We all know the importance of acquiring new customers. But there’s a case to be made in having your marketing, customer success, and sales team come together to secure customer loyalty.

Why?

Because understanding and maximizing customer loyalty helps you drive growth, cut churn, and improve your customer satisfaction — benchmarks that if accomplished benefit every department.

Yet, to achieve the best results, you must conduct a customer loyalty analysis, driven by the right data.

That sounds like a given, but it isn’t.

70% of B2B brands hobble their customer retention efforts simply by not understanding the impact loyalty has on revenue. And this means that they’re failing to live up to their growth potential.

In this article, we explore how to properly analyze the state of your customer loyalty, including the metrics to use and the considerations you shouldn’t forget.

Is Mismanaged Loyalty Worse Than No Loyalty at All?

B2B loyalty programs are as old as retail itself, yet they haven’t always been successful.

Back in 2002, two researchers shared some truth about the assumptions surrounding customer loyalty. Analyzing over 16,000 accounts across individual and corporate customers, they argued that loyalty programs were actually losing companies money overall.

In fact, they found only a very weak correlation between customer longevity and profitability. For B2B tech providers, for example, loyal customers assumed to be quiet, experienced clients were expensive to satisfy, regularly requesting discounts and increasing their demands at every contract renewal.

Now, it’s not all bad. The advantages of customer loyalty are very well established. But what this study showed is that many loyalty programs don’t stay on the right side of the line between genuine advocacy and wasted revenue.

Enter customer loyalty analysis.

To truly understand the impact that your customer loyalty system is having, you need to link your customer experience to your bottom line.

What A Customer Loyalty Analysis Needs to Get Right

To understand your loyalty rates (and to build a customer loyalty program that really grows revenue) your analysis needs the following:

The right data. A customer loyalty analysis should be built on data — not on a hunch or on imprecise customer feedback. We mean solid customer loyalty metrics.

Tied to revenue. One of the key bits of data you’ll need regards revenue. Customer loyalty analyses are often seriously undermined by a lack of data on their financial impacts. To achieve what you want it to, your customer loyalty analysis must link sentiment data with real-world revenue production.

Basis for action. Analysis is great, but it’s what you do with that analysis that matters. Now you know your loyal customers, what are your next steps? The answer should be to pursue upsells, resells, and referral opportunities (i.e. techniques that drive growth).

The right software. The sheer quantity of data required for a customer loyalty analysis can be intimidating, and conclusively monitoring the opinions and experiences of every account demands a certain level of automation.

Customer loyalty software such as CustomerGauge’s Account Experience provides not just automated data collection, but helps you visualize data and close the feedback loop all in one place.

Analyzing Customer Loyalty With CustomerGauge

To build a retention program that actually drives growth, your customer loyalty analysis will need to intertwine sentiment analysis (the customer’s willingness to purchase and recommend) with an understanding of customer action (their true engagement and revenue production).

Here, we show you how you can start analyzing both elements of your customer loyalty retention:

Step 1: Measure Revenue

Let’s start with the key revenue metrics you need to ensure that your loyalty program is driving growth.

1. Repeat Purchase Rate

The very core assumption of customer loyalty is that loyal customers make repeat purchases.

Your repeat purchase rate (RPR) measures the proportion of your customers that makes more than one purchase. This sheds light on the tendency of your customers to buy more than once.

The repeat purchase rate is a percentage. Calculate it within a specific timeframe by dividing the number of customers who made multiple purchases by the number of total customers.

What is a good RPR? In B2C contexts like eCommerce, a 27% RPR has been found to be a good baseline. However, in B2B contexts, you should be aiming much higher.

2. Customer Retention Rate

Now you’ve got a baseline for the general sticking power of your brand, let’s dig in a little deeper.

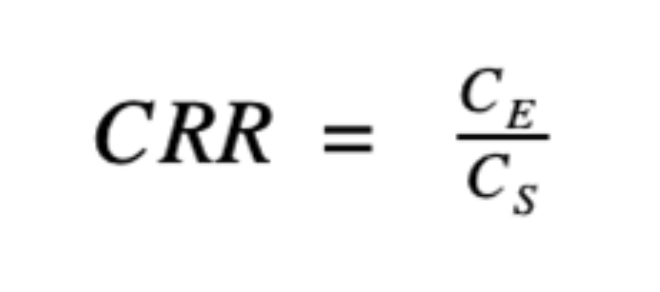

Customer retention rate (CRR) shows the percentage of customers that return within a certain time frame. You can calculate it with the following formula:

First, pick your time frame. Then collect the following figures: the numbers of customers you had at the beginning of that period (CS) and the number of customers at the end (CE). You can ignore the number of new customers acquired.

Now, you’ve got an idea of how many customers stick around to make repeat purchases. CRR is built for comparing retention rates between two periods of time.

Note the difference between retention and loyalty. Customer retention measures whether an existing client continues to purchase your products or services, whilst loyalty describes a propensity to engage with your business’ brand.

