98% of Tesla drivers, for example, would buy the same vehicle again. Meanwhile, Netflix enjoys impressive brand loyalty, with only 20% of customers having accounts with other streaming brands. Or, to take another example, Zoom has a dollar retention rate of 130%, meaning customers on average spend more than they did a year ago.

These customer experience benchmarks will be valuable for tracking your own performance. But what can you do to reach similar levels of customer loyalty?

For B2B brands, creating customer loyalty and retention doesn’t need to be a game of guesswork. Rather, led by data, you can secure excellent customer experience, make your customers stay for longer, and boost your bottom line.

Customer Retention vs Customer Loyalty

Customer retention identifies which customers haven’t churned. Customer loyalty predicts who will stay in the future.

Now that you understand the basics, there’s a little more nuance to it than just that.

The differences between customer retention and customer loyalty are important for any business to know:

Retention describes while loyalty predicts. Retention only shows you how many customers, and how much revenue, remain with your company over time. Customer loyalty, however, measures the likelihood of customers to stick around.

Retention is purely transactional; loyalty is emotional. Retention simply tracks the interactions a customer has with you, as well as the value of those transactions. On the other hand, loyalty digs into the way your customers feel about your brand. That gives you a deeper insight into their satisfaction and overall experience.

Retention shouldn’t imply loyalty. If a customer is retained, it doesn’t necessarily make them loyal. It could just mean that they don’t have an alternative option — but a better offer elsewhere could turn their head.

So, do customer retention and loyalty mean the same thing? No. But it’s important that you measure them both side by side.

Let’s go further into what each concept can do for you.

What Is Customer Retention?

Customer retention measures the number of customers that hang around over a given time frame.

Take away the customers that have churned and exclude new customer acquisitions and you’ll have your customer retention rate.

Retaining customers is good for business.

It reduces the costs of customer acquisition, for one thing. It helps you build deeper relationships with your customers so that you can satisfy them further (and prevent them from going elsewhere). And, it supercharges revenues.

According to Bain & Company, a 5% increase in retention can increase profits by up to 95%.

Yet, lots of businesses don’t know their retention rates at all. In our eBook Retention Management to Cut Churn, we found that 44% of B2B leaders couldn’t tell you their retention rate.

