Customer retention management is the process you put in place to help your organization maintain customers. In other words, it’s the way your business becomes intentional about retention rate and clear on how it affects revenue.

It also stresses the importance of utilizing customer feedback to understand their expectations and how to act accordingly.

Ultimately, the goal of customer retention management is to prevent churn, by doing three main things:

Understanding what would make customers stay. Typically, customer retention programs access this insight through Net Promoter Score surveys. These can tell you how customers feel about your product and brand and why.

Closing the loop with customers based on their feedback. When customers tell you the factors that impact their retention, it’s your job to intervene to make them stay. That’s what closing the loop is all about.

Accessing data on the value of churn drivers. Not all churn drivers will have the same impact on your bottom line. By understanding the financial impact of specific drivers, you’ll know what to prioritize to optimize growth.

If you’re serious about business growth, it’s something you can’t take for granted.

By boosting your retention rate, you’ll enjoy a more loyal and enthusiastic customer base, cut the cost of customer acquisition, and improve your profit margin.

Don’t know where to start with creating a revenue-boosting customer retention program?

Let’s begin with the top reasons why it’s crucial to the success of your business.

Why Customer Retention Matters

Customer retention is the rate at which customers stay with your brand, rather than churn. And whether you’re yet making efforts to manage this, you have a customer retention rate nonetheless.

There are important reasons why your business should focus on customer retention as a key metric, as well as building deeper relationships with your customers to boost your bottom line.

Firstly, it costs less to keep customers. It can be as much as 25 times more expensive to acquire a new customer than to retain an existing one. If there’s one reason why customer retention matters, it’s this.

You’ll understand customers better. Customer retention management programs help you get a deeper understanding of what makes your customers tick. That’s because, when they’re implemented well, they’ll tell you the key drivers of customer churn and the indicators of customer loyalty and satisfaction.

It has trickle-down effects on customer satisfaction. The efforts you put into your customer retention programs won’t just impact your churn rate. Rather, they’ll help to boost your customer experience (CX) in general.

Customers that stay spend more. Studies suggest satisfied customers spend about 140% more than others. Similarly, research from Bain & Company shows that a 5% growth in retention correlates to a 25-85% growth in profit. This means there’s a straight line between your customer retention efforts and your revenue.

