Customer lifetime value (CLTV) is the dollar value of a customer across the entirety of their relationship with your business.

CLTV lets you see how much each individual account is worth to you, from the first purchase to the moment that they no longer need or want your services. It’s useful to know because it tells you which are your most valuable customers while providing an important metric to get buy-in for your marketing efforts and more.

However, most businesses are getting it wrong.

While they happily calculate their financial metrics, what they don’t see is the one key factor that drives their customer lifetime value — (CX) customer experience. The logic is simple: without an exceptional customer experience, you can’t grow your customer loyalty. And without that, your CLTV won’t be going anywhere.

As CustomerGauge’s VP for Education and Services Cary T. Self, recently said,

“I think there's a mistake in just looking at customer lifetime value as a single metric or equation, as many businesses do. It's the first thing we teach you out of the gate in the CustomerGauge Academy: we tie loyalty to customer lifetime value. We do that because, at the end of the day, we're trying to create loyalty to generate revenue and income. We think that’s the right thing to do.”

In this article, we’ll take you through how to calculate customer lifetime value, how it relates to loyalty, and why it matters so much as a metric.

And we’ll show you some strategies to improve your customer value, too.

How to Calculate Customer Lifetime Value

In its simplest terms, customer lifetime value is defined by two factors:

The amount that a customer spends, and

The length of their relationship with your business.

The balance between these is simple.

If your customers increase the amount they spend through upsells or referrals, then their CLTV increases. If you increase the length of the relationship by increasing retention, it has an impact on CLTV (that’s why we say that you can’t really understand CLTV without understanding customer loyalty).

From these two variables, you get the basic calculation for customer lifetime value:

CLTV = annual customer revenue x customer lifetime (in years)

Let’s take an example. Say a customer is on a $20,000 annual plan and they continue using your product for five years. In that case, that customer would have a CLTV of $100,000. But say they upgraded their plan to a $30,000-a-year fee, their CLTV would be $150,000 over the same period.

If you’re a company with a very simple fee structure, that’s the only calculation you need. However, things are typically more complicated than that.

For example, the amount that customers spend may change each year. In one year they may try a new feature, cut the number of users, or you have given them a discount to retain them.

All of these variations need to be included to get an accurate measure.

In cases such as these, you’ll probably want to find out your average customer lifetime value rather than the value of one particular customer. That’s because you want to know the lifetime value of your customers overall.

Calculating Average Customer Lifetime Value

To get an accurate sense of your average CLTV, you’ll want to use a more nuanced equation:

CLTV = customer value x average customer lifespan

where

customer value = average purchase value x average number of purchases.

In this case, we’re assuming that different customers and different products have different values and that you want to aggregate them all. Here’s where things can get a little confusing, and a step-by-step guide can help:

1. Calculate the average purchase value

How much do customers usually spend on a purchase? It doesn’t matter whether they’re paying a monthly subscription fee or a one-off annual payment.

To get a clear picture of this, divide your total revenue by the number of orders you receive in a given period.

Average purchase value = total revenue ➗number of orders

So, if you make a total revenue of $1,000,000 a year made up of 50 orders, your average purchase value is $20,000.

2. Calculate the average number of purchases

How many purchases does the average customer make in a given period? For many subscription-based B2B brands, this number may well just be one. However, B2B brands working in consumer goods or other industries may have a much higher number.

To work this out, divide your total number of purchases by the number of customers.

Average number of purchases = total purchases ➗number of customers

Say your 50 orders were made by 10 customers, then your average number of purchases would be 5.

3. Calculate your customer value

Next, you want to understand how much the average customer is worth to you in a given period. To work this out, multiply your average purchase value by the average number of purchases.

Customer value = average purchase value x average number of purchases

In this case, the average purchase value is $20,000, and the average number of purchases a customer makes is 5, meaning your annual customer value is $100,000.

4. Calculate your customer lifetime value

You now know that your average customer is worth $100,000 in a year. But over their whole lifetime? All you need to do now is multiply that number by your average customer lifetime (in years).

CLTV: average customer value x average customer lifetime

In this case, if you suppose that the average customer lifetime is 5 years, then your CLTV is $500,000.