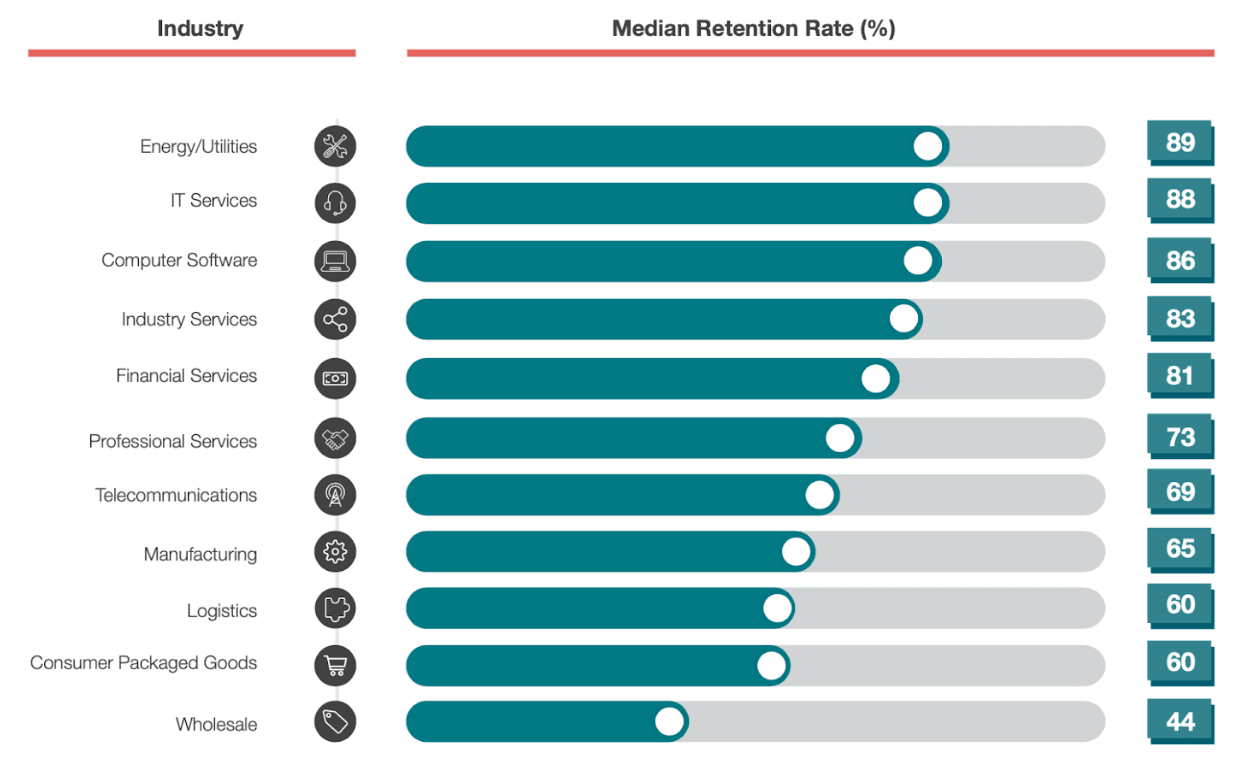

Depending on your industry, your retention rate should look a little like this (according to our 2021 B2B NPS and CX Benchmarks Report):

How to Measure Customer Retention

There are two ways of measuring retention in your business. We suggest you track both.

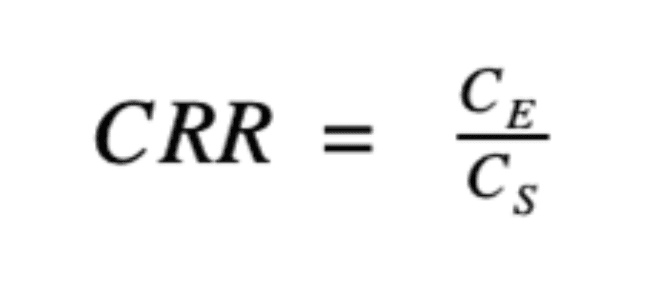

Customer retention rate (CRR). CRR measures the absolute number of customers that you retain. It’s simple: if you had 10 customers, but three of them churned over a year, you would have a retention rate of 70%.

You can use the following formula to describe this better:

Here, CS represents the number of customers at the end of a given period (monthly, annually, or quarterly), while CE represents the number you had at the end.

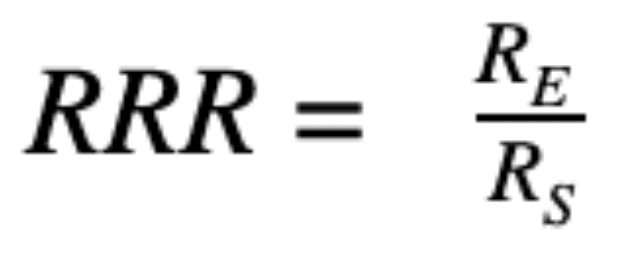

Revenue retention rate (RRR). Alternatively, RRR measures the amount of revenue that you’re retaining. This matters particularly in B2B contexts, where different customer accounts can have radically different values.

Here, you’ll need the following formula:

For example, let’s go back to those 10 customers.

Together, they gave you a revenue of $30,000. Two were worth $5,000, two were worth $4,000, two were worth $3,000, two $2,000, and two $1,000.

The three customers that you lost could be those two worth $5,000 and one worth $4,000. This would mean that you retained just $16,000, or 53.3% of your revenue (compared to 70% CRR).

Alternatively, you could have lost two customers worth $1,000 and one worth $2,000. That would mean you retain $26,000, with an 86.6% retention rate.

Knowing the difference is essential for accurately tracking your retention. However, knowing your past retention rates won’t help you assess your future retention — only loyalty can do that!

What Is Customer Loyalty?

If customer retention is purely transactional, customer loyalty is largely sentimental.

It describes an attitude to your organization among your customers. Loyalty is a sort of attachment, commitment, or affection, rather than just a continued engagement.

While loyal customers also bring revenue gains, the benefits are different.

For example, loyal customers are more likely to leave feedback and be forgiving of slight mistakes. They’re also more likely to try new products. And, of course, they’re much more likely to recommend you to others in the future.

But not all loyal customers are the same. That’s why we speak of different types of loyalty:

Transactional loyalty. Essentially, transactional loyalty is another word for customer retention. Customers repeatedly buy from you but don’t necessarily show any other sympathy for your brand.

Engagement loyalty. If a customer follows you on social media, signs up for your email newsletters, and downloads your white papers, they can be said to be engaged. This is a solid ground for a greater connection.

Emotional loyalty. This is where we get to deeper forms of loyalty. It often comes through personal relationships, such as individual engagements.

