program, but you’ll have a seat at the table when it comes to the future of your company.”

So here’s how you do that.

Activate this three-pronged approach:

Current state of affairs: This is an analysis of where you’re currently at. For this, you measure retention (which customers have stayed) vs. churn (which customers have left) within the last period. These metrics need to be tied to revenue.

Mind of the customer: Where are your customers thinking? This involves conducting surveys while they are active customers and at the point of churn.

Actionable predictions: By creating an interactive map of per account/per customer risks and opportunities, you can transform your customer retention analytics into an applicable strategy.

Current State of Affairs

Calculating Retention Rates

There are two parts to calculating retention. The first part is how many customers you retained, and the second is the financial implications of that retention.

Retention Rates

Retention rate tells you the percentage of customers who stay with you in a given period. It’s worked out by this simple formula:

(retained customers / total customers at the start of period) x 100

Let’s say you decide to work out customer retention for the second quarter of 2022. At the beginning of that quarter, you had a total of 500 customers. By the end, you have 420.

Plug that into the formula and:

(420 / 500) x 100 = 84%

So your retention rate is 84%. (If you’re wondering, our data says that the average churn rate is approximately 23%, making the average retention rate 77%)

Net Revenue Retention

Now to add revenue.

The formula for revenue churn is:

(Retained recurring revenue / retained revenue at the start of period) x 100

Here, recurring revenue is the amount of revenue you receive in a given period. You work that out by multiplying the number of customers by the average revenue per customer.

Your retained recurring revenue will be the number of customers retained over that period multiplied by the average revenue per customer.

As per our previous example, you retained 420 customers out of 500. Let’s say the average revenue per customer is $1,500.

That means your retained revenue is $630,000.

Let’s say your retained revenue at the start of the period is $800,000.

Pop that in the equation and:

(630,000 / 800,000) x 100 = 78.75%

These two metrics work together to give you a deep understanding of the effects of churn in your company. But there’s more to the story.

Not Every Customer is Worth the Same

The reality is, different customers have different worth to your business for multiple reasons.

Spending power is the most obvious, but it’s not the only one. There are other key considerations here. How likely are they to refer your business to a friend? (The famous NPS question, which we’ll get to in a moment.) What are the possibilities when it comes to upsells and cross-sales? And what about loyalty? How likely are they to stick around?

Account Experience works to give you a less generalized picture that takes into account that some customers are worth more than others to your bottom line.

