If you’re lucky enough to count large enterprises among your B2B client base, congratulations!

You’ve undoubtedly invested a lot of money, time, and energy to land that client and nurture their relationship. Mitigating the risk of losing it is probably high on your agenda.

And if it isn’t, it should be.

Our calculations at CustomerGauge show that average churn rates across industries add up to about 27.5%. That might not sound too bad but put it into real terms. If you have annual revenue of $5 million, your churn equates to $1.37 million every year. That’s cash you’re just throwing away.

So, what’s the key to preventing big customers (or even the little ones) from churning?

It’s simple. Understand the reasons why enterprises usually churn and then make sure that you don’t let it happen.

How do you do that? Maintain a 24-hour, 360-degree view of their customer experience of your business.

CustomerGauge’s B2B Account Experience methodology is specifically designed to help you do just that, but we can talk about that later on.

First, let’s consider the 9 most common reasons for customer churn among B2B enterprises and then look at the steps you can take to prevent these from leading to you losing a high-value account.

9 Top Reasons for Customer Churn

According to our research, these are the top reasons for customer churn among large enterprises (in no particular order).

Most of them you can do something about, while others are related to changes beyond your control as a vendor or supplier and can blindside you if you’re not alert to them.

1. Product Bugs or Failures

Failure to deliver, product bugs, or poor product experience are all versions of the same factor in enterprises churning in B2B markets: product failure.

While it can be frustrating in B2C markets, for large B2B companies failures by vendors or suppliers can cost them business or cause reputational damage. If you want to keep all of your clients, ensure your products are working as they should.

2. Price Increases

Changes to supplier prices force enterprises to reduce their profit margins or deliver their own products at less competitive rates. If changing suppliers can keep their costs down or margins up, procurement managers won’t think twice about migrating to new vendors over a price change.

