Introduction

Each US airline leaves up to $1.4 billion in annual revenue on that table by failing to improve its customer experience (Source, Forrester).

Flying a passenger is complex. The margins are lacking relative to supplementary products like food and drinks that passengers can purchase in their airline customer journey.

By establishing optimal customer experiences at each touchpoint, airlines can establish more customer stickiness in the long term and discover opportunities for new sales channels in the short term.

Net Promoter offers an opportunity to do so. By identifying happy customers, and hitting them with the right upsell promotions at the right time, airlines stand to boost revenue.

By identifying drivers of discomfort and disgust, airlines incite future loyalty and passengers will become increasingly less price sensitive in order to fly with the brand where they feel safest.

In this article, we're going to cover the basics of NPS in aviation before taking a look at the NPS benchmarks of 26 global airlines.

We end with some lessons from airlines like United, who've had a rocky road and have been working hard to tackle poor customer experiences.

What is NPS aviation?

NPS stands for Net Promoter Score. The Net Promoter Score and System are measures of customer experience and proven predictors of company growth rates.

Regardless of industry, the NPS score is gained by surveying customers with one, powerful ‘ultimate’ question: “How likely is it that you would recommend our company/product/service to a friend or colleague?”

The question asks about the customer experience as a whole, giving you a big picture understanding of your customer’s journey, so you know where you stand.

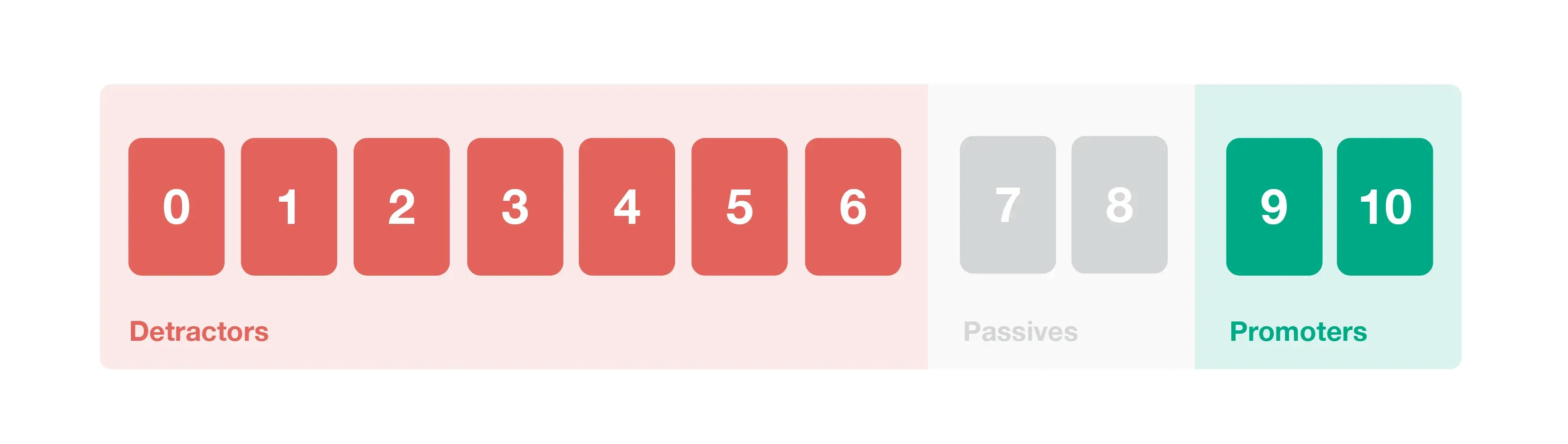

The answers are given on a simple scale of 0-10. Every respondent is then divided into three categories: Detractors (those who gave a score of 0-6), Passives (a score of 7-8), and Promoters (a score of 9 or 10). Your overall NPS score is calculated by subtracting the % detractors from the % promoters.

The founders of NPS, Fred Reichheld and Bain & Co, conducted thorough statistical research into respondents in these three categories and determined that:

- Promoters are more likely to refer new business, cost less to serve and are more likely to spend more over longer periods of time.

- Detractors and passives? More likely to leave you for a competitor in the near future.

So, it’s a no-brainer. You want more promoters and less detractors.

Effective Net Promoter programs use follow up questions in their surveys to identify why customers gave their score, giving the opportunity to act quickly to remedy the situation.

For example, in the aviation industry, NPS allows you to view your customer journey as a whole and improve it end-to-end. But the follow up questions, such as “how much did the check-in experience contribute to your score?” let you dig deeper.

The theory and practice of net promoter design can be complex. At CustomerGauge, we’ve developed resources to help you thoroughly understand and implement NPS the right way.

For example, in our Net Promoter Score course on the CustomerGauge Academy, we recommend using cascading questions in your NPS surveys so your questions appear short and manageable.

What's the airline industry average NPS score?

In the US airline industry the average NPS score is 27 (Satmetrix, 2020).

However, in our research, among the 26 global airlines we reviewed (NPS scores listed below) the average NPS score is 28.

What is a good NPS score in the airline industry?

Bain & Company (the creators of NPS) note that a good NPS score is 0 and above. Above 50 is excellent and above 80 is world class.

A score that's zero and above suggests that you have more Promoters than Detractors, which is a good sign. However, it's important to compare yourself to others in your industry—and in the airline industry, where there is the nuance of budget vs luxury vs long-haul airlines, you need to find the right comparable..

In aviation, where the average score is +26, a score greater than 26 would be considered good, but other consumer-facing industries like healthcare (which topped our ranking) achieved an average score of 58.

It should be your ultimate goal to match NPS leaders like Aeroflot who have an NPS score of 73.

Which airline has the highest NPS? 26 airline net promoter score benchmarks

Our research discovered that Aeroflot, the largest airline in the Russian Federation, has the highest NPS score of 73 (reported in 2019).

Let’s take a look at the leaderboard. It’s important to note that there may be some airlines that we missed, or that haven’t publicly reported their NPS scores.

These are the airline NPS scores we could find from credible sources:

NPS Airline Score Benchmarks

| Company | NPS Score |

|---|---|

| Aeroflot | 73 |

| Alaska | 71 |

| SouthWest Airlines | 71 |

| Jet Blue | 67 |

| Garuda Indonesia | 65 |

| Lufthansa | 57 |

| Emirates Airlines | 54 |

| United Airlines | 50 |

| Virgin America | 48 |

| IAG | 46 |

| Qantas | 44 |

| Delta | 41 |

| Air Asia | 38 |

| Finnair | 38 |

| Jet Airlines | 28 |

| Air France | 27 |

| Thomas Cook Airlines | 24 |

| AirTran | 19 |

| Continental | 17 |

| Singapore Air | 10 |

| American Airlines | 3 |

| US Airways | -8 |

| Batavia Air | -11 |

| EasyJet | -16 |

| Flybe | -24 |

| Ryanair | -61 |

Get more scores! Get the most comprehensive net promoter benchmarks research on the planet here.

Airline customer experience lessons from United

United Airlines (NPS score = 50, up from 10 in 2014)

United Airlines were blasted by negative media coverage in 2017 after a series of mistakes. So how have they been recovering?

In their June 2021 investor event, United Airlines noted that culture change and improved customer focus has driven higher NPS scores.

“Despite the hassles and inconveniences of pandemic travel, customers are noticing a change.”

United has moved the needle by differentiating their 50-seaters:

- A premium service called UnitedFirst

- Introduction of Economy Plus (extra legroom availability)

- 1:1 carry-on capacity

- Onboard snack bar

They have also increased capacity of premium seating to match demand—United is the leader in premium seat capacity amongst their competitors.

And what about future plans? By 2025, United Airlines aims to differentiate and improve CX by building unique airplane interiors:

- 1:1 overhead bins

- Seatback entertainment

- LED lighting

- Next-generation WiFi

With such a larger increase in NPS their plans are certainly working. It’s great to see another company leveraging the voice of the customer to improve service quality and loyalty.

Airline Customer Experience: Three CX Mistakes Airlines Must Avoid

1. Leaving "people" Out of Policy

The Net Promoter Score is used to gauge customer loyalty and brand sentiment within various industries. The airline industry has an overall NPS score of 27. On an individual scale, airlines like JetBlue and Southwest enjoy higher NPS scores than others, with 67 and 71 respectively.