5. Calculate the CLTV of different groups of customers

The clever thing about calculating CLTV is that you can use it to get insight into the value of different segments of your customer base.

For example, would you like to see the average value of customers in one particular geography or specific industry? Or do you want to see the value of your most loyal customers (your promoters)? This could show you where to target your resources.

Working these things out is simple — just make the same calculation for each group of customers you’re interested in.

What’s the Importance of Customer Lifetime Value?

So, now you know how to calculate CLTV. But why does it matter?

Customer lifetime value provides an essential gauge of how valuable your customer relationships are and that can be useful for a number of reasons.

CLTV Shows if You’re Profiting From Customers

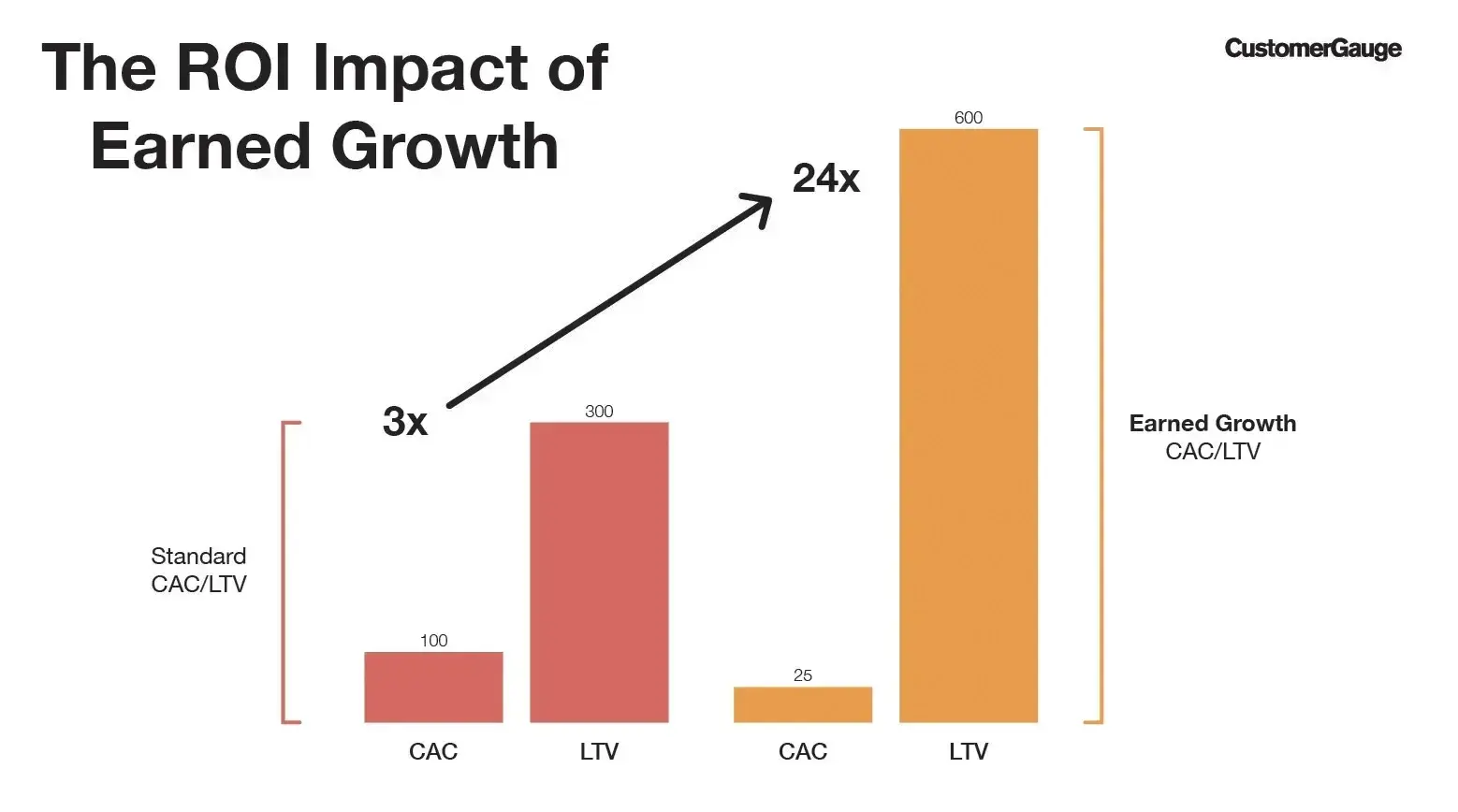

For your business to be profitable, CLTV should be greater than the amount you spend on acquiring new customers — what’s known as your customer acquisition costs (CAC).

On the other hand, if your CLTV is lower than your CAC, you risk spending more on acquiring customers than they repay. That inevitably means you'll be making a loss.

In many ways, your CLTV:CAC ratio is actually more important than your CLTV alone.

While it will not be the same for every business or industry, the general benchmark is that your CLTV should be at least 3x the value of your CAC. However, by following a methodology for Earned Growth, you can supercharge your CLTV by as much as 8X.

Find out more: Average Customer Lifetime Value by Industry

Reveal Which Customers Are Contributing the Most Value

Not every customer will contribute the same value to your business.

Those that are very satisfied with your service will likely stick around longer and spend more while they’re with you (and increase your CLTV). In the language of the Net Promoter Score (NPS), these are your promoters, your most loyal customers.

However, others, your NPS detractors, will have a negative impact on your CLTV.

That’s because their customer lifetime will likely be shorter due to customer churn.

Rather than just looking at an average CLTV, you can break down the CLTV of your detractors and promoters. For example, that’s what Fred Reichheld, the founder of NPS, did at Dell. As he explains in his book, The Ultimate Question 2.0, he discovered that Dell’s promoters were worth $328 but detractors were actually costing the company $58 each.

Having clarity on this can give you the tools to improve your CLTV. You know that, simply, if you can turn some detractors into promoters (through improved customer experience), you’ll improve your CLTV.

And that’s what Dell did. By turning detractors into promoters, Dell was able to improve its CLTV by as much as $167 million.

Clear ROI Metrics Help Get Buy-In for Customer Experience

Knowing the long-term value of your customers allows you to make the case for your customer loyalty program.

In our The State of B2B Account Experience report, we discovered that 70% of B2B brands were not linking their customer experience programs to financial metrics. As many as 63% of businesses weren’t able to calculate their ROI at all.