Advocacy loyalty. When customers are really loyal, they’ll be your advocates. That means that they will recommend you to others, speak at your conferences, or engage in referral programs in other ways.

In this way, customers are not just retained, but they have a deeper connection with you that can last into the future.

How to Measure Loyalty Using Net Promoter Score

The most reliable way to keep track of your loyalty is through customer sentiment surveys. We recommend that you use Net Promoter Score (NPS), the most widely used surveying system among B2B brands.

NPS measures loyalty by asking customers how likely they are to recommend your brand, product, or service to a friend or colleague, on a scale of 0-10. Based on the customer’s response, they’re then categorized as a promoter (scoring 9-10), passive (7-8), or detractor (0-6). Promoters are your most loyal customers, while detractors are those who pose a risk of churn.

With this data, you can calculate an overall NPS score, between -100 and 100, by subtracting the proportion of detractors from the proportion of promoters. According to the designers of NPS, this is the best predictor of future revenue there is.

8 Steps for Creating Customer Loyalty and Retention

Here, we want to show you how to build loyalty and retention—through 8 steps that we teach our customers

Studies repeatedly reveal how important customer loyalty is for your bottom line. It is estimated, for example, that acquiring new customers costs as much as 25 times more than selling to existing customers. Meanwhile, a 5% increase in retention is thought to boost profits by as much as 85%.

The rewards of customer loyalty can be incredible. Follow these 8 steps—from measurement to growth—to ensure you’re getting the best retention rates you can.

1. Measure Loyalty and Define Your Customer Loyalty Objectives

The first step in boosting your customer retention is measurement. And that means measuring your current loyalty and retention rates.

This might sound like a given—but it really isn’t. According to our research, 44% of business executives don’t know their churn rate. However, to improve your loyalty, you need to know how you’re performing today.

You can find out how to measure churn in our ebook Retention Management to Combat Churn (or following the instructions to measure retention in Excel here). But don’t focus on churn rates alone.

By measuring your NPS through a voice of customer program, you’ll understand the specific drivers that are having the biggest impact on churn.

Once you have insight into your present performance, it’s time to set goals for where you’re heading in future. What results do you want to see in a year’s time, for example? Setting these targets is crucial for rallying support, tracking your progress, and boosting motivation.

By the way, using CustomerGauge’s Account Experience methodology, Alchemista went from losing their biggest client to securing a 100% retention rate in just a year. You can do it too.

2. Secure Internal Buy-In

Next, your teams are crucial to your customer loyalty program. Without securing buy-in from across your organization—at all levels—your retention efforts are unlikely to get you off the ground.

There are many ways to grow support for your customer retention efforts, among executives and frontline staff:

Show the cost of doing nothing. Customer retention is not just a revenue opportunity. Low retention is an active drain on your business’s finances. And by doing nothing to tackle it, you’ll be actively losing cash.

Find out for yourself what impact doing nothing to cut churn has on your business, with our ROI calculator. Sharing a predicted ROI can help you gain support too.

Prioritize leadership buy-in. Your executives are the ones who will sign off on investment in your customer retention efforts. Support from them will help you better tackle any lingering resistance later on.

Leverage personal ambition. Among management and frontline staff, being clear on the personal benefits of supporting your program can help. In our experience, we’ve found that individuals who help deliver an excellent customer loyalty program are often in line for promotion.

3. Implement a Customer Loyalty Tool

You and your team may not be able to do everything related to customer loyalty all by yourself. This is particularly true in B2B contexts, where large customer accounts add complexity to your operations.

Instead, customer loyalty software and tools are crucial for a successful implementation of your customer retention program. They can help you manage surveys and closed-loop feedback, cut the cost of manual processes, and enable you to visualize revenue gains—all in one place.

Tools like CustomerGauge’s Account Experience (AX) enable you to track customer sentiment and other key engagement metrics, build an effective referral program, and drive your growth.

For example, the corporate catering company, Alchemista, achieved a 100% retention rate thanks to AX. Back in 2019, they lost their biggest customer to churn — a customer worth 20% of their revenue.

But with AX, they went from what Alchemista’s Christine Marcus called “the biggest mistake I’ve ever made as a CEO” to immediate action on customer feedback.

As Christine said when she appeared at CustomerGauge’s Monetize! conference,

"Onboarding CustomerGauge has had the highest ROI of anything I've ever done at my company."

4. Run Customer Loyalty Surveys

Customer surveys are the primary way you’ll assess the sentiment and drivers behind customer loyalty trends. If you’re serious about creating loyalty and retention, you need to reach out to customers to ask them what they think.

