Customer churn is an urgent and expensive problem for B2B brands.

In fact, estimates by our CEO Adam Dorrell suggest that, across the economy, businesses lose nearly $2 trillion every year due to churn. But while that might sound urgent, not all companies see it that way. Rather, many don’t even know how it’s affecting them at all.

CustomerGauge research discovered that 44% of businesses don’t know their churn rate. It’s a number that’s quite astonishing. That’s nearly half of brands that can’t tell you the financial impact of retention — or how much they’re losing to attrition.

But let’s put it as clearly as possible: customer churn analysis is critical for business growth. And it’s actually much easier than you even realize. As our Global VP of Education and Services, Cary T. Self, recently said in an interview:

There’s a huge misconception around how much effort it takes to measure churn. It’s really not difficult: compare your current business to where it was last year, while excluding new acquisitions. This difference will tell you how much liability you have around your customer experience.

In this article, we show you exactly how to analyze churn. We’ll show you how to measure churn (and what makes a good churn rate), as well as how to predict future customer churn in future.

Then, we’ll help you understand why your customers are churning, too.

How to Measure Customer Churn

Let’s start with measuring customer churn. There are two main metrics you can use to tackle this: customer churn rate and revenue churn. To get the clearest sense of how you’re performing, we recommend you use both.

Customer Churn Rate

Your customer churn rate tells you a simple but important number: the percentage of customers that leave your business over a given period.

While it doesn’t tell you the reasons for retention or loyalty, it does give clarity on how many customers churned and when. And that provides an indispensable benchmarkable figure for your future customer retention efforts.

Measuring your churn rate is easy thanks to the following formula:

(churned customers / total customers at the start of period) x 100

For example, say that at the beginning of the year you had 300 customers, but 50 of them left this year. That would give you the calculation 50/300 = 0.16666. Your customer churn rate would therefore be 16.6%.

Let’s break down what you need to do:

Decide your time period (a month, year, or quarter, for example).

Work out how many customers you had at the beginning of that period.

Find the number of customers that churned during that period.

Divide the number of churned customers by the number of customers at the beginning of the period.

Multiply that number by 100 to get your churn rate.

Revenue Churn

The proportion of customers that churn is an important metric to keep an eye on. But it won’t tell you everything. Something that’s absolutely crucial to know is how your churn rate is affecting your revenue. Here’s Cary again with why:

“I cannot say this enough: if you’re not tying your program to what your leadership and investors think is the single most important number, you’re going to lack support.

“Just running a retention program or analyzing churn because it’s the right thing to do is not enough. Your program should be able to quickly show what impact it has on the bottom line. You’ll not only gain support for your program, but you’ll have a seat at the table when it comes to the future of your company.”

Revenue churn is the key metric here.

To understand this, you’ll need to find your recurring revenue or the amount of revenue you receive in a given time period (it could be monthly recurring revenue or annually). You can work that out by multiplying the number of customers by the average revenue per customer.

Once you’ve found your recurring revenue, work out your revenue churn rate with a very similar formula:

(Churned recurring revenue / recurring revenue at the start of period) x 100

For example, say that at the beginning of the year you had recurring revenue of $600,000, but you lost $90,000 this year. That would give you the calculation 90,000/600,000 = 0.16666. Your revenue churn rate would therefore be 15%.

Let’s break that down again:

Decide your time period.

Find your recurring revenue at the beginning of the period.

Calculate how much recurring revenue you have lost.

Divide churned revenue by the revenue at the beginning of the period.

Multiply it by 100.

By the way, you can convert monthly churn into annual churn by simply multiplying your churn rate by 12.

Crucially, not every customer is worth the same to your business. Deeper insight into how much revenue you’re losing to churn will come through a more nuanced calculation. For example, was it your biggest client that just churned? That’s something that Account Experience makes it very easy to work out.

What is a Good Churn Rate?

You’ve found your churn rate. But is it actually any good? Well, according to our own data, B2B brands on average have an annual churn rate of 23%, or a retention rate of 77%. Here’s how retention rates break down by industry:

How does your churn rate stack up against these? Whatever it is, there’s always room for improvement. Let’s start by understanding why churn is happening.

How to Analyze Customer Churn Drivers

In a customer churn analysis, understanding how many customers are leaving is only the starting point. To put steps in place to improve your churn rate, you’ll want to understand why customers are at risk of churning too.

Related Read: How to do an NPS driver analysis

There are three key ways to perform this analysis before customers have churned: ask driver questions in Net Promoter Score surveys, run transactional surveys, and perform a root cause analysis.

Use NPS follow-up questions. Customer surveys are your not-so-secret weapon in the battle against customer churn. They’re simply an invaluable tool to understand your customer sentiment. Yet to get access to why customers are considering churn, you’ll need to ask more than just the straightforward Net Promoter question.

Ask why customers gave the score they did through a follow-up question. This lets customers explain in their own words the reasons for any dissatisfaction. If any customers are NPS detractors, you want to know urgently what you can do to improve their experience.

Run transactional surveys. Secondly, combine your conventional relational NPS surveys with transactional surveys. Rather than assessing your overall relationship with a customer, transactional surveys dig into their experience of a particular interaction—a purchase or customer service engagement, for example. This can tell you if any particular touchpoint is impacting retention.

Of course, you should ask why here too. The same driver question asked above will help.

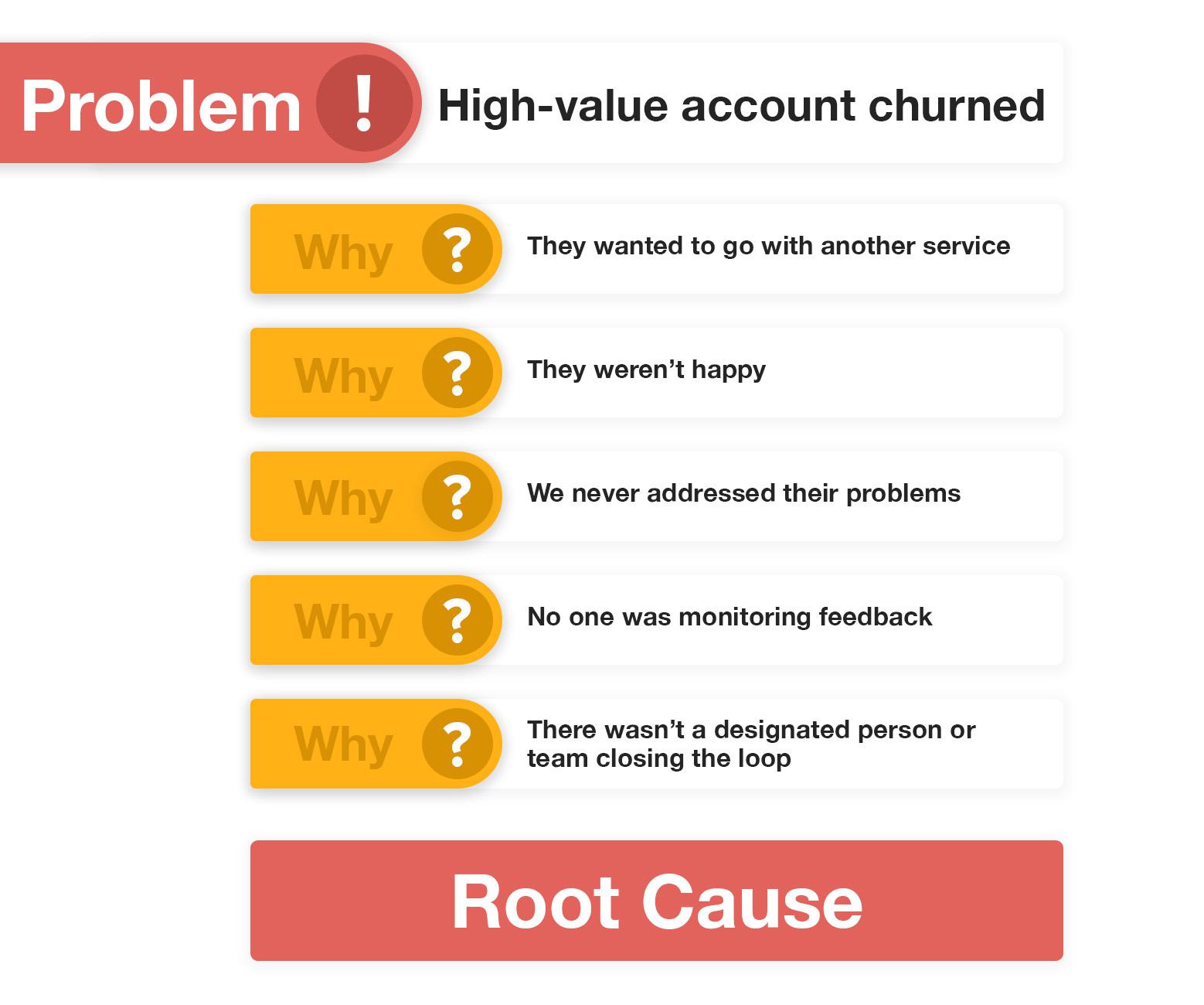

Root-cause analysis. Finally, an important method for you to reach the root cause of a customer problem is root-cause analysis. This will require a little extra effort.

To understand the root cause of an NPS driver or cause of churn, select a subset of survey respondents and interview them using the Five Whys technique. This repeats the question “Why?” a number of times with each answer forming the basis of the next question.

You can find out more about root-cause analysis in our ebook: Root Cause Analysis: The NPS Handbook to Analyze the Drivers of Loyalty

How to Predict Customer Churn

Running customer surveys are an incredibly powerful tool for analyzing the causes of customer churn risk. As such, it’s also an important way to tackle customer churn before it even happens.

The final element of any analysis of customer churn will be customer churn prediction, and here we want to show you some key signs you can use to predict customer churn. Recognizing these is an essential part of your battle against customer attrition. Here are the signs to look out for:

Firstly, a low NPS score. The most obvious signal you can use to predict churn is your customer surveys. If customers are giving you a low score, then you should know they’re at risk of going elsewhere. It’s not a sign you should ignore.

No engagement. As our Cary Self says, “churn doesn’t just come from feedback and data. It comes from a lack of feedback and data.” So what if customers haven’t responded to your survey at all? It could be that they’re thinking of going elsewhere. If survey engagement is low, customers aren’t asking for support, or they’re not turning up to meetings, you need to get in there and find out why.

Falling usage. If as a SaaS brand you track usage of your product (which you should), you may notice your customer isn’t logging in as much as they used to. Or worse, they’ve just got in touch to tell you they would like to reduce the features they pay for. It doesn’t take much analysis to show you that they’re not as committed as they once were. Understanding why is your first step to understanding.

CustomerGauge Can Help With Your Customer Churn Analysis

CustomerGauge can help you get clearer insight into your customer churn data. We can help you combine NPS data with crucial engagement metrics to deliver a 360-degree view of your customer behavior.

What’s more, we put revenue at the heart of all of your customer churn analysis, so you know which customers to prioritize based on the amount of revenue at-risk.