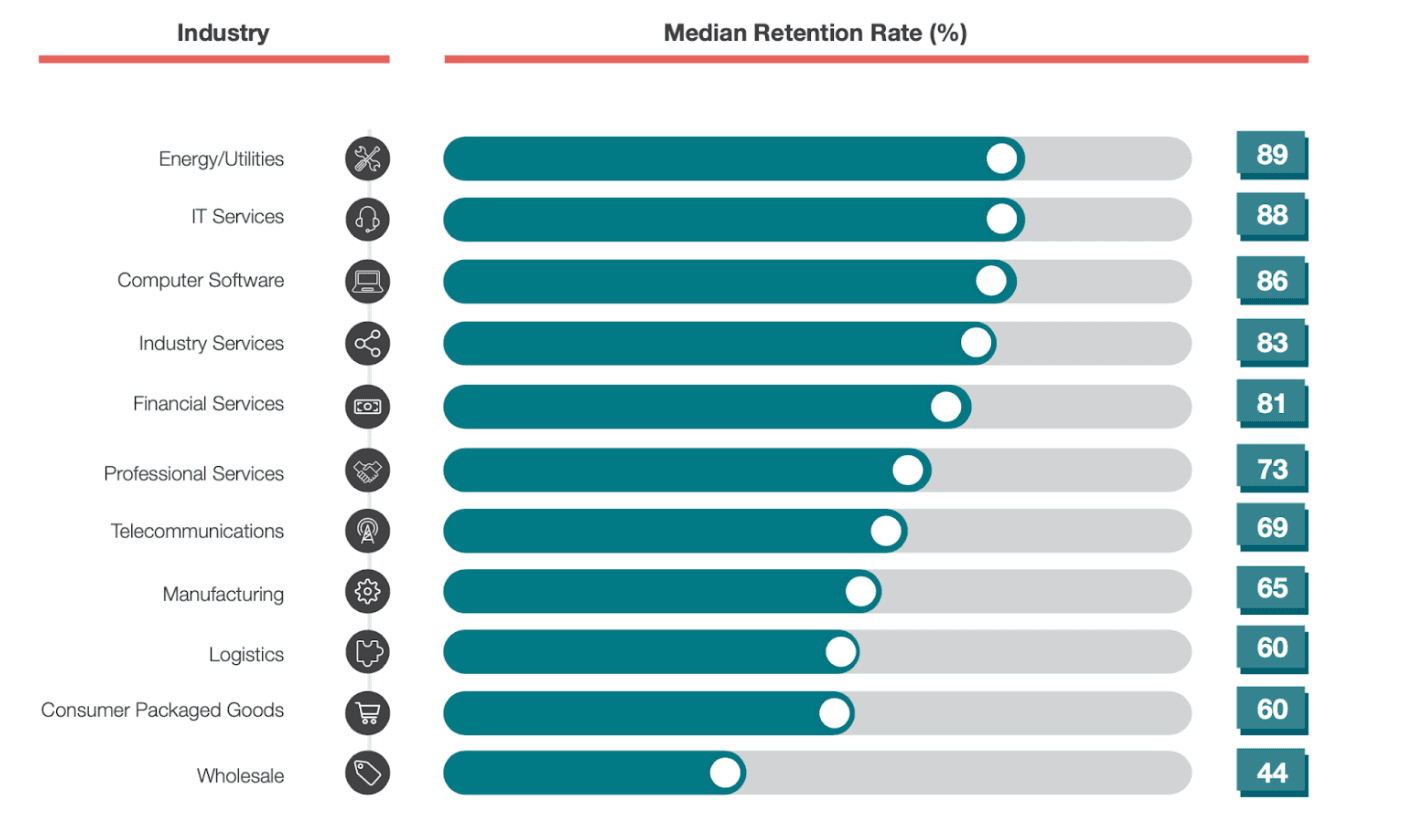

NOTE: The extent to which price matters for churn is likely to vary by industry. As we report in our Account Experience Benchmarks Report, certain sectors, such as energy and utilities, and software and IT services, typically have lower average churn rates (inverse of higher median retention rates).

This is possibly because of high barriers to change i.e. switching suppliers is seen as costly in terms of business interruption and hassle. That means businesses in these sectors may be slightly protected from churn risk if the only change is a marginal price increase.

Conversely, in sectors where average churn is higher and obstacles to change lower such as wholesale, B2B suppliers are much more vulnerable to churn. Here, even a small price rise might be all it takes to send a high-value customer into the arms of a competitor.

3. Poor Customer Experience

Poor customer service is often cited as a major trigger of churn. But, research repeatedly suggests that it is the customer’s experience (not just customer service) that drives customer attrition.

Customer experience (CX) captures the totality of the relationship that makes customers want to stay. It embraces the total experience a customer has when buying, using, or disposing of your product or service, including all the touchpoints from purchase to product usage to yes, customer service.

Failure to manage customer experience is a major customer (and revenue) churn risk, particularly when it comes to high-value accounts.

Get started with customer experience management (CXM) here.

4. Loss of Relationship Contacts

Many B2B brands think it’s enough to engage with just one person in their customer account, especially if the relationship has developed over several years into a professional friendship.

But the hard truth? It isn’t.

The problem is that in these contexts the relationship becomes too reliant on that single personal connection. If the individual in an organization who was once pushing for the adoption of your product leaves, you’re vulnerable to losing the entire account.

The loss of that contact can therefore be one of the earliest and most direct predictors of customer churn.

5. Changes in Perception of Value

Whenever B2B enterprises conduct audits of their supplier lists, what they’re looking to prune out is companies whose service or product is no longer delivering value.

Multiple factors go into deciding B2B value, including price, ability to help them reach the desired outcome, and the relevance of a product or service to achieving that outcome.

Churn for this reason can be a difficult pill to swallow if nothing has changed on your side. What has likely happened is that the customer’s needs have evolved and your product hasn’t adapted to reflect that change.

6. Leadership Changes

Changes at the C-Suite or department head levels in an enterprise can trigger a cascade of changes throughout the organization. This can include high-level changes to business strategy and priorities or more granular changes like decisions to switch suppliers.

New directors or department heads might also want to bring in firms with which they’re more familiar. B2B businesses often work on highly personal relationships. And if an executive trusts someone they have worked with before, it’s no surprise that they’ll want to work with them again.

As a supplier, this can put you in a difficult position, seemingly at the whims of these personal preferences. However, you’ll be a lot less vulnerable to any changes if your product is fully embedded in customer organization.

7. Market Changes

The arrival of new competitors is obviously a threat when it comes to customer churn risk. New market entrants often lower their prices artificially or design unrealistic special offers to tempt clients away from existing market players, with a view to normalizing their offering once the poach is completed.

While there is little you can do to control the players in your market, there’s plenty you can do to ensure customer loyalty.