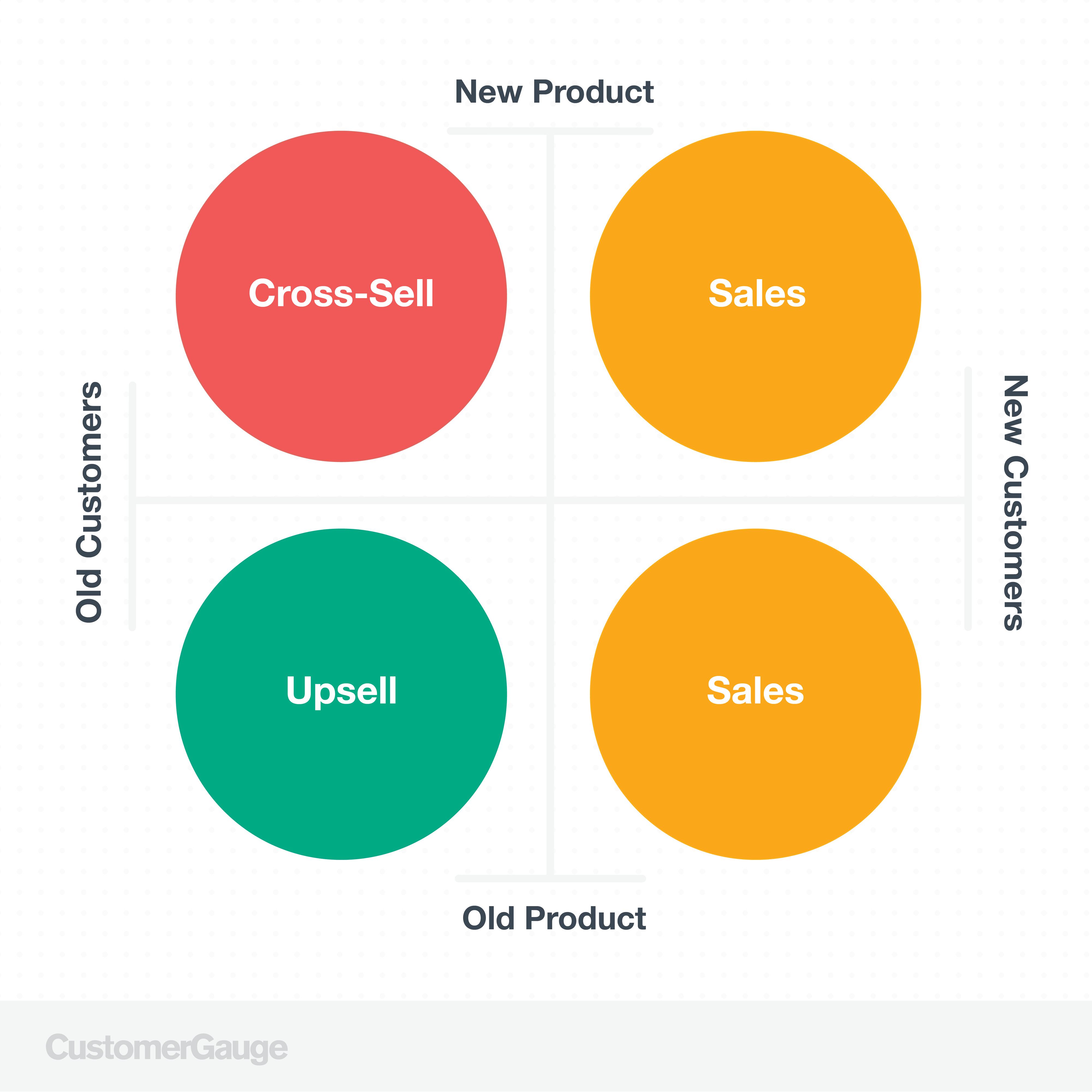

Loyal customers are opportunities for upsells, cross-sells, and referrals. Finally, retaining customers is great per se. But more importantly, loyal customers offer channels to more easily sell new products and gain new customers.

By giving customer retention management the investment it deserves, you’ll be sure to secure those benefits for yourself.

What Makes Good Customer Retention Management?

If you are just starting out with customer retention, what do you need to make sure you do?

Here are 4 things your customer retention management framework needs to provide:

It should be led by data. Our own data shows 44% of business leaders don’t know their churn rate — yes, 44%. Yet, customer retention success starts with concrete data. If you want to invest in a customer retention management strategy, you need to know who is churning, and when, why, and how much they’re worth. Without this data, you’re flying blind.

It should offer flexibility. Businesses have different customer journeys with different touchpoints. And these can change within your business, too. The best kind of customer retention program will give you the flexibility to adapt to changing conditions. So, if you’re just starting out with your customer experience management, choose a framework that can adapt to your needs.

It needs to be supported by CXM software. As your customer base grows, your CX operations will become more complex. And if you’re a B2B brand, you might find managing different stakeholders in each account is complex enough already. A customer retention platform that can give you clarity on all of your retention data will help you make sense of it all.

It must tie customer experience data to revenue. Our research has found that 70% of businesses don’t understand the financial impacts of their customer experience efforts. This must be a fundamental part of your retention management program.

Which customer retention programs do all of these things? Let’s take a look at some of your options, starting with Account Experience — ranked as the #1 customer retention methodology for B2B brands by Gartner.

Customer Retention Management Frameworks to Follow

Account Experience

CustomerGauge’s Account Experience is the most sophisticated customer retention program out there for B2B brands. We built it to enable companies to monetize their Net Promoter efforts and use customer experience to accelerate their revenue.

It works through three steps:

1. Measure

Our Account Experience retention management model starts by measuring customer sentiment. It does that by tracking your Net Promoter Score, or NPS.

NPS is a simple and scalable tool that’s used as the basis of many customer retention strategies. That’s because it can give you clear insight into the precise drivers of customer experience across the customer journey — whether that’s onboarding or customer support.