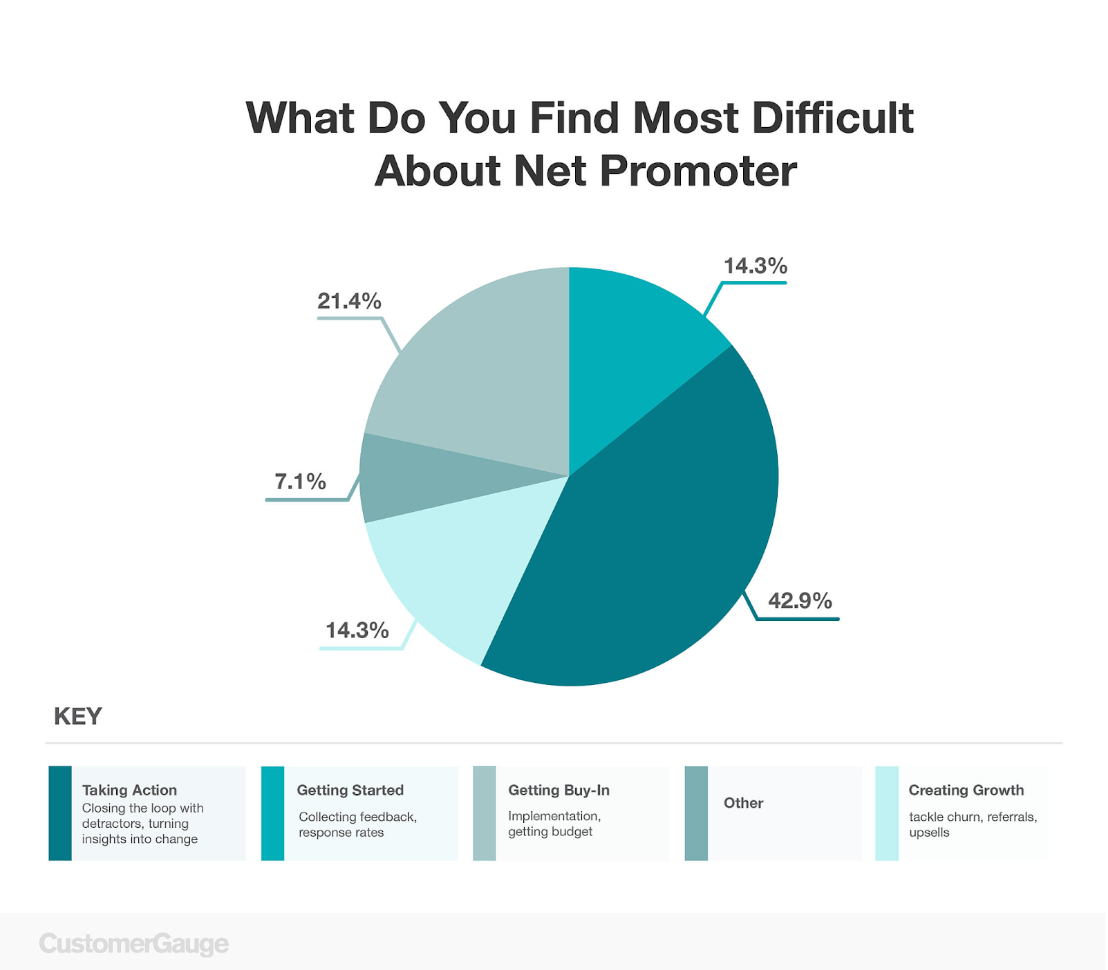

That’s a huge problem, particularly in the coming CX storm where executives are looking for programs to cut. Over one in five CX professionals told us in a recent survey that getting buy-in was the hardest thing about their NPS program.

If you can show CLTV and be clear about the impact your customer experience program is having on it, you’ll be much more likely to secure enduring buy-in from teams and leaders. That means getting the resources and budget you need to continue having an impact.

In Customer Experience, Measurement Improves Performance

“What gets measured gets improved,” so the cliche goes.

And when it comes to CX, the evidence suggests that it’s true. According to one survey, 81% of marketers said that continually monitoring CLTV improves sales performance.

Largely, that’s because your CLTV can tell you which customers are likely to be the most valuable to you, so you can target the same types of customers in the future.

Why Feedback Surveys Can Increase Your Customer Lifetime Value

You know why customer lifetime value matters. But how do you increase it?

One of the best ways to maximize your CLTV is through feedback surveys. Why? Because they help you build loyalty.

Let’s explore that further:

1. By Giving Feedback, Customers Tell You How to Improve

You’ll find all sorts of random, generic tips around the internet about how to improve your CLTV such as “improve onboarding” or “increase purchase size.” The chances are you could have guessed that and you may have been doing it already.

Instead, let your customers tell you how they want you to improve. Maybe your onboarding or customer service is already great, but customers actually want a different feature instead or improve your rewards program.

Listening to them will give you information that’s specific to your business.

Here’s the bottom line: if you listen to your customers, you will improve your loyalty. And greater loyalty means longer customer lifetimes and greater CLTV.