Retention is a binary concept; loyalty is scalable — and a customer you've retained (until now) isn’t necessarily a loyal customer. (By the way, you can discover the different types of customer loyalty here.)

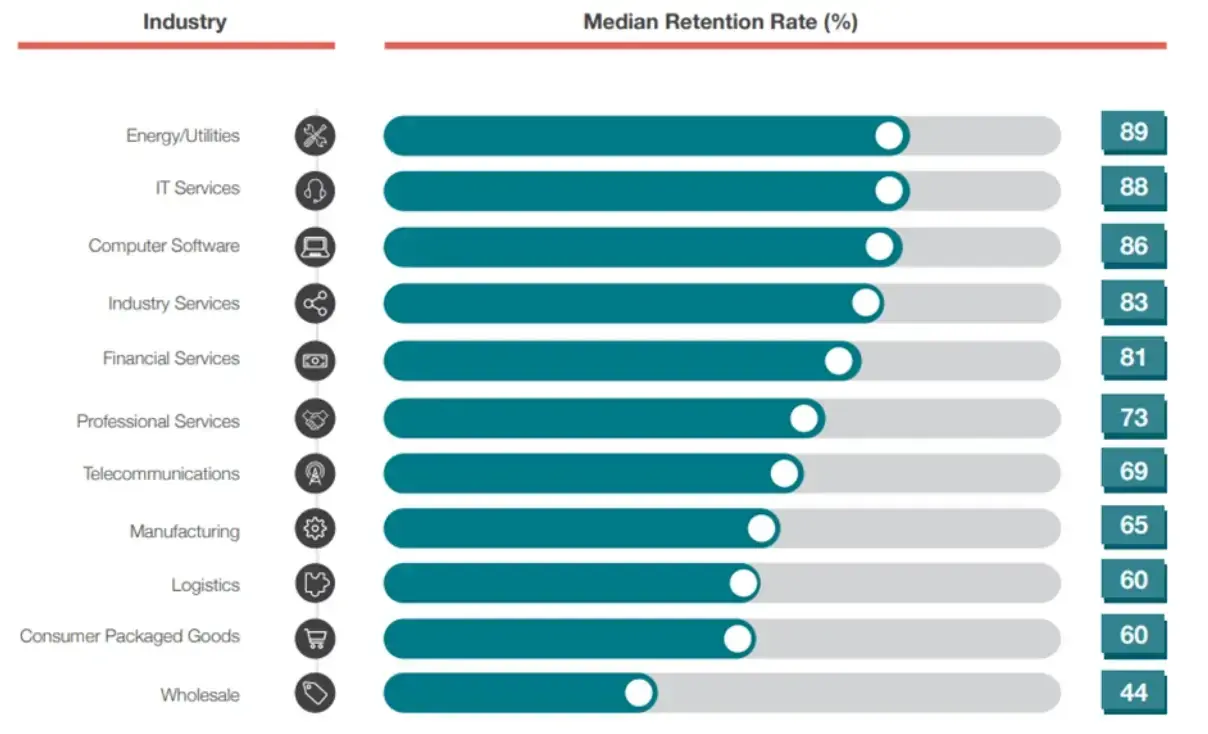

What’s a good customer retention rate? In our 2021 report, The State of B2B Account Experience, we found how customer retention rates differ by industry.

3. Customer Lifetime Value

Finally, to ensure that your continued loyal relationship with your customers remains profitable, we recommend that you regularly calculate your customer lifetime value (CLV).

CLV tracks a customer’s total revenue generation throughout your working relationship.

This sets the context for sentiment data (which we come to below), and is a major component of customer loyalty analysis. If investing in loyalty increases a customer’s lifespan, you need to know one thing: that it will keep customers coming back for more than you invested.

Step 2: Understand Customer Sentiment

Once you’ve gained an overview of your customers’ actions, i.e. the contribution they’re making to your revenue, it’s time to dig into the reasoning behind them. Where step 1 mainly looked at the history of an account’s activity, this step assesses the likelihood of future revenue creation.

Here are the metrics you need to keep an eye on:

1. Net Promoter Score

The Net Promoter Score (NPS) is the most widely used and effective way to measure and categorize the sentiments behind customer loyalty.

Here, a customer is asked the question:

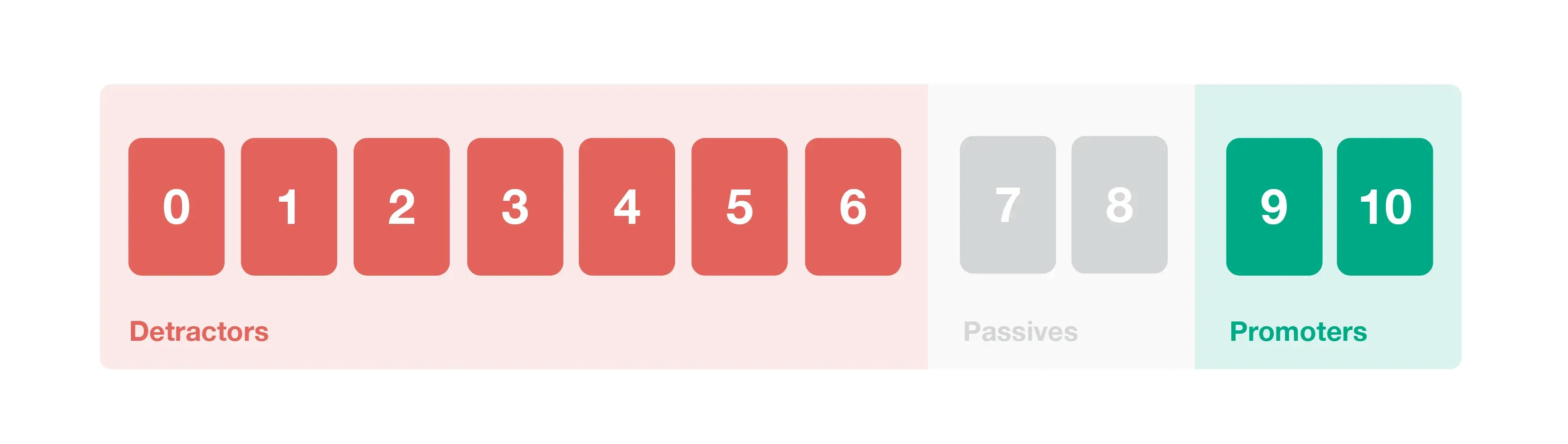

“On a scale of 0 to 10, how likely are you to recommend our company to a friend or colleague?”

From there, respondents are placed into one of three categories.

If they answered with a 9 or 10, we call them promoters. An answer of 7 or 8 identifies them as passives. And anything below 6 makes them detractors. To reach your overall NPS score, subtract the percentage of detractors from that of the promoters.

Tracking your NPS score over time can be a major performance indicator for your loyalty programs and overall marketing efforts — but it’s far from the whole story. The NPS is more than a mark out of 10. Rather, customers should be given the opportunity to say why they have given that score.

At CustomerGauge, our text and sentiment analysis tool automates the process of reading and categorizing your customers’ feedback.

With our industry-specific word recognition database, thoughts are funneled to the relevant team rapidly and accurately. This streamlines your response method, amplifies a customer’s voice across an entire organization, and provides actionable data straight from the client’s mouth.

Want to know more? Read our guide to NPS survey analysis.

2. Customer Satisfaction Score

While NPS addresses loyalty towards your brand, the customer satisfaction score (CSAT) is a survey that addresses satisfaction with a specific product or service.

Similar to NPS, it takes the form of a question, such as, “How satisfied were you with our service today?”, alongside a scale between 1 to 10.

This gives you insight into sentiment across your company’s range of products, helping you hone in on specific sources of customer churn. While it’s useful, we found that it isn’t as popular among B2B brands as NPS, which may limit its value as a benchmarkable metric.

3. Customer Effort Score

Lastly, the customer effort score (CES) evaluates the ease with which accounts can navigate and work with your business. That includes purchasing your product, agreeing on contractual terms, and how supported they feel in the acquisition process.

The easier it is for a customer to work with you, the more likely they are to keep doing so.

A CES survey asks for a grade between 1 and 10 for the specific interaction you’re testing.

From here, you should have a decent view of how many customers trust your organization and why. You’ll also have identified bottlenecks throughout both the product range and customer purchase funnel.

4. Social media listening

Alongside customer surveys, there are alternative, passive ways of understanding your customer sentiment.

Social media and reviews, for example, offer a wealth of information regarding both your company and where you sit in comparison to competitors. The benefit? A social media POV provides insight far more rapidly than orchestrated surveys can, and alerts you to widespread customer issues as they happen.

Step 3: Link Sentiment to Revenue for a Complete Customer Loyalty Analysis

Prioritizing and managing the needs of these clients, each with different sizes, budgets, and stakeholder value, can feel like being torn in two directions at once.

An NPS might paint one client as a promoter, and another as a detractor. Now what?

Fundamentally, loyalty programs are an investment in clients — but you need to know which investments will pay off.

CustomerGauge’s Account Experience places all your clients on the same page. This is achieved by correlating each account’s sentiments with their real-world revenue generation. Our program strips back the variables, showing you the most profitable opportunities to pursue.

CustomerGauge’s Account Experience platform empowers your analysis to:

Identify the value of your customers. Traditional analysis shows you whether a customer is at risk of churn. Account Experience displays how much value is at risk as a result. If a large, established account is at risk of churn, they should be your priority.

Understand the true cost of drivers. There may be specific issues that are driving away repeat customers. Account Experience shows which drivers are having the biggest financial impact, so you know where to direct your resources.

Use CustomerGauge to Analyze Customer Loyalty and Drive Growth

Data shows that brands viewed as “meaningful” outperform the stock market by 134%.

Providing authentic referrals and with a far higher ROI up for grabs, finding and retaining loyal clients is worth the investment.

Account Experience has been consistently ranked by Gartner as the #1 customer experience platform for B2B brands.