You’ll access this information by asking your customers the simple NPS question:

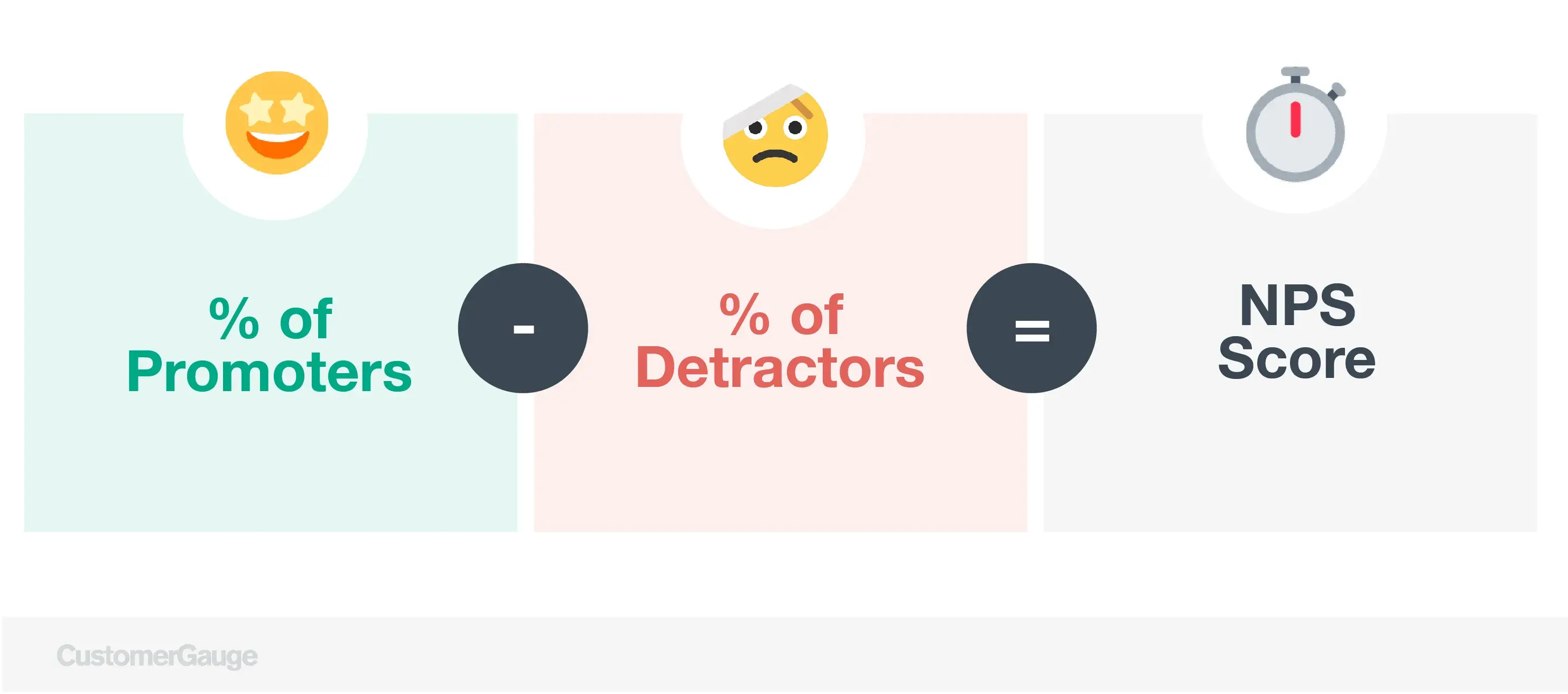

On a scale of 0-10, how likely are you to recommend our product/service/brand to a friend or colleague?

Then, based on their responses, you’ll categorize your customers into promoters (loyal, enthusiastic customers), detractors (churn risks, who may spread negative word of mouth), and passives (who feel neutral but may be flight-risks if something better comes along).

The beauty of this system is that you can use it to identify the specific drivers that are leading to churn.

For example, NPS can tell you that onboarding is highly recommendable, for example, but that customer support is driving people away. When a third of customers will leave your brand after a single bad experience, this is something you’ll want to change as soon as possible.

By the way, we do things differently at CustomerGauge. Rather than relying on heritage NPS, Account Experience enables you to monetize your NPS system for better revenue results.

By monetizing NPS, you can identify key factors that will help you grow in the future:

The value of customer sentiments. If your larger accounts are among your NPS detractors, serious amounts of revenue could be under threat. Account Experience helps you see exactly how much revenue is at risk of churn.

The cost of specific drivers. Monetizing your NPS shows you how much specific drivers, such as customer service, are costing your business. If you don’t do anything to improve them, they will be a financial drain—and you want to know exactly how much they are worth.

With the information collected from your NPS surveys, it’s time to move on to action.