After the wake of high profile incidents in 2017, it’s no surprise that United Airlines had a low score. They’ve now improved their score to +50 points, but there are certainly some lessons to be learned from that period of time.

Below are a list of links to three of the worst incidents in the airline industry, according to social opinion, in 2017:

- (United Airlines) United Flight 3411: You can find the video and further details of the incident from the Chicago Tribune.

- (American Airlines) The Stroller Incident: Further details and the full video can be seen on CNN.

- (Spirit Airlines) Riots in Fort Lauderdale-Hollywood International Airport (FLL): CBS News offers some background on the riots at FLL airport

Poor customer service by airlines is nothing new. However, the graphic nature, unfit policies and easily shareable stories propagated by social media from these flights means once isolated incidents are now thrusted into the public eye for all to see. The question on everyone’s mind is: how did we get here?

The answer is telling: policies that don’t put customers first. While it was the airport police who dragged Dr. David Dao off the plane, one bad-behaved flight attendant and unruly passengers after flight cancellations, it was the policies in place that made these situations boil over.

2. Overbooking Flights and Involuntary Bumping

To be clear, overbooking has been prevalent since the air travel boom of the 1950s. When overbooking flights, it all comes down to profits for the airline. Statistically speaking, people do and will miss their flights, and when you’re running thousands of flights a day, those empty seats offer millions in revenue opportunities within just 24 hours.

Even for airlines that don’t offer refunds for missed flights, in their minds those empty seats offer substantial missed revenue.

How, exactly, airlines determine the number of seats to overbook is complicated.

According to Wired: “Their forecasting systems start with a series of complex inputs: historical data on no-show rates (how many people showed up for this flight last week? Last year?); how many of the tickets sold are refundable; and how many are coming off connected flights. Airlines even use individual data: If you have a habit of missing flights, they’ll sell more seats on your flight than they would otherwise.”

After this an analyst (human), will alter the model based on outside data, such as hurricanes, etc. Based on the data input from both the analyst and algorithm, airlines use this information to determine how many seats to overbook.

But, obviously, people are unpredictable. Some airlines, like Delta, use the opportunity (during the booking process) to have customer bid on how much it would take (in cash value or vouchers) to give up their seat in the event of overbooking, some, like United, haven’t mastered this process.

However, government enablement of involuntary bumping is half the problem in itself. According to Harvard Business Review, the same government regulation allows for a policy that punishes certain travelers:

“The regulation specifies that if a passenger is involuntarily bumped, airlines have to pay a penalty amounting to 200%–400% (depending on the delay length) of the one-way fare that they paid with a maximum cap of $1,350. This provides an incentive for airlines to bump passengers who paid the least amount for their ticket, often the poorest travelers on the plane.”

Airlines and passengers could benefit from reading some the rules handed down by the Department of Transportation, which includes the following interesting customer experience caveats for involuntary bumping:

- If the airline arranges transportation within one hour of your originally scheduled arrival time, no compensation is required.

- If the airline arranges transportation between one and two hours of your original arrival time (between one and four hours on international flights), airlines must compensate you 200% your original one-way fare, with a maximum of $675.

- If an airline cannot guarantee arrival within two hours or later, or at all, that day, passengers should be compensated up to 400% of their ticket cost, up to $1,350.

- These rules vary between domestic and international flights, so remember to review the rules prior to departure.

Airline customer experience lessons:

- When possible, bumping should be avoided once passengers get on the plane. It's cramped, public, and emotions are already running high.

- Airlines should make policies clear to passengers when it comes to overbooking and bumping.

- Overbooking, from a business standpoint, makes sense. However, lax government regulations based on ticket price and company policies that aren’t matching equal worth between passengers increase the volume of involuntary bumping with lower paying passengers (without an indication that this could be case).

- If no amount of money will make a passenger get off a flight, it is time to move on. Statistically speaking, one of your passengers will accept compensation, even if it means stretching the amount.

- Airlines need to take what happened with United seriously, and the warning from Congress that they will take control and end the overbooking policy all together. Canada, just this week, announced that it is now illegal to remove passengers from overbooked flights.

3. Company-First Mentality

Sometimes, being at an airport can feel like herding cattle—where you’re the cattle. This can trickle down from the TSA to, for example, flight attendants that rip baby strollers out of the hands of mothers. With the constant mergers between airlines, the limit in competition has created a mentality among airlines that consumers need them, not the other way around.

This type of thinking is part of the reason there was such fury at the response of CEO Oscar Munoz to United Flight 3411, in a leaked letter to employees:

“…As you will read, this situation was unfortunately compounded when one of the passengers we politely asked to deplane refused and it became necessary to contact Chicago Aviation Security Officers to help. Our employees followed established procedures for dealing with situations like this. While I deeply regret this situation arose, I also emphatically stand behind all of you, and I want to commend you for continuing to go above and beyond to ensure we fly right.”

This response gets right to the heart of “policy over people”: where passengers, not policies and practices that allow for overbooking are to blame.

Airline customer experience lessons:

- If your policies lead to incidents like the one with United, it’s time to reevaluate your policies and employee training. “Standing behind all you do” and “following established procedures” is not the right message to send to your employees or the public.

- Air travel is a high-stress environment. If you treat your passengers with dignity, ultimately that will trickle down to how they treat your employees too.

- Social media is king. Everything can be recorded. Shep Hyken got it right when he said: “Dance like nobody’s watching. Treat the customer like somebody is.”

4. Profit Over Comfort—And Stability

Back in the 50s, flying was truly a luxury.

Now, in the “golden age of travel”, airlines are making flying more affordable, or, so it seems. A push for profits over the years yielded increased fees for baggage and reservation changes (following industry-wide trends), and unprecedented segmentation between regular and elite customers.

While there has always been a differentiation between business and economy fliers, post-merger United took its complex caste system to new levels:

“For its very highest-paying Global Services customers, United layered on the benefits: segregated gate agents, dedicated phone lines; short or skipped security lines: in sum, the complete avoidance of the crowds everyone else deals with. Meanwhile, United took boarding away services at the bottom, shrinking seats, imposing punitive fees, removing pre- for parents with children, and increasing the numbers of boarding classes.”

While some may argue, "well, you pay for what you get", it's hard to pinpoint (there is no perfect answer) where the line is drawn. The other victim of cost-cutting is employees. When Spirit Airlines had to cancel 9 flights due to in-fighting with pilots, everybody lost. This lack of stability between budget airlines and unions is now falling on passengers.

Airline customer experience lessons:

- There has to be a middle ground between those who pay extra for perks and those who simply want to get from here to there in relative comfort.

- Passengers should experience the same great customer service and respect between business and economy class. Period.

- Spirit Airlines has been in hot water before with their pilot union, and it’s not hard to see why. Airlines like Spirit should be looking to improve BOTH customer and employee experience. Aka: Talk to your employees before issues boil over.

What it means to Monetize your NPS in airline industry

We promised we would get to it, and here we are: what it means to monetize your NPS score in aviation.

Firstly, I recommend downloading our whitepaper eBook on AccountExperience. It’s this methodology that sets what we do at CustomerGauge apart from the rest, and it’s this methodology that has earned us the #1 ranking by Gartner for B2B voice of customer platforms.

The eBook will go into detail on anything mentioned here. In short, monetized net promoter is the process of operationalizing NPS survey feedback and scores so that you can:

- Identify which of your accounts are about to churn. E.g. receiving advice like ‘based on your recent survey round $1.6m in revenue is indicated to be at-risk of churn. This includes your largest account with an ARR of $1m.’

- Identify which of your accounts are willing to refer you. E.g. receiving advice like ‘your customer, XYZ Corp, has consistently given you a score of 9 or 10. It’s time to ask them for that referral.’

- Identify which of your accounts are likely upsell opportunities. E.g receiving advice like ‘users at all levels of XYZ Corp’s organisation are extremely happy with your service. Your next review meeting is a good chance to focus on what’s next.’

A monetized net promoter score is the next step: operationalizing. Many companies measure NPS (and therefore run lots of surveys and collect tons of feedback) but fail to act upon it. To act, you need to listen to each piece of feedback and take action upon it: either you talk to your unhappy customers, apologise and fix their issue, or you talk to your happy customers, celebrate together and ask for referrals.

AccountExperience is the methodology that helps you make the shift from ‘NPS is a research tool’ to ‘NPS is a growth driving tool’.