Net Promoter Score surveys are the best way to do this. They’re fast and simple for customers—ensuring an optimal response rate—while delivering nuanced insight for you by digging deep into your customers’ perspectives.

What’s the best way to run customer surveys? Try these three best practices (you can find plenty more here):

Use transactional and relationship surveys. The two main types of NPS survey give you different insights. Relationship surveys track customer sentiment over time, while transactional surveys assess customer responses to specific drivers.

You need both. Find out why here: Relationship vs Transactional Net Promoter Surveys

Survey every quarter. While many companies fear survey fatigue, this is less of a risk than it might seem. In fact, our research has found that surveying customers every quarter can boost retention rates by 51%.

Keep surveys short. NPS surveys reduce the demands on customers by being short and simple. We find that between 2 and 6 survey questions is enough to provide the insight you need while optimizing response rates.

5. Close the Loop with Customers

Customers take your surveys in trust that they’ll see some benefits. And the only way that you can deliver on that trust is by closing the loop.

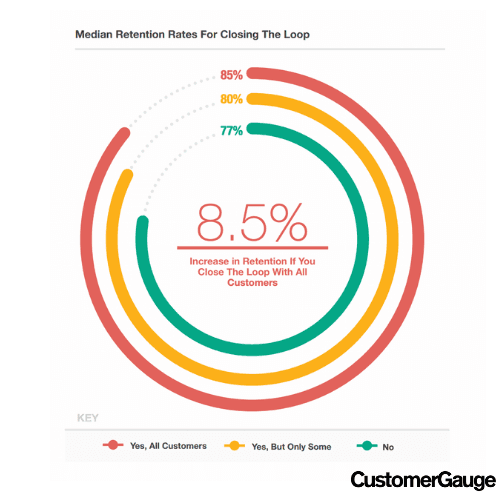

Closing the loop means acting on customer feedback and telling your customers what you’ve done. It’s a sure-fire way to cut churn and improve long-term engagement in your surveys. It builds trust too—and can increase your retention by as much as 8.5%.

In closing the loop, the faster the better. Our experience shows that those companies that close the loop within 48 hours have the best chance of driving retention.

6. Tie Your Customer Loyalty Data to Revenue

To get a full sense of your customer loyalty performance, you can’t rely on customer experience data alone. Instead, it’s crucial that you link up your retention metrics with financial data. This will show you the impact your work is having on your bottom line.

What do you need to get insight into?

The value of your at-risk customers. How much revenue is being lost to churn? And how much is at risk? Linking your customer loyalty metrics to your financial data can tell you exactly that.

The cost of specific drivers. It’s likely that specific touchpoints are having a disproportionate impact on your bottom line. Knowing what these are—whether onboarding or technical support—and how much they’re costing you is crucial.

By the way, 70% of business leaders aren’t linking their customer experience to financial data. But with Account Experience it’s easy.

7. Identify and attack absence of signal.

Identify and engage absence of signal. Often, not all customers will respond to your customer surveys (although it’s possible!). Tracking other engagement metrics, such as product usage, support requests, and CRM activity will give you a sense of how customers are engaging with your brand.

Top tip. If they’re not engaging, reach out to ask them why. It can be the difference between a churned customer and a retained one.

8. Realize Strategies to Boost Retention and Revenue

Finally, to create customer loyalty and retention, you need to use that financial information to improve your business performance. How? Try three strategies:

Improve specific drivers. The drivers that you identified in step 6 are one of the most important ways you can reduce costs and boost profits. If you know that technical support is a major driver of churn, for example, you know where best to put your retention-boosting efforts.

Engage with churn risks. NPS surveys can tell you which customers are most likely to churn. But by linking that to financial data, you can find out how much those at-risk customers are worth. Reaching out to them with a reason to stay will be a fundamental part of your churn-busting strategy.

Identify upselling and cross-selling opportunities. Those customers who stay will be great opportunities to referrals and resells. According to Gartner, 80% of profits come from 20% of customers. It’s an important thing to remember when considering your churn rate.

Read more: 5 Inspiring Real-World Loyalty Programs

CustomerGauge Can Help You Improve Customer Loyalty and Retention

At CustomerGauge, we’re experts in customer experience. We can help you listen to the voice of your customers, cut churn by improving their experience, and boost your revenue growth.

Creating customer loyalty and retention can be a lot of work. But you don’t have to do it alone. Book a demo to see for yourself how we can help.

Hey there! Did you know we have a library of customer retention & loyalty articles? Check these topics out: