Measuring the health of your customer relationships on a regular basis is important for business growth.

It helps to ensure that customer issues don’t accumulate and stay unresolved, which could lead to your customers becoming detractors and subsequently churning.

The best way to do this? Regular Voice of Customer (VoC) surveys.

But, like every survey you undertake, you need to be strategic in the VoC survey questions you ask. You want to make sure that the process is simple and seamless for your customers, while still providing you with all the information you need. The last thing you want to do is irritate your customers, especially if they already have concerns they want to raise.

Let’s take a look at effective VoC surveys and what questions you should ask.

What is a Voice of the Customer Survey?

VoC surveys gather useful feedback from your customers about your brand, products, or services. They’re not designed to measure everything at once, but rather to give you regular insight into issues that could turn your promoters and passives into detractors.

According to our research, VoC surveys should ideally have six questions or less. Yes, we know, that’s not much at all. But if you keep your surveys short and succinct, you’re likely to receive a rate of retention of up to 5.3% higher.

If your questions have been carefully designed, you should get everything you need.

We recommend that you conduct VoC surveys every quarter so that nothing goes unaddressed for too long. And if you don’t believe customer experience issues are that important, remember this stat: approximately 59% of customers in the U.S. will walk away from a company they love after just several bad experiences with them (17% will leave after being let down just once).

Good customer experience, on the other hand, can drive revenue by as much as 84%.

Ultimately, you want to know what your customers think and feel—and VoC surveys are one of the most valuable ways to go about this.

Questions to Ask Yourself Before Sending Your Voice of Customer Survey

Before we get into some examples, let’s take a look at the kinds of questions you should ask yourself before you question anyone else. Bear the answers to these questions in mind as you start putting your VoC survey together.

What is the goal of your survey? Are you trying to assess brand sentiment or capture customer feedback? Are you looking for deeper information into the market as a whole? What are the outcomes you want? Work backwards from there.

Who are you surveying? Are you surveying all of your customers or only customers who engaged with you in the last two months? Be careful of surveying brand-new customers too quickly. They haven’t had much time to engage with you yet, and might find being on the receiving end of a survey so soon a bit annoying. Consider your list of recipients thoroughly before you hit send.

Are you looking for quantitative or qualitative information? Quantitative questions will give you clear information on key issues, while qualitative questions will give you deeper, more nuanced insight. Both are valuable, but which questions you ask depends on what you’re looking for.

Are your questions simple enough? VoC surveys should be simple and easy to respond to.

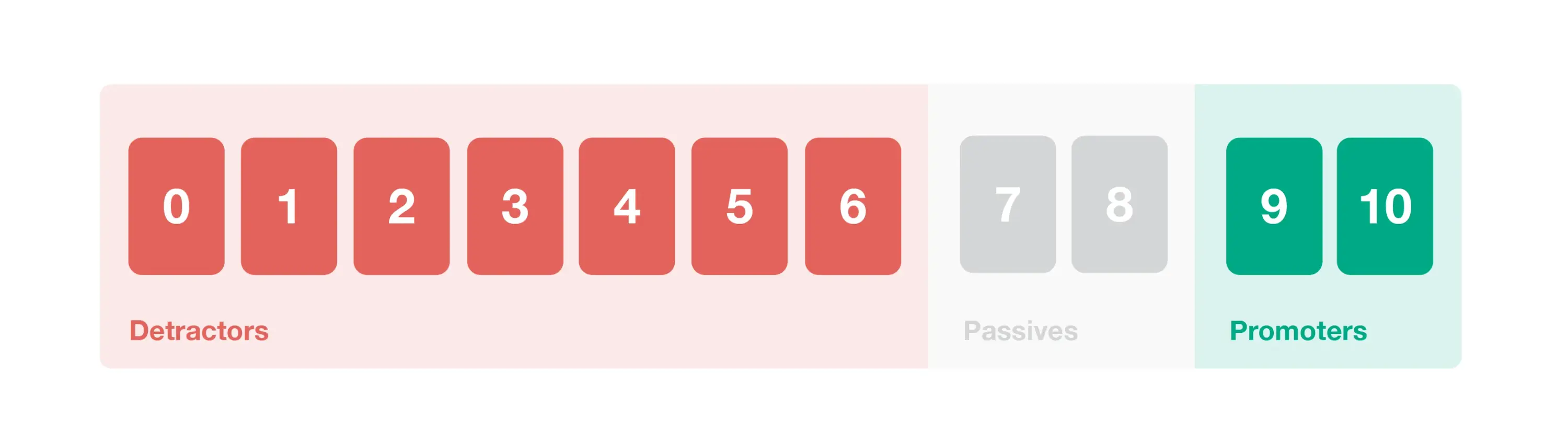

Are your answering options designed appropriately? VoC answers can take many forms. Some are rating scales that range from 0 to 10 or from “strongly disagree” to “strongly agree”, some are multiple-choice options, and some are open answers. Make sure the design of your answers is tailored to the question concerned.

Does your survey require follow up? With Net Promoter Score (NPS) surveys, yes, some sort of follow-up is usually required to resolve issues with unhappy customers quickly. Remember, in addition to growing your bottom line, the ultimate goal is always to retain your customers.

Great Voice of Customer Survey Question Examples

Are you looking for value or results-based information? Insight into how satisfied your customers are with your brand, products, or services? Or maybe you’re curious about their perception of or loyalty towards your brand.

Each of these motives is guided by a different methodology:

Customer Effort Score (CES) VoC surveys assess how easy a customer found interacting with you, and how much effort they had to put in to get an issue solved.

Customer Satisfaction (CSAT) VoC surveys measure how happy customers are with your brand. These types of surveys could be based either on a particular transaction or on the overall relationship.

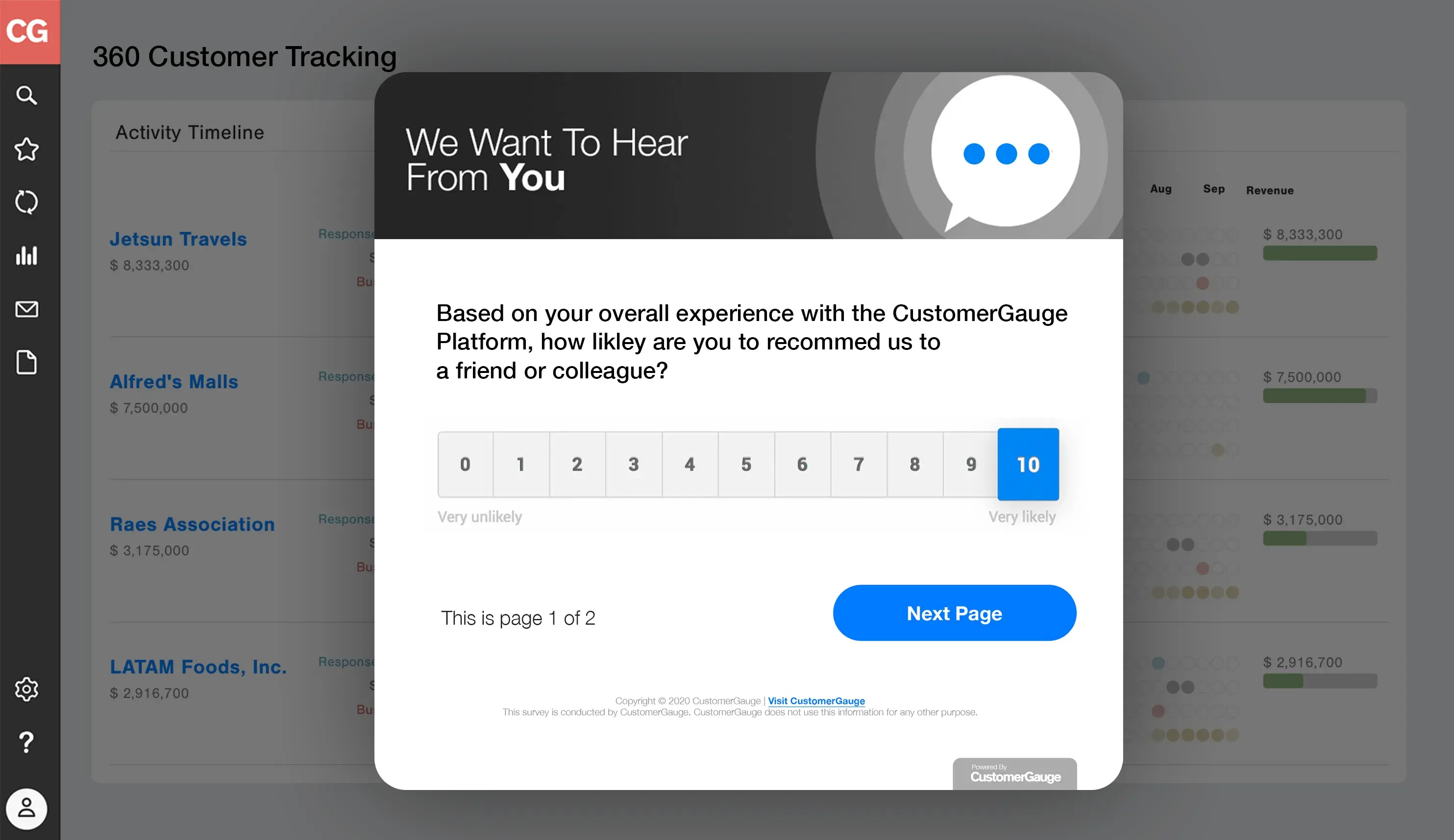

Net Promoter Score (NPS) VoC surveys are one of the most commonly used brand loyalty surveys. If you’ve ever come across a survey asking you, “On a scale from 0 to 10, how likely are you to recommend our company to a friend or colleague?”, that’s NPS in action.

Here are some useful question examples:

Value or Results-Based VoC Questions

Did you find everything you were looking for today?

Is there a product or service you were looking for that we didn’t have?

From 1 to 10, how would you rate the value of your purchase?

What are the most important qualities you look for in a product? (Here, you might provide a selection of multiple-choice answers, and the option to write an answer if theirs is not listed.)

Did our customer service help you resolve an issue?

Brand Loyalty or Brand Perception VoC Questions

- How likely are you to recommend us to a friend or colleague? (Offer the NPS scale from 0 to 10.)

Why did you answer the way you did? (This follow-up question is open-ended, and respondents may choose to engage with it or not.)

When you think about our brand, product or service, what comes to mind?

What might prevent you from continuing to do business with us over time? (Give multiple-choice answer options, with an open-ended “other” option.)

How likely are you to switch to another brand, product or service? (Use a sliding scale from very unlikely to very likely.)

Customer Satisfaction VoC Questions

How was your experience with us today?

How satisfied are you with the service you received?

Was your customer service agent able to handle your issue?

How satisfied are you with the amount of time it took to resolve your issue?

What could we have done to improve our service?

You can find more VoC survey questions to ask in our article on the Net Promoter Score question.

Collecting Voice of Customer: Follow-up and Cascading Questions

We’ve included a few follow-up questions above, which can help you to probe further into a specific problem if you wish. Qualitative follow-up questions on quantitative questions can help to give you a holistic view of a particular answer.

For example, you could follow up the question, “How likely are you to recommend our company to others?” with “Tell us why you chose option 6”.

By using only a few questions in your VoC survey (remember, we recommend a maximum of six), you’re likely only to receive insight into a few select issues. That’s okay.

To help gather more information over time, we also suggest using cascading questions.

Within surveys, cascading questions offer a more personalized experience for customers and more accurate root cause and driver analysis for companies. This type of analysis not only helps you to determine the drivers behind detraction, but also shows pathways to monetize opportunities with existing customers.

Looking for more information? Here’s why you should use cascading questions in your surveys.

And for further tips on how to improve your VoC system, check out our article on how to improve NPS.

Putting Voice of the Customer Survey Data to Good Use

Of course, all of this information is only worthwhile if you use it to improve your business and your offerings. To do this well, link your VoC data to your bottom line. For that, CustomerGauge’s Account Experience methodology and voice of customer software can help.

Whether you’re still getting your first VoC survey off the ground and need a bit of help, or you’re sitting on valuable data that you don’t know what to do with, CustomerGauge are here to support you to get your customer experience program to drive growth. Talk to us today to learn more.