2. Act

Action is what turns the insights from your Net Promoter surveys into profitable strategies for growth.

Our Account Experience methodology focuses on two central tasks that should form the basis of your retention program: closing the loop and optimization.

Closing the loop is perhaps the most important action to solve customer retention issues.

Whether customers are detractors or promoters, you need to respond to their surveys fast to get them to stay. This is something that everyone in your organization can play a role in:

Frontline staff can work to identify the root cause of NPS scores

Middle management can monitor performance trends and ensure best practices are followed

Senior executives are there to identify strategic or structural problems and refine investment needs.

All of these tasks will have an impact on your retention. How? Because by acting on customer feedback and telling customers what you’ve done, you’ll build trust, show customers you care, and turn detractors into promoters.

Then, optimization is about setting targets and improving your retention rate against those goals. It’s a crucial part of your process because companies that set targets grow twice as fast as those that don’t.

Most businesses using heritage Net Promoter systems stop there.

However, our Account Experience model takes you a step further to use customer retention rates to inform growth.

3. Grow

The third and final stage of our Account Experience customer retention model is Grow.

This is when your customer retention efforts have a direct impact on revenue.

How is it done? Firstly, by using monetized NPS and other metrics to ensure you understand the financial value of your customer experience.

Then, follow three steps:

Know your at-risk value. Identifying which customers are most likely to churn is the key task of your retention strategy. But understanding how much those customers are worth to your business is an insight that will drive your strategy. Closing the loop with these customers quickly will drive retention — and boost your bottom line.

By the way, you can discover how much it is costing you to be doing nothing with our ROI calculator.

Leverage promoters for referrals. The value of promoters is that they’re willing to recommend your brand to others. Nudging them to do so will have a big impact on your bottom line.

For example, thanks to Account Experience, SmartBear grew a $6 million referral machine in just six months. Find out how they did it.

Identify opportunities for up-sales. Customer retention helps drive growth by making it easier to sell to existing customers.

While Account Experience is recognized as the best customer retention program for B2B brands, there are alternative retention management strategies out there.

Here are two more that can support your own efforts:

HubSpot customer relationship management model. Hubspot’s model for customer retention gives a comprehensive view of your organization’s relationship with your customers through marketing, sales, service, and content management.

All of these aspects of your business will have an impact on customer retention, that’s for sure. Yet, HubSpot’s strategy has little to say about closing the loop or monetizing your customer survey data for growth.

Peppers and Rogers’s IDIC model provides an alternative framework for managing your customer relationships, focusing on four main stages: Identify, Differentiate, Interact, and Customize. Together, these walk you through the process of surveying your customers, understanding their value, and closing the loop with them directly.

However, what it doesn’t do is help you identify strategies for business growth. And ultimately, that’s what customer retention should be all about.

5 Customer Retention Best Practices

Whichever customer retention model you choose to adopt, to be successful you must link your customer data to your bottom line.

With that in mind, here are 5 best practices to ensure your customer retention management runs the way it should:

Survey regularly. Keeping in touch with your customers (and ensuring they keep in touch with you) is a crucial part of retention management. However, too many businesses are put off by concerns about survey fatigue. That’s fair enough, but our research shows that surveying quarterly can boost retention by 51%.

Increase signal in accounts. For B2B brands, surveying one contact from each of your customer accounts isn’t enough. Instead, for best results, maximize the number of contacts you survey. It can boost retention by 18% and you’ll get a much truer sense of your account sentiment.

Close the loop with all accounts. When customers give you feedback, they expect you to act on it. Closing the loop is the best way to boost trust and optimize future survey response rates. But do it fast — within 48 hours has the best results.

Combine analysis with action. Getting data on retention rates is a good start, but effective retention management doesn’t stop there. That information has to drive churn-bashing action on your customer experience drivers and more.

Tie retention metrics to revenue. Finally, as we said before, a customer retention management program that doesn’t link your CX data to revenue is not worth the investment. Clarifying the precise impact of your retention on your revenue is a must.

Use CustomerGauge Account Experience to Combat Churn

Account Experience is the number one customer retention management framework out there for B2B brands.

It enables you to track customer experience metrics simply and easily, while tying those metrics to your revenue data.

Find out for yourself how it works by booking a demo. Or, for more information on cutting customer churn yourself, download our guide: NPS 101: Retention Management to Combat Churn