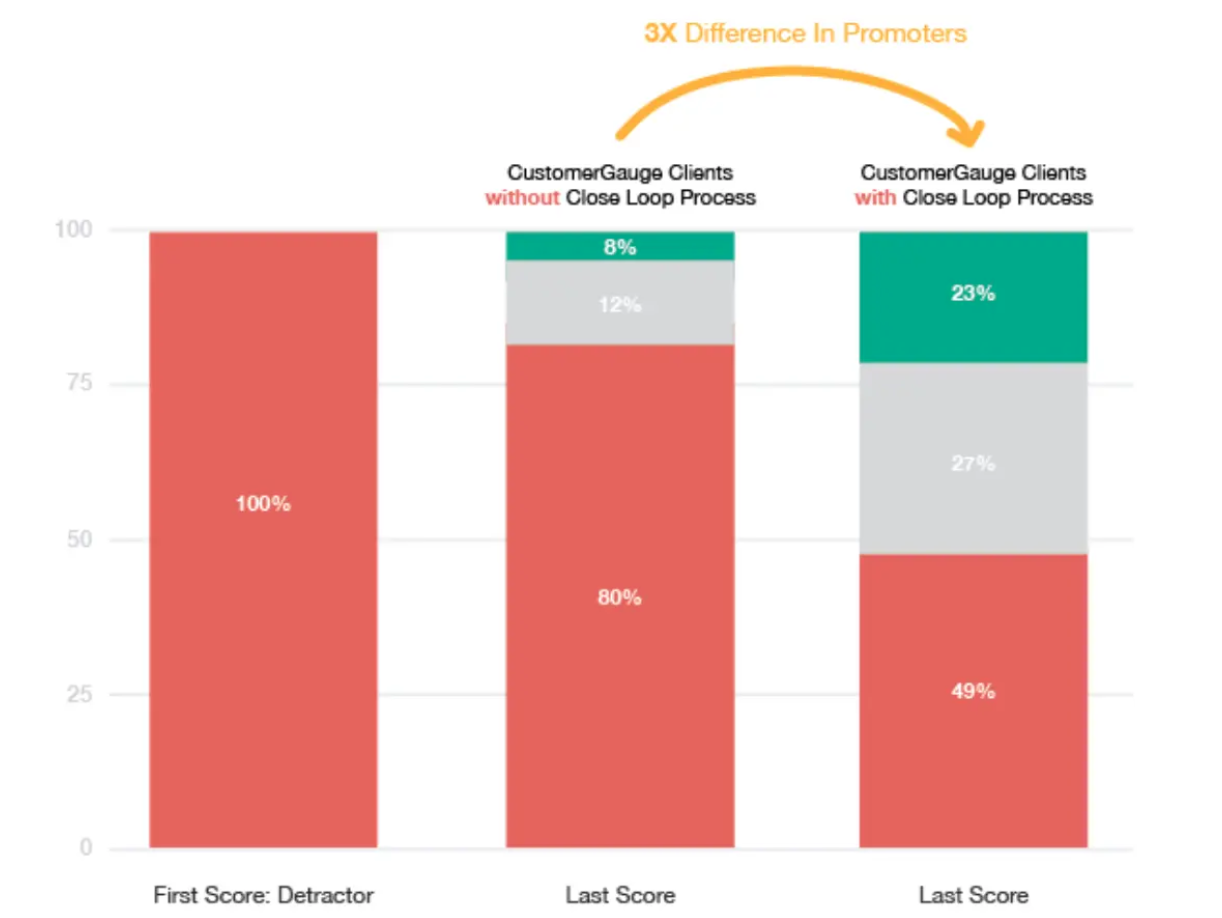

2. Closing the Loop Improves Retention, Loyalty, and Spend

It sounds so simple. Collect customer feedback, act on it, and tell your customers what you have done.

This should be the basis of any healthy customer relationship. However, this process (what we call closing the loop) is actually one of the most difficult parts of CX according to businesses.

However, it’s worth the struggle. Closing the loop quickly can result in a 12% increase in retention and can increase your number of promoters by 3X.

You know what that means? Increased CLTV through greater retention and higher spend.

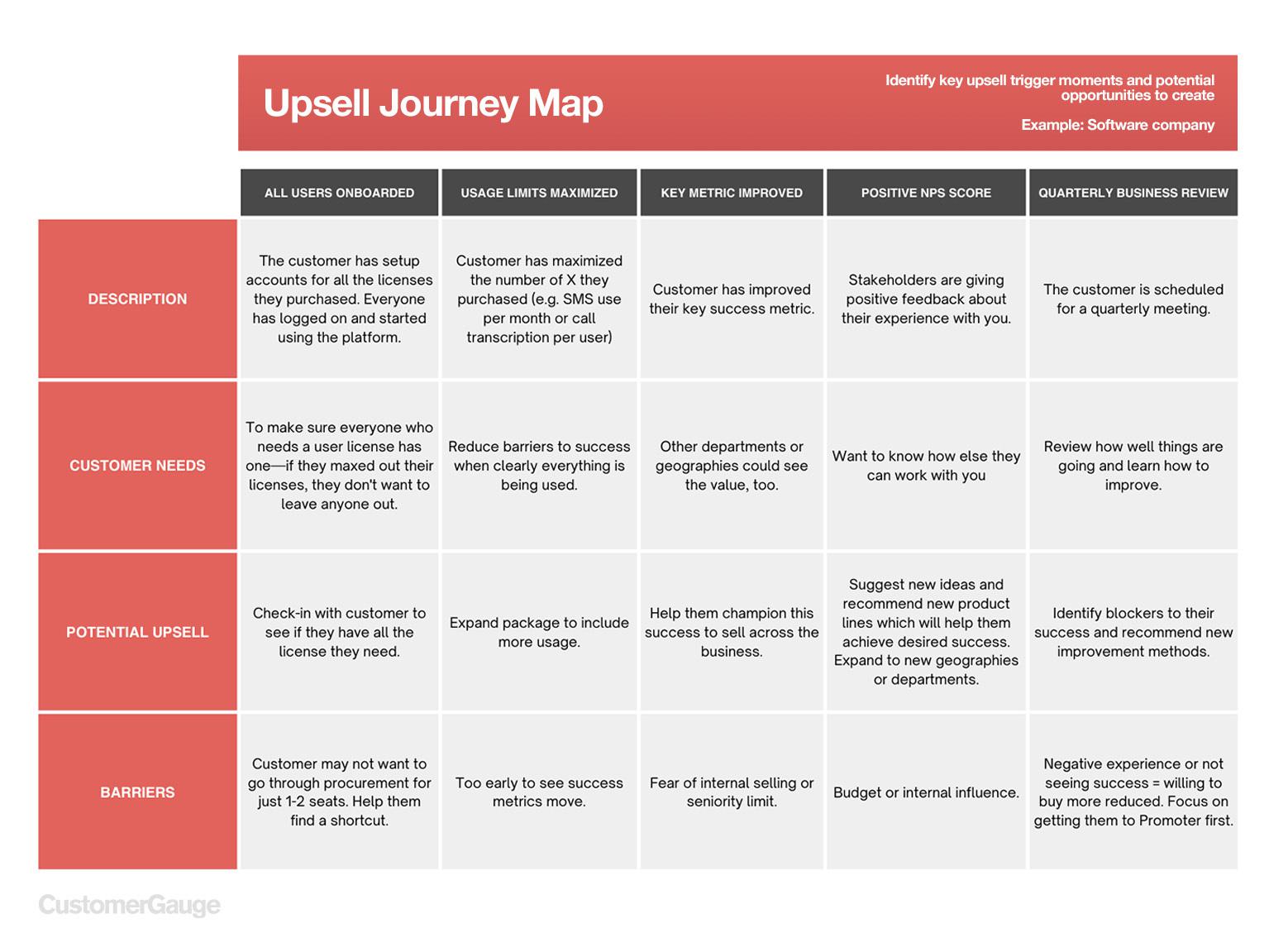

3. Customers That Say They’re Happy Are Great Opportunities For Upsell

Remember the two factors that contribute to customer lifetime value? Amount spent and length of customer relationship. While increased retention improves the latter, you shouldn’t neglect how much your customers are spending.

The thing about loyal customers is that they typically spend more (some studies suggest as much as 140% more). But they don’t usually do that all by themselves. You need to make that happen by taking advantage of upsell opportunities.

Upsell opportunities are when customers are in a position to get more value from the customer relationship. And the best way to identify these opportunities? Customer experience surveys.

Your most enthusiastic customers are most likely to buy more from you. But not all of them can afford to. By referencing your NPS data with financial metrics, you can see which happy customers have space to benefit more from you.

4. NPS Surveys Are the Basis of Your Referral System

When a customer responds to your NPS survey, they’re literally telling you if they would be willing to refer you to their friends and colleagues. To improve your CLTV, you need to make that happen.

The reality is that often all you need to do is ask and far too many businesses don’t.

Actually, it’s one of the most common missed revenue opportunities.

In our research, we found that 63% of businesses aren’t tracking referrals as a result of their CX program, and their CLTV will suffer as a result.

Improve Your CLTV With CustomerGauge

Ready to measure and grow your customer lifetime value? We can help.

At CustomerGauge, we designed our Account Experience (AX) methodology to enable B2B brands to use customer loyalty to CLTV drive growth. With our voice of the customer (VoC) software, you’ll have the tools to boost retention, identify and seize upsell opportunities, and secure referrals.