The Mind of the Customer

Using NPS as a Measure of Retention

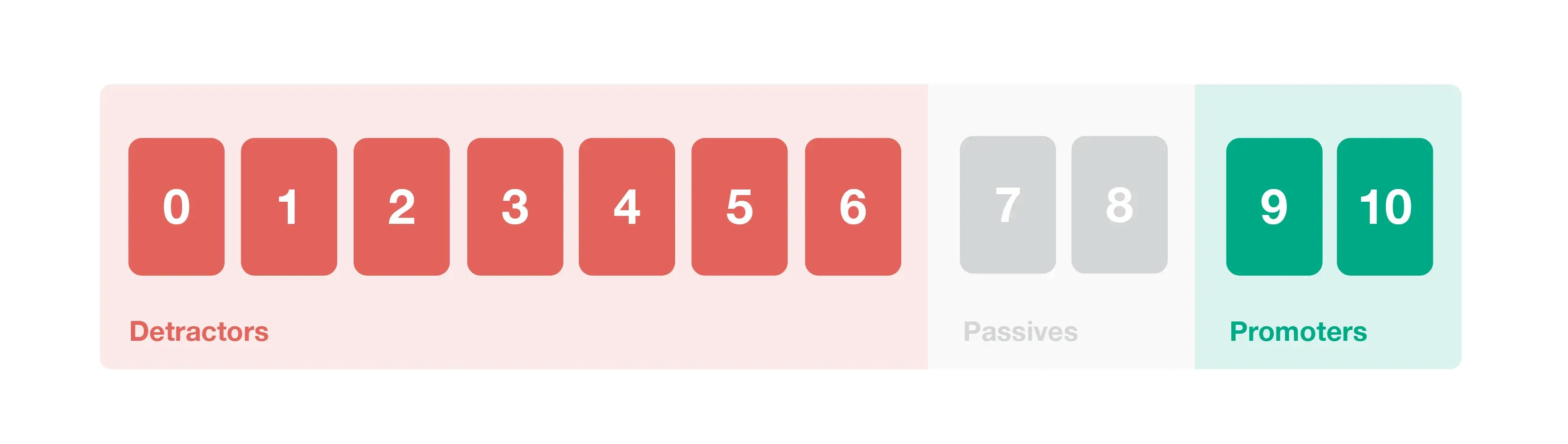

Something of a gold standard for gauging customer sentiment is the Net Promoter Score (NPS). This popular metric gives insight into retention by asking one simple survey question:

“On a scale of 0 to 10, how likely are you to recommend our business to a friend or colleague?”

Bain & Company’s Fred Richfield was right when he saw this as a profound measurement of customer loyalty. But for this metric to be meaningful, it has to be tied back into your larger VoC system—and to your revenue.

Our research showed that you get more actionable retention data and better response rates if you ask not one but between two and six questions.

As we recommend in our ebook, The Fine Art of Surveying, that means collecting three points of data:

The Net Promoter Score itself.

The NPS Driver, a follow-up question in your survey that allows you to better understand the why behind the NPS score

Verbatim comments, essentially a free text field where you can garner more insight into what your customers are thinking

(The analysis of this data can be tricky, particularly in the B2C space. We take you through how to do it here.)

When using NPS as a customer retention analytic, here are some things to consider:

Is it representative? Do you have a large enough data set for the data to be an accurate indicator of the sentiments of your customer base?

A significant part of this equation is open and response rates. We’ve found that a healthy response rate positively impacts several metrics, from NPS to retention.

No engagement on an account—what we have termed “absence of signal”—is a trustworthy predictor of churn. By maximizing response rates, Account Experience helps to mitigate this risk.

Are all customers treated equally? In this instance, treating everyone equally is not optimal as it will not give you the relevant data you need.

As we addressed, customers or accounts all come with varying degrees of revenue generation capabilities. If you’re in the B2B arena, two of your largest accounts, for example, could bring in 40% of your total revenue. They are the ones to be nurtured.

Which brings us to the next question:

Are your metrics tied to revenue? We're stuck on this one, but there’s a reason for that. Our Monetized NPS brings traditional NPS into the current market by tying revenue, retention, revenue, upsells, and cross-sales to the NPS metric.

Churn Surveys

It’s one thing to know that your customers are leaving—and another to know why. Are they leaving because of customer service? Are they no longer using your product/service? Have they gone with another vendor?

If, for example, 60% of your customers are leaving because of poor customer service, well, this is highly actionable retention data to have.

Other Useful Metrics

Customer Lifetime Value (CLV). This is the net profit that can be attributed to an account over the entire period of their relationship with you. We give you the full breakdown of what it means and how to calculate it, here.

Particularly if you’re in the B2C arena, metrics like repeat purchases and product return rate become important for analyzing customer retention, with formulae as follows:

Repeat purchases formula. Divide the total number of customers who have purchased more than once by the total number of customers and multiple by 100.

Product return rate. Divide the number of returned items by the total number of sold items and multiple by 100.

Actionable Predictions

Next step: try and gain as much control over the future as possible.

There are two pieces to this puzzle:

Likelihood of retention

Revenue value of the customer

Your next job is to make a map of customers based on these factors—who is safe, who is at-risk, and who you’re not too sure of.

CustomerGauge performs predictive churn analytics so that you can then spend your resources conceiving of actionable change based on these findings.

How CustomerGauge Can Help

Customer retention analysis, while necessary, can be cumbersome to do in a way that’s accurate and actionable. What’s more, retention is only one piece of the CX puzzle. These insights have to be part of a holistic customer engagement strategy.

You don’t have to do it alone. At CustomerGauge, we can help you access meaningful data and then make it work for you. Book your Account Experience demo today.