8. Consolidated Supplier Lists

Even if your high-value enterprise customer is happy with the value you deliver, decisions at enterprises are often made at higher levels than those of your account contact. Perhaps the person you interact with is happy with your product, but your value might not be that obvious at higher levels.

If opportunities to streamline supplier lists arise, for example if another vendor suddenly expands their offering to include the service you provide, enterprises may well terminate contracts simply to consolidate supplier lists, gain efficiencies, or exploit economies of scale.

9. Compliance Requirements

For enterprises with shareholders or those under public ownership, compliance and regulatory rules may dictate their supplier contracts more than the preferences of individual managers.

For example, it might be the case that supplier contracts must automatically be terminated and put to tender again after a set number of years in the name of transparency.

New investment rules, incentives or taxation changes, such as those designed to promote green investment, can also influence enterprises to switch suppliers if their current ones don’t tick the right boxes.

How to Combat B2B Churn

You can’t always avoid the pain of suddenly losing your high-value accounts. As you would have noticed, a lot of the factors that might contribute to enterprise churn are changes outside your control.

However, having comprehensive and accurate insight into how your enterprise customers are experiencing your business at every touchpoint and all levels means you can anticipate some of these changes and stay ahead of the curve.

How? Here are a few steps:

If you’re starting from scratch and you don’t have a customer retention management program, you need to start one. That usually begins with securing buy-in for your strategy and deciding the goals you want to achieve.

Invest in some solid Voice of the Customer (VoC) software to support your program. Of course, you should make sure that whatever you choose is specifically designed for the B2B market.

Invite as much feedback as you can by starting conversations with your enterprise customers and implementing a customer survey system that works for them. We recommend Net Promoter Score over Customer Satisfaction or Customer Effort Score (and our research has found that 41% of B2B businesses would say the same).

Listen To The Account Experience Podcast Episode on NPS v CSAT

Consider appointing a chief customer officer to take the lead.

Link up your retention data to financial metrics. By measuring your ROI, you’ll be better placed to get buy-in right the way up to your C-Suite.

If you have these basics in place but are still worried about enterprise churn, these two specific strategies will help you target retention on these kinds of accounts.

Strategies to Target Enterprise Churn in B2B Businesses

1. Let Revenue Guide Your Experience Program

It’s easy for CX practitioners to fall victim to the Happy Ears Problem: thinking things are going well because they’re listening to their happiest customers, only to be caught out when the quieter customers start dropping away.

The problem is: what if your quieter customers represent your highest-value accounts? This was exactly the mistake we made that led to us developing the Account Experience approach.

When we ranked our accounts by total revenue rather than feedback, we discovered our 20 highest-value customers had little to no responses and very low engagement. And low engagement is one of the strongest predictors that an account needs attention. We had left ourselves wide open to churn, all the while thinking that we were doing fantastically.

What was the key to overcoming this? Combining our B2B experience program with revenue data — and we recommend you do the same.

We enhanced the Net Promoter System® by prioritizing account revenue and growth and termed this new methodology Monetized Net Promoter®. Then, put it at the heart of the shift from Customer Experience to Account Experience.

The results? We turned retention around and started onboarding, and retaining, new enterprise clients at a steady clip.

2. Multiple Stakeholders From Every Account

At least three of the factors for enterprise churn we identify above (loss of contact, change in perception of value, and change in leadership), can be mitigated by simply expanding the number of contacts you have in each account.

The impacts are considerable. B2B CustomerGauge customers who surveyed multiple contacts in an account experienced 18% higher retention rates than those who only surveyed single contacts.

Better yet, ensure that those contacts include people at leadership level. A general rule we advise our Account Experience clients to follow is this: 10 contacts across all three levels of an organization (C-level, middle management, and front-line) for every $1 million in revenue.

By spreading your relationship and surveying sentiment at all levels, one loss of contact doesn’t spell the end of your account. It’s also less likely that your value will be overlooked by new staff or new leaders. And if there’s a risk, you can catch it before they churn.

If you want an unbiased and updated view of account sentiment at your enterprise customers, survey multiple contacts.

Cut Churn With CustomerGauge

All in all, If you have strong enough visibility on your customer sentiment at all levels, and you know how to prioritize your highest revenue accounts, you can navigate changes beyond your control and come out with your crucial high-value enterprise accounts still intact.

CustomerGauge’s Account Experience software is designed to help B2B businesses do just that.