In this guide, we go into extensive detail on the Net Promoter Score.

Alongside the basics covered here, the system, and how to implement NPS, we've interviewed experts for more than 20+ articles that deep dive into the subject (find those linked throughout this page).

We believe the most crucial reads for building a successful Net Promoter program are on improving survey response rates and closing the loop—both of which we teach our customers extensively.

There are so many best practices and wrong turns you can take on your journey to building a world-class customer experience.

This guide leverages 10 years of our expertise coaching our customers, as well as expert interviews with Fred Reichheld and Maureen Burns (the Bain & Co-founders of NPS).

We hope it steers you in the right direction.

What is Net Promoter Score (NPS)?

Net Promoter Score (NPS) is a voice of the customer (VoC) tool used by organizations to collect feedback from their customers.

It's typically one simple question (noted below) that asks for a score between 0-10, followed by several follow-up questions to determine the root cause of the score.

When enough customers are surveyed regularly, the aggregate NPS score calculation offers insight into your customer base's health.

When used correctly, Net Promoter offers a pathway forward to continuous improvement in customer experience and customer retention.

The Net Promoter Score Question

Note: Full guide to the Net Promoter Question here (with templates & examples).

Initial development of the NPS score metric proved that, out of all of the ways a company could track customer loyalty, asking customers about their willingness to recommend your services correlated best with future growth.

This led Fred Reichheld, alongside Bain & Co, to develop and test this one simple question:

On a scale from 0 to 10, how likely is it that you would recommend our company/product/service to a friend or colleague?

Organizations ask this question to customers either immediately after a touchpoint event to enquire about their experience (called transactional NPS) or as a general question about their overall experience with the brand (called relational NPS).

Later on, you’ll want to know why your customers gave the answer they gave (and we discuss this below), but this initial question digs deep into your customer’s commitment to your brand.

So, how will customers respond to the question?

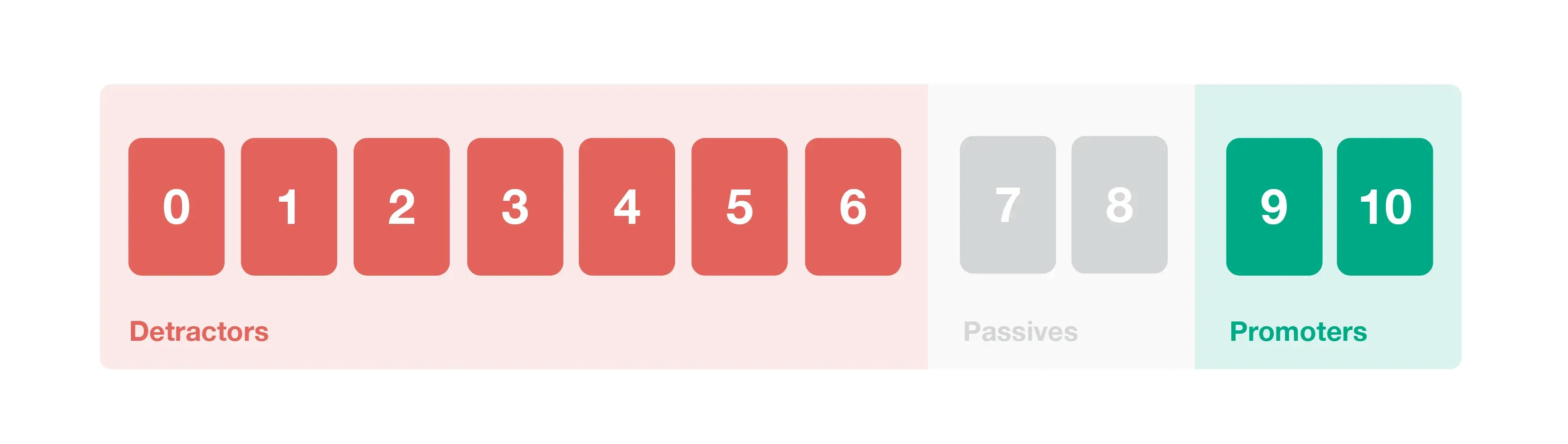

Depending on where they place themselves on the scale, you can categorize them as promoters, passives, or detractors:

Promoters, Passives, and Detractors: What’s the Difference?

Promoters, passives, and NPS detractors are the three types of customers that will emerge from your NPS survey. Depending on the category in which they sit, you’ll be able to gauge their loyalty, but also their potential impact on your revenue growth:

Promoters. Scoring 9 or 10 in response to the NPS question, promoters are the type of customer from which the whole system takes its name. These are the customers that are loyal, enthusiastic, and passionate about what you do.

Crucially, they will be willing to go out of their way to refer you to other customers. And, this way, they’ll have a direct positive impact on your bottom line.

Passives. Passives score 7 to 8 on the scale. These customers aren’t as enthusiastic as promoters, and they always carry the risk of churning or becoming detractors. However, they’re unlikely right now to spread negative word of mouth all by themselves, and with a little nurturing, they may even become promoters.

Detractors. Detractors rate your brand between 0 and 6. They’re not happy with their customer experience and they’re at the greatest risk of churning and spreading negative word of mouth.

This matters, because churn means revenue loss. What’s more, customers who have had a bad experience are twice as likely to tell others about your brand.

Learn how to turn detractors into promoters here.

How to Calculate Net Promoter Score

Now, it’s time to get into the nitty gritty of calculating your own Net Promoter Score.

Luckily, it’s really simple, and can be completed in four stages:

1. Run surveys and collect results from the Ultimate Question. Start by asking: “On a scale of 0-10, how likely are you to recommend our product/service to a friend, colleague, or family member?”.

The way that you ask the question, and the frequency and design of your NPS surveys, will affect your response rate, the accuracy of results, and the usefulness of your data. We’ll show you what you need to know below.

2. Find the proportion of detractors and promoters. How many of your customers are promoters? How many are detractors? From the results of your survey, calculate the percentage of each category.

If you have 1,000 responses and 800 score 9-10, you have 80% promoters.

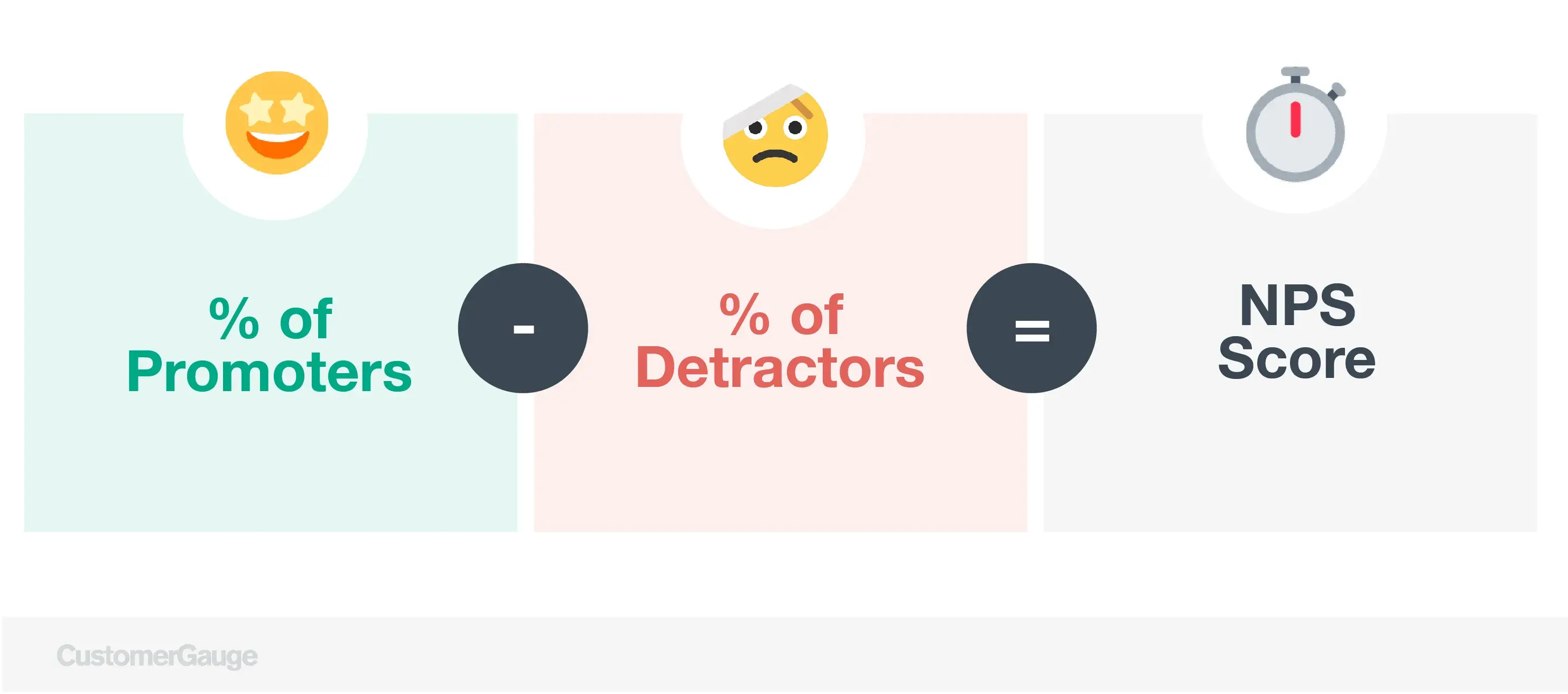

3. Use the NPS formula. There’s a simple formula to calculate your headline NPS score:

% of promoters – % of detractors = NPS score

Your score can be anywhere between -100 and 100. The higher the better.

So, if you have 80% promoters and 15% detractors, you have an NPS score of 65. But if you have 15% promoters and 80% detractors, your score is -65.

By the way, for this calculation, you can ignore the percentage of passive customers.

4. Benchmark and keep measuring. Your NPS score is only useful if you measure it consistently over time. So, begin by remembering your current result and use that as a basis to grow. It’s the only way to get an accurate sense of how you’re performing in the long run.

Let’s tackle a crucial question first: why measure your NPS? And to answer that properly, we need to go back to the very beginning of NPS.

Learn more: What's a good NPS score?

A Short History of Net Promoter Score

So, let’s take it again from the top. The history of Net Promoter Score has its roots in 2003. All those years ago, NPS was invented to help companies understand and earn customer loyalty.

In his book, The Ultimate Question: Driving Good Profits and True Growth, the researcher Frederick F. Reichheld was the first to outline what he called NPS. The “ultimate question” of the title was, of course, the NPS question we just explored, and Reichheld gave it this name because he already recognized its power.

Now, conventional customer satisfaction surveys were well-used in the industry at the time. But they were generally unwieldy, difficult to benchmark, and couldn’t provide the detail that companies wanted to drive business growth.

So, Reichheld—with help from Bain & Company and Satmetrix—got to work to explore options for a simpler approach. In his research, he found that a company could ask a customer 19 different possible questions to understand their loyalty. And from those options, the Ultimate Question emerged as the most incisive, to quickly understand their sentiments.

What’s more, high scores on the NPS question correlated strongly with future referrals, repurchases, and revenue growth.

Yet too many businesses soon started focusing exclusively on this score—and that wasn’t delivering the promised results.

As a result, Bain & Company built the NPS Score into the heart of a new approach, the NPS System. This outlined a model for businesses to build around, so they could turn their metrics into action.

For two decades, companies—including the majority of Fortune 1000 brands—have been using the NPS Score to get accurate insight into their customers.

What’s the Goal of NPS?

The goal of NPS is to monitor your customer experience and show you how to improve. But it does a lot more than that too.

In fact, with NPS, the return on your investment in CX can be immense:

Better understand your customers. NPS helps you better serve your customers by enabling you to listen to them. Furthermore, by linking your NPS data with your revenue, you can clearly identify ROI from CX projects and drive executive buy-in—perfect to get more budget, resources, and respect for customer-focused projects.

Tackle customer churn. It’s said that 80% of profits come from 20% of customers. NPS helps flag whether that 20% of customers are happy or unhappy so that you can take action. Targeted action means you'll never be blindsided again by losing a large customer.

Fact: acquiring new customers costs you 5 to 25 times more than retaining existing customers. That’s why loyalty matters so much.

Quantify word of mouth. These days, the most trusted source of information on your brand is a customer’s friends or family. If businesses are neglecting this powerful marketing channel, then they’re doing something wrong.

Knowing how often customers will recommend you is crucial. And NPS is the one metric that can show you.

Get a benchmark for customer experience. Studies suggest that customer experience is a more important brand differentiator even than product and price. Understanding how you perform in comparison to other brands will enable you to get a competitive edge. NPS comes in handy there too.

Yet, crucially, businesses have found that NPS is not just about quantifying your CX. Instead, it can deliver returns on your internal processes too:

Identify areas to improve your products. Customer feedback through NPS can give you insight into how to build better products. For example, Tesla’s NPS score is so high because customer feedback has a direct and visible impact on product development. That means better products and more satisfied customers.

Align your team. Identifying a metric around which your whole organization can rally can build staff motivation, improve performance, and get everyone on the same page about business strategy. If there’s one CX metric to track, it’s NPS.

Improve the experience of your employees. Customer experience goes hand-in-hand with employee experience. Without happy employees, you won’t have happy customers—and vice versa.

NPS vs CES: Which to Track?

Of course, NPS is not the only metric out there for measuring customer experience. Customer effort score (CES) is one of the most popular alternatives. So, it’s worth considering the differences.

CES looks at the amount of effort that customers make in each interaction with your brand. The less effort they must make the better the customer experience.

CES is based on research that’s shown that reducing the effort customers expend has a much bigger impact on improving customer loyalty than exceeding expectations or delighting customers. This makes a lot of sense when you consider that 82% of people still think that purchases “take too much effort”.

Yet, CES does have its drawbacks. For example, it doesn’t gauge the influence of price, product, and competitors on the customer experience. And it’s not well-equipped to identify the driver behind the customer response.

We compared NPS, CES and CSAT in-depth here. Of course, there’s no harm in tracking all CX metrics.

But if you’re going to pick one, we’d recommend NPS because it has several advantages.

Benefits of NPS

You get built-in driver analysis. Why are customers saying what they’re saying about their CX? NPS tells you a couple of simple additional questions—which CES lacks.

It demands minimal effort from your customers. Alongside a driver question to understand why customers are saying what they’re saying, the NPS question is effortless for customers.

That means a high response rate. The less effort a survey requires, the more likely customers are to respond. Our research says that while companies prefer email, customers are actually more likely to respond to phone surveys. Why? It’s easier.

Continual rollout. On a practical level, you don’t want to receive 800 survey responses all at the same time—because that means you have 800 responses to close the loop with. A simple survey like NPS makes managing this easy.

It gives a more complete view of the customer experience. CX is not just about effort—although that plays a role. Instead, NPS gives you an in-depth view of customers' feelings, when, and why.

Find out more: 8 Benefits of the Net Promoter Score

Beyond the NPS Score: Net Promoter System and Account Experience

The Ultimate Question is the beginning of your NPS program, but it doesn’t end there. To get real revenue-boosting results from your CX efforts, you need to implement a transformational Net Promoter strategy.

Bain & Company’s Net Promoter System is one way to do this. Bain developed their NPS System as a model for companies to transform their internal processes to become better able to turn the NPS Score into action. It works by organizing your company in three main components:

The inner loop. Your frontline learns from and responds to customer feedback, in real time.

The huddle. These are short, regular meetings that provide frontline employees and managers with a way to share with each other what they have learned from customer feedback. They can use this opportunity to escalate bigger issues.

Finally, the outer loop uses what is learned from huddles, inner loop, and other key operational data to make strategic investments in customers, from policy changes to new product launches

By organizing your customer experience management around these three components in the NPS System, you can build transparency and promote a cross-level system in which customers come first. But Bain’s system is not the only way to build the NPS Score into your business.

Monetize Your Net Promoter Score

An alternative way to embed the NPS Score into your business is with CustomerGauge’s NPS framework, Account Experience.

This is a system we developed to take heritage NPS to the next level for B2B and B2B2C organizations who want to act immediately to improve each customer’s experience and to turn CX feedback into action and profitable growth.

At the heart of Account Experience is monetized NPS, the new metric we developed that brings the basic NPS Score in line with financial data. This way, you can track the revenue impact of NPS in real-time.

How? Account Experience works through four steps:

Measure NPS. Any NPS system starts with measurement. Beyond standard NPS, AX helps you ask the right question, to the right people, at the right times. You’ve seen how this works above, but we’ll dig into the details later in this guide.

Act. Companies that want to do their CX right need to quickly engage with customer feedback (we’re talking within 48 hours). This means closing the loop with customers so that they know their feedback is making a difference. It’ll help you upgrade detractors into passives and passives into promoters.

Monetize and Grow. By adding revenue figures to Net Promoter Score and customer data, you can identify opportunities for growth within your customer base. Setting smart CX goals can help drive revenue too.

Combine. Beyond monetization, companies following Account Experience best practices also measure engagement signals across multiple touchpoints and identify accounts with absence of signal, too.

Account Experience is an indispensable customer experience management strategy because it guides action, not just business organization and process. What’s more, thanks to monetized NPS, Account Experience lets you clarify the impact your NPS is having on your bottom line.

By combining revenue with NPS data, you’ll unlock deeper value otherwise buried in NPS.

B2B vs B2C Net Promoter?

Editors note: Read our complete guide to NPS in B2B here.

Before we get on to the ins and outs of calculating NPS, we need to talk about B2B Net Promoter. While NPS is most often used among B2C customers—namely, organizations that work directly with end-consumers—it may be of even greater value for B2B brands.

Yet there are challenges. In B2C, measuring NPS is simple, with every individual customer having their individual say. But in B2B contexts—where your organization has clients who are companies themselves—things work a little differently. Here’s why:

B2B brands are suffering decreasing loyalty. According to research by Bain & Company, 68% of B2B executives report that customers are less loyal than they used to be. This means that companies need to work harder to satisfy their customers, along the length of the customer journey.

More customer touchpoints. In B2B customer journeys, every touchpoint between you and your customer account may be performed by a different individual person. To get a full sense of your NPS performance, you’ll need to survey as many of those as you can.

B2B brands are less conscious of CX. A study by Accenture showed that only 28% of B2B leaders felt they had an influence over the direction of CX. That means that there may be some resistance to CX within your organization.

A need for technical support. With more customer touchpoints to track, B2B brands need technical support that can keep up with the added complexity.

Luckily, there’s support out there for B2B brands looking to improve their NPS score and boost their customer experience.

CustomerGauge can help. According to Gartner, we’re the leading solution for B2B customer experience management. Book a demo and find out why.

Read more: 10 Best NPS Softwares for B2B

How to Run Net Promoter Surveys and Collect Feedback

When it comes to NPS programs, the most important thing is to just get started. Reach out to your customers, ask them the Ultimate Question, and begin to analyze how you are performing.

But once you’ve done that, it’s time to go back and refine your processes, across each of the three stages of your Monetized NPS system: Measure, Act, and Grow. To ensure you get the best, most accurate results, you’ll need to follow some crucial NPS best practices.

1. Measure Customer Feedback

In all customer surveys, the way that you ask your questions, and when, will have a big impact on the quality of your results.

This is largely a game of experimentation, of understanding what works best for your brand. So, there’s no harm if you don’t have the highest response rate the first time. There’s opportunity to improve.

Here, we share some basic advice to get you started.

Transactional vs Relational NPS Programs

There are two main types of NPS customer surveys, which are used to track different customer sentiments. These are relationship surveys and transactional surveys:

Relationship surveys. These are short customer surveys conducted quarterly. When done well, they provide a continual stream of insight into your customer sentiment. But remember, one survey per account is not enough for B2B brands. Instead, you should be surveying as many people in that account as possible.

Surveying quarterly can feel like a lot of work, but it has its benefits. Our research shows that companies see a 5.2% increase in retention if customers are surveyed every quarter. Short, frequent surveys work best.

Transactional surveys. Alternatively, short questionnaires can be triggered after some sort of customer transaction, such as a purchase, upgrade, or delivery. Transactional surveys are usually tied directly to different customer touchpoints.

These surveys should be linked to specific drivers, i.e. your customer touchpoints. This will give you the clearest sense of what part of the customer journey needs improvement.

When calculating your NPS score, don’t confuse things by combining your relationship and transactional surveys into a single metric. Instead, always lead with the results of your relationship surveys.

We recommend that you begin your NPS program with a relationship survey to investigate customer loyalty and brand perception, and uncover which touchpoints are affecting it - be it good or bad. Not all companies need transactional surveys, but if you feel they are needed, only begin once you have identified the touchpoints that are the most important to the customer experience.

Read more on this subject: Relational vs transactional NPS surveys—which to use and when

How to Send a Net Promoter Score Survey

For those new to customer surveys, you might be surprised by how much the practicalities of designing and delivering surveys affects the results. But they do—and a lot. As such, here are some survey best practices to bear in mind.

- Where to send a survey

The channel through which you distribute your survey will affect your response rate. In our research, we found that website surveys are the highest performers, with 5.5% of customers responding. Phone surveys came second, with 5.4% of customers.

Typically, companies prefer to send surveys over email, because it costs less and you have more space to build customer trust. (Ever wondered, what are the costs of NPS?) However, the response rate is considerably lower.

- Which questions should an NPS survey include?

An NPS survey strictly only needs a single question—the Ultimate Question. However, our research has shown that a few more questions can provide you with better results, while boosting retention.

If you keep your NPS surveys to between 2 and 6 questions, you’ll boost your retention by 5.2%.

Alongside the Ultimate Question, include a driver question, in the form of either a cascading or open-ended question. You may want to consider adding a demographic question, to understand who your customers are, as well as a request to get in touch again in future.

- When to send an NPS survey.

There’s no specific best day of the week or time of the day to send an NPS survey. The data on that just isn’t very reliable. But what we can say is that surveying your customers every quarter is what you really should be aiming for.

Read more: Best Time & Day to Send Survey Emails

- Who to ask and how many?

In any NPS survey, you should be aiming to get as high a response rate as possible. Typically, companies get around 10% of their survey recipients to respond, but that’s not an excellent result.

Instead, target a 60% response rate if you’re a B2B brand. Yes, it’s doable. One of our clients, ICON Communication, even achieved a 100% response rate.

Of course, you should aim to achieve statistical significance in your sample size too. But you shouldn’t get too bogged down with it. Here’s why you should be careful with statistics in your Net Promoter System.

Especially in the B2B world i.e. if you're trying to gauge and improve the experience of partners, distribution channels or large sized customers, we recommend that you survey multiple stakeholders in each account to get a realistic picture of the relationship health. Buying journeys are complex in B2B—and it's not just the end user in charge of a contract renewal.

Further reading on best practice: 16 NPS Survey Best Practices

Other Tips for Improving Your NPS Response Rate

That’s not all you can do to improve your CX survey response rate, though. Follow these tips to improve your performance:

Stay on-purpose. Do you need to survey everyone to meet your goals? Even your brand new customers? We suspect not—and bothering customers with surveys that are irrelevant to them won’t help your response rate. Make every survey have a clear purpose, with trackable outcomes.

Make your first impression count. They say 47% of people decide whether to open an email based on the subject line. Keep it short.

Say thanks and close the loop. If customers don’t feel appreciated, they won’t respond next time. You’ve asked them for a favor, so it’s only right that you say thanks—and show them how you’re putting their feedback to use. We've found that companies which close the loop on customer feedback see a significantly higher response rate and 3x increase in promoters on their next survey.

Discover more strategies for boosting your response rate here: 10 Ways To Improve Your NPS Response Rate

2. Act: Why Closing the Loop is Critical for NPS Success

Closing the loop is the part of your NPS system that involves taking customer feedback on board—and then telling your customers what you have done to improve.

We wouldn’t be exaggerating if we were to say that there’s no point doing an NPS survey if you don’t close the loop. But the number of companies that don’t is remarkable.

According to Gartner, 95% of companies run CX surveys. But only 10% use this feedback to change their business processes. And only 5% tell their customers what they have done.

Here’s why those companies aren’t taking full advantage of their CX program:

Closing the loop shows you care. Customers don’t actively enjoy taking surveys. Instead, they do it as a favor. If you close the loop, they’ll feel appreciated and they’ll see you’re serious about their feedback.

It improves your response rate. Knowing you’re listening will encourage customers to respond next time. Our research shows customers are 21% more likely to answer the next survey if you closed the loop.

It helps drive root cause analysis. Driver questions are a great simple way to understand how your customers feel about particular touchpoints. But if you want to really dig down into a customer problem, you’ll want to go further. Closing the loop with customers is the way that you can discover the root cause.

Leverage promoters. Promoters are willing to refer you to their friends and colleagues. But they might not do this unless you actively ask them. Closing the loop is a great time to do this to boost your revenue.

Reduce churn. You can turn a detractor into a promoter by merely reaching out and showing them that you’ve learned from their feedback.

3. Monetize & Grow: Why It’s Important to Tie NPS to Revenue

Monetizing NPS is the final part of your NPS system. It’s not just a bonus stage. Rather, it is a crucial part of what customer experience management strategy is all about—as it enables you to use CX data to inform your business processes. Here’s how:

Understand the value of your customers. Not all customers are worth the same to your business. And if it is the highest value customers that are churning most often, you know that there’s a problem. By tying NPS to revenue, you’ll see how much revenue is at risk of churn—and where you should focus your CX resources.

Prove your CX program’s ROI. While the chief customer officer is an increasingly common presence in business, there remains skepticism about its hard financial impact. By tying NPS to revenue, you can make that clear and secure the investment your CX team deserves.

Get buy-in from all levels of the company. Customer experience strategy works best when everyone is on-board. By proving the value of your CX program by detailing its impact on revenue, you’ll be improving your customer satisfaction in the long run too.

Check out these 13 ways to visualize NPS to get ideas for your revenue-focused NPS dashboard.

Three NPS Case Studies

The Net Promoter System is effective as a growth driver. But don’t just take our word for it. Here are three success stories from brands who have committed to their NPS:

INAP. INAP is a data center management company that once had a massive churn problem. But thanks to CustomerGauge’s Account Experience NPS program, the brand managed to cut their churn rate in half in two years.

How? You can find out all the details in this presentation with TJ Waldorf from INAP. But for TJ, C-level buy-in, linking NPS to revenue, and action were all crucial for the company.

"’Fueled by action’ [are] probably the most important words. It's one thing to just collect the data, but in my mind, the crux of this program is to actually do something with it."

Alchemista. In 2019, the catering brand, Alchemista, lost its biggest client without warning. But now the company boasts a 100% retention rate.

What happened? Alchemista invested in a CX program based on NPS.

“Onboarding CustomerGauge has had the highest ROI of anything I've ever done at my company," says Christine Marcus, Alchemista’s CEO.

Find out more here: How Alchemista Went From Losing Their Biggest Customer to 100% Retention

- SmartBear. Finally, SmartBear proves the value of tying your CX program to your bottom line. From beginning an NPS program in 2017 from scratch, the company went on to build an incredible revenue-building CX machine. By September 2018, they had achieved:

Increased referral close rates from 30% to 47%

Brought in $6 million of referral revenue

Identified customers at risk of churn and achieved a save rate of 60%.

Get Started With NPS Through CustomerGauge

With CustomerGauge’s Account Experience program, you can achieve the same success. Book a meeting with our expert NPS consultants here!